- Polygon witnessed an increase in terms of stablecoin volume.

- However, NFT volume fell and MATIC went on a downward trajectory.

The Polygon network has been experiencing consistently high activity for quite some time now. This occurrence can be partially attributed to a notable surge in stablecoin volume on the network.

Is your wallet green? Check out the Matic Profit Calculator

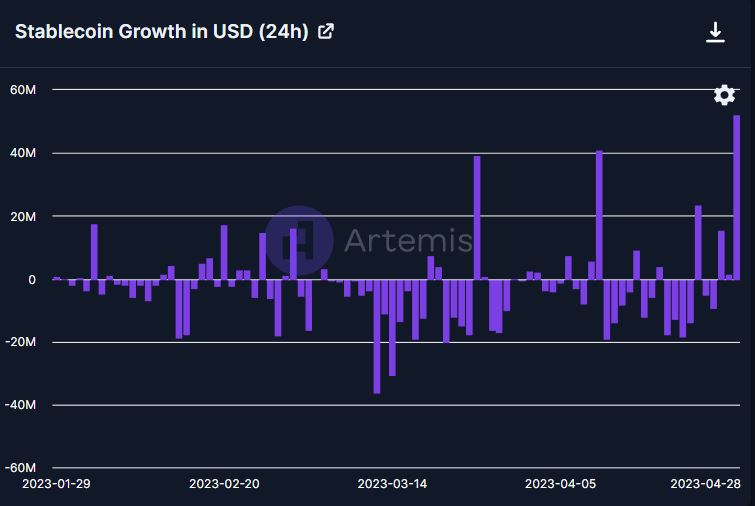

According to Artemis data, the liquidity of stablecoins on the Polygon network increased 5.37% over the past week to a total of $1.54 billion.

The increase in stablecoin liquidity on the Polygon network is a positive development that indicates an increase in the use of the network.

The presence of stablecoins could potentially attract more users to the network looking for a safe and reliable store of value for their assets.

Source: Artemis

In terms of day-to-day activity, the Polygon network performed relatively well. Artemis’ data indicated a spike in user activity in recent weeks.

However, the same cannot be said for the total number of transactions made on the network.

In recent days, the total number of transactions on the network has dropped from 2.81 million to 2.09 million.

Source: Artemis

dapp me up

One of the reasons for the decline in activity on the Polygon network could be the declining interest in Polygon’s dApps.

Dapp Radar’s data revealed that many dApps witnessed a decrease in activity on their platforms over the past week.

Planet IX, a popular gaming dApp on the Polygon network, recorded a 57.88% drop in terms of daily active addresses over the past week.

Subsequently, the total volume and transactions on the network also declined.

Source: Dapp Radar

In addition, the Polygon network took a hit in terms of the NFT space. According to data from Dune Analytics, Polygon’s sales volumes fell from 400.00 to 200.00 in the past few days.

Despite integrating y00ts and DeGods NFTs into its network, Polygon was unable to sustain user interest in the NFT space.

Realistic or not, here is the MATIC market cap in BTC terms

Source: Dune analysis

Well, the price of MATIC was also affected during this period. In fact, MATIC’s network growth also tumbled, indicating that new addresses are not very interested in trading the token, pressed for time.

Source: Sentiment