Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Chainlink is currently being traded at critical levels of demand, because the wider crypto market is confronted with constant pressure. With the worldwide financial circumstances that are becoming increasingly vulnerable, volatility continues to dominate risk assets. Geopolitical tensions and radical rates imposed by world leaders – including recent movements of US President Donald Trump – have only added the uncertainty, the trust of investors and holding bullish momentum in crypto.

Related lecture

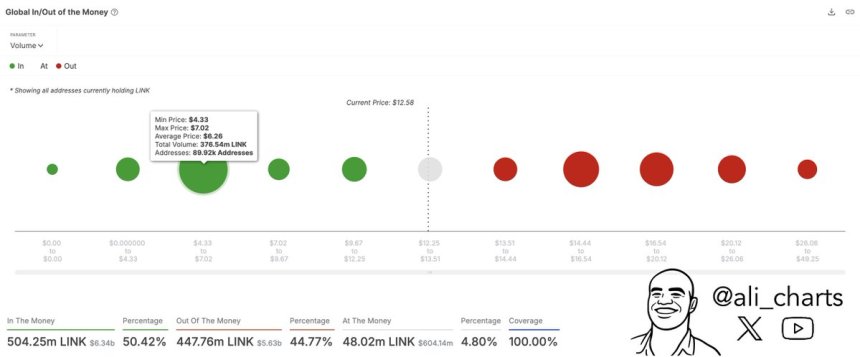

In the midst of this background, Chainlink has difficulty reclaiming higher terrain, instead to consolidate an important support zone. According to data on the chains, the most critical demand from Link is at $ 6.26. This concentration of buying interest is a potentially strong support area that must defend bulls to prevent a deeper correction.

As markets respond to the shifting of macro -economic signals, Chainlink’s ability to maintain this demand zone can determine the next step. If this level fails, extra disadvantage can follow. But if it applies, it could serve as a basis for a potential rebound as soon as sentiment improves. For now, all eyes remain on the price action of Link, while it is one of the most important battery zones on his graph test.

Chainlink consolidates if the next demand level is below

Despite the broader market uncertainty, Chainlink remains one of the most prominent players in the Real-World Asset (RWA) Token risation story-a sector that is expected to see considerable growth in the coming years. As traditional financing continues to explore the blockchain infrastructure, the Oracle technology of Chainlink and decentralized data feeds remain essential for bridging off-chain assets with applications on chains.

In the short term, however, the LINK price campaign has reflected the wider crypto market. Chainlink has fallen by 17% since 26 March, with the current price promotion that demonstrates constant uncertainty. Link consolidates just above an important demand level, and although bulls have had difficulty regaining the momentum, some analysts believe that the worst might be left behind. The fear of continuous sales pressure continues, but the general market conditions suggest that the sharpest subtics can be over.

Ali Martinez supports this display shared on-chain thatA revelation that the most critical demand wall for chain link $ 6.26 is, where nearly 90,000 investors have collected around 376 million link tokens. This strong accumulation zone can form the basis that is needed for price stabilization and a potential reversal, especially if a broader market sentiment starts to restore.

While analysts still warn of a possible deeper correction, the fading intensity of sale and the presence of strong support indicates growing resilience. The long-term fundamentals from Chainlink, in particular the leadership in the RWA room, continue to attract attention in times of market stress. If the level of $ 6.26 applies, Link may be well positioned for a rebound as soon as Bullish Momentum returns about the crypto landscape.

Related lecture

Link contains solid soil such as Bulls Eye Recovery Confirmation

Chainlink (link) acts at $ 12.8 after passing a few days of heavy sales pressure. Despite the recent disadvantage, Bulls have succeeded in defending the crucial level of support of $ 12.3, which has been followed as a solid demand zone so far. This handle is an important victory in the short term, but the wider trend remains fragile as link struggles to get back momentum.

To confirm a potential recovery rally, Bulls must be the link above the level of $ 14.6 push-and-a critical resistance zone that matches both the 4-U-UNIAL advancing average (MA) and the exponential advancing average (EMA). A decisive outbreak above this area would signal renewed strength and possibly pull more buyers back on the market.

Related lecture

However, the risk of further disadvantage is still looming. If Link loses its grip on the demand zone of $ 12.3, the following logical support could be near the $ 10, a psychological level that has not been tested since the beginning of Q4 2023. With the wider cryptomarkt still under pressure and sentiment carefully, left at an intersection. The coming days will be crucial if bulls try to reclaim the momentum and prevent it from sliding deeper into the correction area.

Featured image of Dall-E, graph of TradingView