- Analysts warn of a possible BTC crash around Trump’s inauguration day

- Coinbase Premium Index has fallen to a yearly low, highlighting weak demand in the market

Donald Trump’s upcoming inauguration as US president on January 20 has produced mixed prospects Bitcoin [BTC] of analysts.

In fact, a recent Forbes report even claimed that the event could crash BTC because the market is “delusional” and has overpriced the asset based on pro-crypto policies that might as well not materialize.

The report quoted K33 Research’s market outlook for December, which read:

“It is highly likely that the market will be delusional about the pace of policy change and overestimate the impact heralded by the inauguration.”

Trump’s inauguration to crash BTC?

This cautious view was also shared by BitMEX co-founder and crypto investor Arthur Hayes. In his December newsletter, Hayes warned that the inauguration could be marked by a massive sell-off. He said,

“I believe the crypto markets will experience a dire dump around Trump’s Inauguration Day on January 20, 2025.”

Furthermore, based on seasonal trends, January is not one of the best months for BTC. Should history rhyme, BTC could face one potential risk in the short term.

However, part of the community still expects major policy changes, including the creation of BTC’s strategic reserve. In fact, the BTC reserve could be the main catalyst for BTC price action in 2025.

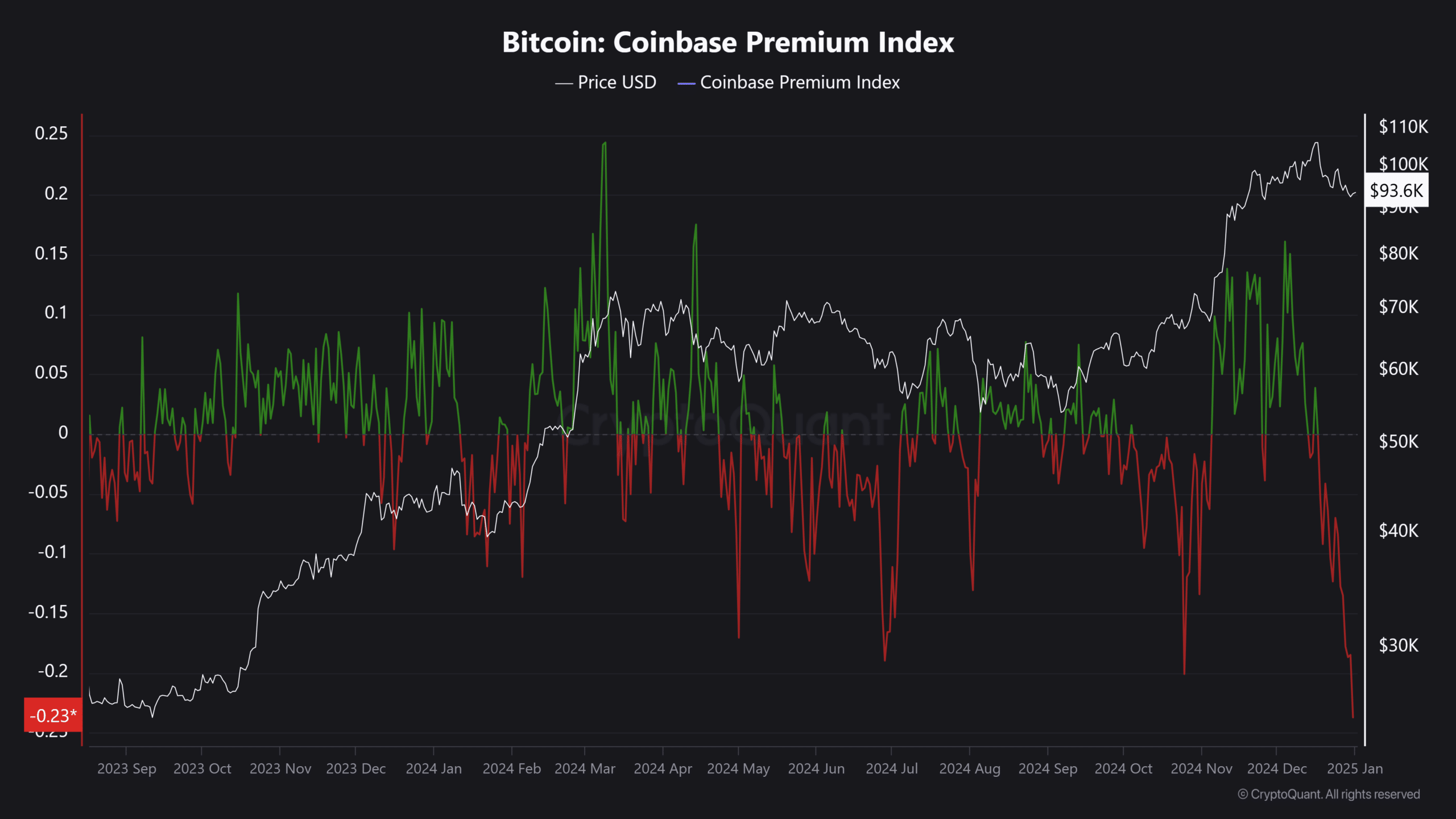

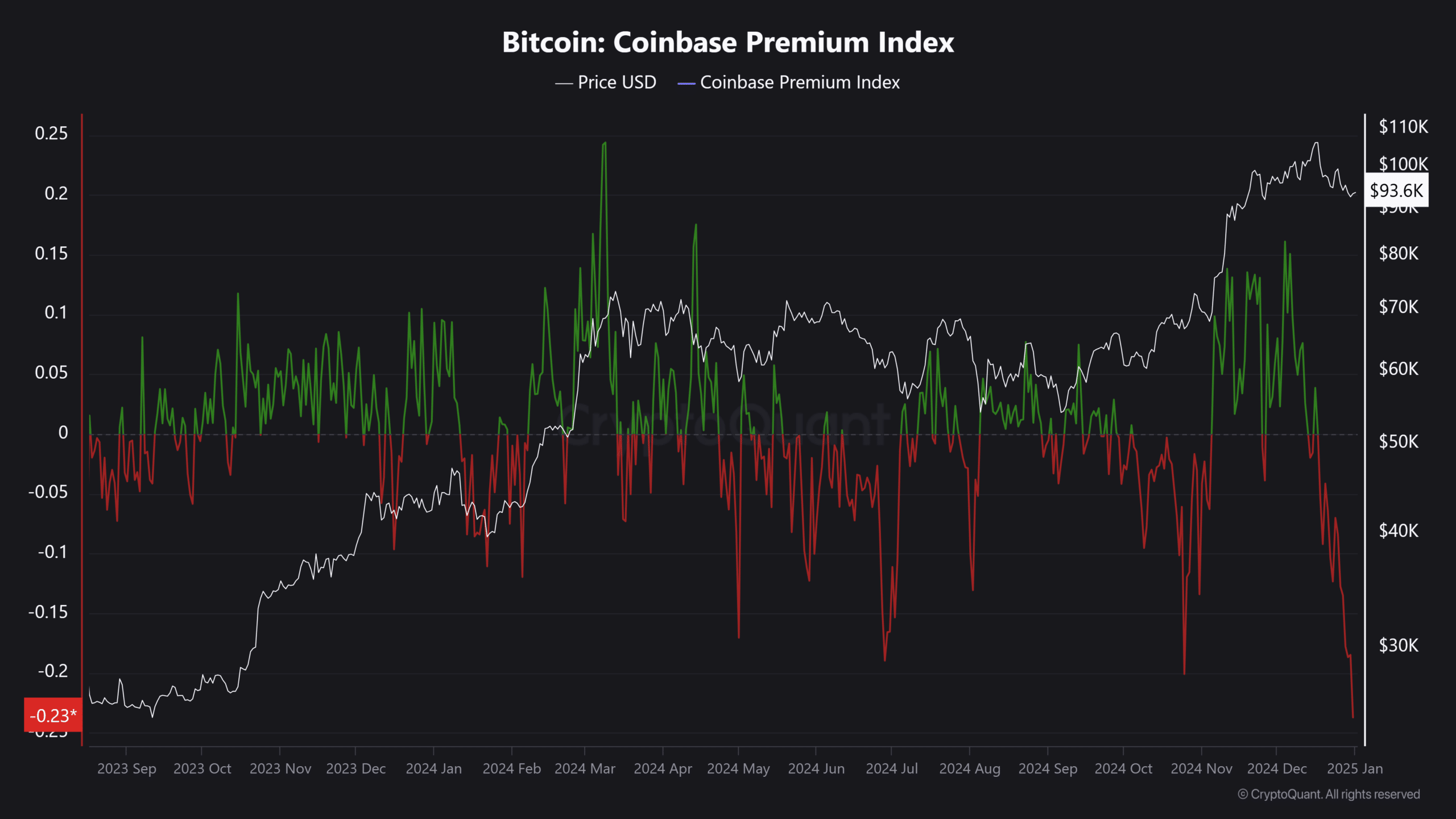

That said, the Coinbase Premium Index indicated that December’s selling pressure for the cryptocurrency has extended into early 2025.

Read Bitcoin [BTC] Price prediction 2025-2026

In most cases, BTC’s recovery coincides with strong demand from Coinbase (US investors). Thus, the low demand suggested that a BTC rebound was still not in the cards, at least not at the time of writing.

Source: CryptoQuant