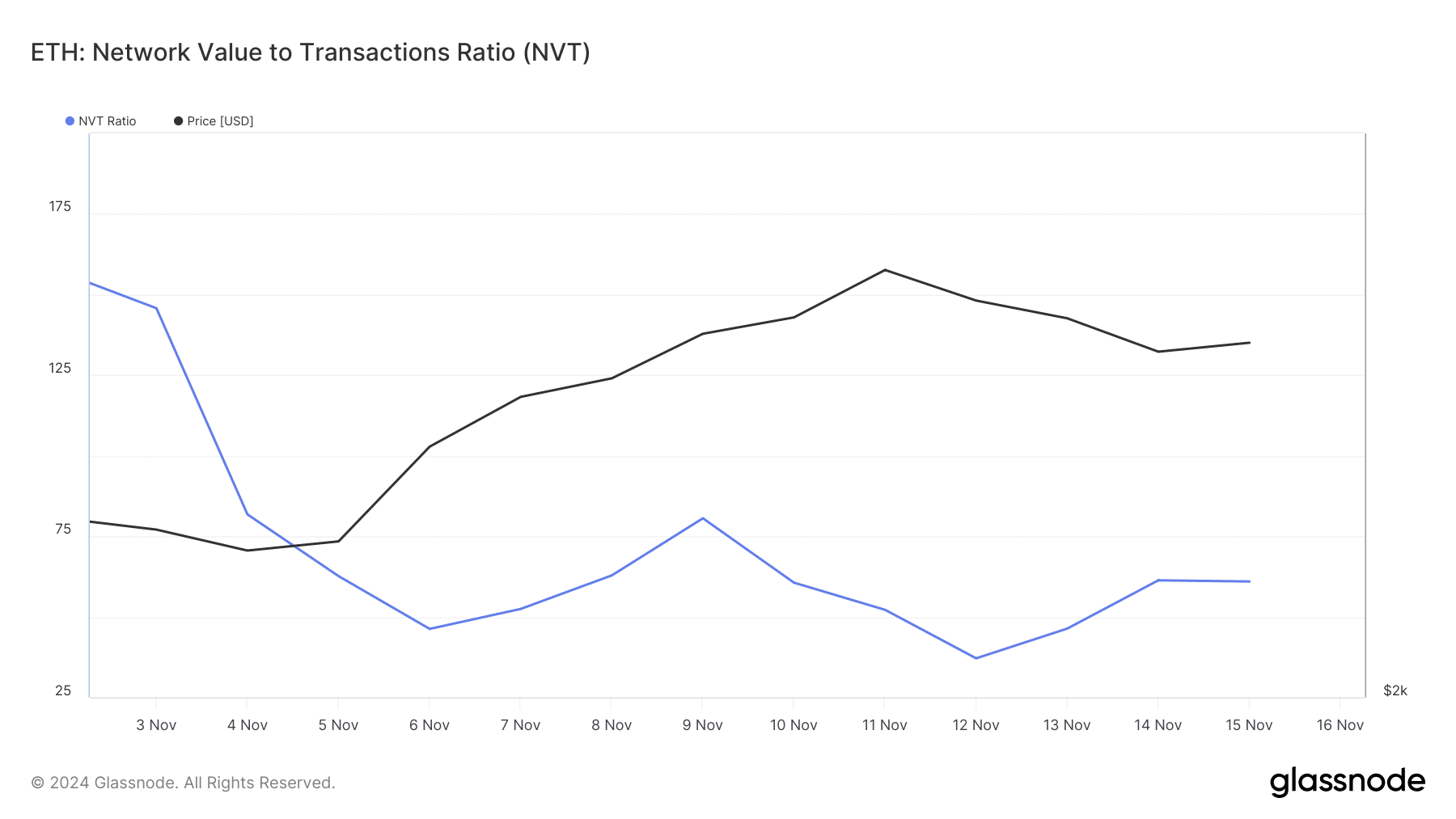

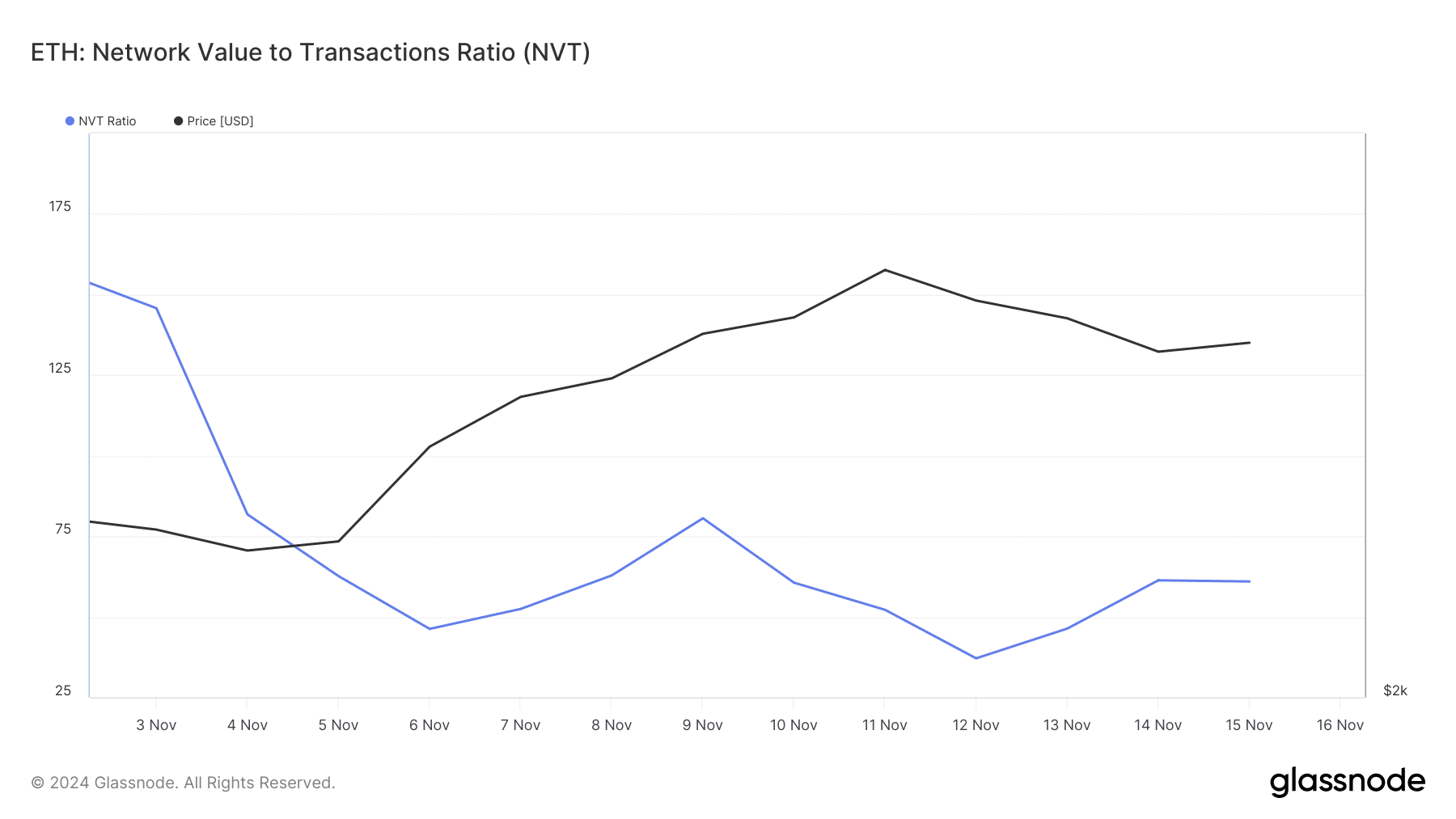

- Investors started accumulating ETH when the altcoin price fell from $3.4k

- The NVT ratio showed that Ethereum was undervalued on the charts

Ethereum [ETH]the world’s largest altcoin, reached a new high on one front this week, a high not seen in more than a year. This happened especially while the market recorded a slight decline in the charts.

Will this latest development change the scenario in ETH’s favor again?

Ethereum reaches a milestone!

IntoTheBlock recently released a tweet reveal an interesting update. The tweet showed that Ethereum recorded a huge increase in outflows last week. To be precise, the number crossed $1 billion, which was a level last seen in May 2023. The update also suggested that Bitcoin [BTC] also registered a similar increase in outflows during the same period.

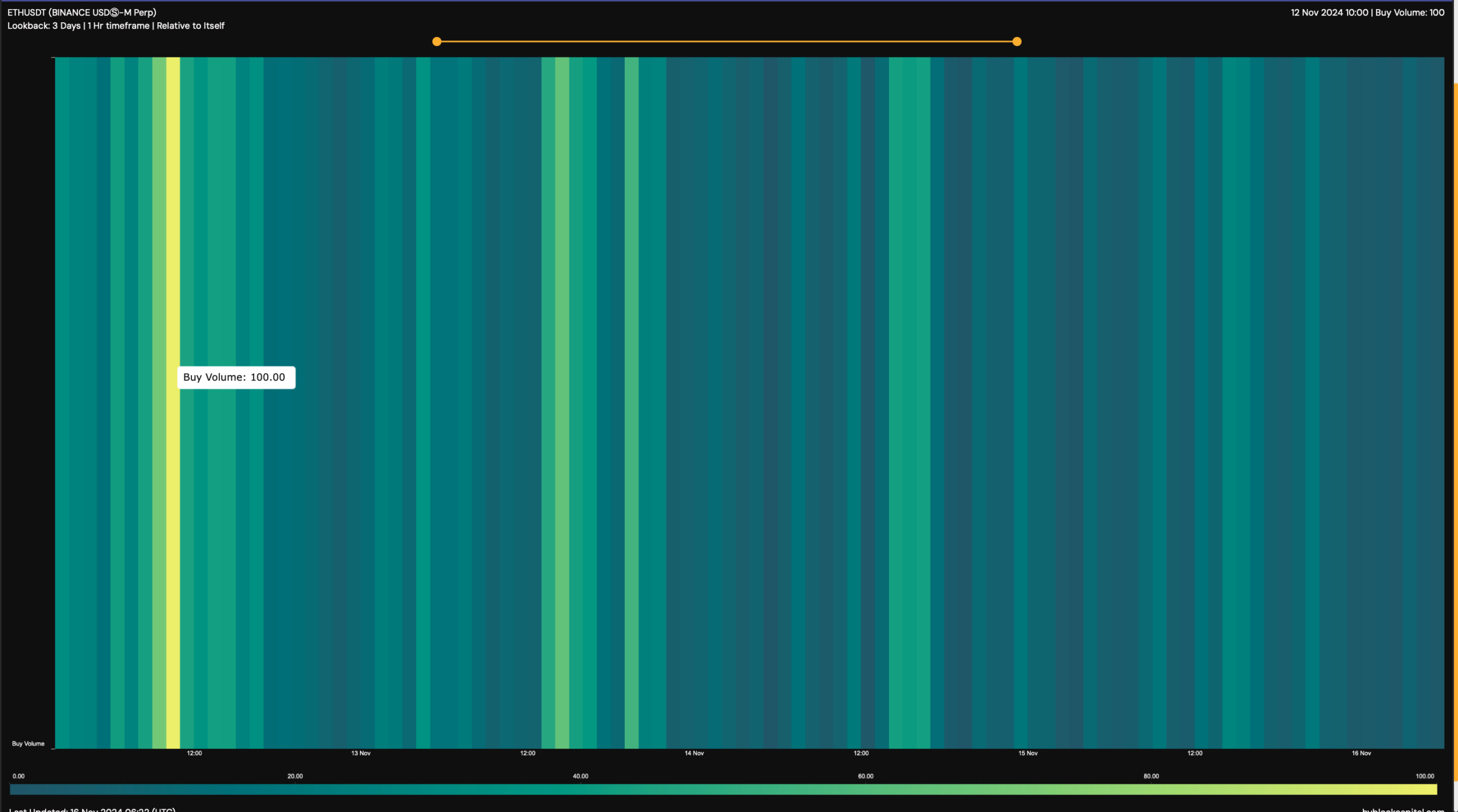

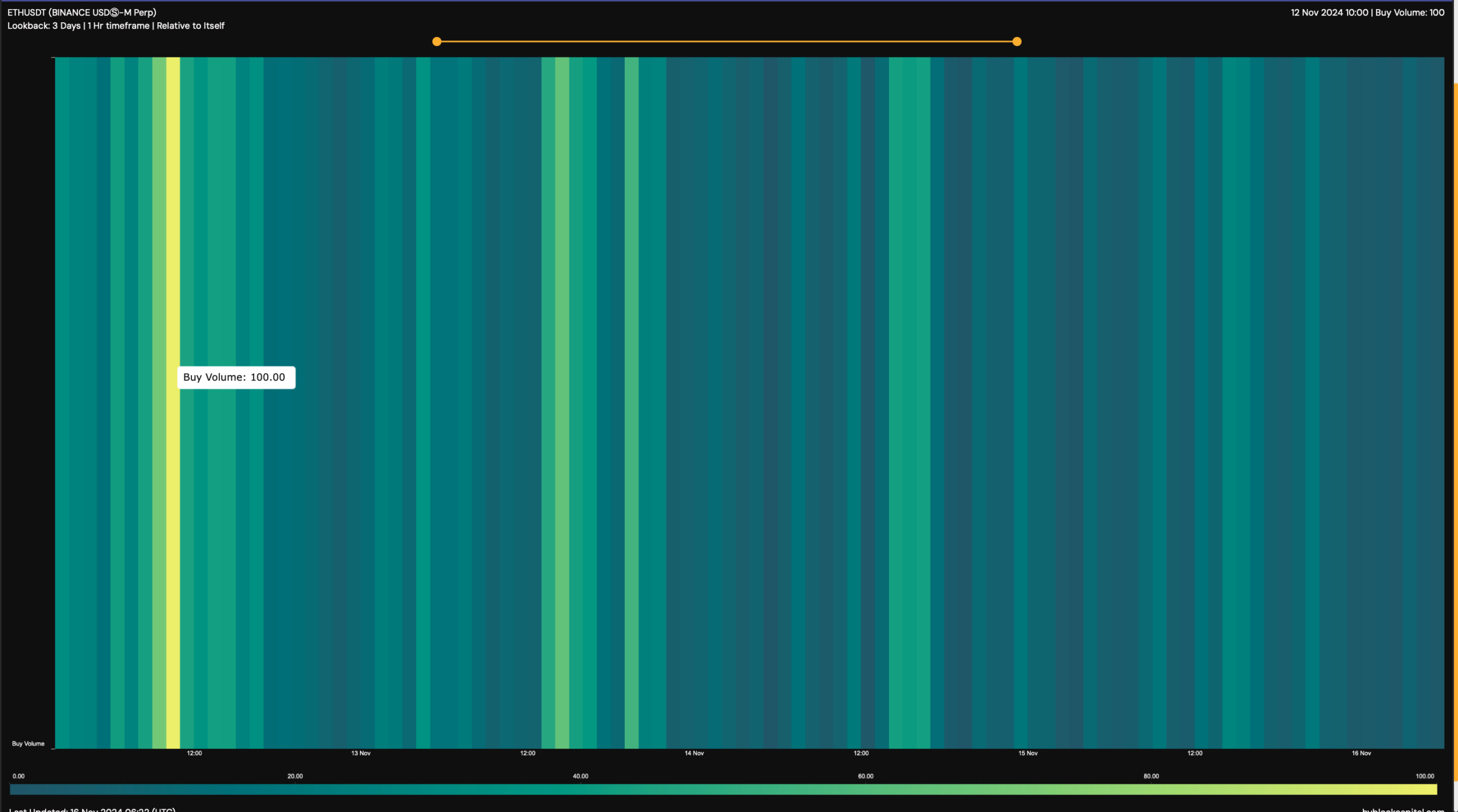

An increase in outflow means that accumulation is high. A possible reason for this development could be ETH’s decline from $3.4k. Hyblock Capital’s data also told a similar story when ETH buying volume reached 100 on November 12.

This was the same day that the price of ETH started falling after reaching $3.4k. This suggested that investors were planning to buy the dip, hoping for further price appreciation in the near term.

Source: HyblockCapital

That’s basically what happened in the last few days. After dipping to near $3k support, ETH’s piece gained bullish momentum. The price rose almost 3% in the last 24 hours and was trading at $3,117.03 at the time of writing.

Furthermore, investors appeared to be considering buying Ethereum, suggesting its value could rise even further. This trend of persistent buying was also proven by ETH’s exchange net flows.

According to CryptoQuantthe token’s net deposits on exchanges were low, compared to the seven-day average. Furthermore, ETH’s Coinbase premium was also green, indicating that buying sentiment among US investors was strong.

Apart from this, whale activity around ETH also remained high. Basically AMBCrypto reported earlier that whale trades surged in late October and early November, correlating with ETH’s bull rally.

Will this upward trend sustain itself?

The better news for investors was that Ethereum might as well manage to maintain this newly acquired upward momentum.

The altcoin king’s NVT ratio registered a sharp decline over the past two weeks. When this measure falls, it means an asset is undervalued, indicating a short-term increase in price.

Source: Glassnode

Read Ethereums [ETH] Price prediction 2024–2025

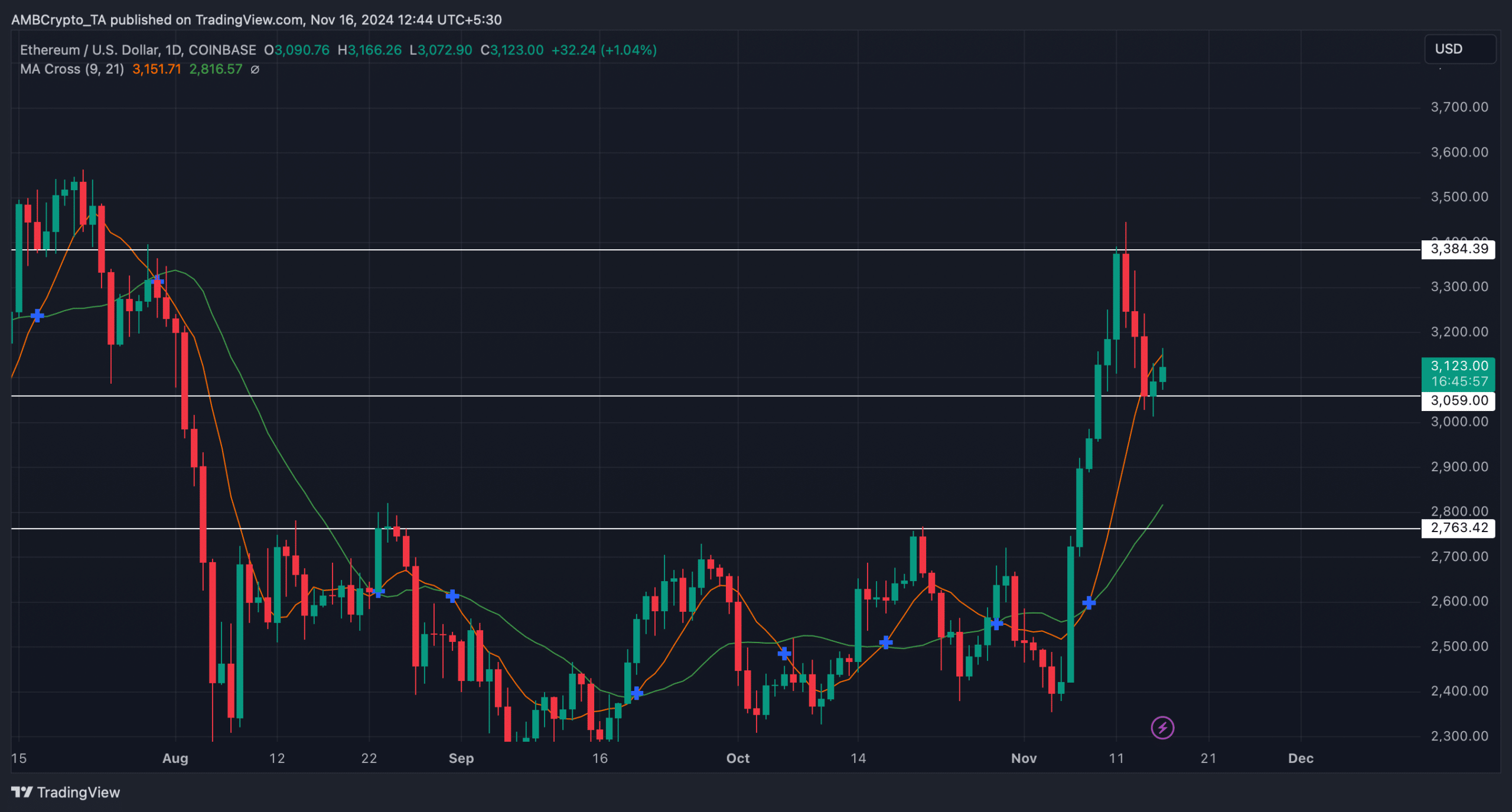

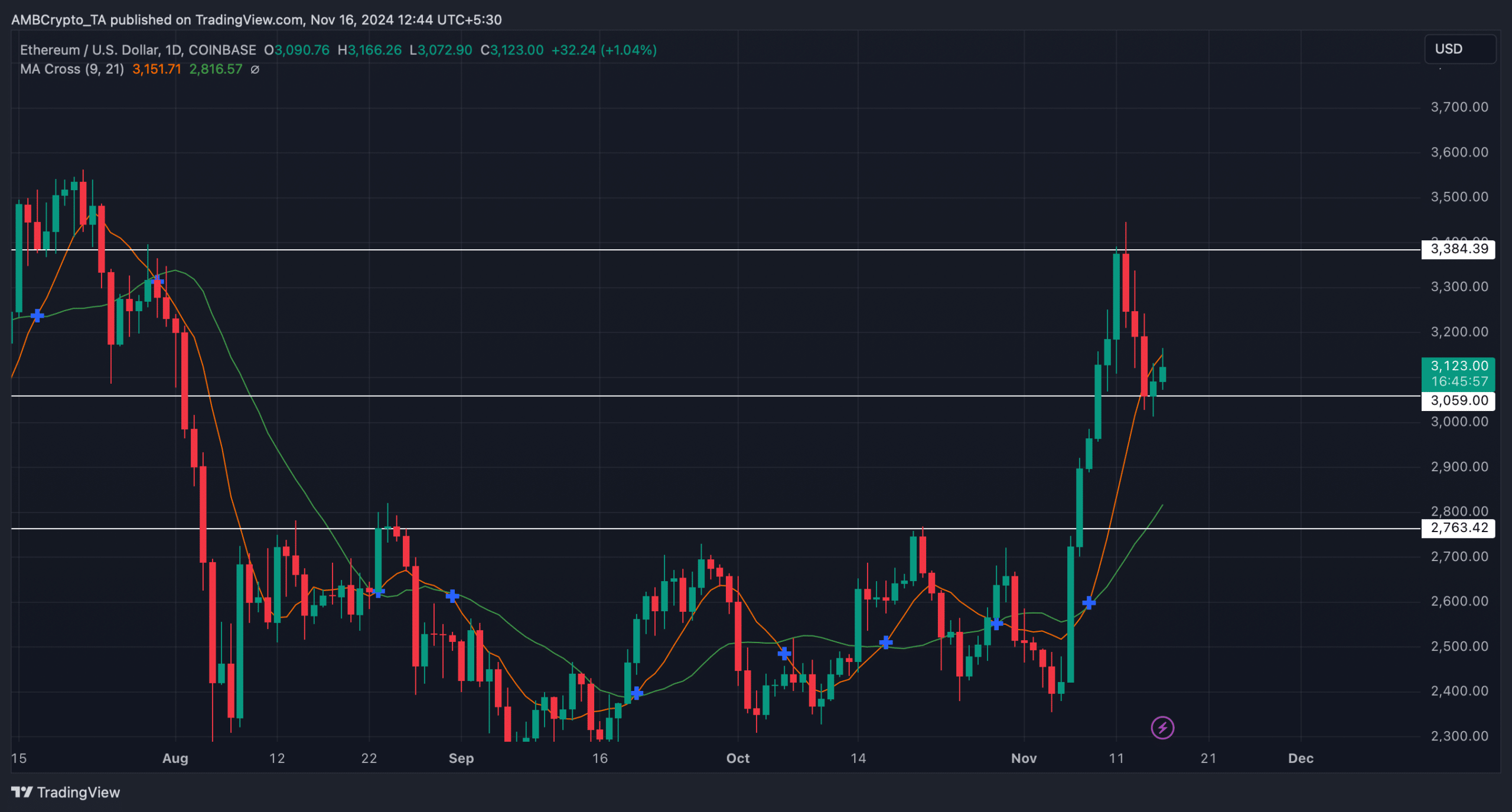

Finally, the MA cross-technical indicator pointed out that Ethereum’s 9-day MA was well above the 21-day MA.

If the indicator is to be believed, ETH could continue its uptrend and soon reach its resistance at $3.38k. However, if ETH sees a pullback and falls below the $3k support, the chance of the price plummeting to $2.7k cannot yet be ruled out.

Source: TradingView