- Aave has successfully broken over his falling wedge formation, because technical analysis refers to Bullish price action.

- The update of the protocol management, whale accumulation and a weekly return proposal of $ 1 million suggest a bullish market sentiment.

Aave [AAVE] The focus of the market caught after a price dump of 11.78% and the announcement by the protocol of future growth strategies.

At the time of writing it had a considerable bullish momentum after his outbreak and acted according to $ 232, according to Mint market cap facts. Signals for chains suggest a potential Uptrend rally if bulls remain strong.

Price promotion and technical indicators

Since the beginning of 2025, Aave has been acting in a falling wedge formation.

According to WorldOfCarts’ Analysis of X (formerly Twitter), it could collect to the $ 258 key resistance level in the medium term, while in the long term it focused the psychological level of $ 350.

The RSI of the coin was 49, signaling space for more buying, at the time of press.

The advancing averages in the short and long term, the MACD and Momentum indicators flashed a ‘Koop’ signal, which strengthens the outbreak.

Source: TradingView

Insights on chains that support the Aave price action

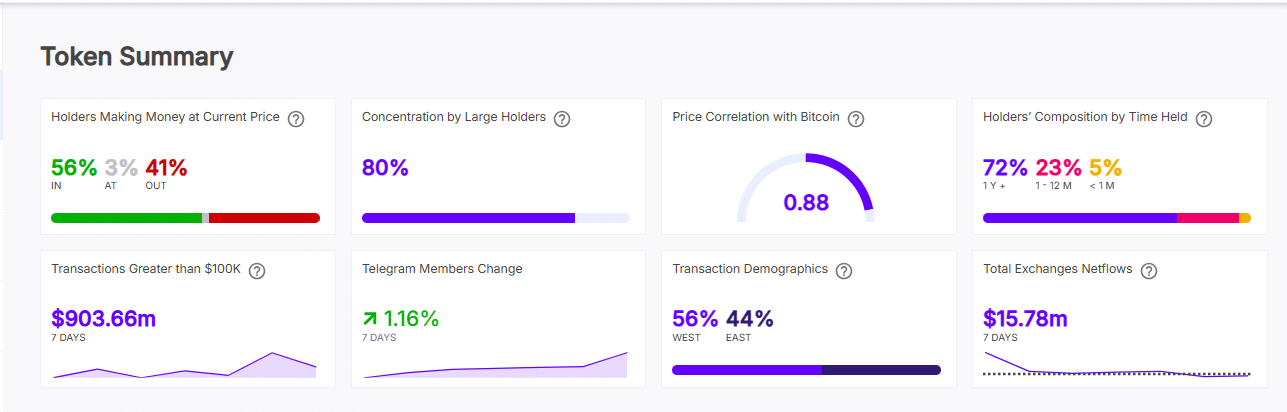

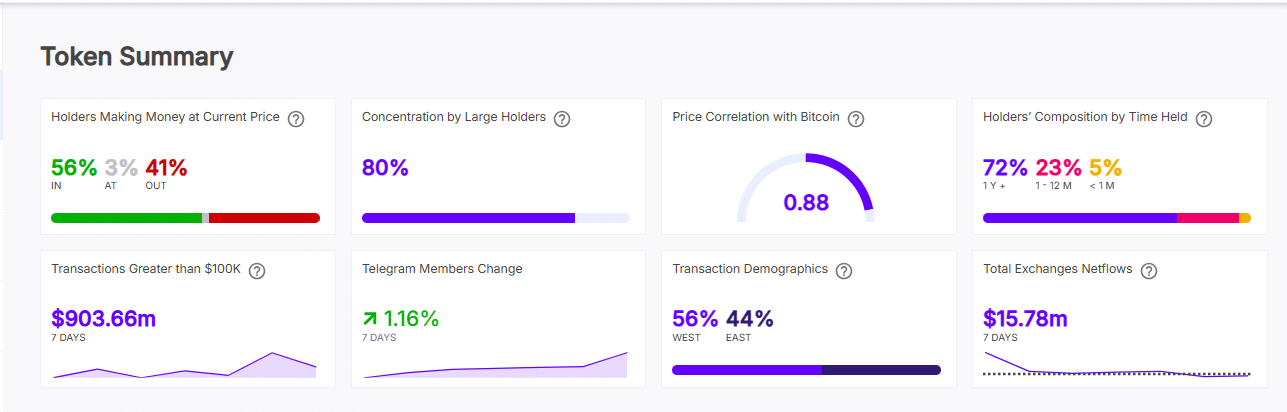

According to IntotheLocck Data, large holders control 80% of Aave, with 56% of them in the money.

Since the majority of whale have a profit, the further accumulation of investors and purchasing pressure can see, leading to a bullish rally to the most important level of $ 258.

Source: Intotheblock

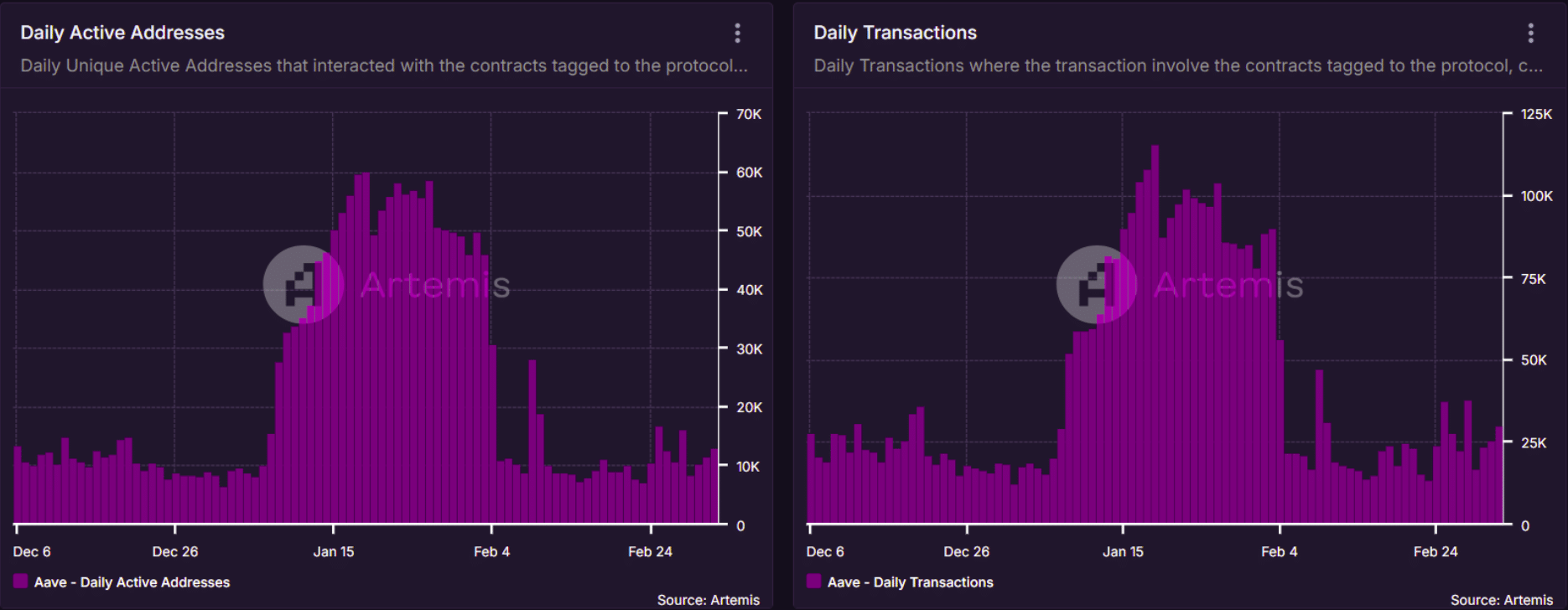

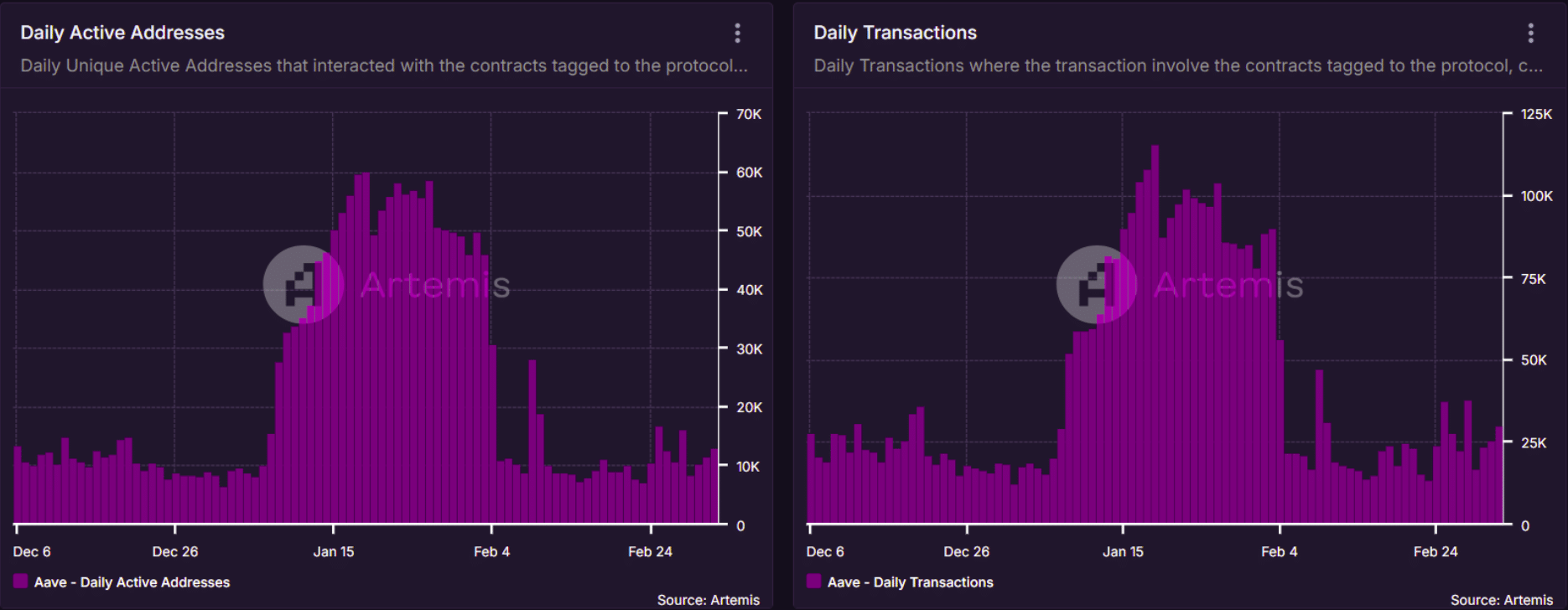

The large transactions of Aave (more than $ 100k) reached $ 903.66 million last week because the currency was dealing with renewed interest rates among traders.

The daily transactions have increased steadily in addition to active addresses, which demonstrates the growth of network activity.

Source: Artemis

Market front views indicate …

The Aave protocol announced a weekly token purchase of $ 1 million under its new proposal for ‘Aavenomics’, which reduces Aave’s offer. This purchase of the offer could position the currency for a bullish rally after the recent outbreak.

The 24-hour long-short ratio rose from 1.4 to 1.5 in four hours, some more traders who bought Aave. The coin‘s Breakout signals a trend removal after weeks of Downtrend, stimulated by management updates and the announcement of the protocol.

Large -scale investors will probably buy an Aave, aimed at long -term profits. Strong purchasing pressure can help the coin surpass the $ 258 resistance and focus on $ 350.

Monitoring of whale and network activity near key levels can offer further insights into Aave’s price movements.