- Maker recently responded from an important support zone where hundreds of thousands of units were purchased.

- However, some traders take profit – a movement that can influence the potential market movement of MKR.

In the last 24 hours, buyers shifted the sentiment after they had sold a large part of the asset earlier in the past month. This renewed purchase activity has led to a price increase of 1.66%.

Large buying orders can cause a rally

According to Ambcrypto analysis, this price jump can mark the start of a further rally, with an additional benefit of 41% as a maker [MKR] strives to re -test a key resistance level at $ 1,800.

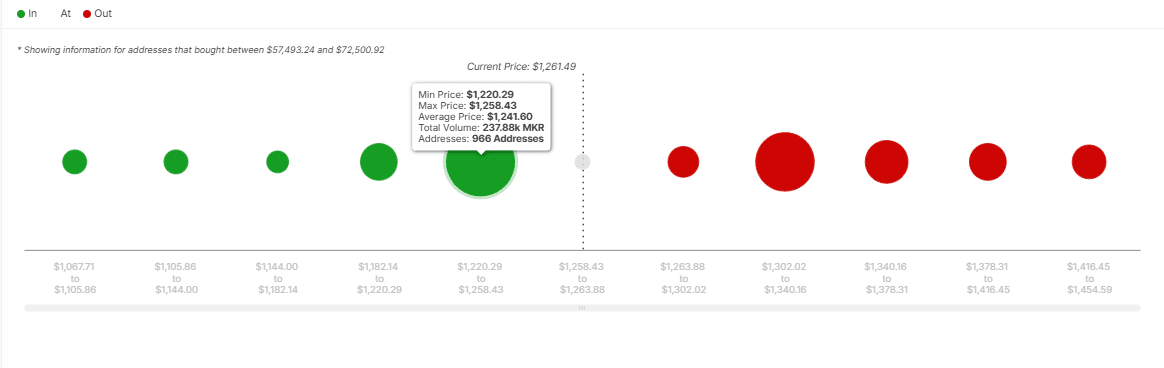

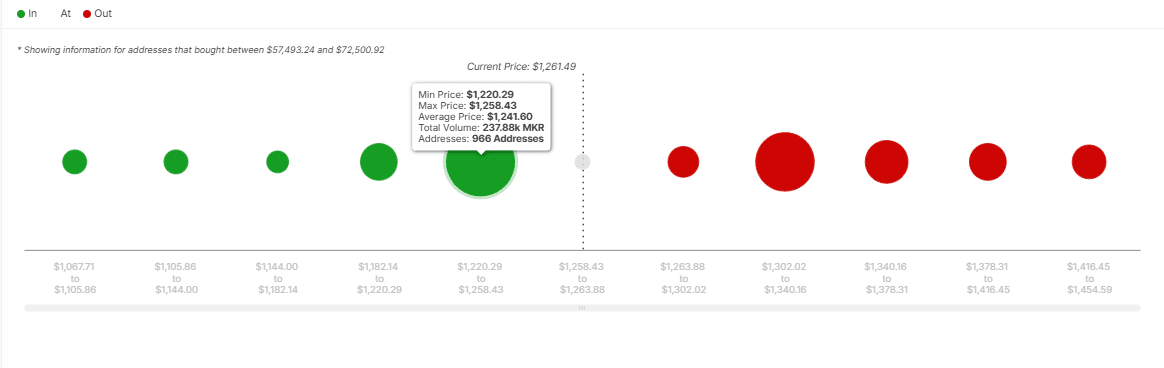

The in/out of the money around price (Iomap), which helps to identify potential demand and supply zones, shows that MKR has responded to an important demand area that could activate a large rally.

Source: Intotheblock

This zone, located between $ 1,220.29 and $ 1,258.43, saw a record traded 237,880 MKR, worth around $ 299 million – a considerable volume that fed the recent uptrend.

When such an accumulation with a high volume occurs, a corresponding price increase and volume often indicates an approaching market trally.

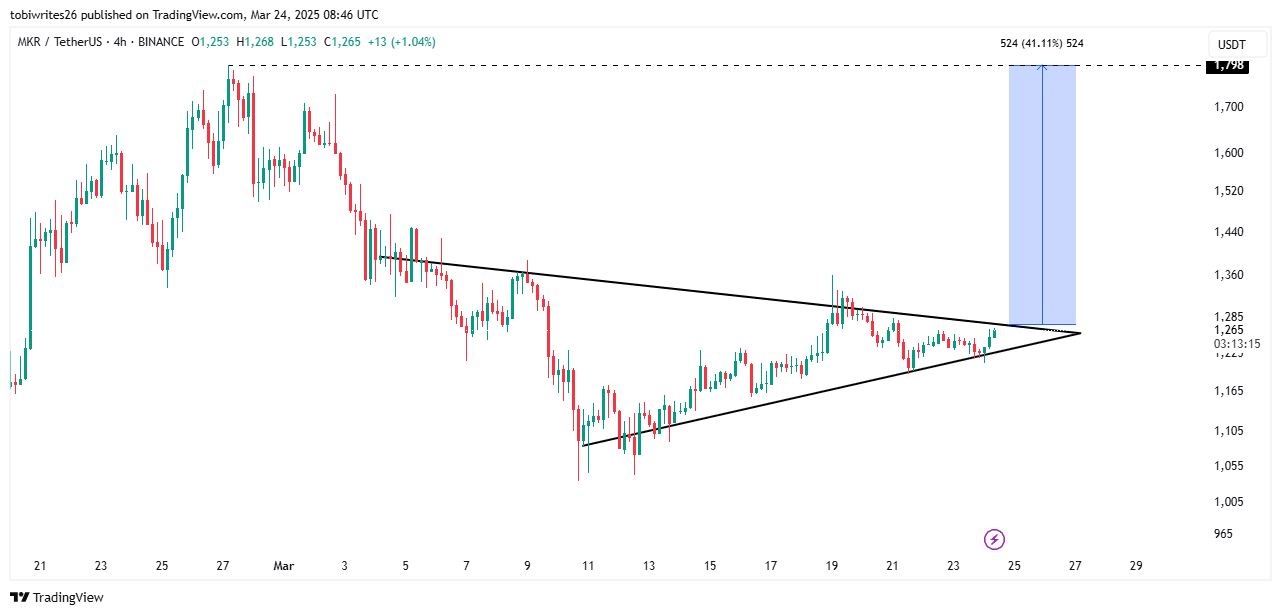

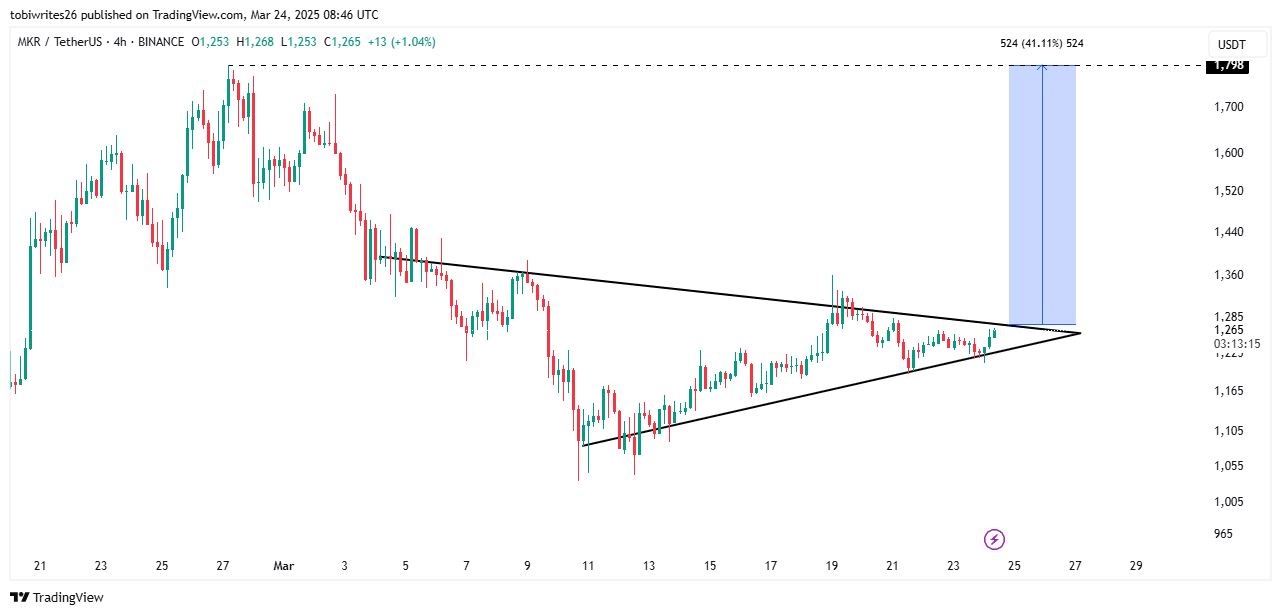

On the graph, MKR seems ready to try a bullish breakout from a symmetrical triangle, according to the large buying orders. Based on the analysis, if it actively breaks this resistance, it could rise 41% to reach $ 1,800.

Source: TradingView

A symmetrical triangular pattern arises when converging support and resistance lines create a consolidation phase. As soon as the price action breaks out, this usually leads to a strong directional movement.

Derivatives traders go long before the rally

Market sentiment remains Bullish, in particular in the derivatives market, where traders open more long positions pending an outbreak.

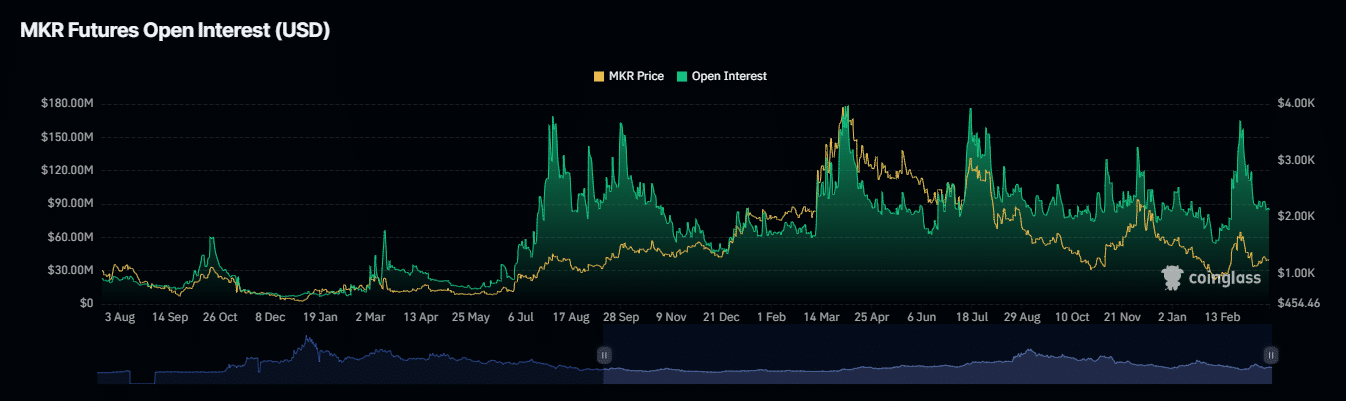

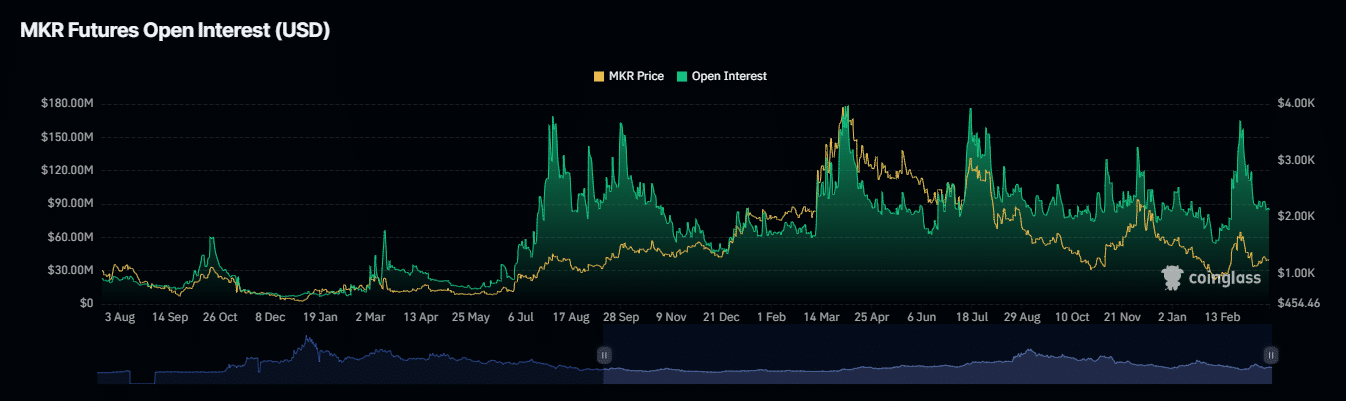

Data from Coinglass shows that MKR’s Open Interest (OI) has risen steadily and has reached $ 87.80 million in the last 24 hours. This increase indicates more restless derivative contracts in the market.

Source: Coinglass

A study of the rising financing percentage suggests that these contracts prefer long positions.

The aggregated financing percentage, which has risen to 0.0088%, implies that long traders pay a premium to short sellers to maintain their positions – usually observed in bullish market phases.

Making a profit can slow the growth of MKR

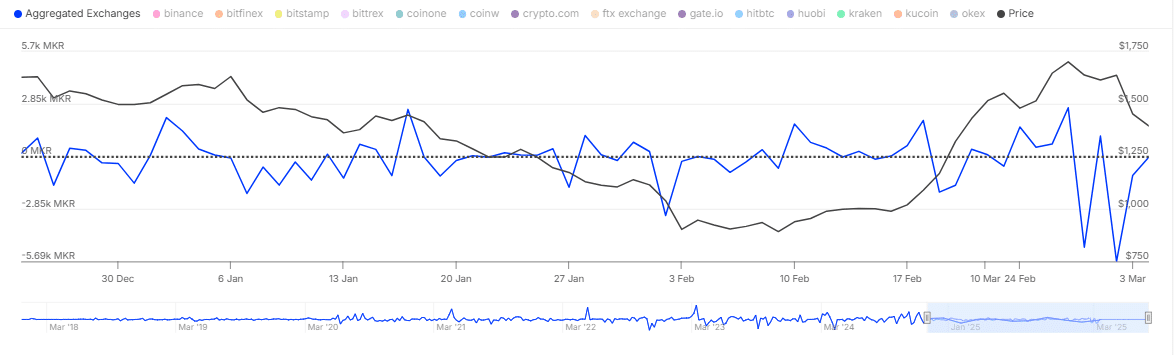

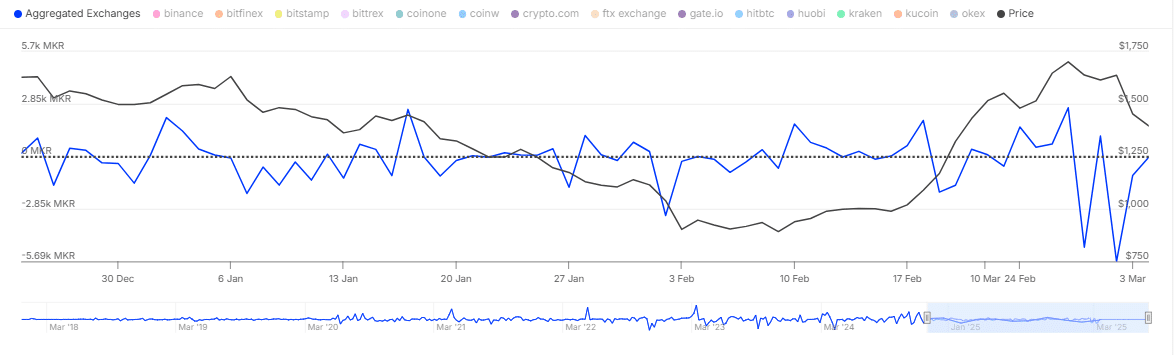

Although the wider market remains bullish, some spot traders take profit, as indicated by the Exchange Netflow that becomes positive.

Source: Intotheblock

The Netflow -Metric, which follows the buying and selling activities within a certain period, shows that 989.63 MKR (worth $ 1.2 million) has been sold.

However, this sales pressure is relatively low compared to the purchase activity of the previous days, which suggests that traders achieve profit and at the same time keep the majority of their positions intact.

It is important to note that if the sales activities continue on the spot market and more assets are loaded, this may indicate a shift to Bearish sentiment instead of a simple profit -making phase.

For now, however, MKR remains largely bullish and focuses on $ 1,800.