At least three major economic data releases are scheduled this week: the unemployment claims, the manufacturing PMI and the services PMI. All this crucial data will be released on October 24th. What are our expectations? And how will this affect the crypto market?

Unemployment claims in the United States: an overview

On October 12, the Initial Workless Claims index was 241 thousand – lower than the index value of 260 thousand on October 5. This week the consensus shows that the value could rise to 247 thousand – a slight increase of 6 thousand.

A slight increase in unemployment claims could indicate a slightly weaker labor market. If this trend continues, it could theoretically prompt the Federal Reserve to consider more rate cuts, which could be good for cryptos.

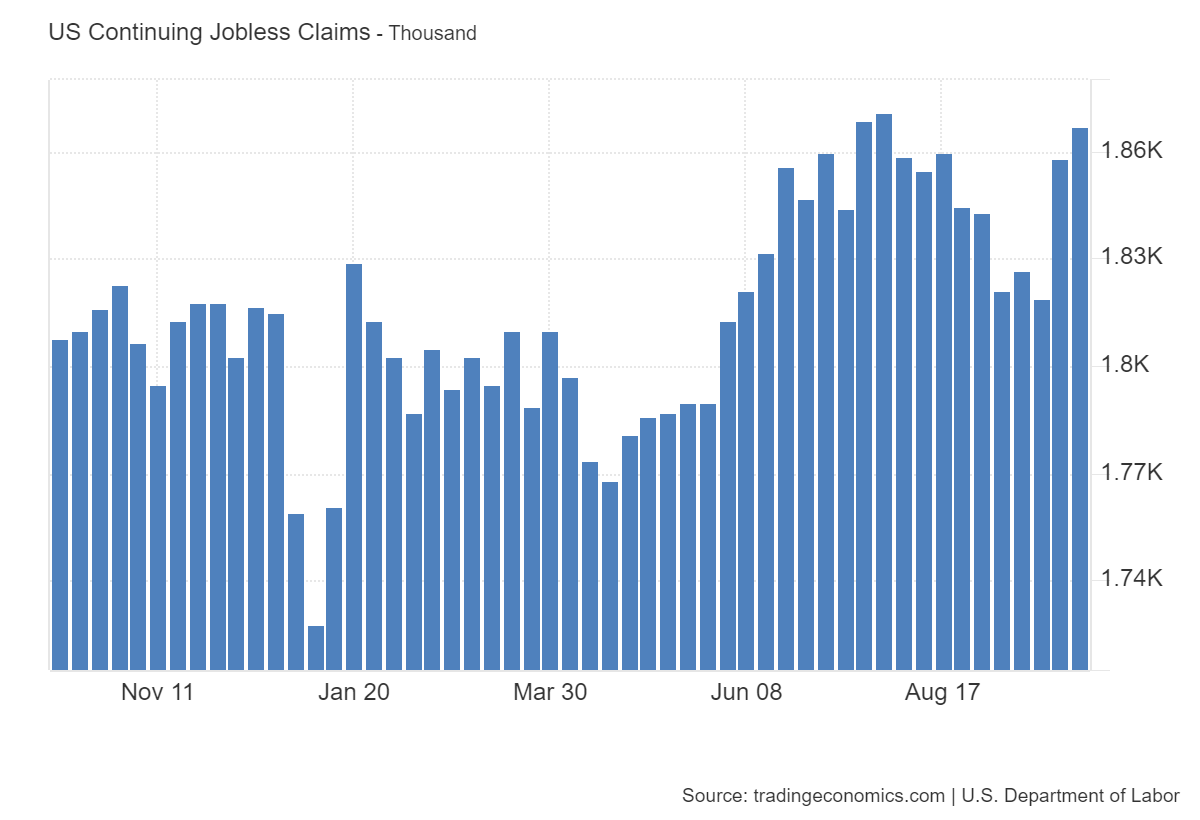

Meanwhile, the US Continuing Jobless Claims index stood at 1,867K on October 17 – higher than the value of 1,861K recorded on October 10. This week, according to TEForecast, the value is expected to drop slightly to 1865K.

A small decline in continued claims indicates that the labor market is still stable. If these numbers improve, it could mean the economy is stronger.

Manufacturing PMI & Services PMI: what you should never miss

In September, the US manufacturing PMI index was 47.3 – the lowest since June 2023. In May 2024 it was above 51. In June it rose even further. However, it has fallen continuously since June.

A continued decline in the manufacturing PMI could signal an economic slowdown. Investors can turn to cryptocurrencies as a hedge against traditional market risks.

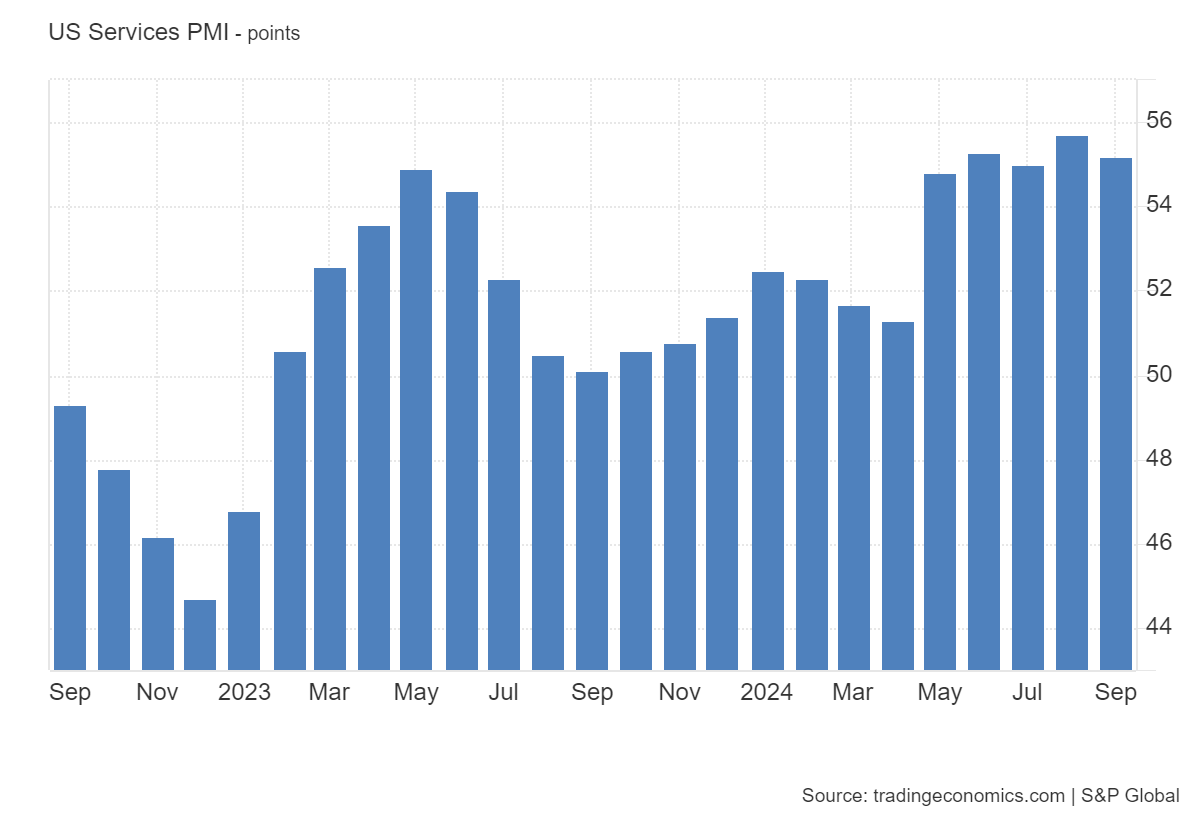

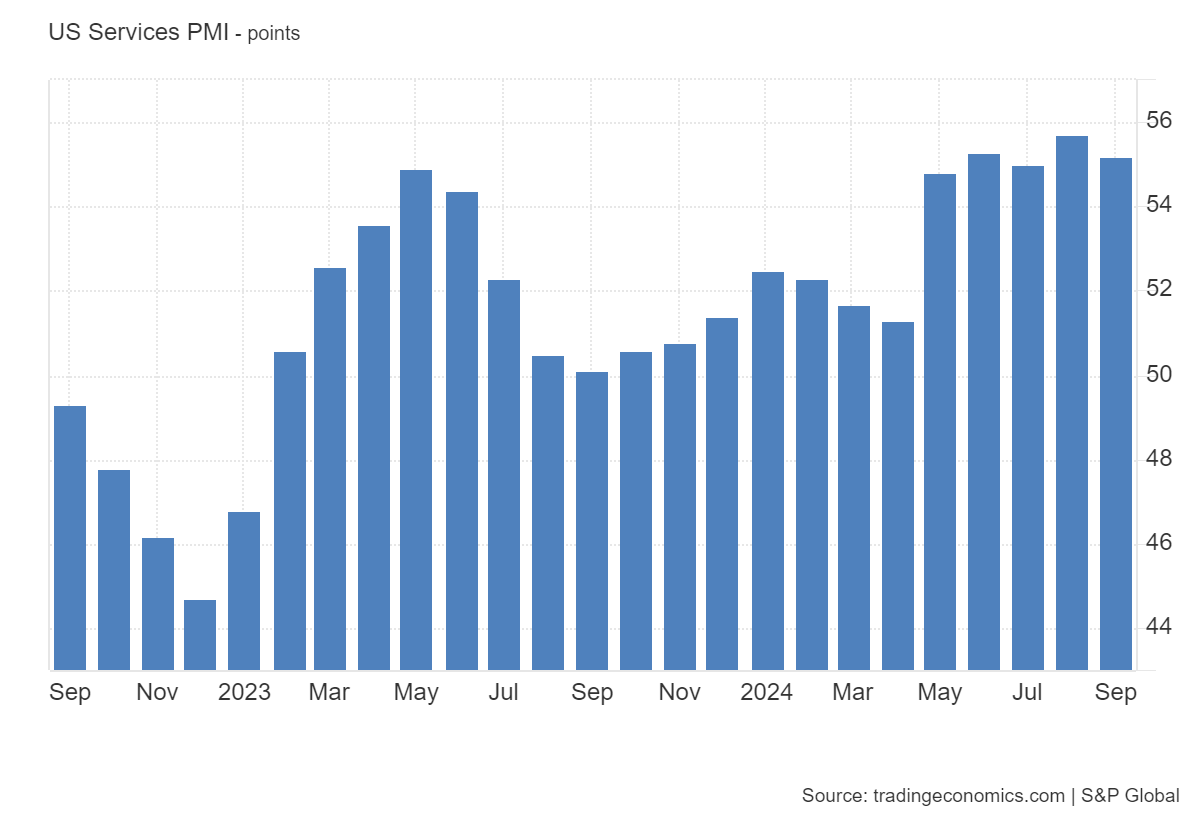

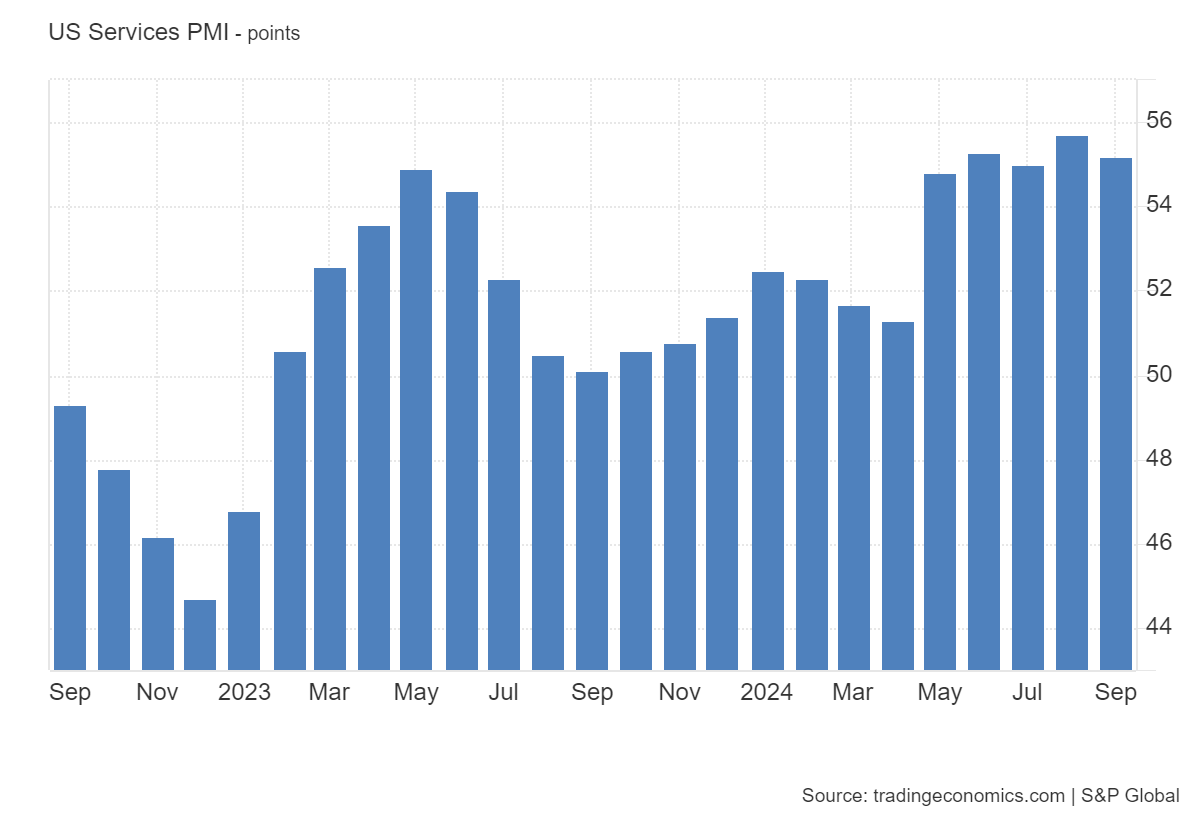

In September, the US services PMI index was 55.2 – lower than the value of 55.7 reported in August.

A strong services sector is a positive sign for the economy, which may reduce interest in riskier assets such as cryptocurrencies.

In conclusion, this week’s economic data is expected to show small changes, with a slight increase in unemployment claims and modest movement in the PMI indices. It is important to keep a close eye on data releases, especially the Manufacturing PMI. If the data shows a weakening economy that deviates from the expected pattern, it could certainly increase interest in the cryptocurrency sector.

- Also read:

- Warren Under Fire: Crypto Community Backs Deaton in 2024 Senate Elections

- ,

Stay informed Coinpedia for more economic insights that could impact cryptos!