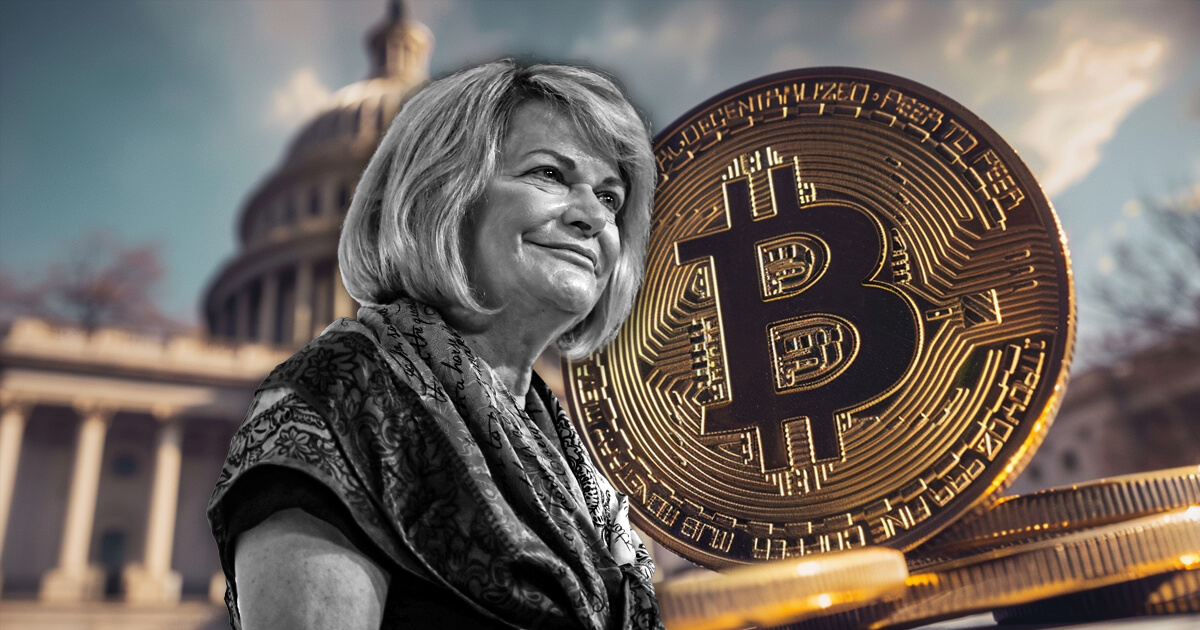

Following her announcement of a historic proposal to boost the US dollar and pay off the national debt by establishing a strategic Bitcoin reserve, US Senator Cynthia Lummis (R-WY) officially introduced the “Boosting innovation, technology and competitiveness through the Optimized Investment Nationwide (BITCOIN) Act” in the Senate on July 31.

The legislation aims to establish a strategic Bitcoin reserve to transparently manage the federal government’s Bitcoin holdings. It also explicitly protects the private property rights of individuals and organizations.

According to Lummis:

“Bitco is transforming not only our country, but also the world. Becoming the first developed country to adopt Bitcoin as a savings technology secures our position as a global leader in financial innovation. This is our Louisiana buying moment that will help us reach the next financial frontier.”

The senator from Wyoming has long been a supporter of Bitcoin and believes it can help the country solve the national debt crisis while strengthening the dollar.

The Bitcoin Act

The BITCOIN Act aims to strengthen the US balance sheet by creating a strategic Bitcoin reserve. This reserve will serve as an additional store of value and ensure transparent management of the federal government’s Bitcoin holdings. The legislation outlines a number of key provisions:

The law proposes the creation of a decentralized network of secure Bitcoin vaults, managed by the US Treasury Department. These vaults will meet regulatory requirements to ensure the highest level of physical and cybersecurity for the country’s Bitcoin holdings.

An important aspect of the law is the implementation of a Bitcoin purchasing program. This program will acquire up to 1 million Bitcoins over a period of time, which represents approximately 5% of the total Bitcoin supply. This initiative reflects the size and scope of America’s gold reserves.

According to Lummis:

“The creation of a strategic Bitcoin reserve aims to increase the United States’ financial leadership and security in the global economy, similar to the historical role of gold reserves.”

To fund the creation of the Strategic Bitcoin Reserve, the law will diversify existing funds within the Federal Reserve System and the Treasury Department. This approach aims to offset costs without placing additional financial burdens on the government.

Rights and transparency

Importantly, the BITCOIN Act affirms the self-custody rights of private Bitcoin holders. It emphasizes that the strategic Bitcoin reserve will not infringe on individual financial freedoms, ensuring that private property rights remain protected.

It will ensure that the federal government cannot seize or deface lawfully acquired Bitcoin assets, upholding the principles of financial sovereignty, privacy and personal freedom in the digital age.

The law requires the establishment of a quarterly Proof of Reserve system to ensure transparency. This system includes public cryptographic attestations and independent third-party audits.

In addition, the Secretary of the Treasury will publish annual public reports on the status of the Bitcoin Purchase Program, detailing the total holdings, transactions, and demonstrated control of private keys related to the Strategic Bitcoin Reserve.

The law highlights Bitcoin’s unique properties as a decentralized and finitely scarce digital asset, which can replenish existing national reserves and strengthen the position of the US dollar in the global financial system. The BITCOIN Act aims to increase financial resilience and promote global financial innovation by diversifying national assets to include Bitcoin.

The introduction of this legislation represents an important step toward integrating digital assets into U.S. financial strategy, and reflects a forward-looking approach to financial innovation and security. Bitcoin has become an increasingly important issue in the upcoming presidential elections, with bipartisan support from US lawmakers.