- Litecoin whales deliver a surprising outcome in late June.

- The whale purchase could boost retail, but could it be a liquidity trap?

Just a week ago, we took a look at how Litecoin [LTC] streamlined, especially after a bearish performance in late June. We also pointed out the halving as the main upcoming event and why it hasn’t impacted the price yet.

Is your wallet green? Check out the Litecoin Profit Calculator

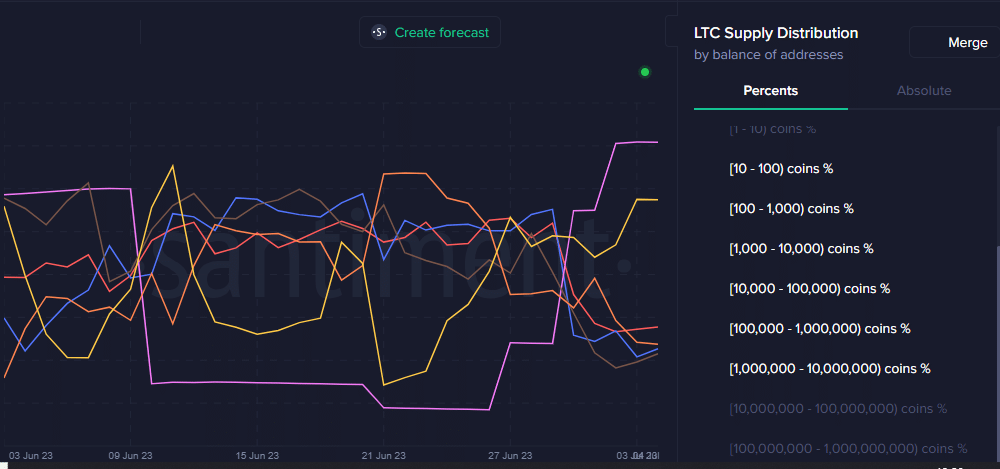

Fast forward to the present day and a lot has changed as far as Litecoin is concerned in the past few days. The distribution of supply shows that some categories of whales accumulated during the dip. Whales in the range of 10,000 to 100,000 LTC (indicated in yellow) and 1 million to 10 million LTC (indicated in purple) have accumulated during the last 10 days of June.

Source: Sentiment

The two whale categories collectively control the majority of Litecoin’s circulating supply. It was worth noting that most of the other top whale categories contributed to the selling pressure. Interestingly enough, this accumulation hardly affected the price until the last day of June. LTC’s on-chain volume registered a major spike on June 30.

Source: Sentiment

Can the Litecoin Bulls Keep Up the Pace in July?

The volume increase was clearly bullish as Litecoin price action bounced back up about 28% on the same day. Interestingly, the bullish volume of the past few days pushed the price to a new 12-month high. LTC peaked at $114.98 during its latest increase but was trading at $107.37 at the time of writing.

Source: TradingView

Bullish volume pushed LTC into overbought territory, but does this mean it will move down even more in the coming days? Well, Litecoin’s MVRV ratio was slightly below its recent monthly peak. This means that most of the recent buyers are now making a profit. The average coin age dropped significantly between June 28 and July 1, confirming that a significant amount has been exchanged after a long period.

Source: Sentiment

But what does all this mean for LTC? On the one hand, the recent rally and high MVRV ratio mean that those who bought recently are already making a profit. As such, there may be an incentive to pay out said profits, especially if Litecoin is able to attract more liquidity. On the other hand, exit liquidity may not be enough to encourage short-term profit taking.

Only 30 days left until the Litecoin Halving!!

More information

https://t.co/8YXNk7JNMZ $LTC #mondaymotivation pic.twitter.com/1j5FFPOhPS

— Litecoin (@litecoin) July 3, 2023

Read more about Litcoin (LTC) price prediction for 2023/2024

The next 4 weeks are crucial for Litecoin due to the upcoming halving. That event could encourage more LTC holders to hodl in anticipation of more potential winnings.

Likewise, more liquidity will flow to Litecoin near the halving event.