- A high hash rate and minimal fees strengthen Litecoin’s reputation as a better alternative to Bitcoin.

- However, Litecoin’s price action against Bitcoin has weakened, as evidenced by the declining LTC/BTC ratio.

Litecoin [LTC] has seen a notable spike in high-value transactions on the network over the past four weeks, indicating growing interest from large-scale investors.

Earlier this month, Santiment noted that the network had been monitoring a “consistently higher than normal level of whale activity” since the last week of August, amid growing social dominance.

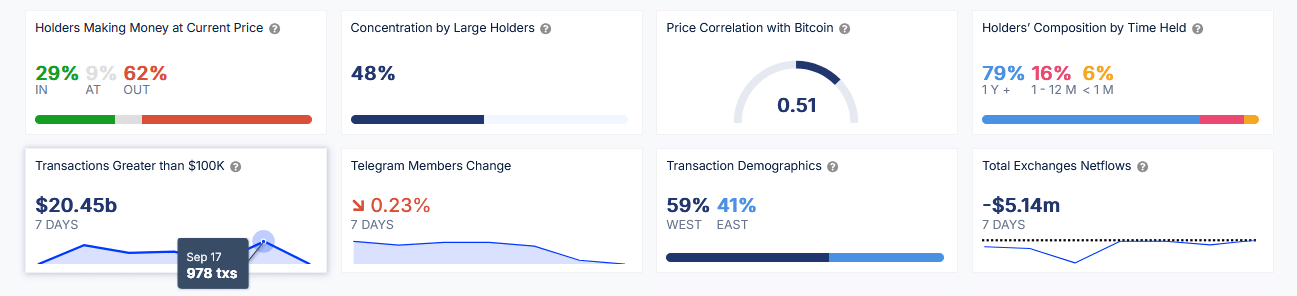

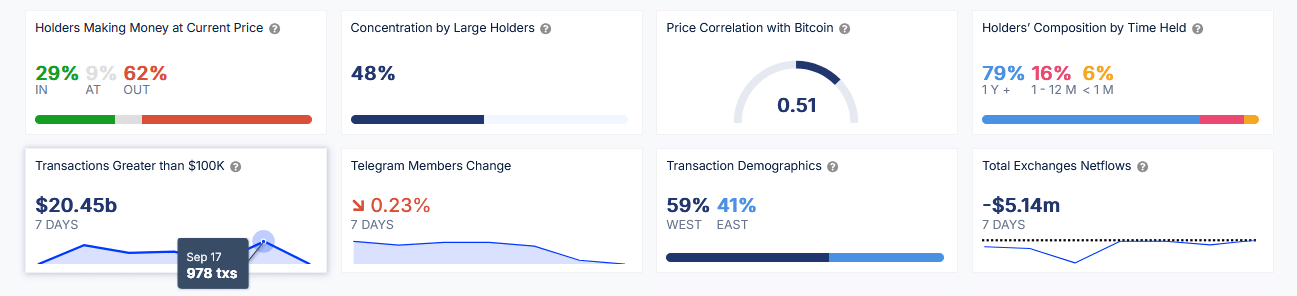

Data from on-chain resource IntoTheBlock shows that transactions over $100,000 in the last seven days currently amount to $20.45 billion. This figure is remarkable, especially compared to Ethereum’s $24.95 billion during the same period.

Source: IntoTheBlock

The data also indicates an increase in the number of these daily large transactions from about 830 in the last week of August to well over 1,000 in the first week of September. Over the past seven days, this figure has hovered above 850, peaking at 978 on September 17.

The increasing number of high-value transactions indicates increased activity by large investors such as institutional investors, which could influence spot market dynamics. It also points to the potential for more liquidity in the market, which could stabilize prices and reduce short-term volatility.

Network health: hashrate and transaction costs

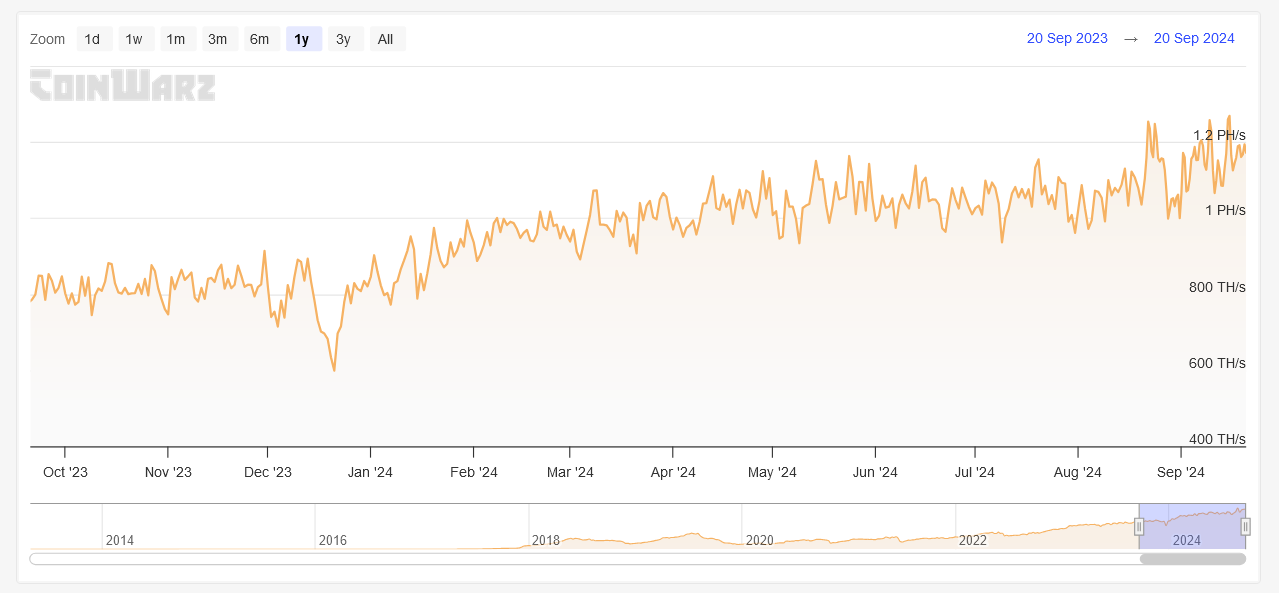

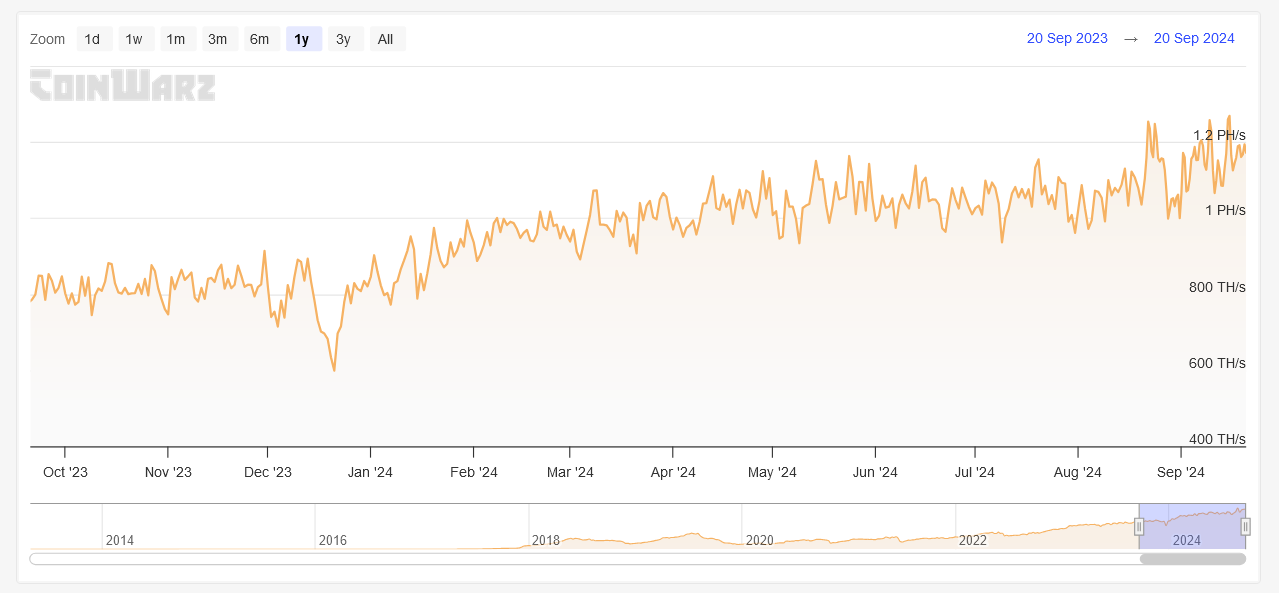

On the network side, Litecoin continues to show strong fundamentals. The hashing power in the network has risen above 1 quadrillion hashes per second since September 14.

The latest data shows that the hash rate of the Litecoin network was 1.19 PH/s at block height 2,759,493 with a difficulty of 41,089,116.87.

Source: Coinwarz

This robust hash rate growth is a positive sign for the overall health and security of the network, further strengthening confidence in the network’s resilience against attacks.

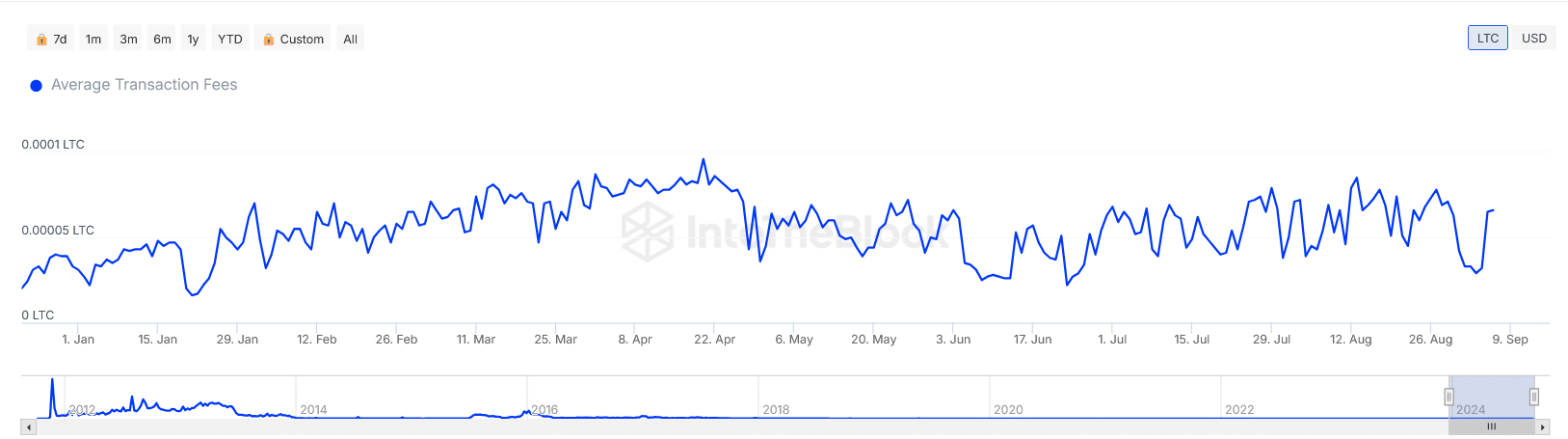

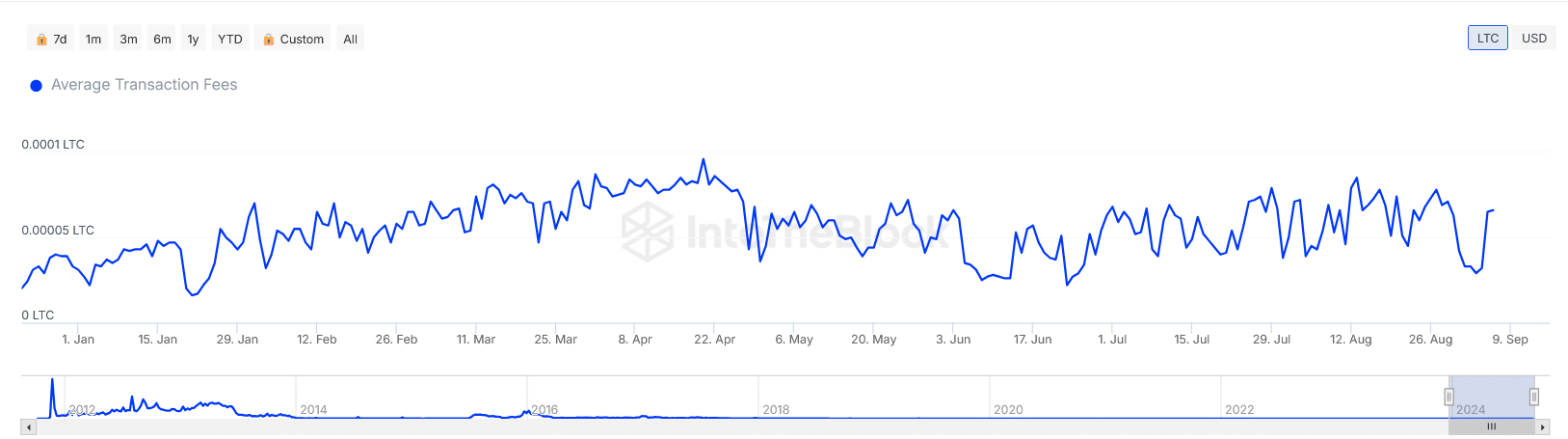

Furthermore, Litecoin has maintained its status as a low-cost transaction network, supporting the narrative that LTC is the “silver” to Bitcoin’s “gold.”

Daily average transaction fees have consistently remained below 0.0001 LTC (less than $0.01) throughout the year.

Source: IntoTheBlock

Such low transaction fees make it an attractive choice for users looking for fast and cost-efficient transfers, especially during congestion phases on other networks.

Litecoin’s fast processing speeds also help significantly minimize the threat of double spending, making it ideal for payments. A recent one analysis from CoinGate showed that Litecoin accounted for 12.3% of payments in August, behind Tron and Bitcoin.

LTC price action and correlation to BTC

Litecoin (LTC) was trading at $65.95, after rising 4% over the past seven days. Despite strong network and transaction metrics, Litecoin has struggled against Bitcoin.

Read Litecoins [LTC] Price forecast 2024–2025

The LTC/BTC ratio is trending downward, indicating underperformance compared to the flagship cryptocurrency.

Source: TradingView

Furthermore, Litecoin’s 30-day correlation with Bitcoin has increased from 0.46 on September 6 to 0.51 at the time of writing. This correlation, while typical of many altcoins, suggests that LTC’s price movement is influenced by Bitcoin rather than unique catalysts.