Chainlink’s LINK price is up over 40% and trading above $10. The bulls appear to be in control and could target a rally towards the $12 resistance.

- Chainlink price is gaining pace above the USD 10.00 resistance against the US Dollar.

- The price is trading above the $10.00 level and the 100-day simple moving average.

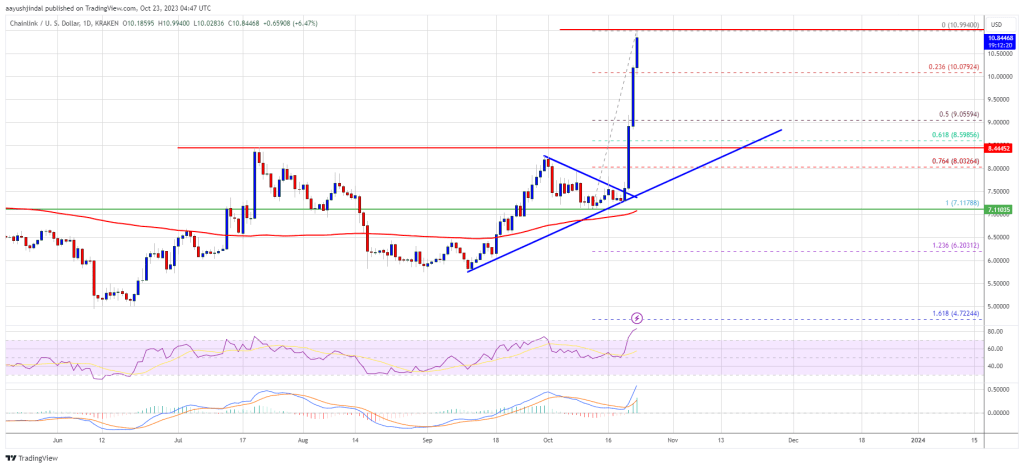

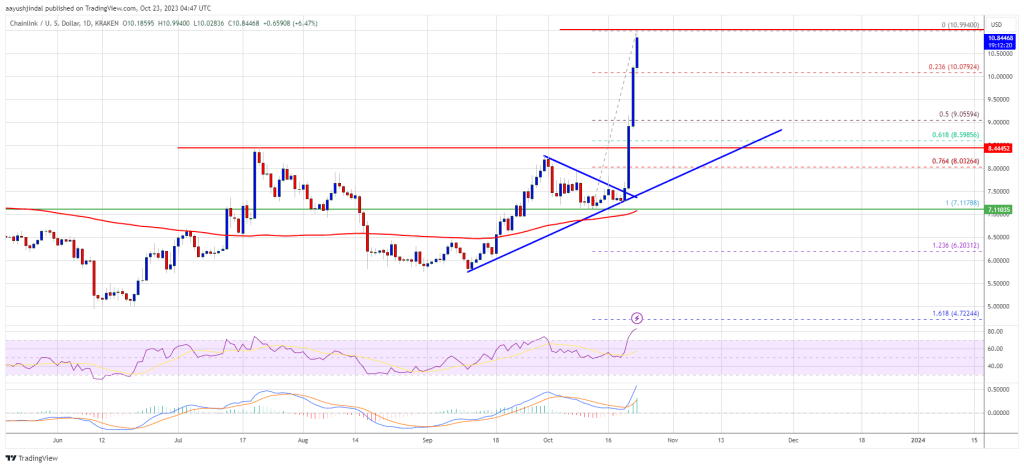

- A major bullish trendline is forming with support near $8.60 on the daily chart of the LINK/USD pair (Kraken data source).

- The price could continue to rise towards the USD 11.25 and USD 12.00 resistance levels.

Chainlink Price Begins New Rally

In recent days, the LINK price started a strong rally against the US dollar. The price formed a base above the USD 7.00 level before the bulls took action. There was a big pump above the USD 7.50 and USD 8.00 resistance levels.

In the last three days, the price has risen by more than 40%, clearing many hurdles around $9.00. The recent pump in Bitcoin has also helped LINK surpass the USD 10.00 resistance. A new multi-week high is formed near $10.99. The price is now consolidating gains well above the 23.6% Fib retracement level of the upward move from the $7.11 swing low to the $10.99 high.

LINK is now trading above the $10.00 level and the 100 simple moving average (4-hours). There is also a major bullish trendline forming with support around $8.60 on the daily chart of the LINK/USD pair. The trendline is near the 61.8% Fib retracement level of the upward move from the $7.11 swing low to the $10.99 high.

Source: LINKUSD on TradingView.com

If there is a fresh rise, the price could face resistance near USD 11.20. The first major resistance is near the $12.00 zone. A clear break above USD 12.00 could potentially trigger a steady rise towards the USD 12.20 and USD 12.50 levels. The next major resistance is near the USD 13.20 level, above which the price could test USD 15.00.

Are dips limited in LINK?

If Chainlink fails to climb above the USD 11.20 resistance level, a downside correction could occur. The initial downside support is near the $10.00 level.

The next major support is near USD 9.00, below which the price could test the trendline support at USD 8.60. Any further losses could push LINK towards the $8.00 level in the near term.

Technical indicators

4-hour MACD – The MACD for LINK/USD is gaining strength in the bullish zone.

4-hour RSI (Relative Strength Index) – The RSI for LINK/USD is now above the 50 level.

Major support levels – USD 10.00 and USD 9.00.

Major resistance levels – $11.20 and $12.00.