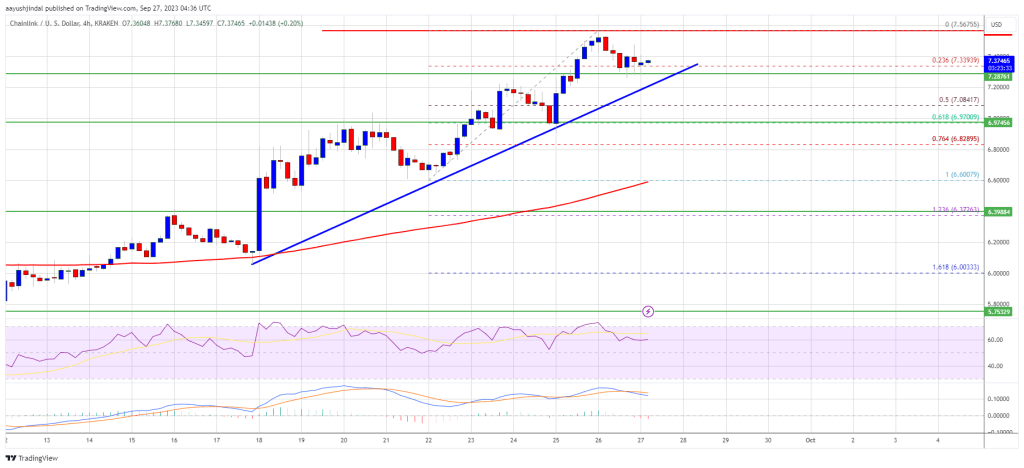

Chainlink’s LINK price is moving higher above the USD 7.25 resistance. The price is now consolidating gains and could target more gains above $7.50.

- Chainlink price is showing positive signs above $7.25 against the US dollar.

- The price is trading above the USD 7.30 level and the 100 simple moving average (4 hours).

- A major bullish trendline is forming with support near $7.25 on the 4-hour chart of the LINK/USD pair (Kraken data source).

- The price could rise again unless there is a close below the USD 6.95 support.

Chainlink (LINK) Price looks for more benefits

In the latest LINK price prediction, we discussed the chances of more gains above the $7.00 level against the US dollar. The price remained stable and rose above the $7.25 level.

The price even broke the $7.50 level. Chainlink traded as high as $7.56, outperforming Bitcoin and Ethereum. Recently there was a small downward correction below $7.40. The price tested the 23.6% Fib retracement level of the upward move from the $6.60 swing low to the $7.56 high.

LINK is now trading above the $6.50 level and the 100 simple moving average (4-hours). There is also a major bullish trendline forming with support around $7.25 on the 4-hour chart of the LINK/USD pair.

Source: LINKUSD on TradingView.com

If there is a fresh rise, the price could face resistance near USD 7.45. The first major resistance is near the $7.50 zone. A clear break above USD 7.50 could potentially trigger a steady rise towards the USD 8.00 and USD 8.20 levels. The next major resistance is near the USD 8.50 level, above which the price could test USD 8.80.

Are dips limited?

If Chainlink price fails to rise above the USD 7.50 resistance level, a downside extension could occur. The initial downside support is near the $7.25 level.

The next major support is near the $6.95 level or the 61.8% Fib retracement level of the upward move from the $6.60 swing low to the $7.56 high, below which the price reaches the $6.80 level could test. Any further losses could push LINK towards the $6.60 level in the near term.

Technical indicators

4-hour MACD – The MACD for LINK/USD is losing momentum in the bullish zone.

4-hour RSI (Relative Strength Index) – The RSI for LINK/USD is now above the 50 level.

Major support levels – $7.25 and $6.95.

Major resistance levels – $7.50 and $8.50.