- LINK has made impressive progress in networking activity, but the whale exodus has dampened the surge

- Can Trump’s retail capital and advocacy give LINK the boost it needs?

Just two weeks ago, Chainlink [LINK] lit up the charts with a massive 21% increase in one day, thanks to a $1 million purchase by World Liberty Financial (WLF).

This explosive rally, fueled by the ‘Trump pump’, put LINK in the spotlight as a major player at the intersection of politics and crypto. But as quickly as the hype flared up, it quickly dissipated. And that had a corresponding effect on the altcoin.

At the time of writing, LINK had returned to around $22.8, with a bearish MACD crossover indicating further decline. Hence the question: how will the altcoin perform in the coming year?

LINK’s comeback is FOMO-worthy

Over the past four years, Chainlink has made incredible progress. The number of addresses on the network has increased from 213,000 to 690,000. Also in December its total value was locked (TVL) crossed $1 billion for the first time.

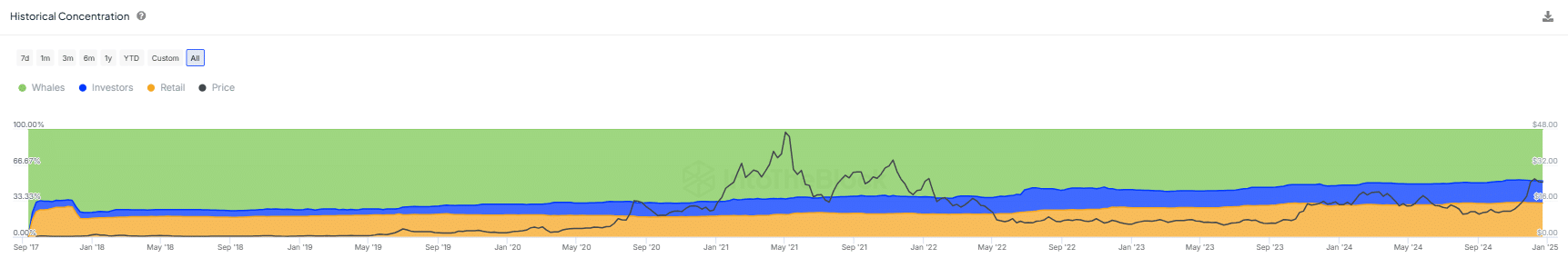

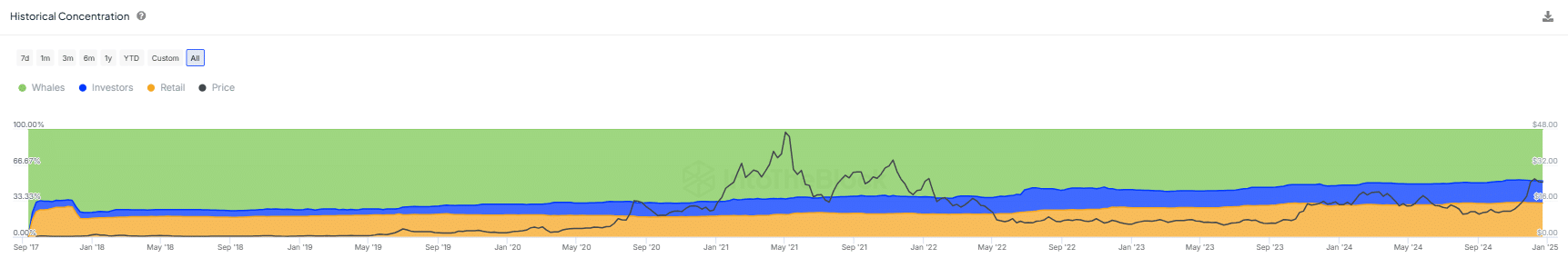

What’s even more intriguing is the shift in LINK’s token distribution. Once dominated by large holders who controlled 70% of the supply, that figure has since fallen to 48%. In the meantime, private investors have also taken their course, and they now own 32% of LINK’s offering.

Source: IntoTheBlock

But why is this important? A recent AMBCrypto report Ethereum emphasized [ETH] increasing centralization, with whales exerting excessive control and preventing the price from breaking the $4,000 mark. So LINK’s move toward more balanced distribution could differentiate the company in the long run.

However, there’s a catch: despite LINK’s progress in decentralization, the price has struggled to regain the all-time high of $53 from three years ago. Even with strong volume and network growth, LINK has not been able to break through top 10.

This means that external market factors, along with a notable number of whale portfolios disappearing, could put downward pressure on LINK’s price.

That said, the recent “Trump pump” served as a powerful catalyst, triggering a flood of new FOMO among new players. So the question is –

Will it last?

Over the past 30 days, LINK has grown tremendously with impressive double-digit growth, surpassing many of its competitors. Zooming out, with a 50% year-to-date (YTD) price increase, it remains neck-and-neck with Ethereum.

Where Chainlink really stands out, however, is in its broader appeal. Support from newly elected President Donald Trump has sparked new interest, while the reduction in whale manipulation has paved the way for a more organic market.

Furthermore, LINK’s Oracle network extends its use case to several industriesmaking it a practical utility.

Is your portfolio green? View the LINK Profit Calculator

With all these factors in play, Chainlink is positioning itself as a top contender in the altcoin race. It attracts both short-term traders looking for a solid diversification play and long-term HODLers looking for steady growth.