- LimeWire’s recent rally showed strong buying interest and broke above key resistance levels

- Buyers should watch for a potential bullish 20/50 day EMA crossover as it could signal the start of a longer uptrend

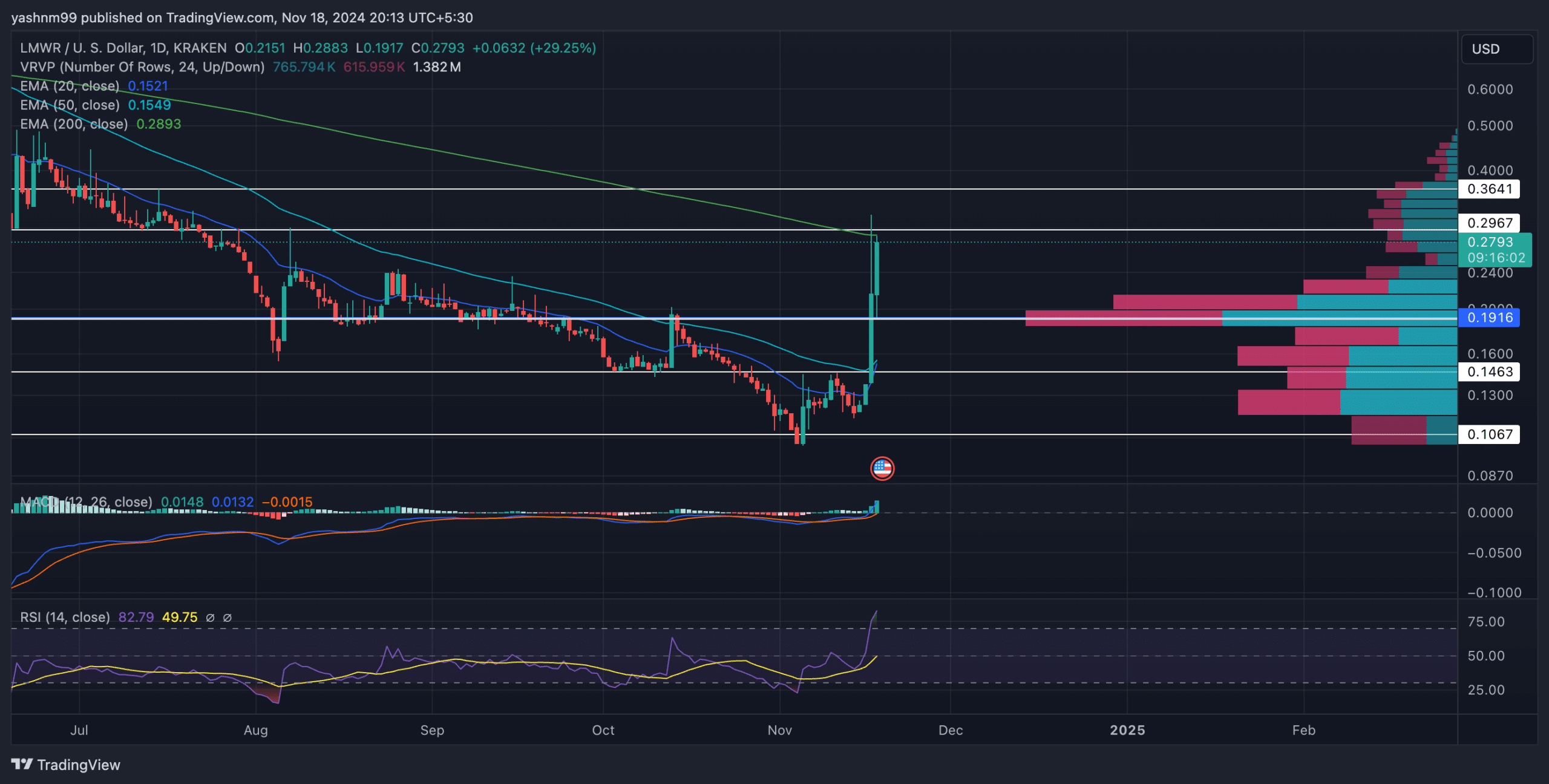

LimeWire (LMWR) has been in the spotlight recently after a huge rally in recent days. The altcoin rose more than 200% from the November 5 rally, peaking at around $0.32 on November 17. This surge pushed LMWR into a price discovery phase, having finally broken through its long-standing resistance.

At the time of writing, LMWR was trading around $0.27, up about 65% in the last 24 hours. The price action tested resistance several times around $0.3 but struggled to find a decisive close above this level. Interestingly, the $0.3 resistance also appeared to be in line with the 200-day EMA – which formed a critical zone for bulls to move past.

Can LMWR Buyers Keep the Momentum or Will Sellers Regain Control?

Source: LMWR/USDT

During the latest rally, LMWR cleared the 20-day EMA ($0.151) and the 50-day EMA ($0.1545), with the price now trying to hold above this short-term support. Should the LMWR witness a bullish crossover from the 20-day EMA over the 50-day EMA, this could pave the way for a more sustained recovery, attacking the $0.36 resistance.

However, failure to close above the $0.3 zone could lead to a short-term correction, with immediate support remaining at $0.2. The RSI at the time of writing was around 81, indicating that the LMWR was in overbought territory.

So buyers should be somewhat cautious here, as an RSI above 80 could indicate a possible reversal as selling pressure increases.

Here it is worth noting that the altcoin saw an increase of over 260% in its 24-hour trading volumes. This jump coincided with a daily gain of over 65%, showing a healthy upward trend. Still, traders should also keep an eye on Bitcoin’s price movements. Especially since overall market sentiment could influence LMWR’s next moves.

MACD and volume profile analysis

The MACD indicator recently turned positive with the MACD line crossing above the signal line. The MACD line jumped above the zero mark while the signal line was about to cross the equilibrium. A continued uptrend of these two lines would reaffirm the short-term bullish trend on the LMWR charts.

Finally, the Visible Volume Profile Range (VPVR) revealed a significant area of buying activity between $0.15 and $0.21. This zone could act as strong support in the event of a pullback.

Conversely, the volume profile showed limited resistance above $0.32, indicating that a decisive break above this level could open the door for quick gains towards $0.36 and above.