- BTC’s multi-month price range could soon be over.

- Analysts predicted that BTC could explode above $90,000 in the fourth quarter of 2024.

Bitcoin [BTC] has been stuck in a choppy price range for more than six months, pushing some traders and investors to the sidelines.

Although last week’s Fed rollover triggered a relief rally to $64,000, some market experts remained cautious about the US recession.

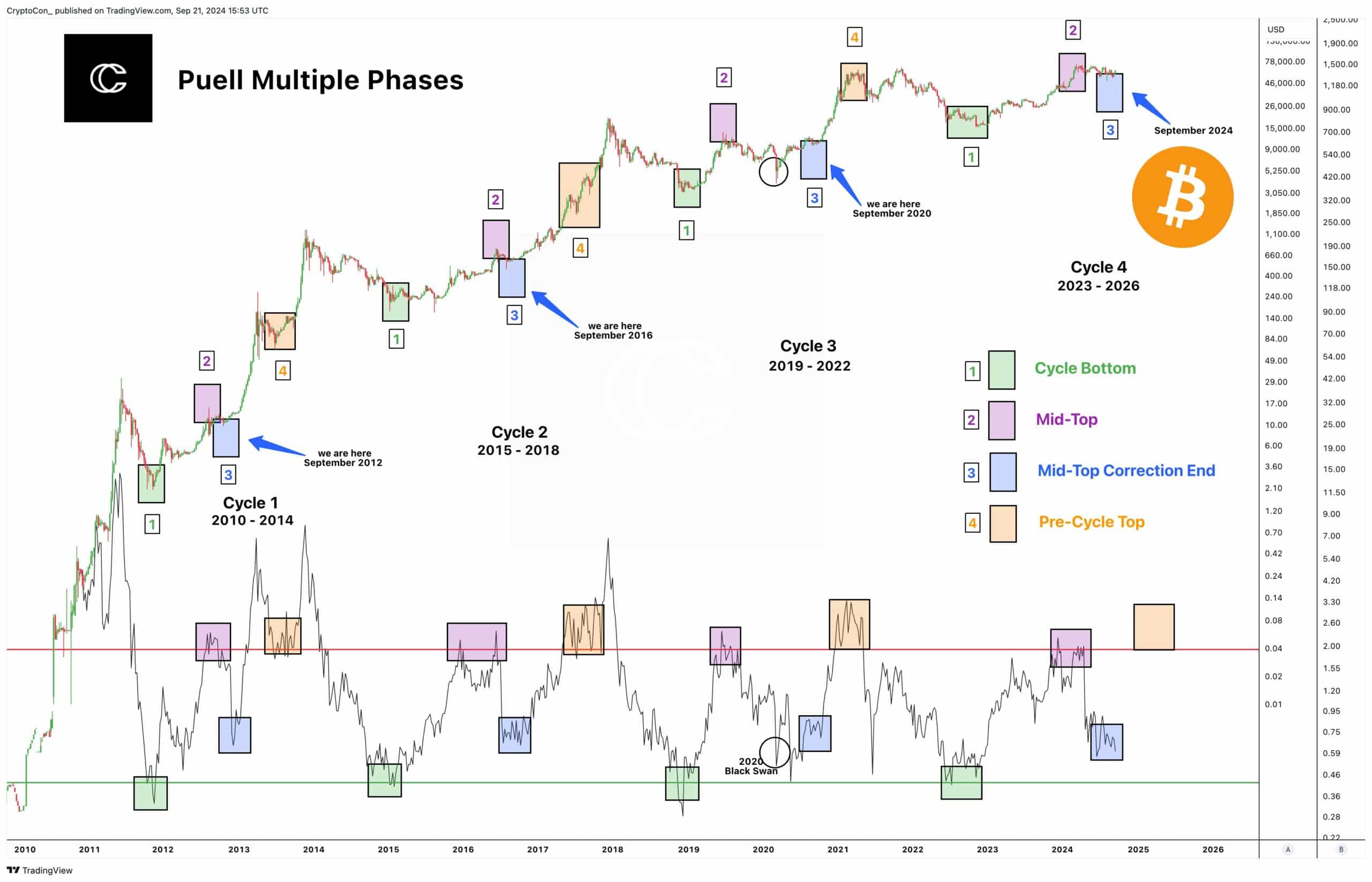

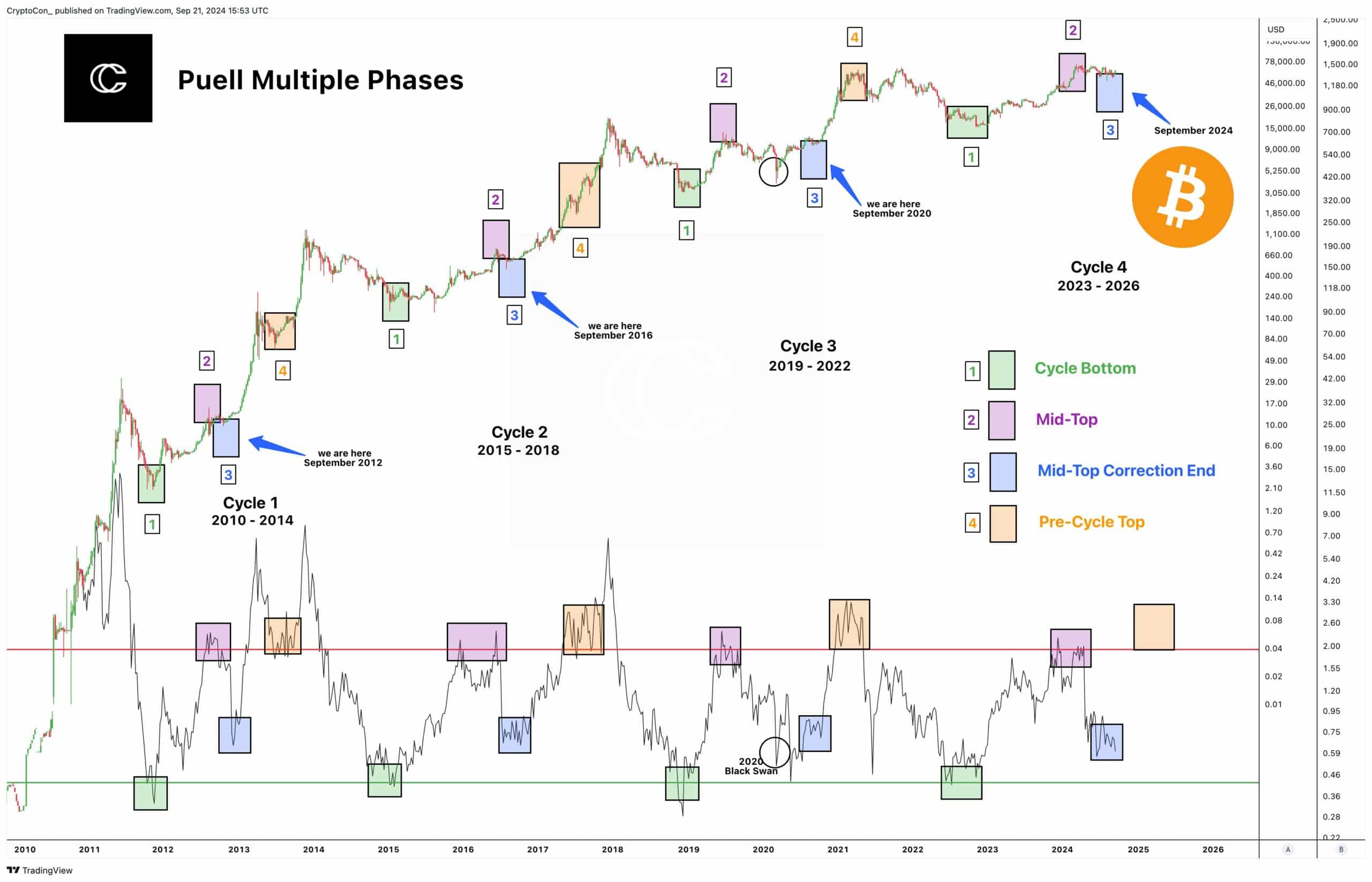

Bitcoin analyst Crypto Con noted that based on Puell Multiple’s historical patterns, the boring price range could soon be over. He stated,

“The phases on Puell Multiple make it abundantly clear that we are in the middle of the mid-top correction, which comes just before the real bull run.”

Source: CryptoCon/X

For context: Puell Multiple Metric Meter market cycle tops and bottoms based on miner profitability. By extension, it is also a BTC valuation signal that determines whether the market is overheated.

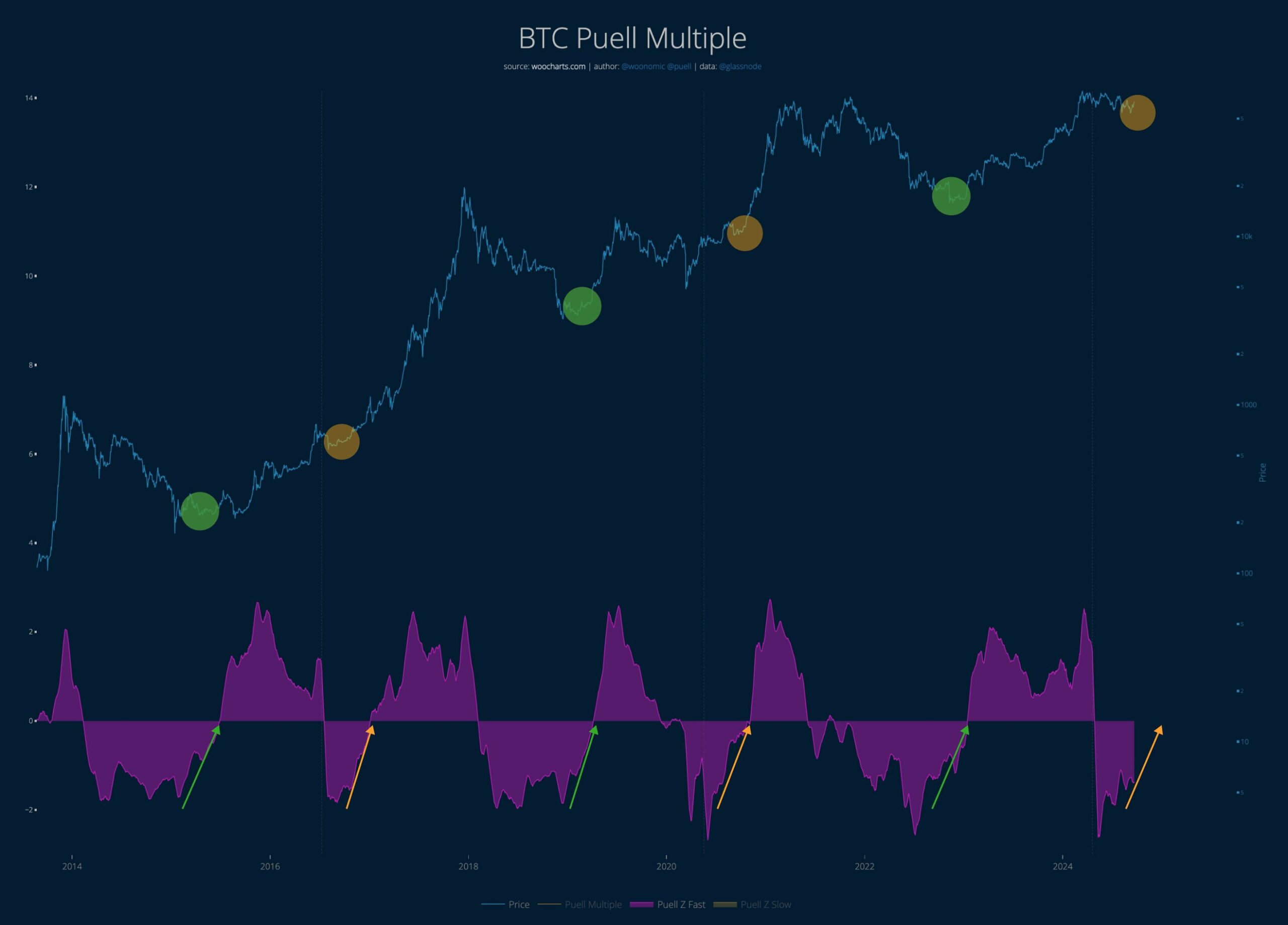

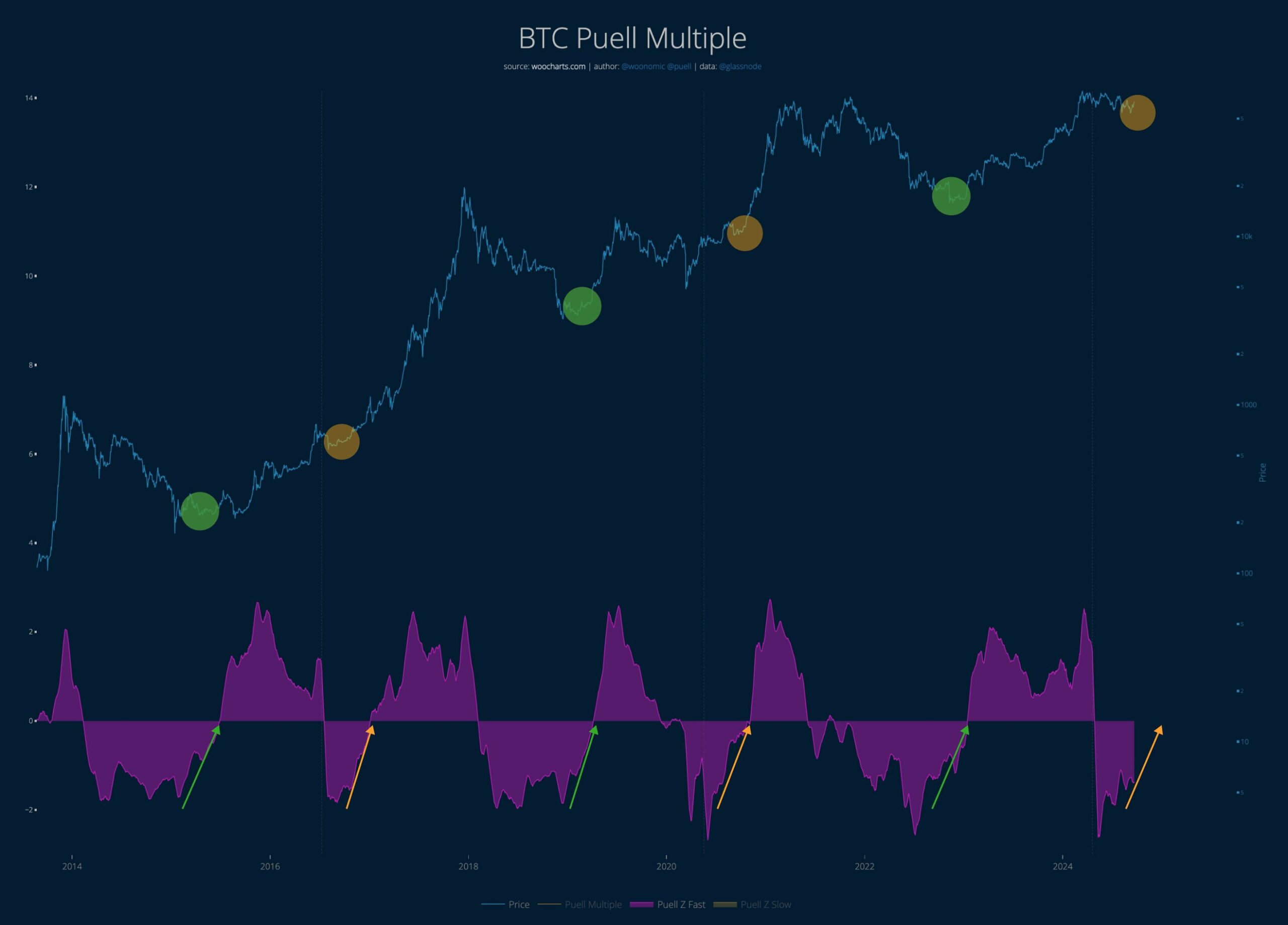

The current ‘mid-top correction break’ was the next best time to score a discounted BTC before the next leg up. The same view was echoed by another BTC analyst, Willy Woo. He quoted Dr. David Puell and said,

“Famous quote from Dr. Puell. The best time to buy #Bitcoin is at the bottom; the next best time to buy is the reaccumulation after the halving.”

Source: Willy Woo/X

The green bubbles show the bottoms of the cycle, while the orange bubbles show the reaccumulation range after the halving. BTC’s price range since April is part of the post-halving range.

In other words, this might be the last and best BTC buy opportunity as the parabolic run begins in the coming weeks. Market experts are increasingly sharing the bullish outlook for the fourth quarter and 2025.

Geoff Kendricks, Head of Digital Asset Research at Standard Chartered, projected that BTC could reach $200,000 by the end of 2025 regardless of who wins the US elections. The executive added that the wealth could rise to $125,000 by the end of 2024 if Trump wins the election.

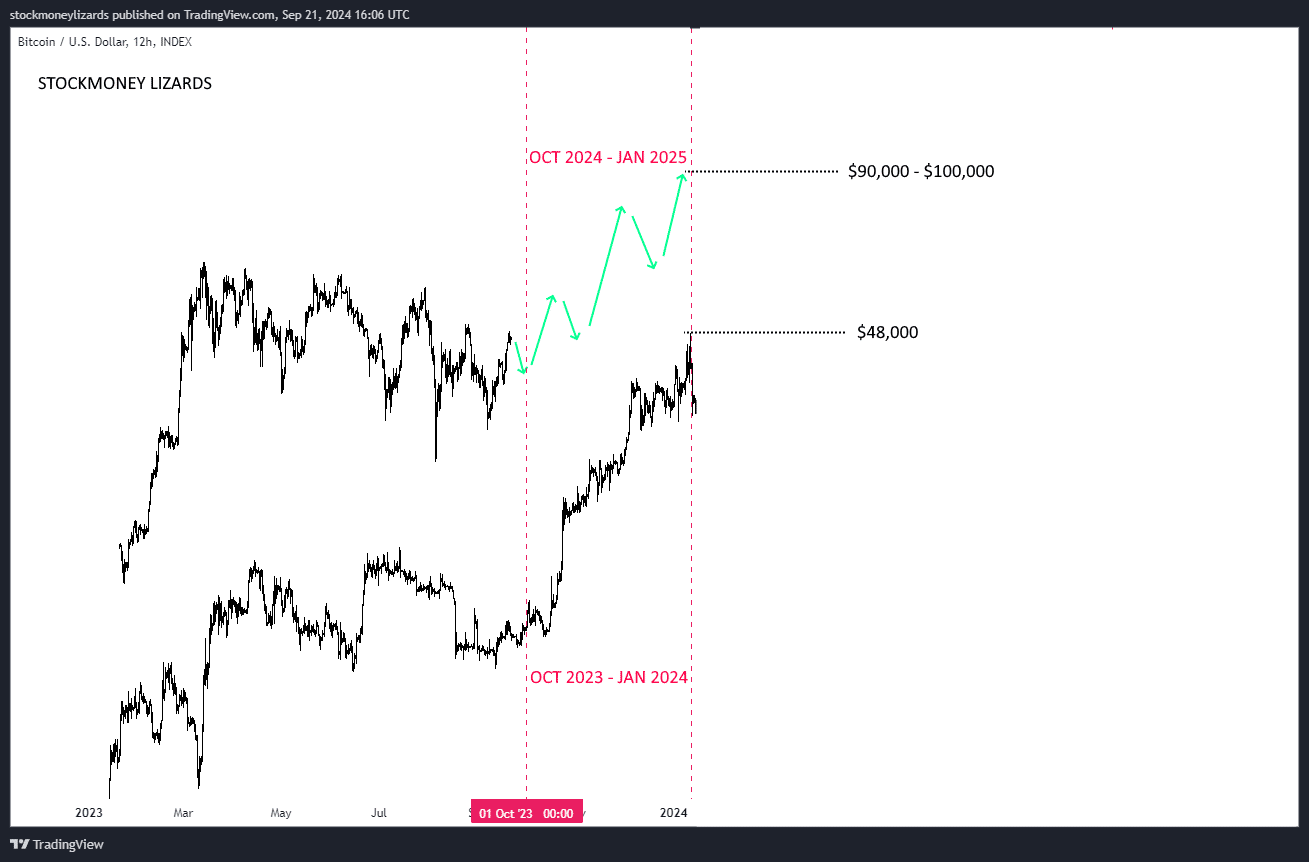

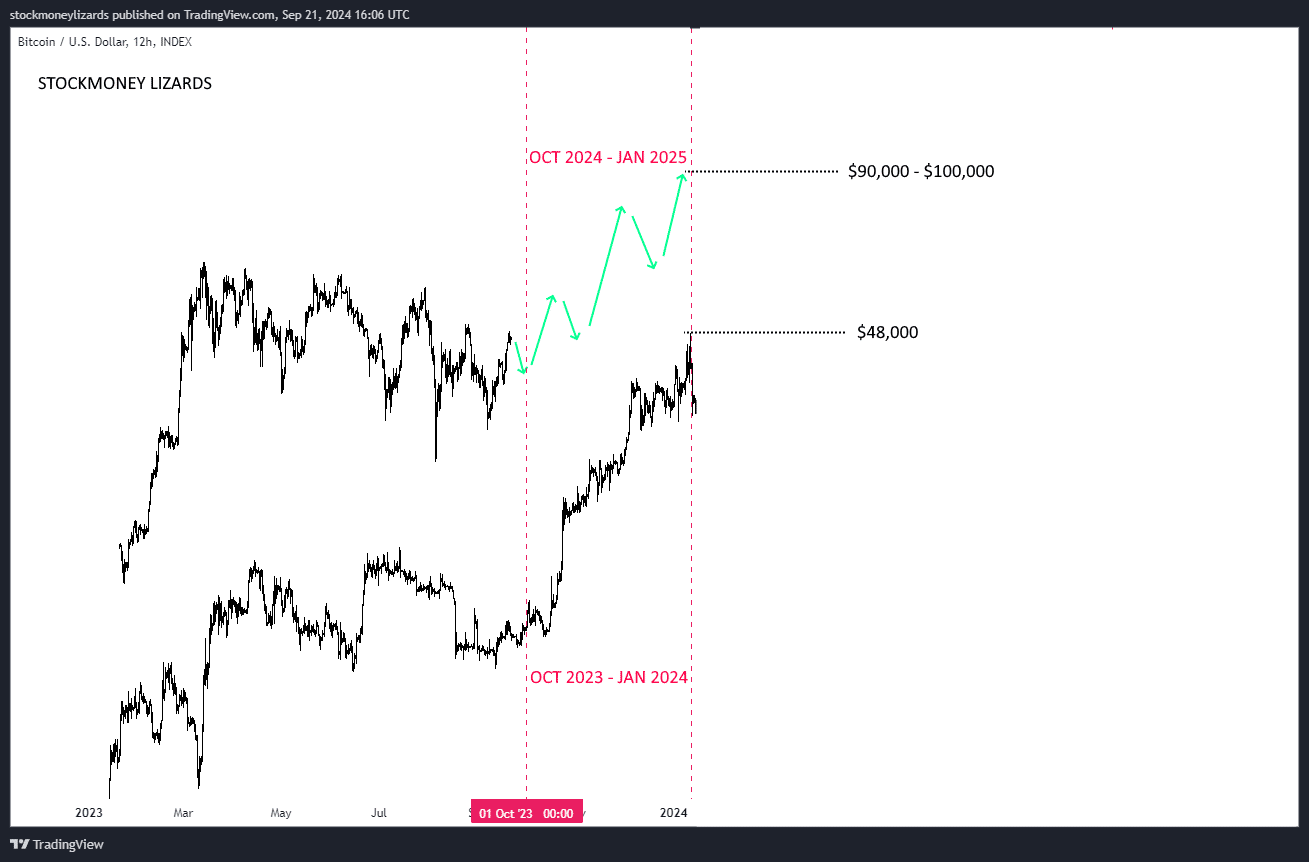

Market analyst Stockmoney Lizards shared a similar view: treasure that BTC could reach $90,000 to $100,000 between the fourth quarter of 2024 and early 2025.

Source: Stock Money Lizards

However, past performance does not determine BTC’s future results. Besides, geopolitical and other macro updates may also impact these projections. So monitoring these fronts along with expert projections is crucial.