The Bitcoin market is experiencing a period of adjustment following the highly anticipated launch of US spot ETFs last week. After surging to a two-year high near $49,000, so has the leading cryptocurrency withdrawn over the last four days, currently trading at $42,588 with a market cap of $834 billion.

This correction provides an opportunity to assess the underlying dynamics and potential future trajectories of the digital asset.

ETF Approval Hype Fades: Markets React

The initial excitement around the ETF’s approval was palpable and led to a rapid price increase as investors anticipated greater accessibility and institutional adoption. However, profit-taking and market uncertainty soon increased, pushing the price back closer to pre-ETF levels.

This pattern is consistent with the “buy the rumor, sell the fact” phenomenon often observed in financial markets, and highlights the distinction between anticipation and actualization.

Adding to the selling pressure is the recent outflow from the Grayscale Bitcoin Trust. The massive fund, which previously traded at a discount due to its closed structure, was converted into an ETF last week.

However, some investors opted to buy back their shares rather than move to the new structure, resulting in a net outflow of $579 million. This suggests that liquidity considerations and possible portfolio adjustments played a role in the post-ETF price movement.

Bitcoin currently trading at $42,619 on the daily chart: TradingView.com

Furthermore, the activity of Bitcoin miners, the decentralized network responsible for validating transactions and generating new coins, is another factor to take into account. The Bitcoin Miners’ Position Index (MPI) peaked at 9.43 on January 12, indicating a significant increase in Bitcoin movement by miners.

While the exact reasons for this activity remain unclear, it could potentially indicate profit-taking by miners looking to capitalize on the recent price increase.

In spite of the recent correction, Analysts remain divided on the short- and long-term prospects for Bitcoin. Ali Martinez, a leading crypto analyst, identifies a “parallel channel” pattern on the price chart, indicating a potential retracement to $35,000 before a potential recovery towards $50,000.

However, Martinez also acknowledges the risk of further downward pressure if miners continue to sell off their assets.

Source: Ali Martinez

Bitcoin Outlook: Analysts Cautious Amid Complexity

Tony Sycamore, another market analyst, takes a more conservative approach and expects range-bound trading between $38,000 and $40,000 in the near future. Both analysts emphasize the importance of monitoring miner activity and investor sentiment in the coming weeks, as these factors will play a crucial role in determining the next change in direction for Bitcoin.

Ultimately, recent market dynamics highlight the complexity of the Bitcoin ecosystem. While the launch of the ETF represents a significant milestone for institutional adoption, it is not a guaranteed catalyst for immediate stock price appreciation.

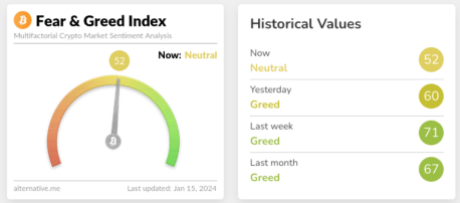

The Crypto Fear and Greed Index drops to its lowest level in three months. Source: Alternative.me

Meanwhile, just a few days after the historic approval of spot Bitcoin ETFs in the US, the Crypto Fear and Greed Index has fallen back to ‘neutral’ levels last seen in October 2023.

The indicator shows that the current market sentiment score for Bitcoin is 52 out of 100, which is the lowest since October 19 last year, when Bitcoin’s price was trading at around $31,000 daily.

Featured image from Shutterstock

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.