Amid the bearish impression circulating in the cryptocurrency market lately, a prominent crypto analyst has revealed a recent trend Bitcoin (BTC)which will help strengthen the continuation of the price rally.

What Bitcoin Needs to Maintain and Extend Its Rally

A cryptocurrency analyst recently known as Ali shared this crucial information with the entire cryptocurrency community on December 18, 2023. The analyst took to X (formerly Twitter) to highlight what Bitcoin needs to continue its upward trajectory.

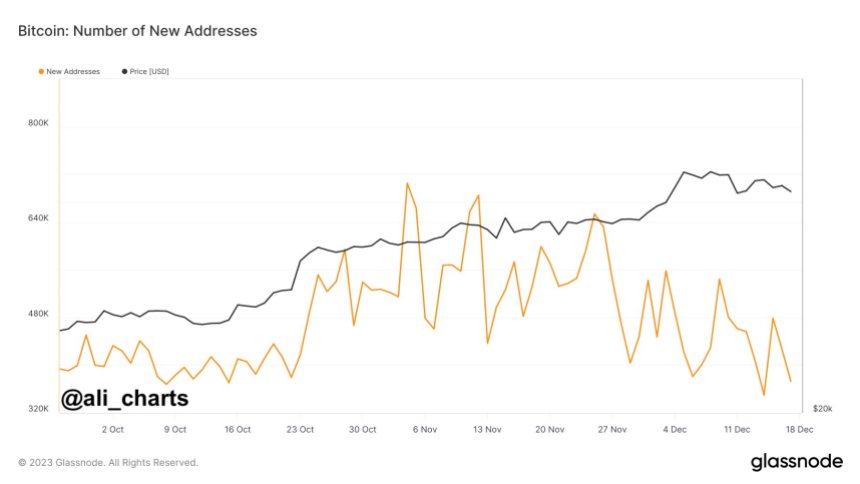

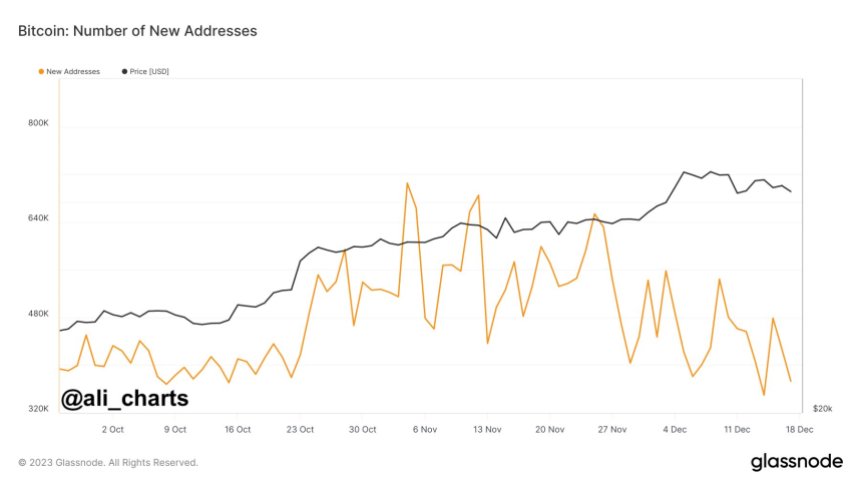

Ali said the crypto asset has experienced a dip in network growth over the past month, raising concerns about the stability of BTC’s recent price surge to $44,000.

He added that the creation of new Bitcoin addresses must be expanded to ensure a robust continuation of the rally. This will provide much-needed support for the crypto asset to maintain its bullish momentum.

The message read:

There has been a noticeable dip in the growth of the #Bitcoin network over the past month, casting doubt on the sustainability of $BTC’s recent move to $44,000. For a robust continuation of the bull rally, it is critical to see an increase in the number of new $BTC addresses. This would provide the necessary support for continued bullish momentum.

BTC needs further investor and institutional support to support the rally. A chart accompanied the crypto analyst’s X-post to further support his projection.

This forecast means that further corrections could be a scenario for the digital asset. This is due to the discrepancy between the creation of new addresses and the current price increase of Bitcoin.

Still approving a Bitcoin spot an exchange-traded fund (ETF) in the US would be a opportunity for more institutional investment, reversing this trend.

At the time of writing, BTC was trading at $40,980, indicating a decline of more than 2% in the past 24 hours. According to CoinMarketCap, the market capitalization has fallen by the same percentage over the past 24 hours.

Digital asset prices have increased by 146% in the past year, showing astonishing growth during this period. Its same-year performance surpassed 73% of the 100 leading crypto assets, making it one of the top performers.

The crypto asset fell under its crucial supply area

Ali too shared another post on X showing that Bitcoin has witnessed a dip below its key supply zone. The analyst pointed out that the zone ranges from $41,200 to $42,400, with the asset recently falling below this range.

He added that 1.87 million addresses in this region have accumulated approximately 730,000 BTC. Of After this decline, these holders can sell the token to limit losses.

The crypto analyst also highlighted a potential decline to the next demand zone, ranging from $37,500 to $38,700. Meanwhile, approximately 1.28 million addresses in this region have collected 553,000 BTC tokens.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.