Bitcoin price holds gains above $37,000. BTC is consolidating and could be aiming for another rally soon if it breaks the USD 38,000 resistance zone.

- Bitcoin is still consolidating below the USD 37,750 resistance.

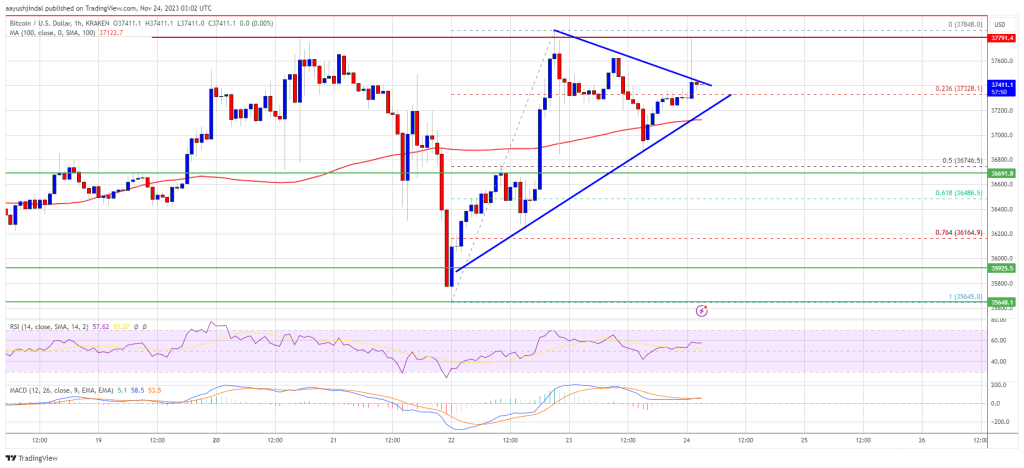

- The price is trading above USD 37,200 and the 100 hourly Simple Moving Average.

- A short-term contracting triangle is forming with resistance near $37,420 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a strong rise if it breaks the $38,000 resistance zone.

Bitcoin price remains supported

Bitcoin price remained well bid and started a steady rise above the USD 37,000 resistance. BTC trimmed all losses and even revisited the USD 37,750 resistance zone. It seems like the bulls are still struggling to break the USD 37,750 resistance zone.

It reached a high near $37,848 and the price is now consolidating gains. There was a move below the 23.6% Fib retracement level of the upward move from the $35,645 swing low to the $37,848 high.

Bitcoin is now trading above $37,200 and the 100 hourly Simple Moving Average. A short-term contracting triangle is also forming with resistance near $37,420 on the hourly chart of the BTC/USD pair. On the upside, immediate resistance is around the $37,420 level.

The first major resistance forms around $37,750. The main resistance is still around the USD 38,000 level. A close above the $38,000 resistance could trigger a strong upside.

Source: BTCUSD on TradingView.com

The next major resistance could be near USD 38,800, above which BTC could rise and test the USD 39,200 level. In the mentioned case, it could even rise towards the USD 40,000 resistance.

Another drop in BTC?

If Bitcoin fails to rise above the USD 37,750 resistance zone, it could start a new decline. The immediate downside support is near the USD 37,200 level.

The next major support is $37,000 and the 100 hourly Simple Moving Average. The first major support is at $36,750 or the 50% Fib retracement level of the upward move from the $35,645 swing low to the $37,848 high. If there is a move below $36,750, there is a risk of more downside. In the mentioned case, the price could fall towards the $36,000 support in the short term. The next major support or target could be $35,650.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major support levels – USD 37,000, followed by USD 36,750.

Major resistance levels – $37,750, $38,000 and $38,800.