- Aggressive buying returns such as Bitcoin floats near all-time highlights, but whale behavior shows divergence.

- RSI indicates an overbought levels, while MACD -Momentum weakens -BTC must break $ 105k or risk -pullback.

Bitcoin’s [BTC] Momentum is building again, while aggressive buyers flood the market.

The Taker Buy/Sell Ratio has risen to 1.02 – a level that is no longer seen since different historical pimples – with a growing conviction among market participants.

Data on the chain shows large portfolios that accumulate, positioning prior to what many speculate could be a last push in the direction of new all-time highlights.

With the warming of sentiment and BTC that floats just below the previous peak, is the next stage of the rally at the point to start?

An increase in market confidence?

According to a recent Cryptoquant reportThe Taker Buy/Sell Ratio is decided above the 1.00 marking and becomes 1.02 – a level that is historically linked to Breakout moments in the price action of Bitcoin.

Source: Cryptuquant

Similar peaks were recorded near the $ 15k $ 20k accumulation zone at the end of 2022 and just before the $ 30k breakout in October 2023.

With BTC, which is now floating in the vicinity of all time, shows the return of aggressive purchasing-growing belief-but it also increases the bet, because this threshold has previously preceded both rallies and sharp reversations.

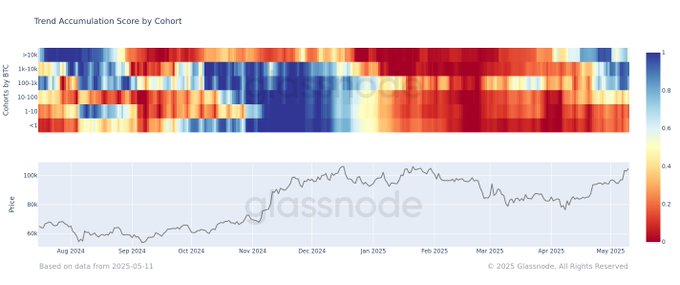

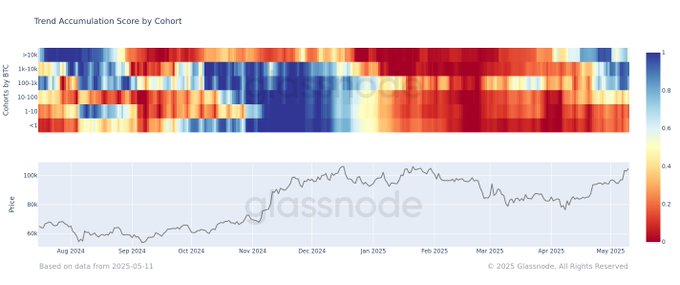

Mega holders have paused

Although the general battery trends remain bullish, a further look reveals a subtle behavioral shift.

According to Glassnode, Ultra-large whales with more than 10,000 BTC have cooled their purchase activity and returned to a neutral accumulation score around 0.5.

Medium-sized cohorts, on the other hand, portfolios that hold between 1,000 and 10,000 BTC-stay-active buyers, with scores near 0.9.

Source: Glassnode

Even smaller portfolios of institutional size show persistent power. Retail, however, continues to distribute.

While Bullish Momentum persists, the rally is increasingly driven by medium whales instead of the deepest bags.