- Bitcoin has registered a rapid increase in value over the past 24 hours

- The coin has hit an all-time high of over $89,000 as it moves closer to the $100,000 mark

The outcome of the American presidential elections has made the financial markets more optimistic. And Donald Trump’s re-election has also had a significant effect on the cryptocurrency market, with Bitcoin (BTC) taking the lead.

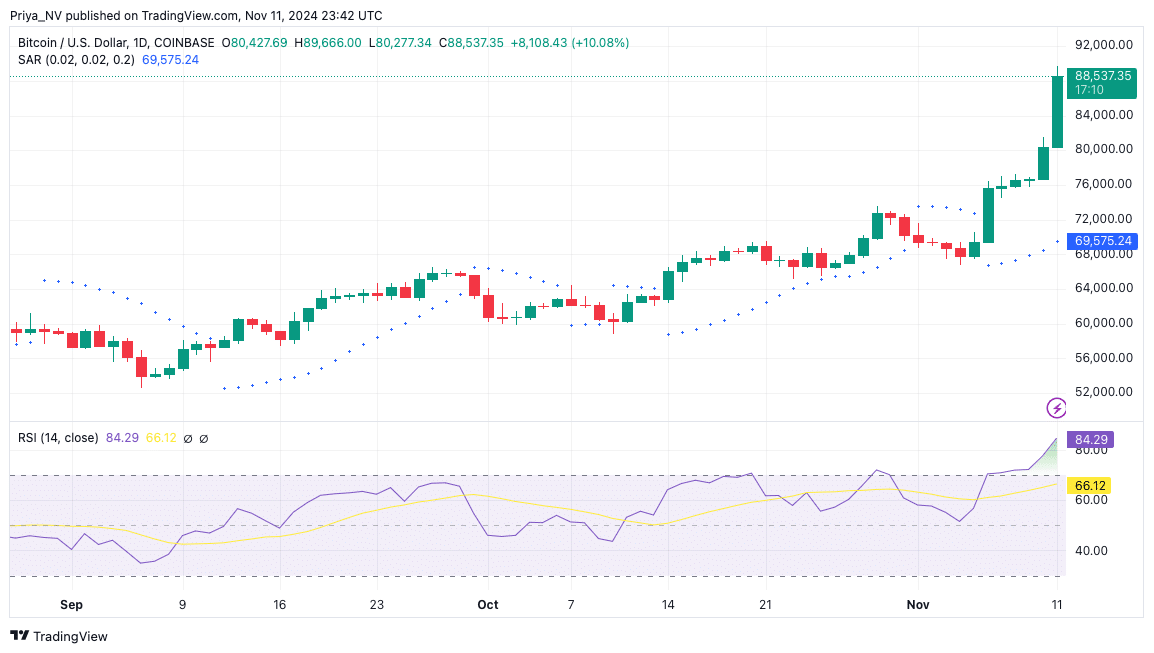

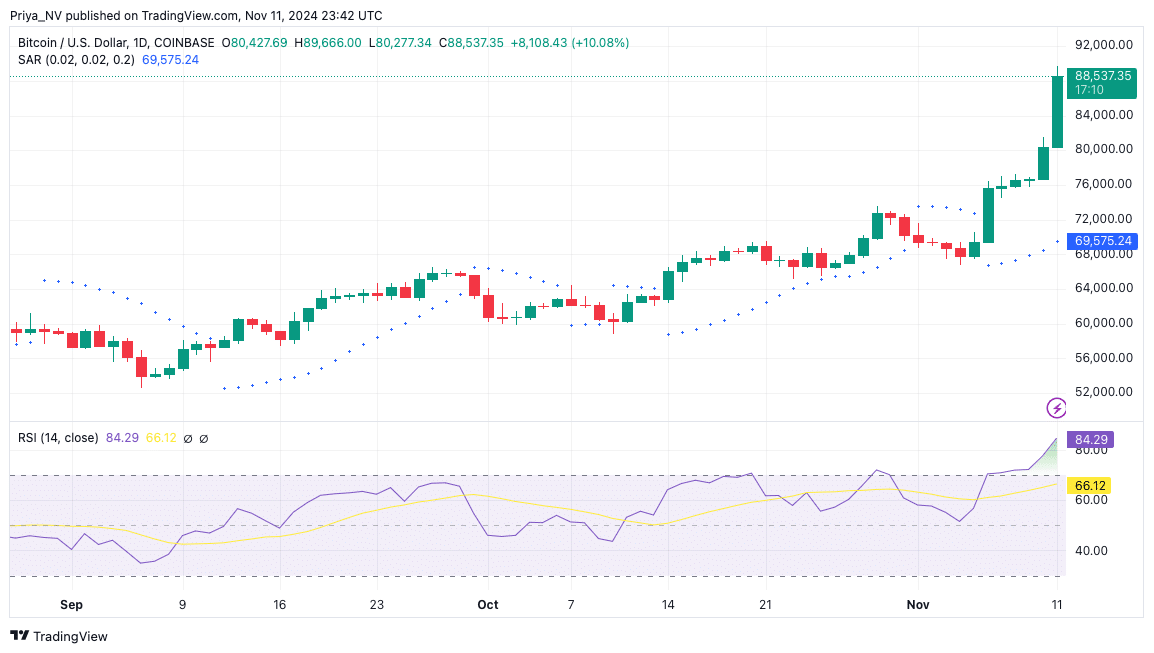

Notably, the king coin broke multiple records in just one day, hitting a daily high of $89,666 on Coinbase, according to TradingView. At the time of writing, the coin was trading above $88,000, with a price valued at $88,664, according to CoinMarketCap.

In the last 24 hours, the coin has registered a change of more than 10%, and since Trump’s election, it has registered an uptrend of more than 30%. The coin’s trading volume reached $116.47 billion, while its market capitalization was valued at $1.75 trillion.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Bitcoin (BTC) placed on the most wanted list

Interestingly, the last time the currency saw such a rise was in late March and early April this year. The coin had then reached a peak of over $70,000 and this level was seen again this week. Remarkably, the coin has gained more than $9,000 in just one day, with Bitcoin’s closing price for Sunday at $80,087.81, according to TradingView.

Moreover, this upward movement is reminiscent of all the previous times Bitcoin (BTC) has experienced a rapid bull run. This could indicate that $100,000 is not far away for the largest cryptocurrency on the market. And according to TradingView indicators such as Parabolic SAR and RSI, the market is currently witnessing tremendous interest from buyers.

In the one-day chart, the dots are placed below the candlesticks, indicating a continued uptrend, indicating bullish sentiment. Meanwhile, the Relative Strength Index is well above 70, indicating that BTC is currently overbought, reflecting the market’s extreme greed.

Source: TradingView

Bitcoin’s ripple effect

Notably, the fact that Bitcoin has reached new all-time highs appears to have had an impact not only on the rest of the cryptocurrency market, but also on other financial and non-financial institutions that have a shared interest. MicroStrategy, a software and Bitcoin development company, saw its stock price hit a 24-year high today, with the value reaching a high of $351.73 today.

Coinbase, an American-based cryptocurrency exchange, also recorded a similar trend. The company’s share price reached a high of $334.86, a level not seen since November 2021. Notably, Coinbase was among the political donors who poured millions of dollars toward pro-crypto and bipartisan super PAC Fairehake. And the investments seem to be working out in the company’s favor, and actual gains could be measured in the Q4 reports, which would be out next year.