- Recently, JUP hit a major hurdle as it failed to break above a key resistance level, leading some traders to sell.

- Nevertheless, bullish sentiment remains strong, allowing JUP to avoid a sharp decline during the recent selling activity.

Jupiters [JUP] Its market performance was impressive and positioned it ahead of some other tokens. Over the past month, it has risen 45.85%, with an additional 5.89% increase in the past 24 hours.

However, there was uncertainty as to whether this rally would last as some market participants bought while others sold.

Jupiter’s bullish potential could drive the price to $1.8

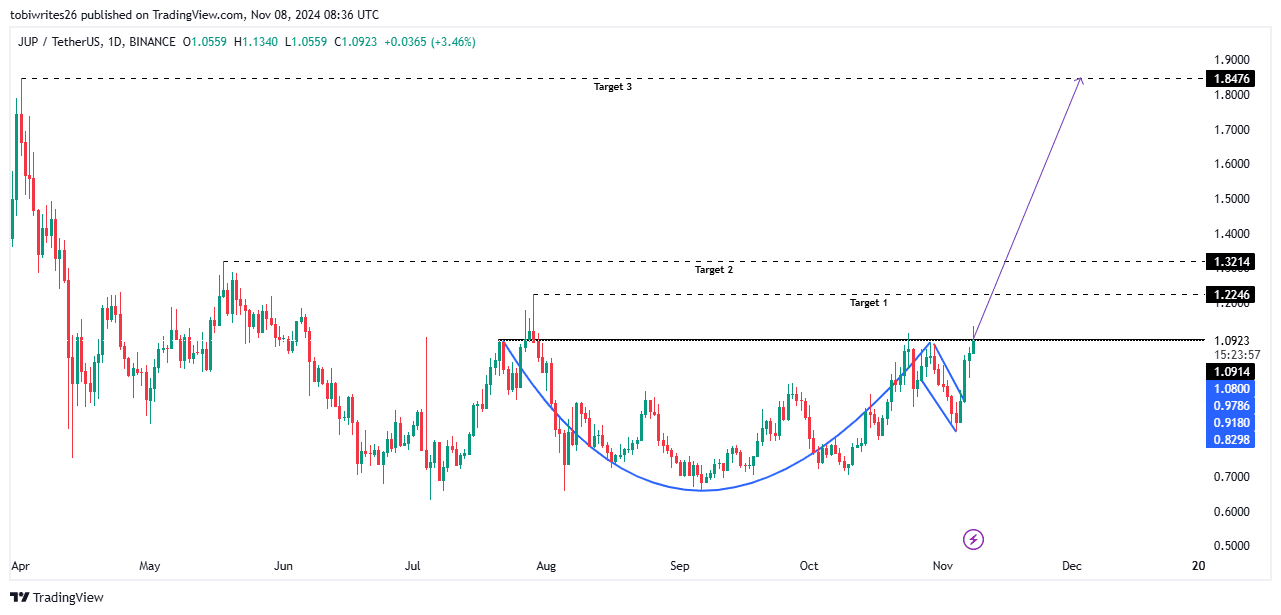

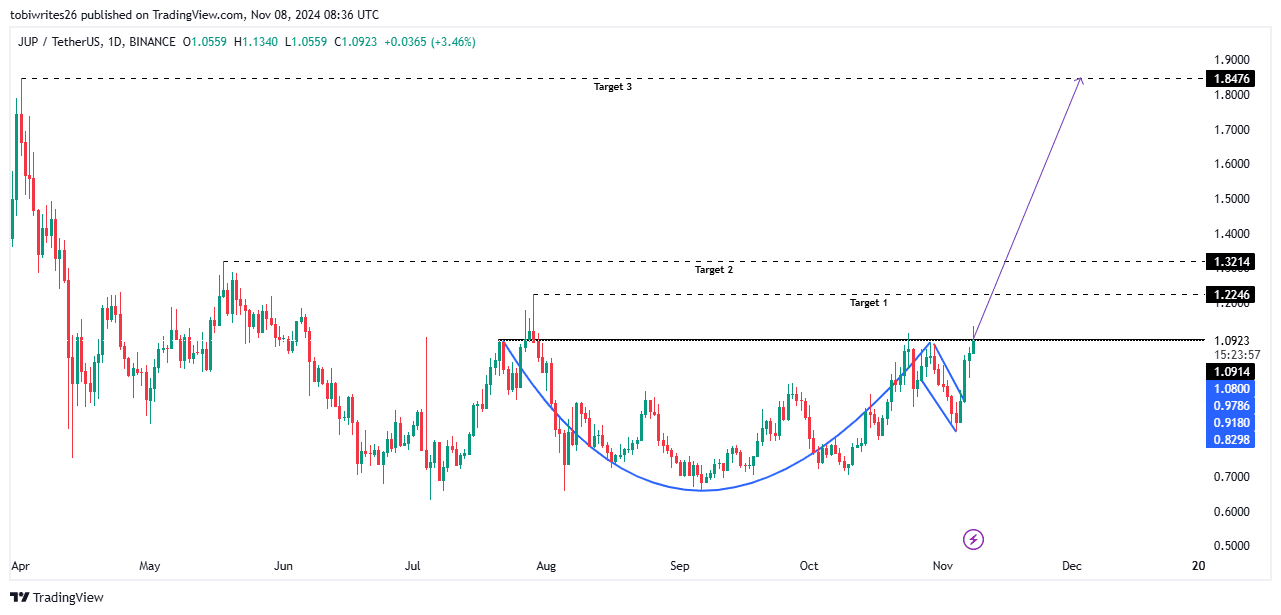

On the chart, JUP showed bullish signals, forming a ‘cup and handle’ pattern (highlighted in blue in the image below) – a formation that often indicates an impending upward move.

To achieve this bullish trend, JUP must first break the key resistance level at $1.0914, which potentially entails major selling pressure. If this level is breached, there were three potential targets to consider: $1.22, $1.32 and the long-term target of $1.8.

Source: trading view

Further analysis indicated that it was highly likely that this rally could unfold.

The accumulation continues and supports the bullish momentum

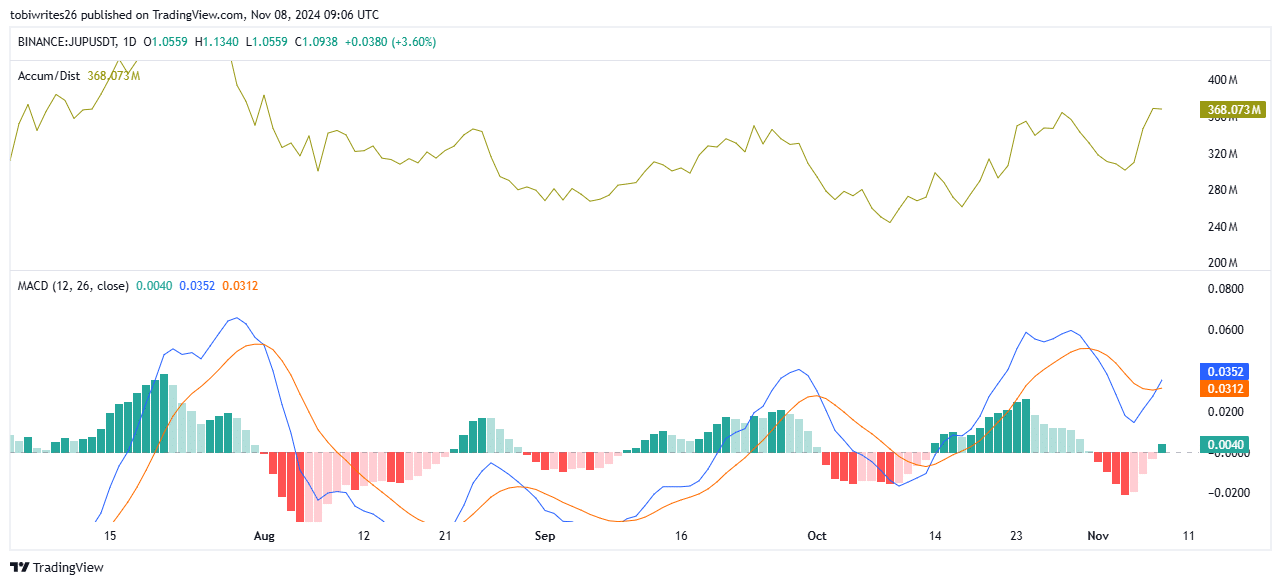

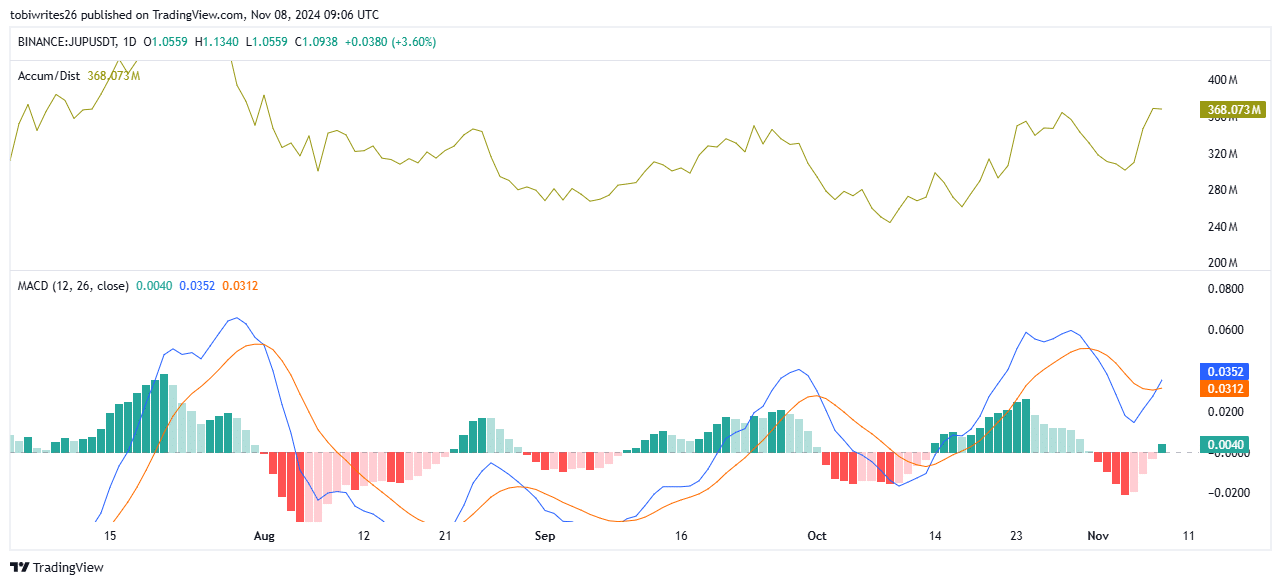

Accumulation was ongoing and trending upward with potential to rise further. Currently, volume stands at 367.829 million, indicating strong buying activity.

The A/D (accumulation/distribution) indicator measures the flow of volume into and out of an asset, allowing traders to gauge buying or selling pressure by combining price and volume to reflect market sentiment.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator also showed an uptrend and moved into positive territory, supporting a bullish outlook.

The MACD has formed a ‘Golden Cross’ pattern, with the blue MACD line crossing the orange signal line. This pattern often precedes a significant rally, potentially pushing JUP towards the expected $1.8 target.

Source: trading view

Adding to this bullish sentiment was Open Interest, which reflects the number of unsettled contracts on the market. Currently, long contracts dominate with an increase of 17.17%, amounting to $139.51 million according to Mint glass.

Selling pressure could slow JUP’s rally

AMBCrypto has noticed significant selling activity on JUP that could potentially hinder the rally. Key indicators of this selling pressure include negative financing rates and positive alternating current.

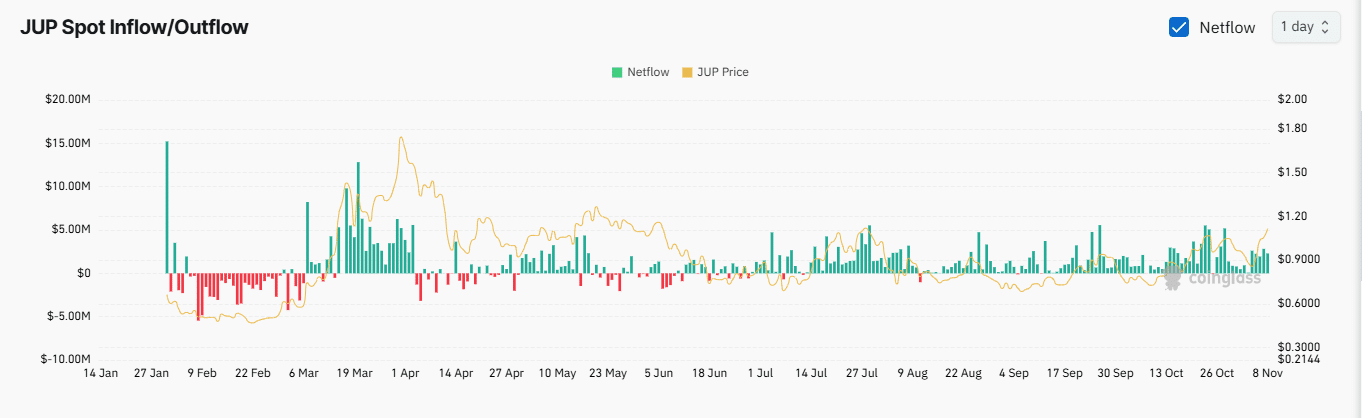

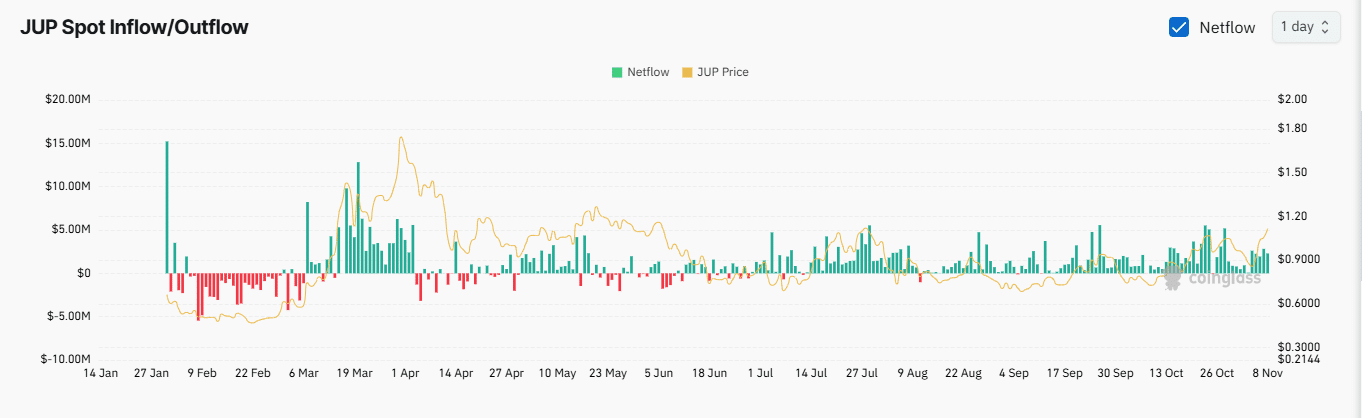

At the time of writing, the funding rate fell to -0.0007, indicating that short positions were paying long positions to keep their trades open. Likewise, Exchange Netflow has remained mostly positive across all time frames, from hourly to weekly.

Source: Coinglass

Realistic or not, here is JUP’s market cap in SOL terms

This suggested that spot traders were taking Jupiter to exchanges to sell, putting downward pressure on assets. Approximately $11.05 million worth of JUP has been deposited on exchanges in the last seven days.

If these numbers continue to exert downward pressure and selling continues, JUP’s price will likely move lower.