German industrial giant Siemens AG used global bank JPMorgan’s blockchain-based payment system Onyx and SWIAT’s private blockchain to issue and settle a tokenized version of its commercial paper, the companies said Monday.

Siemens issued €100,000 worth of crypto securities under the German Electronic Securities Act (eWpG) on September 13, redeeming it three days later. Payments were made on the Onyx network using the JPM Coin System, while asset transfers were handled via the delivery-versus-payment (DvP) mechanism of the SWIAT network.

The entire process took 93 seconds from the confirmation of the transaction by the parties on SWIAT to the final settlement confirmation sent to the parties that the transfer of assets and payments had been completed. DekaBank also participated and acted as a regulated crypto securities registrar on the SWIAT network.

The transaction marked the beginning of collaboration between Onyx and SWIAT to develop asset issuance products on blockchain rails for commercial banks. Their goal is to shorten value chains, increase transaction flexibility and speeds, and ultimately make financial transactions via blockchain rails scalable for commercial banks, the companies said.

Read more: Siemens issues $330 million digital bonds on private blockchain with major German banks including Deutsche Bank

Tokenization of traditional financial instruments, or real-world assets (RWA), is a fast-growing area for blockchain technology, with major banks becoming increasingly involved. JPMorgan has been an early leader in this space with Onyx and its JPM Coin blockchain-based settlement technology.

Transactions with JPM Coin have “exploded” after the introduction of programmability to the network, with transactions reaching several billion dollars on some days, says Umar Farooq, head of Onyx at JP Morgan, said in May during a panel discussion at Consensus 2024.

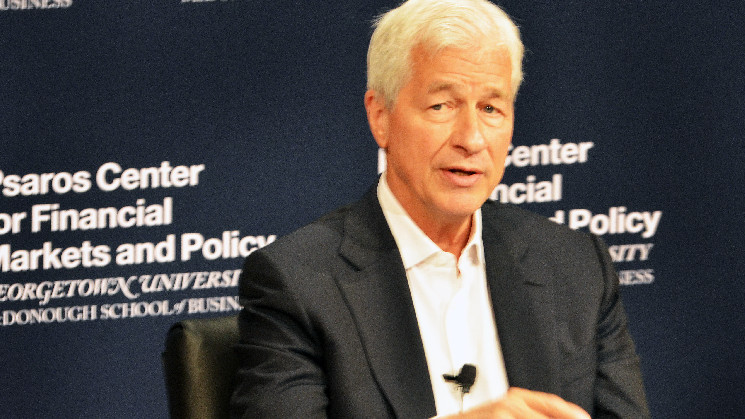

“We are probably one of the bigger users of blockchain,” JPMorgan CEO Jaime Dimon said at a recent event at Georgetown University, although he argued that the technology is just a database. Dimon has been an outspoken critic of cryptocurrencies, calling them “pet rock” several times.

Jesse Hamilton contributed reporting to the story.