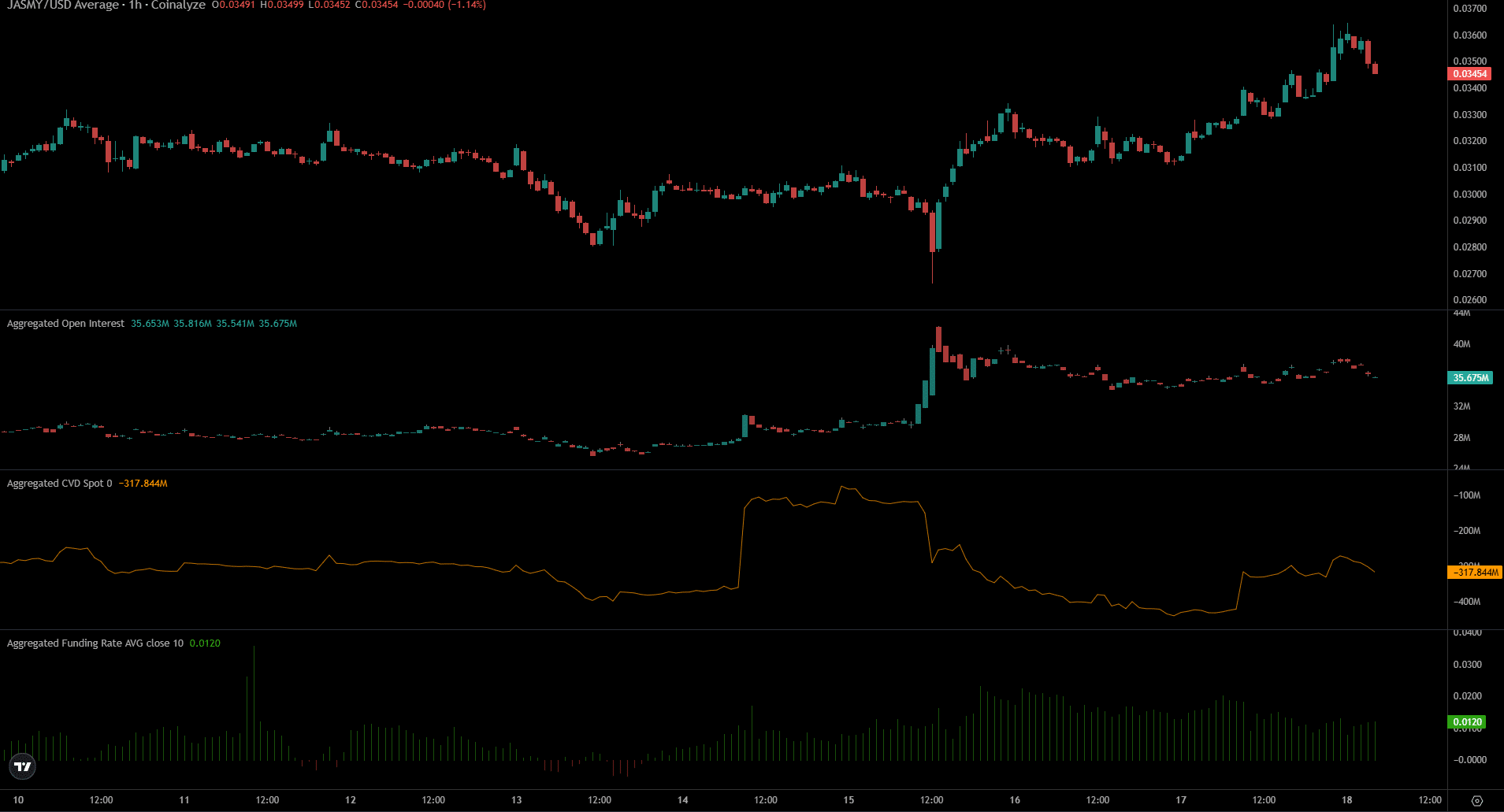

- JasmyCoin made a new lower low on Wednesday, January 15, turning the structure bearish

- The weakness in the lower time frame of Open Interest revealed that bullish sentiment was weak

JasmyCoin [JASMY] lost 18.66% of its value, compared to the daily opening a month ago. The token was in a steady downtrend that seemed to have stopped in December, but that was not the case. And yet there was evidence of accumulation.

The price action charts outlined two key levels for JASMY. Despite the losses from a week ago, JasmyCoin bulls have the potential to force a recovery.

Range extremes are still important to JasmyCoin

Source: JASMY/USDT on TradingView

On the daily chart, JASMY had a bearish market structure. In December and early January, price action looked like a range between roughly $0.032 and $0.04. However, Bitcoin [BTC] The drop to $92,000 in the second week of January pushed JASMY below the $0.032 support zone.

Subsequently, the price appeared to reach a new lower high in recent days, but this has not yet been confirmed. Trading volume has been subdued since the second half of December, but last week’s rally from $0.03 saw a slight increase in trading volume.

If this volume boost continues, it could mean a momentum reversal for JasmyCoin. At the time of writing, momentum was bearish, evidenced by the bearish crossover of the 20 and 50 DMAs. On the other hand, the A/D indicator has been rising slowly, indicating higher buying pressure.

Lack of bids in the short term is a concern

Over the past 48 hours, the price of JasmyCoin has increased by almost 12%. And yet Open Interest only increased by 3.4%. However, the unenthusiastic reaction in the speculative market was a somewhat bearish development.

Realistic or not, here is JASMY’s market cap in BTC terms

Finally, the funding rate remained positive, with spot CVD rising over the past 24 hours. These were small bullish signals, but they were not enough to overshadow the lack of speculative bidding.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer