Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Bitcoin fell marginal after reaching a new peak above $ 97,000 on 2 May. It withdrew into just under $ 94,000, a decrease from 3% to 4% compared to the recent high. Although the price movements keep traders nervous in the short term, data is starting to show signs in the longer term that can influence what happens next.

Related lecture

Index reading indicates a potential early bullmarkt

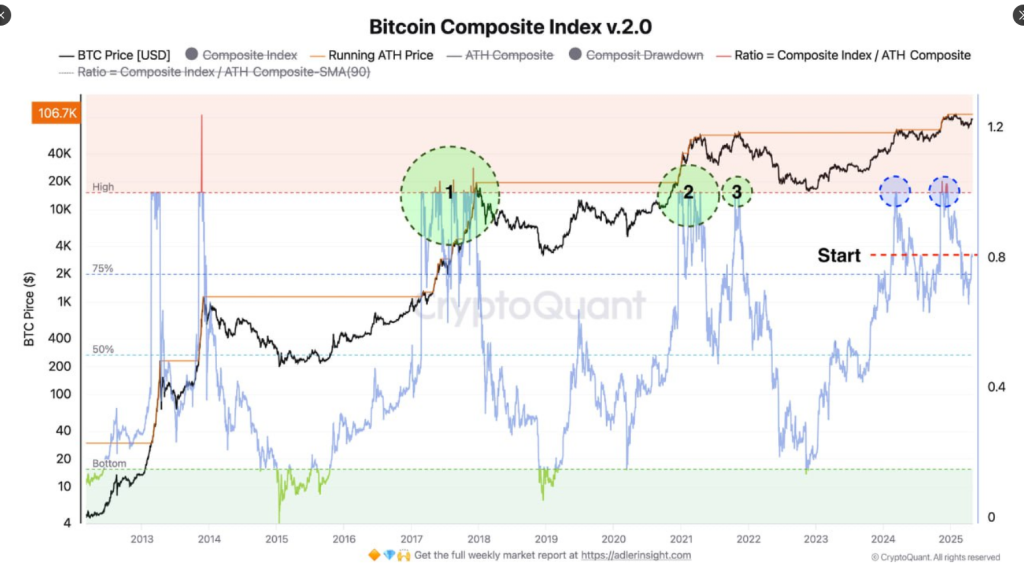

One meter, which is called the Bitcoin Composite Index V2.0, is now at a lecture of 0.8. The index combines price action with blockchain activity and tries to weigh where Bitcoin could go. For analyst Constantin Kogan, A reading On this scale it was previously published for a few solid price rallies, such as in 2017 and 2021.

Kogan described how if this number increases to 1.0 and holds, Bitcoin can accelerate considerably faster. The index is not entirely there now – but it goes in the right direction. One of the most important components of the index, the ‘running ATH price’, has also started trending. This suggests that extra buyers enter the market and that faith can increase.

The upward momentum in Bitcoin is just starting to build, with on-chain statistics such as the Bitcoin Composite Index that indicates the start of a bull market. The index has already reached 0.8 (80%). Here are three possible scenarios:

Bullish: BTC can go to … pic.twitter.com/8bz4vmr2ch

– Constantin Kogan (@Constkogan) May 4, 2025

Price goal can reach $ 175k if the momentum continues

If Bitcoin retains his momentum and the composite index drives to more than 1.0, analysts predict the price that rise sharply. The given target range is between $ 150,000 and $ 175,000. That is when bullish momentum speeds up and trends from the past are repeated.

But if the index remains between 0.8 and 1.0, Bitcoin can get stuck a little. That means a accessible market, ranging from $ 90,000 to $ 110,000. Kogan also emphasized a third, less likely route – if the index drops below 0.75. Then Bitcoin can come back to $ 70,000 to $ 85,000.

Show delivery data where buyers entered

The second part of the puzzle is of the UTXO Realized price distribution Graph, also called the URPD graph. Provided by Analyst Checkmate, it appears where the holders of Bitcoin last transferred their coins. This gives a feeling of who bought when – and at what price.

A huge segment of buyers seems to have entered between $ 93,000 and $ 98,000. That region is currently behaving like a crucial food zone. It is the region where investors have just bought Bitcoin and can hold or sell based on what follows.

Related lecture

Markt is waiting for a clear relocation of the current zone

Bitcoin is square in the middle of that range at around $ 94,000. As Checkmate notes, the next step will depend on whether the price breaks out strongly or will be rejected. A strong outbreak, apparent from a powerful daily candle, could recently make a profit supply and produce the prices higher. But if the price cannot rise through this area, it can create a lower high and attract extra sales pressure.

Bitcoin is currently in the guard mode. Traders and analysts monitor both the composite index and delivery figures to determine whether the current silence will be the next leg – or a further step down.

Featured image of Gemini Imagen, Graph of TradingView