Following recent geopolitical events, the correlation between gold and Bitcoin prices has come under renewed scrutiny by market analysts. Here’s a deep dive into the relationship and its implications.

The correlation between gold and Bitcoin

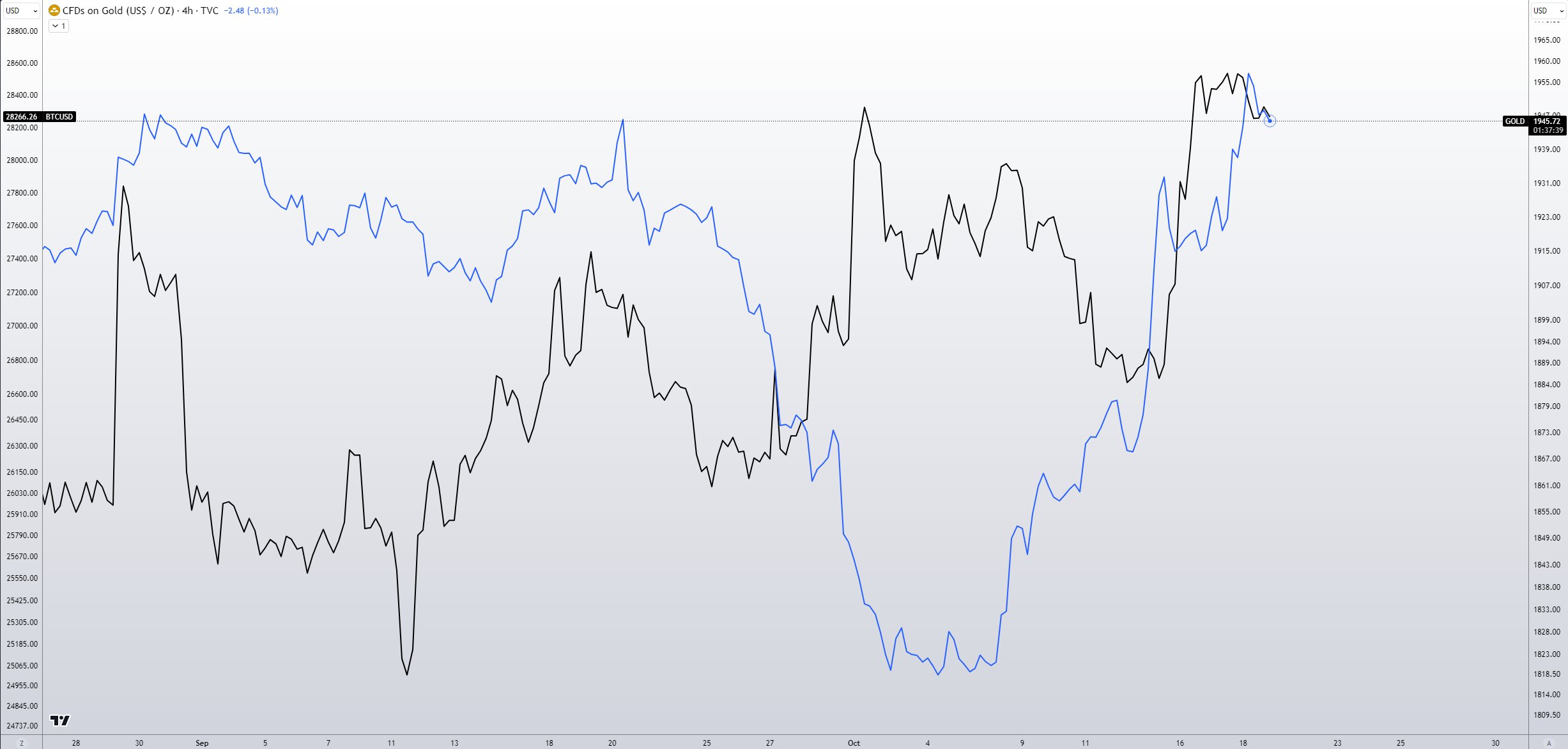

After the recent war between Israel and Hamas, gold experienced a rapid price increase. This shift interestingly mirrored the movements in the Bitcoin market, highlighting a revived correlation between the two assets. Skew, a renowned market analyst, shared his insights on X (formerly Twitter), noticing on October 11, that “correlation applied rather loosely to BTC periods of 35 days + where there is price decoupling between both markets.”

However, just days later on October 16, he noted a possible “recorrelation” as both Bitcoin followed the latest gold rally. Today the statement stands stronger with the latest version of Skew tweet“It seems that the correlation between BTC and gold is still there. Gold could be the next big thing for BTC.”

In his recent insights Shared in the Onramp Weekly Roundup, Bitcoin analyst Dylan LeClair highlighted the implications of the ongoing Treasury sell-off. The rising cost of long-term financing has a direct impact on the global cost of capital and provides a valuation benchmark for various assets.

More importantly, the government bond market supports the global financial ecosystem. The current instability could put pressure on asset prices and worsen the already existing debt cycle, potentially endangering the US fiscal position. This precarious situation is in stark contrast to the US government’s fiscal measures, as evidenced by plans such as the “WHITE HOUSE BUILDING $100 TRILLION UKRAINE, ISRAEL AND BORDER ASK,” which, according to LeClair, indicates a lack of fiscal discipline.

Gold, real returns and the changing landscape

To complicate matters further, Bill Dudley, former president of the Federal Reserve Bank of New York, noted in his recent Bloomberg piece that the current cycle of quantitative tightening (QT) will likely last until the end of 2025. interest rates and the risk of turbulence in government bond markets. But should serious dysfunction emerge in the Treasury market, the Federal Reserve could reconsider its QT trajectory.

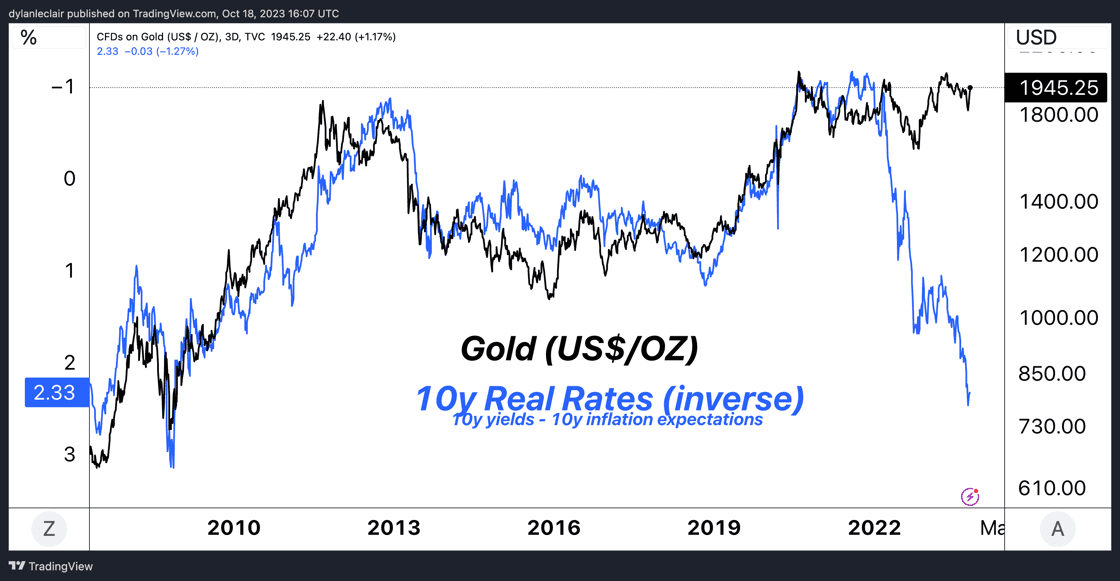

Interestingly, after the Russia-Ukraine conflict and the subsequent seizure of Russia’s G7 reserves, gold and real returns have shown an atypical positive correlation, calling into question their historically negative relationship.

In this evolving geopolitical landscape, where even G7 sovereign debt is not immune to confiscation, traditional ‘safe assets’ are being reevaluated. This uncertainty, combined with the not-so-safe ‘risk-free’ government bond yields, has strengthened gold’s position (and price) as an anti-risk monetary asset and could push Bitcoin onto a similar trajectory.

According to LeClair:

However, this repositioning is not just limited to gold. Bitcoin, with its unique advantages and growing liquidity profile, is on a similar trajectory, albeit still in the very early stages of monetization with a $500 billion market cap.

The best BTC price indicator?

Under these current conditions, the gold price could be a leading indicator for the price of Bitcoin, assuming the correlation between the two assets continues. This would imply that Bitcoin is classified by a majority of investors as a ‘safe haven’, like gold, and not as a ‘risk asset’.

However, this opinion is not shared by everyone. James Butterfill, head of research at CoinShares, pointed out that the Bitcoin market has shifted its focus following the fake news about a spot approval of Bitcoin ETF. He noticed that investors now appear to be prioritizing ETF approval over macroeconomic expectations, and placing less emphasis on the Federal Reserve’s actions.

Since the error in Coin Telegraph’s tweet about the approval of a Bitcoin Spot ETF, Bitcoin prices have decoupled from December interest rate expectations. It appears that investors are now solely focused on the ETF’s approval, and not on what the FED is doing.

At the time of writing, Bitcoin was trading at $28,450.

Featured image from iStock, chart from TradingView.com