The NFT (non-fungible token) auction market has cooled down significantly after the frenzy of 2021, characterized by fewer auctions and lower price ranges, but experts liken the phase to a healthy consolidation that will usher in more sustainable growth over the years.

According to Artprice’s 2024 Contemporary Art Market report, the NFT auction raised just $9.3 million last year.

This was a far cry from the height of speculation in 2021, when digital artist Beeple sold an NFT for an astonishing $69 million at Christie’s, thrusting him into the global spotlight.

While the event sent shockwaves through both the tech and art worlds and marked NFTs as a revolutionary new asset class, the NFT market raised an impressive $110.5 million through regulated auctions that year, with pieces from emerging artists like Fewocious and collections like CryptoPunks that made millions. .

2023 saw the market move away from dizzying price tags, with fewer auctions and more moderate price ranges becoming the new norm.

The report says:

What was once a chaotic and speculative bubble has now calmed down into a more stable market, giving collectors and investors room to assess the true impact of this digital art revolution.

Less notable sales, but NFT collections see continued interest

Since the height of the NFT boom, the market’s leading artists have seen their prices fall to more reasonable levels.

Fewocious, a 2021 teen sensation who sold a piece for $2.8 million at Sotheby’s, has not had any work offered at auction this year.

Likewise, Larva Labs’ CryptoPunks, once a darling of the NFT space, are no longer attracting the wild bids they once did.

Even Beeple, whose work sparked the NFT boom, saw much more modest sales of $177,800 in 2023.

Despite this market correction, buyer interest remains steady, especially for established NFT collections, the report said.

Yuga Labs, maker of the Bored Ape Yacht Club (BAYC), continues to see strong demand. During a recent Sotheby’s online sale, 100% of Yuga Labs’ NFTs were sold, with the most valuable lot fetching $264,000.

This suggests that while the broader NFT market has cooled, there is still great enthusiasm for high-end collections.

Cooling down in NFT auctions is in line with the broader cooling of the art market

The decline in NFT auction values should not be viewed in isolation.

According to Artnet’s 2024 mid-year review, a total of $5.05 billion was spent on art at auction in the first half of 2024, a decline of 29.5% from the same period last year.

The Artprice report adds that the global contemporary art market also failed to set major auction records last year, even as the number of transactions on affordable works increased.

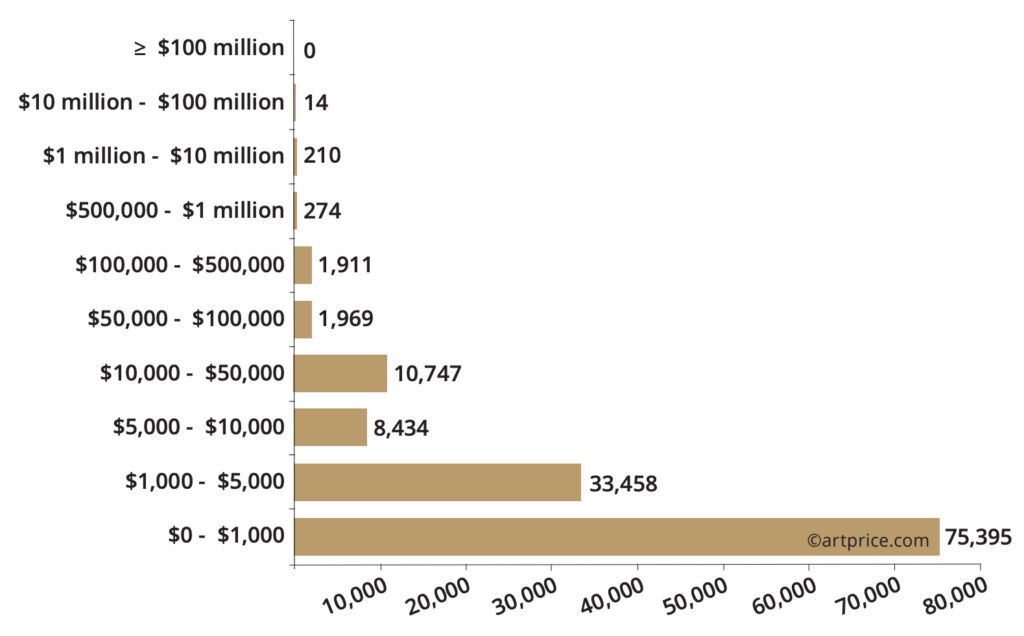

Contemporary art auction results by price range 2023-24, Source: Artprice

According to the report, there was a notable contraction in contemporary art auctions in the 2023-2024 financial year, with nearly a billion dollars less compared to the historic peak two years ago.

However, with a total of $1.888 billion, the market has returned to pre-pandemic levels, exceeding the average of the five years preceding the health crisis by $200 million.

The global context, with its persistent geopolitical and economic tensions, has slowed down the market for prestige works. Convince salespeople

Understandably, auctioning off their most valuable possessions is a difficult task in uncertain times. Meanwhile, major buyers are clearly in a cautious mood and are keeping a close eye on the long-term prospects.

What’s next for the NFT auction marketplace?

Experts see a silver lining in the slump.

Artprice says collectors can now buy works from leading digital artists for much less than 2021’s sky-high prices.

Renowned artists such as Refik Anadol, who recently exhibited at the Museum of Modern Art (MoMA), and Dmitri Cherniak, a pioneer of generative art, have seen their NFTs available at auction for between $15,000 and $20,000.

Additionally, for under $10,000, buyers can find nearly 200 NFTs from artists like Moxarra Gonzalez, Matt Deslauriers, and Hideo, all selected by major auction houses in the past year.

As NFTs enter their second decade of existence, but only their third year on the regulated auction market, the speculative wave and FOMO phenomenon have subsided and the hype has subsided. We are now looking at a golden opportunity to build a solid and sustainable market, far away from the excitement of the buzz.

This shift signals that the NFT market is maturing and moving from a speculative frenzy to a more sustainable model.

The market is now focused on building a solid foundation rather than chasing viral moments.

While the spectacular price increases of the past may no longer dominate the headlines, the digital art world is working towards a measured, more resilient future.

With this newfound stability, there is a golden opportunity for collectors and artists alike to foster a sustainable market in the years to come.

The post-NFT auction market cools down significantly: is there a silver lining for investors? first appeared on Invezz