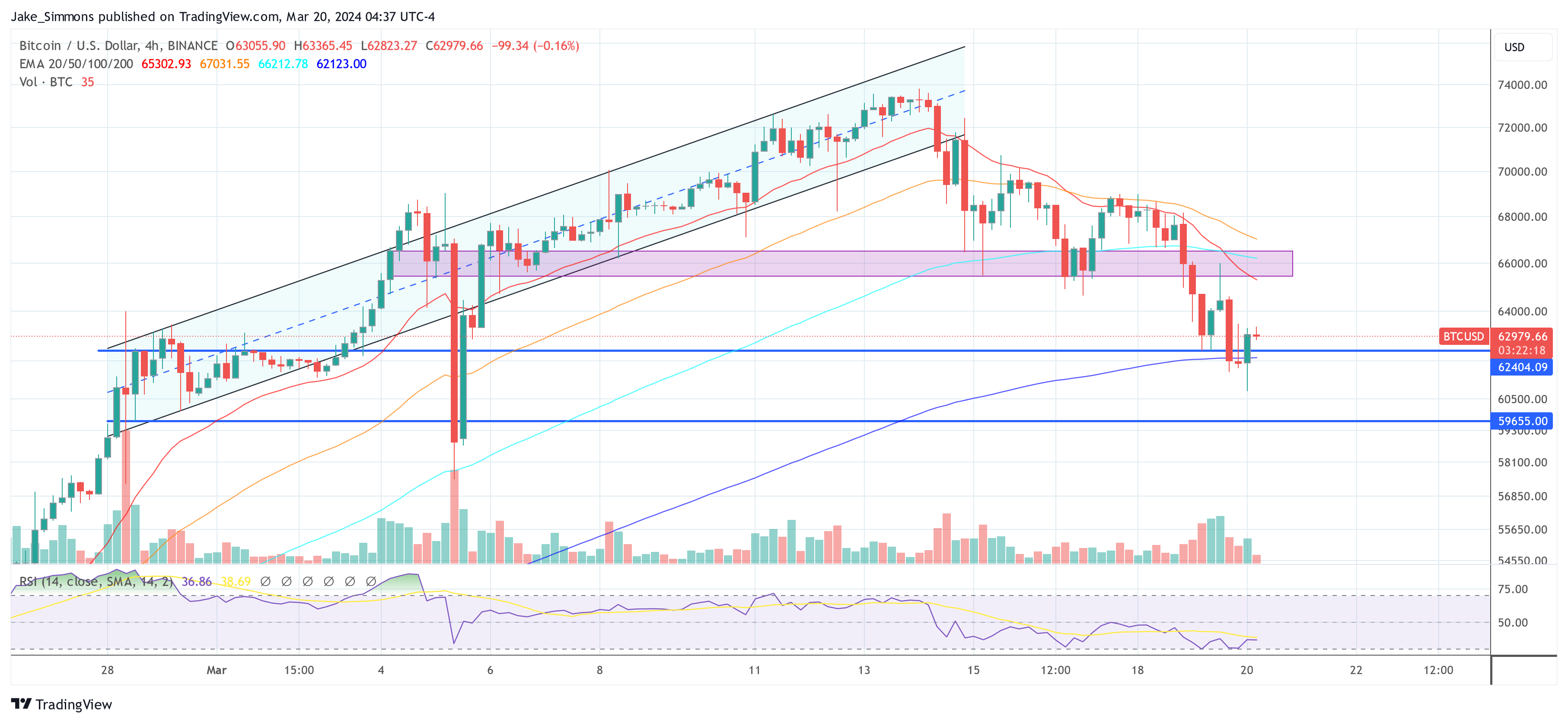

Bitcoin has experienced a sharp decline from its March 14 high of over $73,600 to its current low of under $60,800, translating into a -17% loss in value. This significant drop has led to a flurry of activity on social media platforms, most notably cryptocurrency.

Unpacking the Bitcoin Crash: Expert Opinions

Alex Krüger, a respected figure in both macroeconomics and crypto, was quick to identify the key factors that contributed to Bitcoin’s price decline. According to Krüger, the crash can be attributed to several key factors: excessive leverage in the market, Ethereum’s negative impact on overall market sentiment due to ETF speculation, a notable decline in Bitcoin ETF inflows, and the irrational exuberance surrounding Solana- memecoins, which he refers to disparagingly as “shitcoin mania.”

Reasons for the crash, in order of importance

(for those who need them)

#1 Too much influence (financing is important)

#2 ETH drives the market south (the market decides the ETF is off)

#3 Negative BTC ETF Inflows (note, data is T+1)

#4 Solana shitcoin mania (it went too far)— Alex Kruger (@krugermacro) March 20, 2024

WhalePanda, another influential voice in the crypto space, pointed out the alarming pace of ETF outflows, with a record $326 million leaving the market yesterday. This move has been especially detrimental to GBTC, which saw outflows of $443.5 million.

In contrast, Blackrock’s inflows were just $75.2 million, which is the second lowest to date. Furthermore, Fidelity only saw $39.6 million in inflows. “There is not much to say, this is bad for the price and we are likely to see a decline now as this news also affects sentiment. Let’s see what the flows are tomorrow. On the plus side, we are about 30 days away from the halving and GBTC being stretched,” he noted.

Yesterday’s ETF flows by @FarsideUK.

We had an outflow of $326 million. Largest outflow to date.

Blackrock didn’t save us $GBTCwhich was evident with the price action.$GBTC had outflows of $443.5 million, Blackrock had inflows of $75.2 million, their second lowest to… pic.twitter.com/hIingoYMly

— WalvisPanda (@WalvisPanda) March 20, 2024

Charles Edwards, founder of crypto hedge fund Capriole Investments, as long as a historical perspective on Bitcoin’s recent price movement, suggesting that a 20% to 30% pullback is within the norm for Bitcoin bull runs.

“A normal Bitcoin bull run pullback is 30%. In December we were already in the longest winning streak in Bitcoin history. A 20% pullback here takes us to $59,000. A 30% pullback would be $51,000. These are all levels that we should expect to see as possible,” he stated.

Rekt Capital has provided an analysis of Bitcoin’s price revisions since the 2022 bear market low, noting that the current pullback is only the fifth major pullback, with all previous ones exceeding -20% lows and lasting 14 to 63 days . In short, there are two important conclusions to be drawn about this current retracement

The closer Bitcoin gets to a -20% pullback, the better the odds become.

Retraces need time to fully mature (minimum 2-3 weeks, maximum 2 months).

Since the bear market bottomed in November 2022…

Bitcoin has experienced the following setbacks:

• -23% (February 2023) for 21 days

• -21% (April/May 2023) for 63 days

• -22% (July/September 2023) for 63 days

• -21% (January 2023) for 14 days

This… pic.twitter.com/cQyQOLA5Zv

— Rekt Capital (@rektcapital) March 19, 2024

Alex Thorn, head of research at crypto giant Galaxy Digital, had done this before warned of the likelihood of significant corrections during bull markets, suggesting that the current pullback is relatively standard. “Two weeks ago I warned that major corrections are not only possible but *likely* in Bitcoin bull markets. At -15% this is quite standard historically. Bull markets are climbing a wall of worry.”

Macro analyst Ted (@tedtalksmacro) specifically focused on the implications of the upcoming Federal Open Market Committee (FOMC) meeting. He marked the massive outflows from spot BTC ETFs, attributing them to traders’ cautious stance in the run-up to the FOMC decision and the potential impact of US tax season.

However, after the drop to $60,800, Ted suggested the market had fully priced in the worst-case scenario, signaling a potential bullish reversal if the FOMC’s decisions align with market expectations for rate cuts by year-end. He claimed:

Time to bid. FOMC hedging completed, worst case priced. All that happens from here is that these protective positions unwind in or on today’s event. Bulls should act quickly on this. […] The market fully priced in a new Fed move at today’s meeting, pricing in three rate cuts by the end of the year. Anything different from this from the current new economic projections/dotplot materials will move the market sharply.

At the time of writing, BTC was trading at $62,979.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.