- Solana acts under a crucial support zone and from here the price can move in both directions.

- Given the market context, is a deeper pullback afterwards, or will the bulls grab the dip?

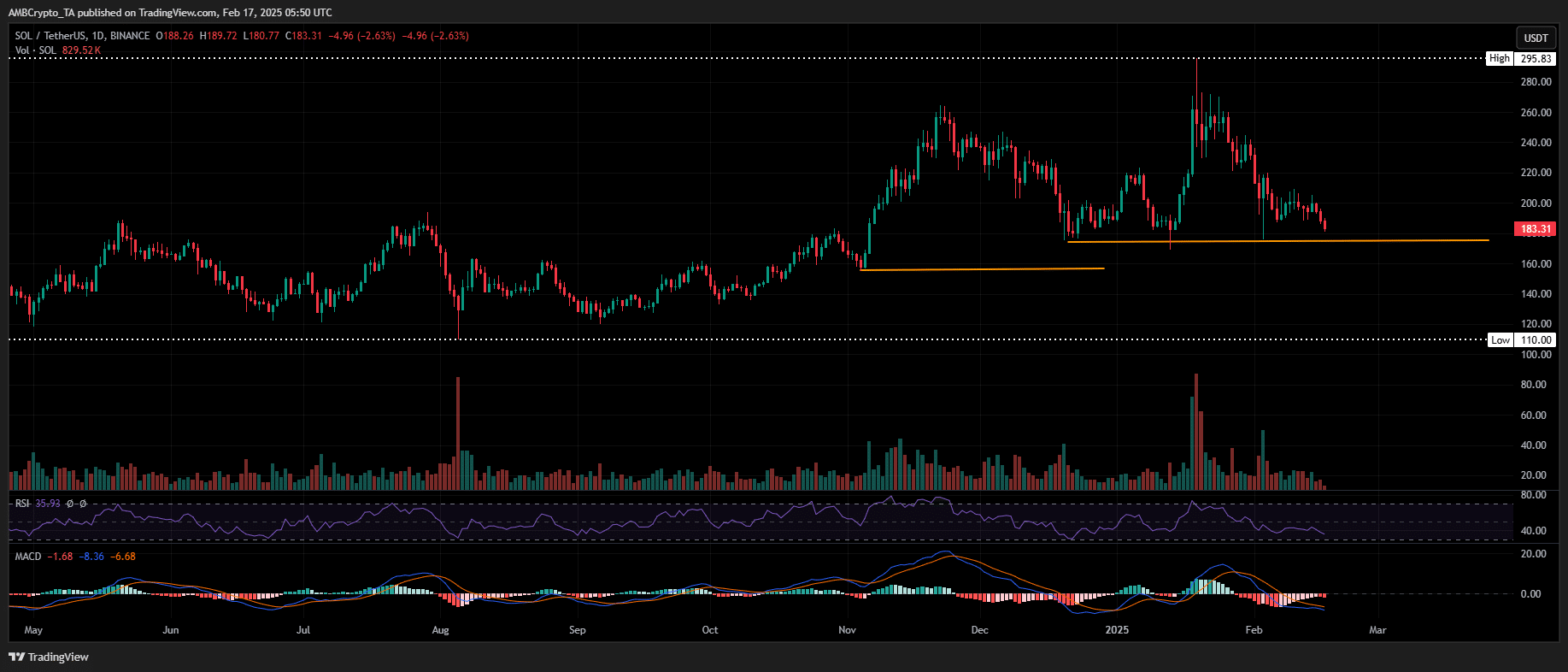

After throwing out 5% of its market value, Solana [SOL] In the vicinity of a critical support zone-one that has fueled historically strong rebounds in the direction of the range of $ 250- $ 260 – an increase of 35% compared to its current price.

Source: TradingView (SOL/USDT)

Historically, this support zone has fueled strong rebounds and with a volume of 65%, now more than $ 2 billion, traders can expect a repeat.

In addition, the SOL/BTC pair reflects a similar pattern of the last cycle, when a bullish reversal Solana pushed by 65% to $ 270 in just two weeks. But don’t forget – the hype of the Trump Memecoin launch played an enormous role and led to an increase of 19% in Solana.

So, while a rebound of 35% could be useful with the consolidation of Bitcoin, the Altcoin sees -related and a strong volume that it supports. But let’s really be – it’s still too early to call.

It must be noted whether the market browses into a solid bottom before both retail and speculative capital dive headfirst in the ‘dip’.

Solana at Crossroads: rebound or going backwards?

At the time of writing, Solana saw a strong purchase interest in the futures market, with open interest (OI) an increase of 8.37% at $ 5.85 billion.

More than $ 14 million in longs were liquidated within 24 hours, in accordance with the decrease of 2.65% of SOL. Despite the liquidations, Solana is far from the delivery. Traders take high risks, betting on a potential rebound.

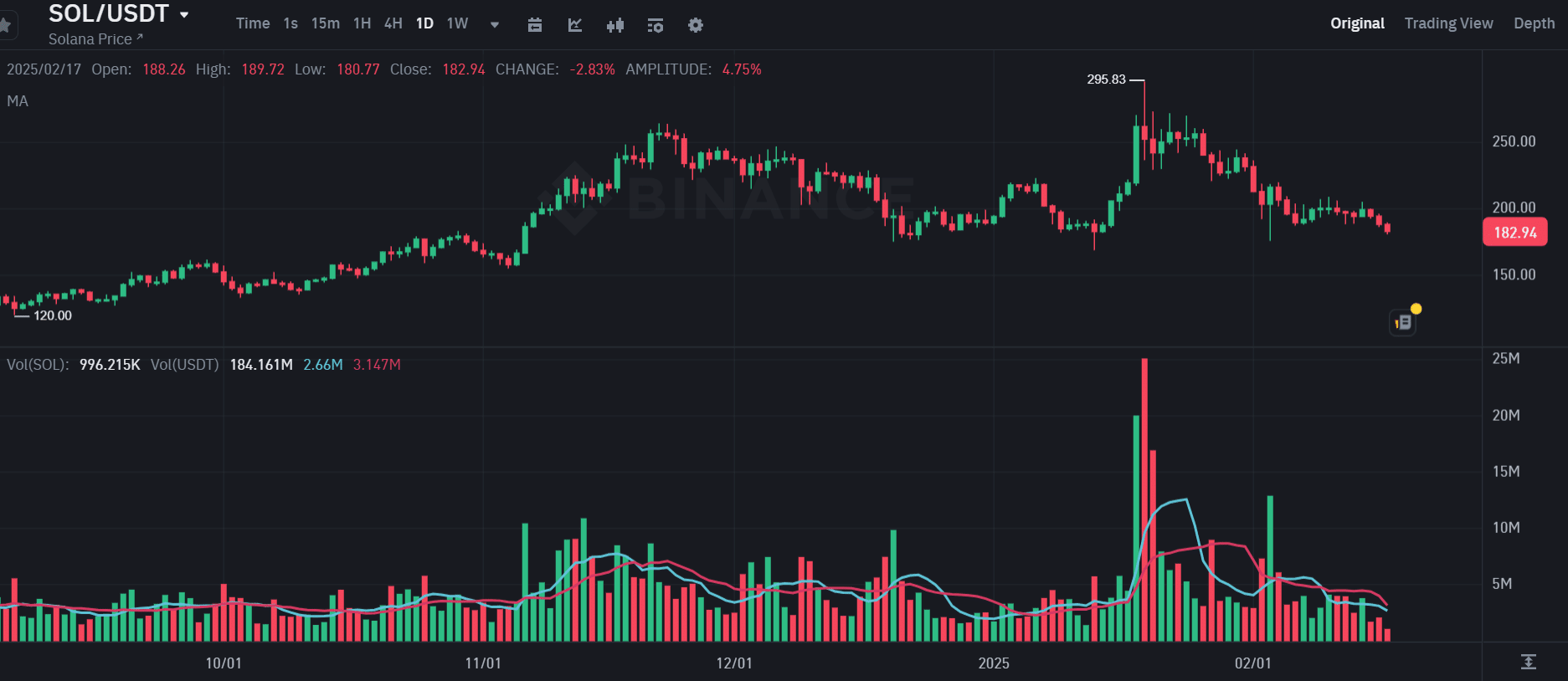

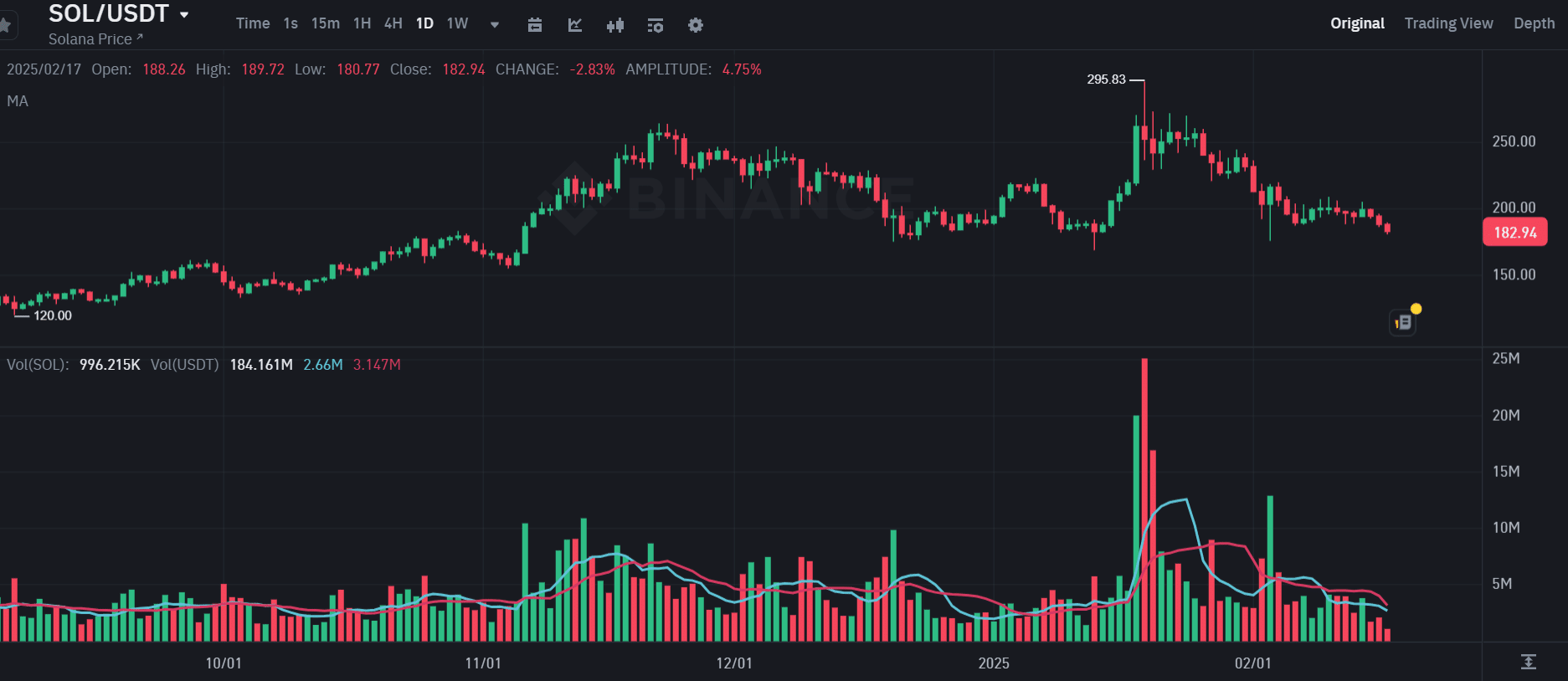

However, as Ambcrypto notes, this strategy can be counterproductive if Spothandel does not come to the fore. Binance -Details show three consecutive days of sales orders.

Unless this shifts to green, a bottom of $ 180 might be difficult to touch. A pullback to $ 160 is more likely if long squeezing is not kept under control.

Source: Binance

With a high risk sentiment that runs through the derivatives market, caution is crucial.

While the buzz from around 35% rebound to $ 250 spreads on social media, the reality suggests more days of heavy liquidations.

Traders run the risk of losing millions, so that every rebound for Solana is still far away.