- The market saw significant declines this past week.

- There is still time in the year when the market can push for one last rally.

The Santa Claus rally, a seasonal market trend where prices historically rise in the last week of December, has become a hot topic in the crypto world.

As we approach the end of 2024, crypto investors are wondering if this rally has fizzled out yet or if it still has the potential to drive the markets higher.

Current market overview

Bitcoin [BTC]the market leader, is currently trading at around $95.00, reflecting an increase of less than 1% in the last 24 hours.

Ethereum [ETH] follows suit with an increase of less than 1%, with a price of approximately $3,291. Solana [SOL] and Binance Coin [BNB] are also showing slight gains, with the total crypto market cap hovering around $3.5 trillion.

Despite the small decline, trading volumes remain strong. Bitcoin’s dominance, now at 55.08%, underlines its crucial role during this seasonal period.

Source: Coinglass

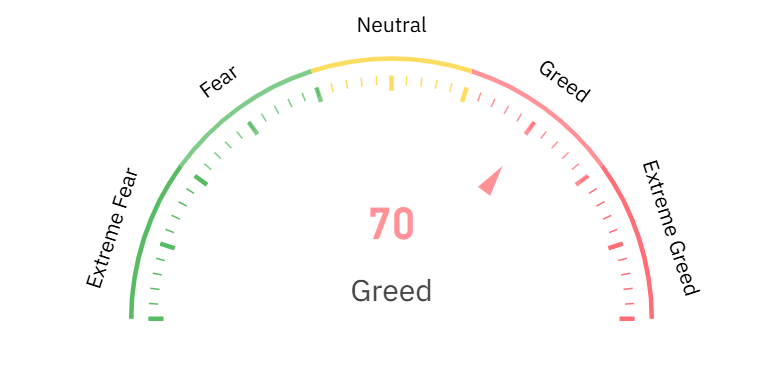

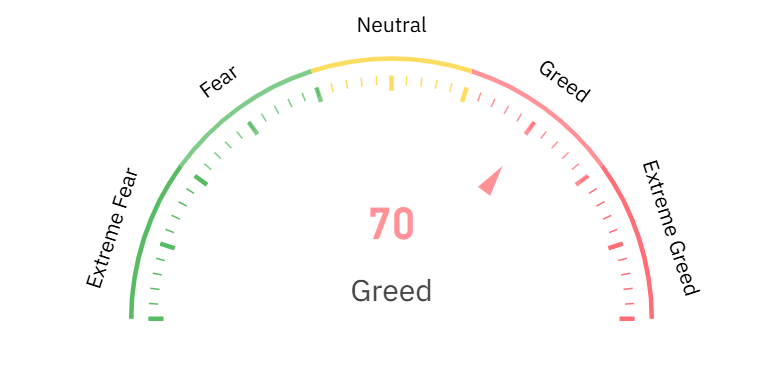

Furthermore, the Fear & Greed Index, currently at 70 (Greed), suggests that market sentiment remains bullish, albeit cautiously.

Has the Santa Claus rally lost its momentum?

The Santa Claus rally has traditionally been linked to bullish sentiment, tax-driven purchasing and increased retail participation. However, recent events have caused volatility, including the expiration of more than $2.6 billion in Bitcoin and Ethereum options.

This options expire often causes price fluctuations as traders adjust their positions.

Data on the chain shows mixed signals. Whale activity has declined and fewer large transactions have been recorded, while private investors continue to accumulate.

Meanwhile, technical indicators such as the Relative Strength Index (RSI) for BTC and ETH are hovering around neutral levels, indicating a lack of clear directional momentum.

What this means for investors

The performance of the rally in the coming days will largely depend on the key resistance levels. Bitcoin faces a psychological barrier at $100,000, while Ethereum needs to regain $3,500 to regain bullish momentum.

Bollinger Bands indicate reduced volatility, but any breakout can be significant.

For those entering today’s market, risk management is critical. Investors should pay attention to momentum shifts, especially in the MACD and RSI, while keeping an eye on macroeconomic trends and regulatory updates that could impact sentiment.

Although the Santa Claus rally has not produced explosive profits, its potential has not been completely diminished. The next week will be crucial as the market transitions to 2025.

Staying informed and adapting to market conditions will be crucial for crypto investors looking to take advantage of the year-end opportunities.