- A strong breakout pattern has emerged for $LUNC, targeting a potential upside of over 567%.

- On-chain metrics showed rising transaction volume and a positive funding rate, indicating optimism.

Terra Classic [LUNC] is showing signs of a massive breakout and attracting investors’ attention.

Technical indicators and strong on-chain activity suggested that LUNC may be gearing up for a significant price move, with a potential for a 567% upside.

The broader cryptocurrency market continues to experience volatility and uncertainty. However, amid these conditions, LUNC stood out for its promising technical patterns.

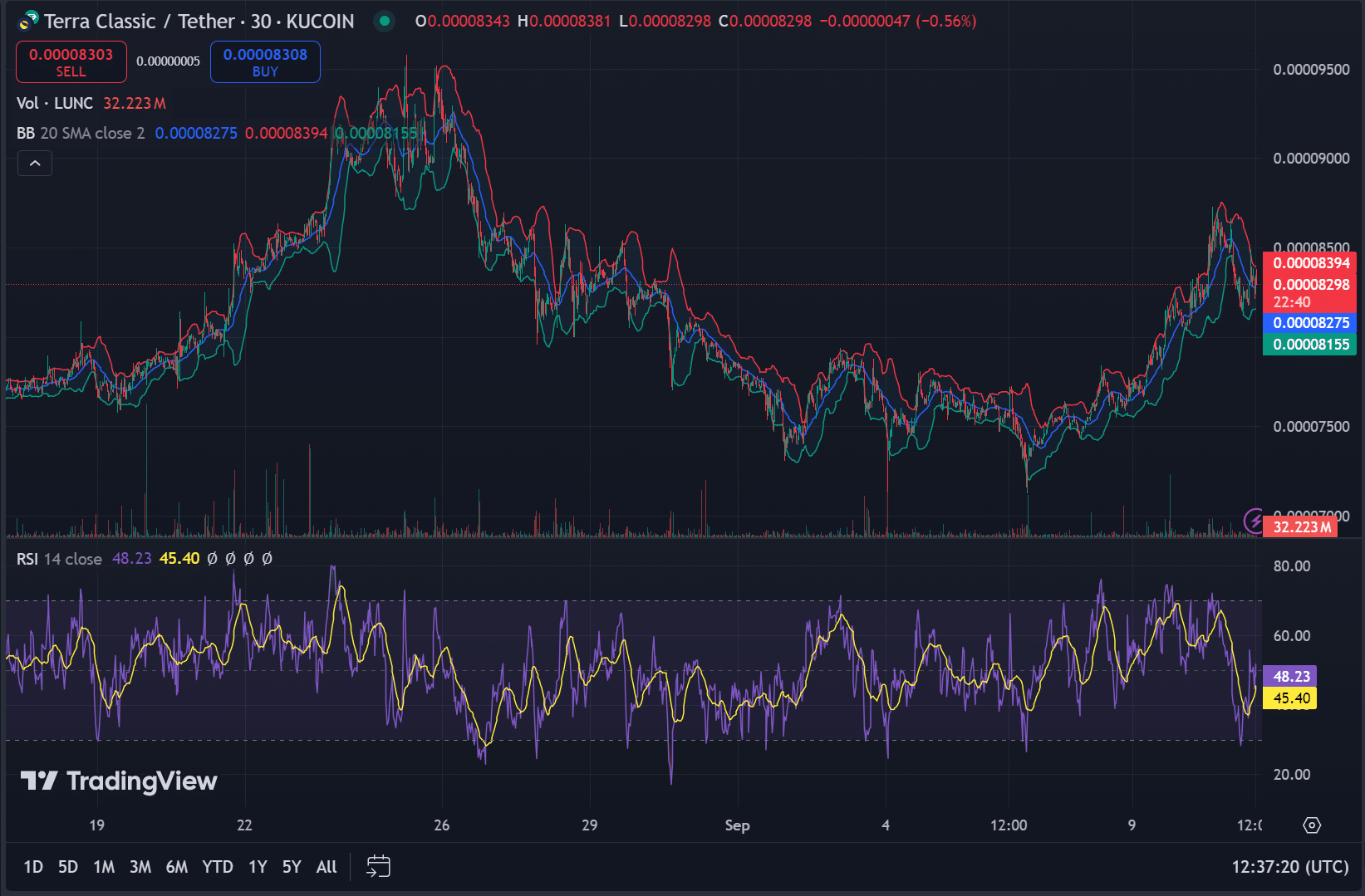

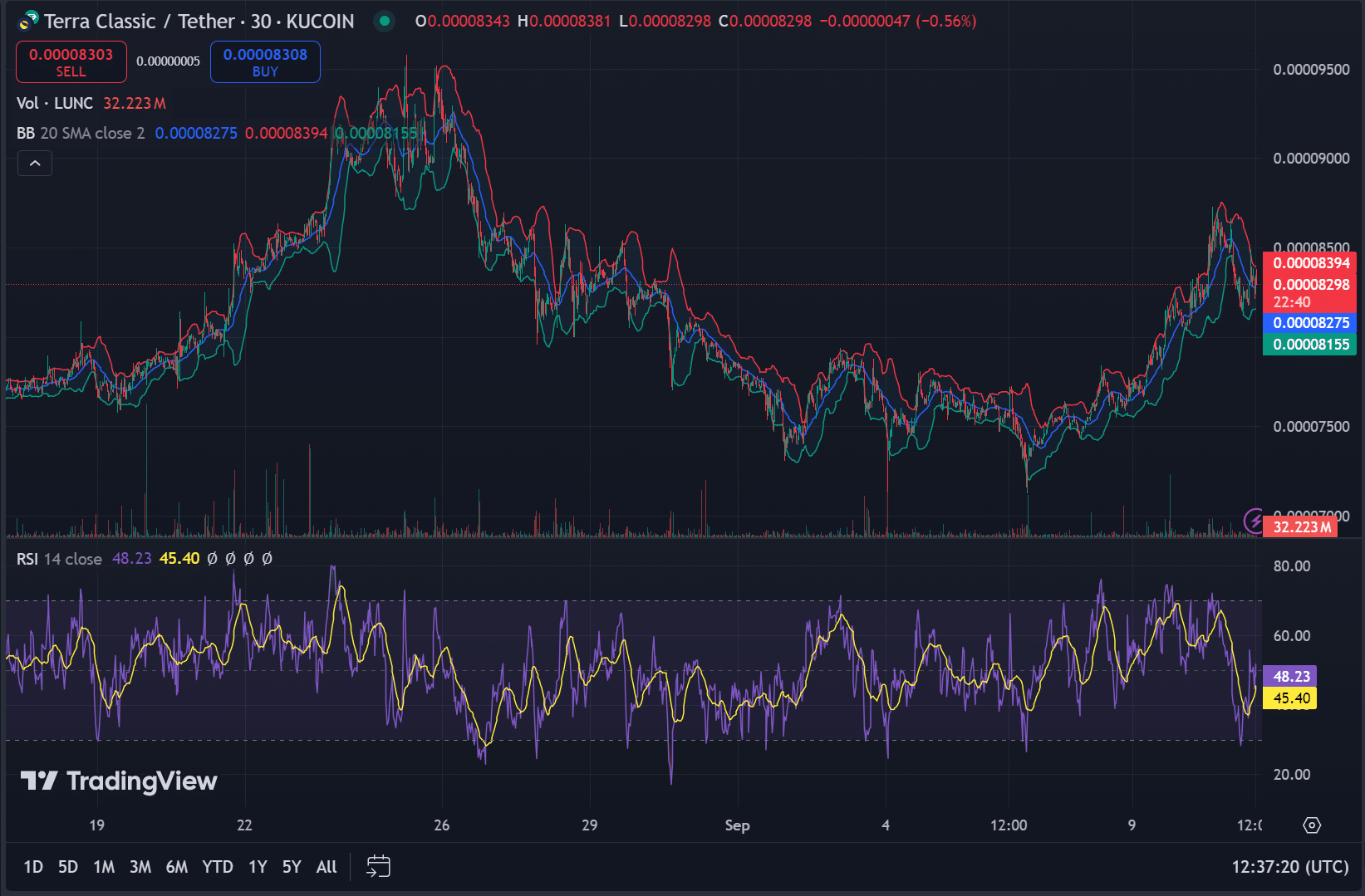

At the time of writing, LUNC was trading at $0.00008326, reflecting a modest gain of 0.85% over the past 24 hours.

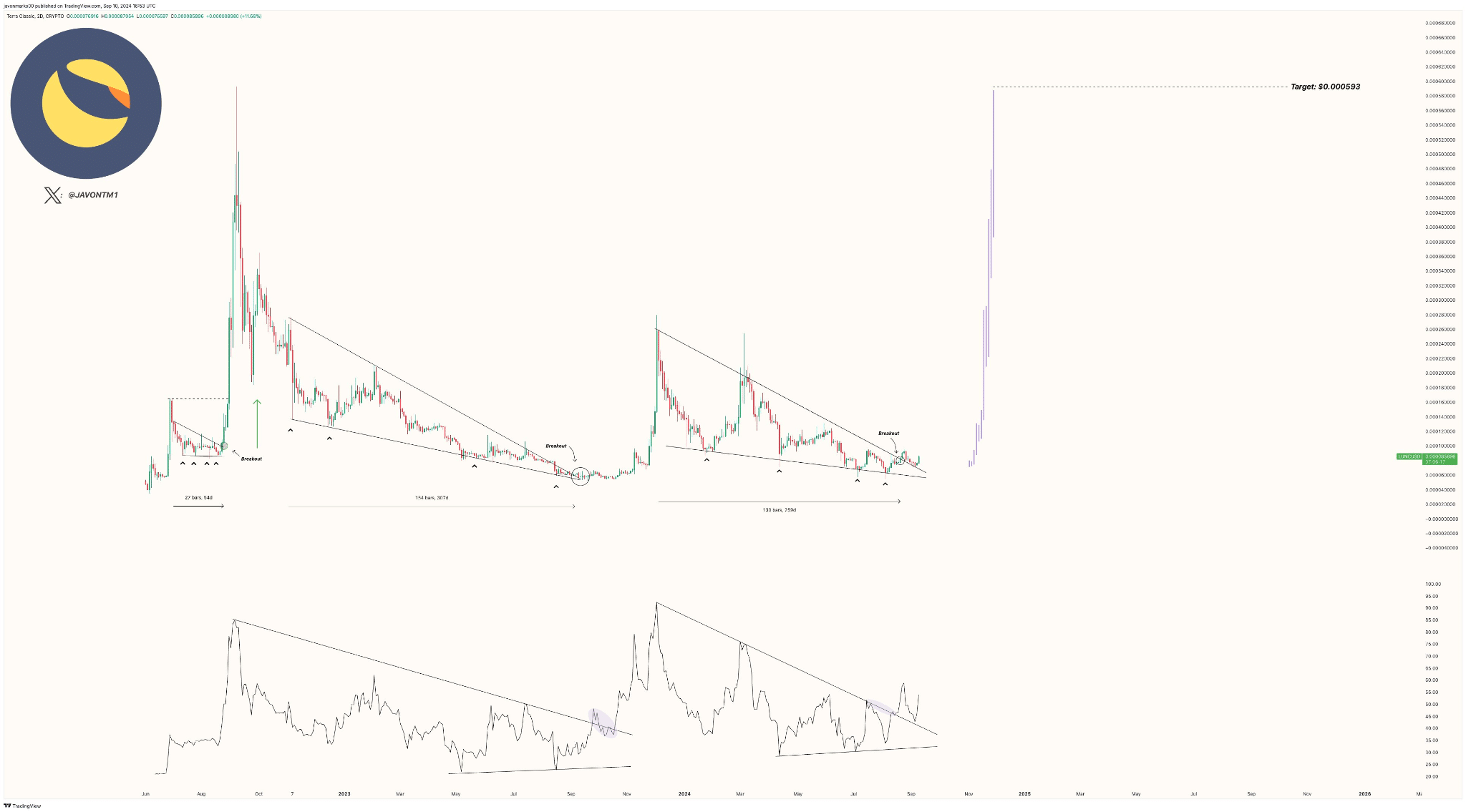

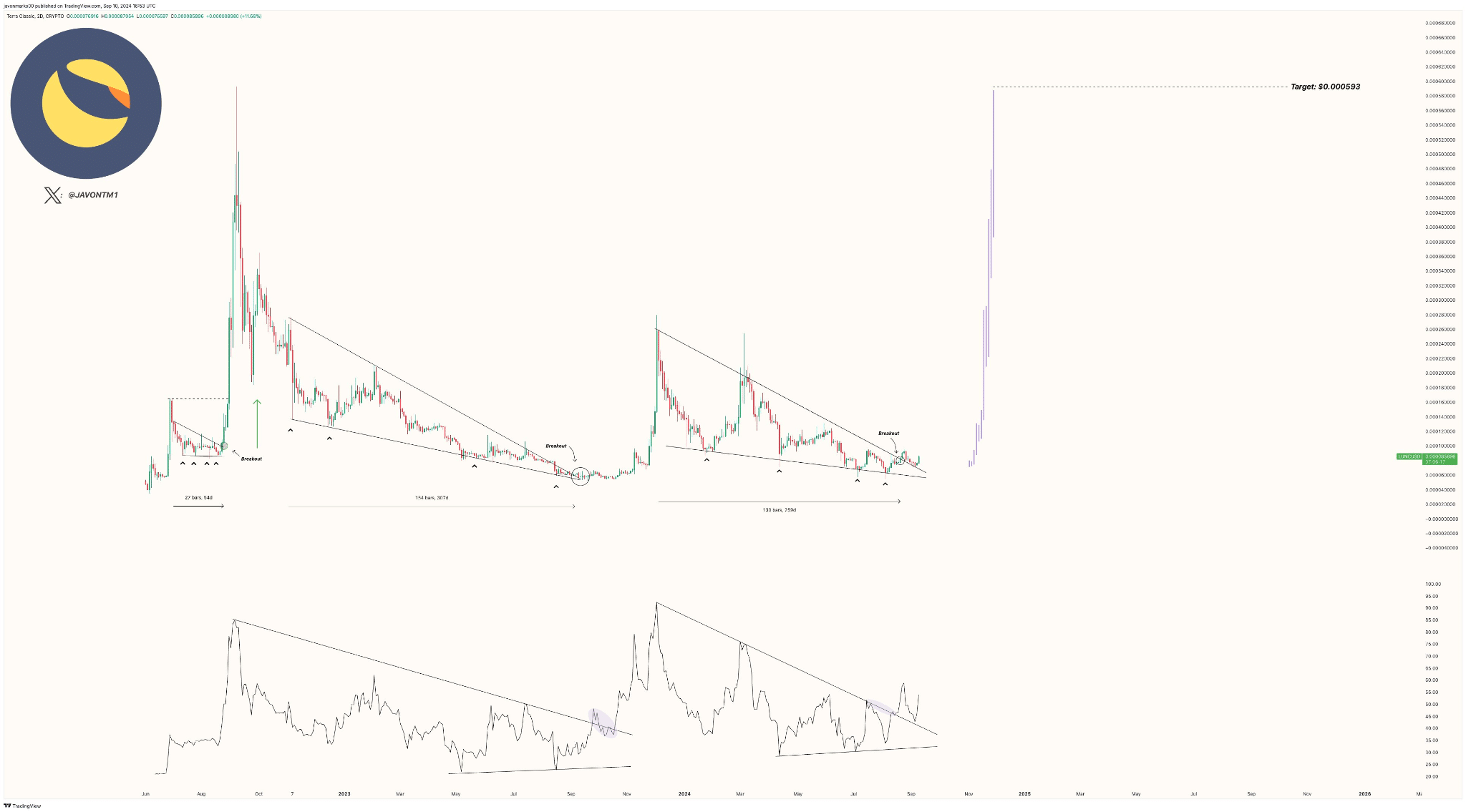

A technical analysis shared by analyst Javon Marks on X (formerly Twitter) highlighted a strong breakout from a long-term falling triangle pattern, a classic indicator of an impending uptrend.

The RSI has tested again, indicating strengthening momentum. Analysts are now targeting $0.000593, a potential gain of over 567% from current prices.

Source:

Has the LUNC triangle outbreak been confirmed?

Recent technical charts indicated that LUNC broke the descending triangle pattern, which lasted for more than 150 days.

The support level at test time was around $0.00008, while the resistance level was expected to be close to $0.00012. The RSI held steady above 45, supporting momentum for a possible price increase.

Source: TradingView

Increasing transaction volume and TVL insights

On-chain data further supported the bullish sentiment. Daily transaction volume has increased significantly, with an increase of 32.46% in the last 24 hours. This increase reflected traders’ growing interest in LUNC.

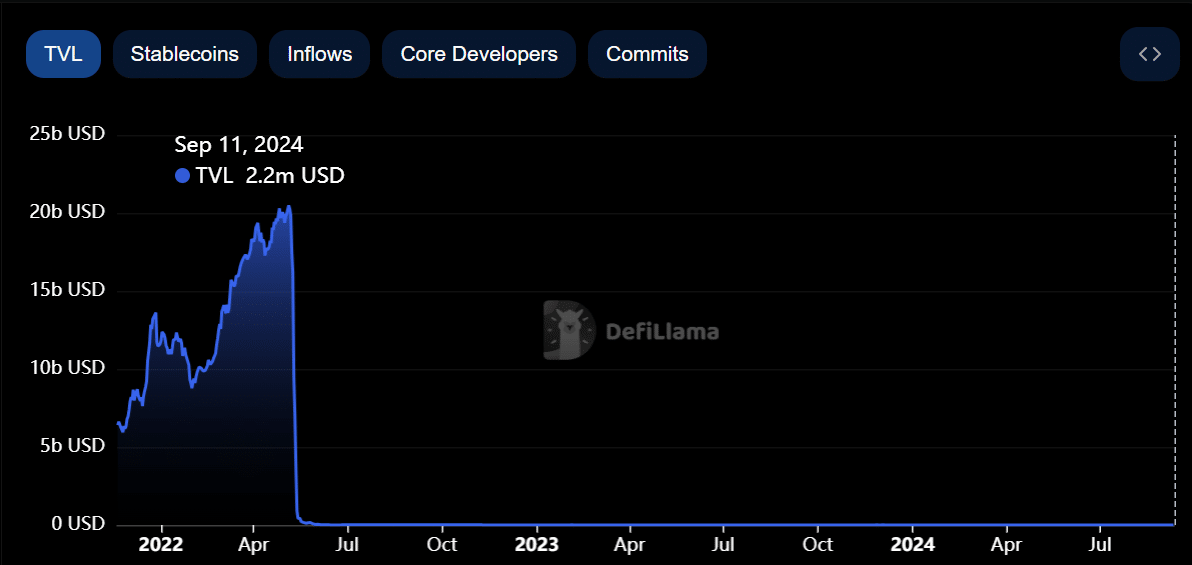

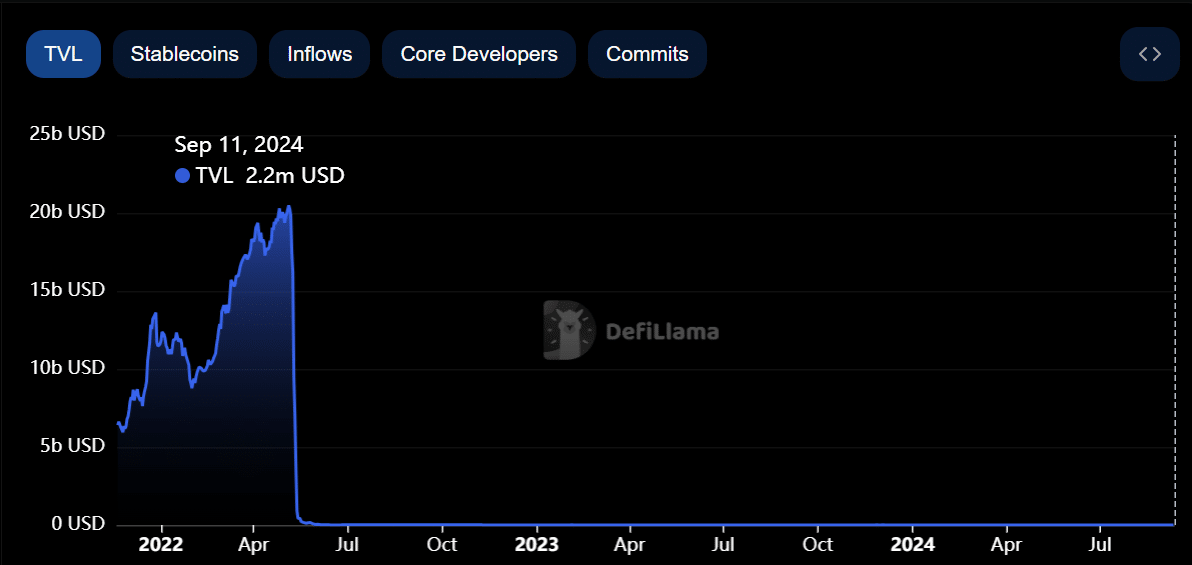

However, Total Value Locked (TVL) remained low at $2.2 million, a sharp decline from its historical highs. While this low TVL could indicate caution, the increasing transaction volume shows optimism in the short term.

Source: DefiLlama

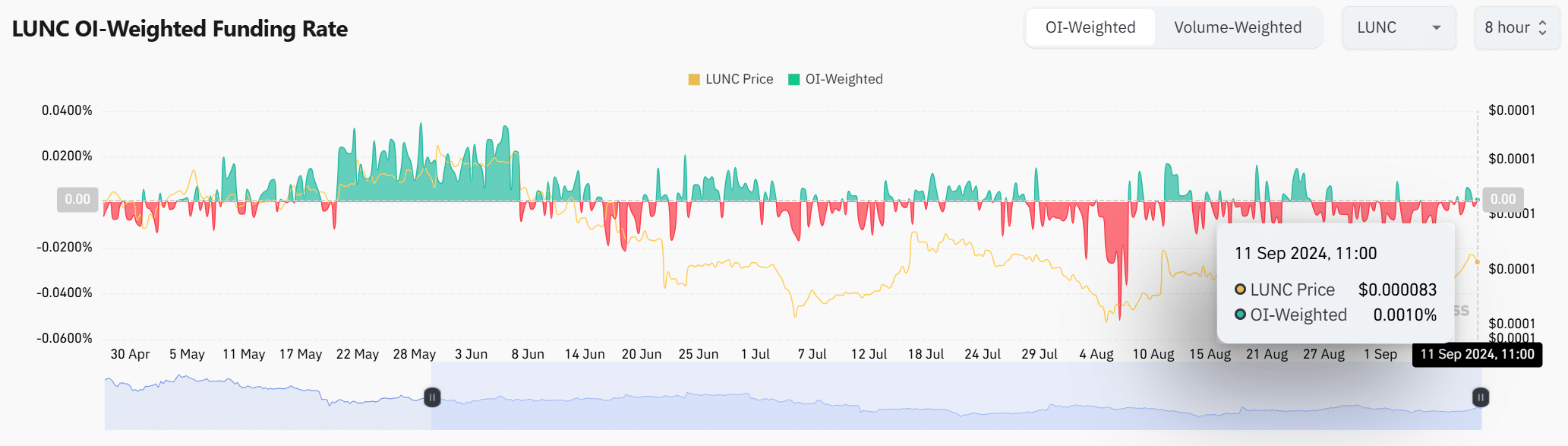

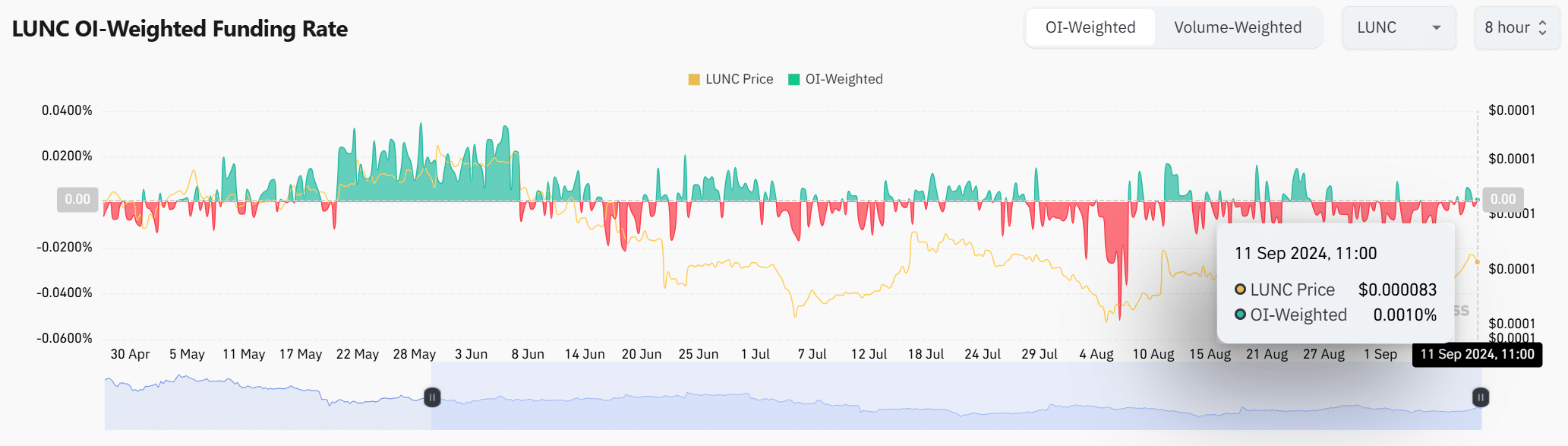

The OI-weighted funding rate for LUNC has remained positive, with a press-time rate of 0.0010% as of September 11.

This consistent positive rate indicated that long positions were willing to pay funding fees to maintain their positions, signaling confidence in the market’s upward direction.

Source: Coinglass

Read Terra Classic’s [LUNC] Price forecast 2024–2025

The positive funding rate aligned with bullish sentiment and strengthened the technical analysis, suggesting further gains.

Both technical and internal indicators pointed to the possibility of a major breakthrough for LUNC. The coming days will be crucial to confirm whether this bullish momentum can be sustained.

![Is Terra Classic [LUNC] on the verge of a 567% breakout?](https://free.cc/wp-content/uploads/2024/09/lunc-webp-1000x600.webp)