- Pepe’s Oktoberrally remains one of the most striking price movements, which represent a price increase of 227%

- To determine whether Pepe is placed for a similar rally, the current technical setup is worth analyzing

In a recent market commentaryAnalysts hinted to the possibility of an advantage of 100% in Pepe [PEPE]Parallels draw with its breakout pattern in October.

In particular, 2024 marked a breakout year for the memecoin, after it had achieved a remarkable 1,435% on an annual basis for the opening price of the new year of $ 0.0000013. By doing this, it closed the year with exponential returns.

At the time of the press, however, Pepe traded 61% below the opening of the first quarter of 2025, as a result of broader market corrections. Nevertheless, the current 1-day map structure reflects the consolidation range of the late October, characterized by compressed price action.

Historically, this pattern preceded a sharp outbreak, with the same seeing Pepe with 227%, with a peak of $ 0.00002597 on November 14.

As a result, speculation or the memecoin could be ready for a similar outbreak in the short term. A repeated rally, maybe?

Source: TradingView (Pepe/USDT)

Expansion of Pepe’s fundamental arrangement

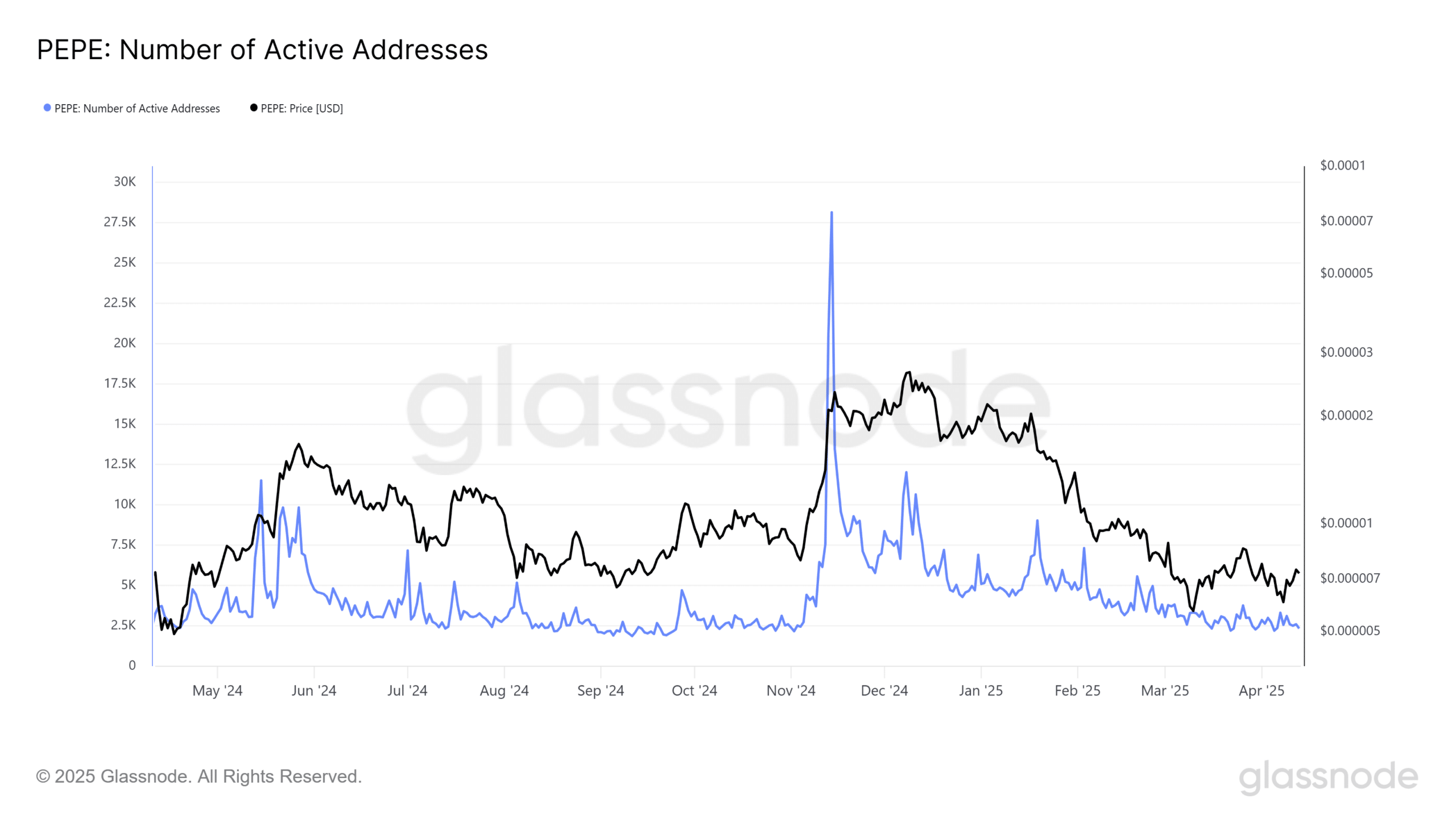

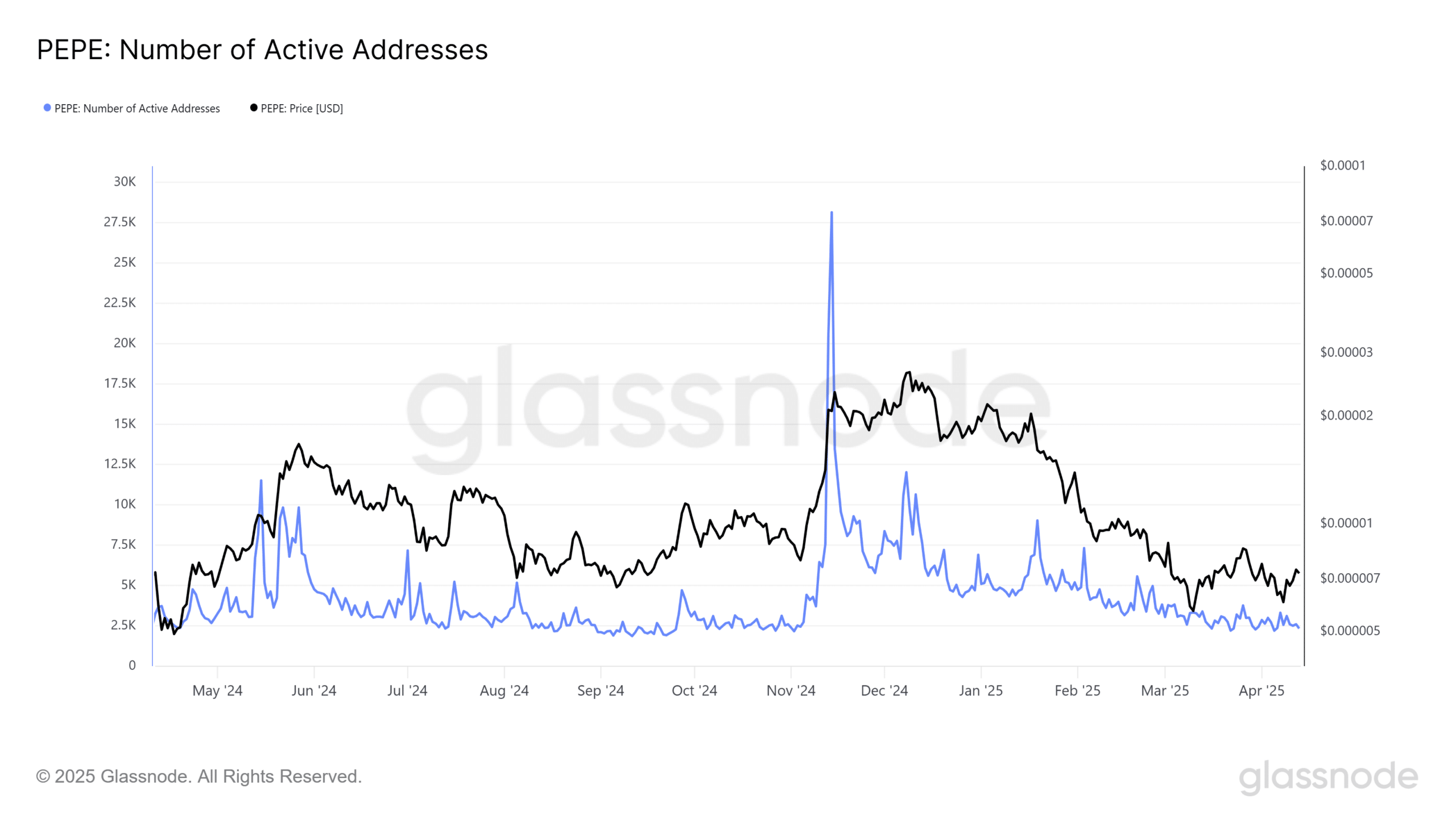

Interestingly, active addresses on the PEPE network amount to an average of 2,500 prior to a significant increase to 20,500 in mid-November, in accordance with the parabolic price movement of the token.

Historically, such an increase in activities at the chain was a leading indicator of Bullish Momentum.

The current network statistics, however, remain relatively flat, with active addresses at 2,587 – reflection of previous consolidation phases before Breakout events.

In other words, this can mean a similar accumulation pattern that previously went to a significant price shift. .

Source: Glassnode

Despite the lack of concrete confirmation, the speculative rally potential of Pepe can be a double -edged sword. Especially when considering derivative market data.

For example – Coinglass -Data indicated that despite muted activity on the chain and a lack of clear accumulation signals in the spot market volume, Open Interest (OI) on Pepe Futures has risen sharply.

In fact, it exceeded the November levels with an increase of almost 5%, with the same linked to $ 301.48 million at the time of the press.

Consequently, Pepe’s weekly profit of 20% can run the risk of activating liquidation cascades, especially in long positions, due to the absence of DIP purchase support. This would be in control of shorts-sellers, which emphasizes the need for cautious risk management.

Although historical patterns seemed to point to a possible outbreak, the cryptomarkt trust hard data, no coincidences. Pepe’s profit is driven by livered liquidity instead of organic buying, making it vulnerable to a sharp reversal.