Here’s what Santiment’s various on-chain indicators have to say about whether Pepe Coin could see another pump soon or not.

The Memecoin’s on-chain stats have fallen since the top

PEPE has been one of the hottest topics in the cryptocurrency market lately, thanks to the explosive growth the meme coin has been experiencing. Between the end of last month and May 5, the coin saw its price rise by as much as 1,200%.

However, the uptrend ended there and the cryptocurrency has since fallen sharply. According to Sanitationthe on-chain analytics company’s “social dominance” indicator signaled this top in advance.

Social dominance tells us what percentage of social media discussions regarding the top 100 cryptocurrencies by market cap are about a particular coin.

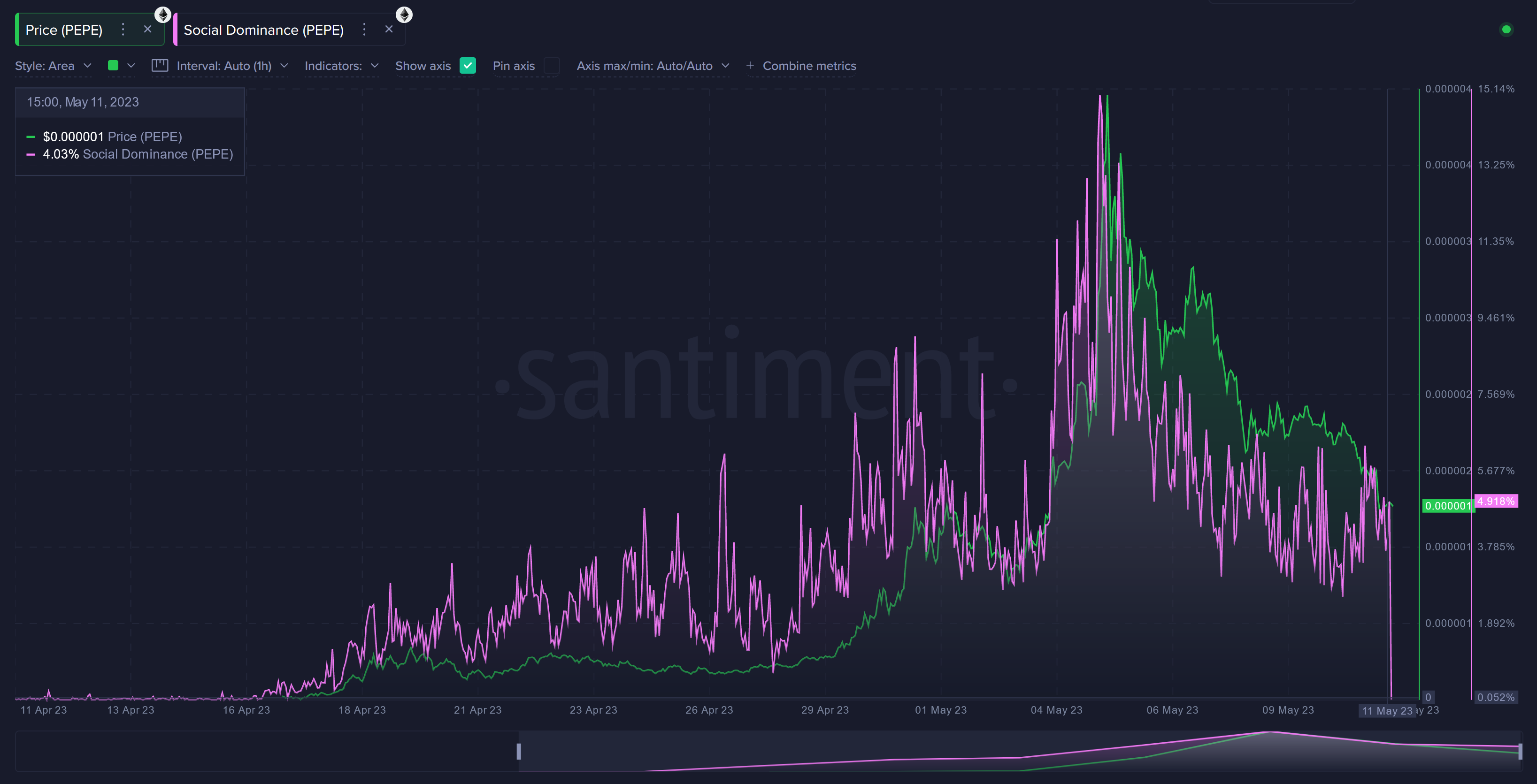

As the chart below shows, Pepe’s social dominance rose to very high levels just before the peak took shape earlier this month.

Looks like the value of the metric has come down in recent days | Source: Santiment

Whenever social dominance reaches a high level, it is a sign of euphoria among investors, something that has historically led to top formations for cryptocurrencies.

Santiment notes that the indicator still has a value of about 5%, meaning that 5% of all discussions regarding the top 100 assets are currently related to the meme coin.

“It would be a good sign that traders are starting to wander off and look for pumps from other altcoins,” the company explains.

The active addresses metric, which measures the total number of unique addresses participating in certain transaction activities on the blockchain, also saw a spike just before the summit.

The metric seems to have calmed down | Source: Santiment

When this indicator has a high value, it means that a large number of investors are currently executing trades. The price generally becomes more likely to become volatile when the metric shows such a trend.

The chart shows that the active address indicator has dropped in value for PEPE over the past few days, meaning that market activity has calmed down.

An interesting trend is also visible in the data for the supply of the largest Pepe Coin holders, as shown in the chart below.

The holdings of the memecoin's whales | Source: Santiment

These giant holders had gathered as the rally was going on, but just as the top was taking shape, they began to eject coins from their wallets.

This cohort has since continued to sell as the value of PEPE has gone downhill. “If you see these lines going up again, PEPE is much more likely to pump for the second time (though probably a smaller round),” Santiment explains.

However, a positive sign for the asset could be that its trading volume has recently recovered after falling since its peak (as have the other metrics).

The trading volume of the asset | Source: Santiment

“All in all, meme coins should be taken for what they are. They are governed by speculation and public expectations. “In these fresh, new assets that fit this description, you probably want to watch when the public gets too emphatic that a price direction is going to happen.”

PEPE price

At the time of writing, Pepe Coin is trading around $0.000001251, down 37% over the past week.

The asset continues to decline | Source: PEPEUSD on TradingView

Featured image from iStock.com, charts from TradingView.com, Santiment.net