- Bitcoin as an institutional active for Nvidia is completely logical for two important reasons

- The brand positioning if a progressive act is set to improve if this happens

Crypto Twitter is Abuzz of speculation that Nvidia may consider a strategic allocation of Bitcoin [BTC] To his business basket.

However, according to ambcrypto, this dissertation is not far -fetched. The most important macro and market dynamics even suggested that this could be a calculated step to diversify the exposure to the balance and to cover itself against the depreciation of the Fiat.

If confirmed, such a allocation could act as an important bullish catalyst for Bitcoin. It even has the potential to pull more institutional investors on the market.

Strategic feeling behind the role of Bitcoin in the treasury of Nvidia

The US economy is only halfway through the re -election cycle of Trump and yet the best shares in the public company have fallen by more than 20% in Q1. Nvidia, arranged among the top three public companies with a market capitalization of $ 2.72 trillion, is no exception.

At the time of the press, the share valuations had fallen by 24.44% compared to the first opening of $ 138. However, this can simply be the start of a greater decline.

Source: TradingView (NVDA)

As a technology giant who has been deeply invested in artificial intelligence (AI), Nvidia is square at the intersection of the trade war in the US china. This exposes the company to potential geopolitical risks that can continue to press its share price.

In addition, with increasing inflation that the purchasing power of the US dollar erodes, Nvidia could be confronted with higher operational costs, in particular for components and logistics for supply chain.

Given this macro -economic pressure, it is no surprise that more listed companies turn to Bitcoin to cover themselves against these risks.

In fact, metaplanet Recently published 3.6 billion JPY in 0% ordinary bonds to acquire extra bitcoin. It positions itself as part of the growing trend of companies that add crypto assets to their business reserves.

Is evidence in the figures

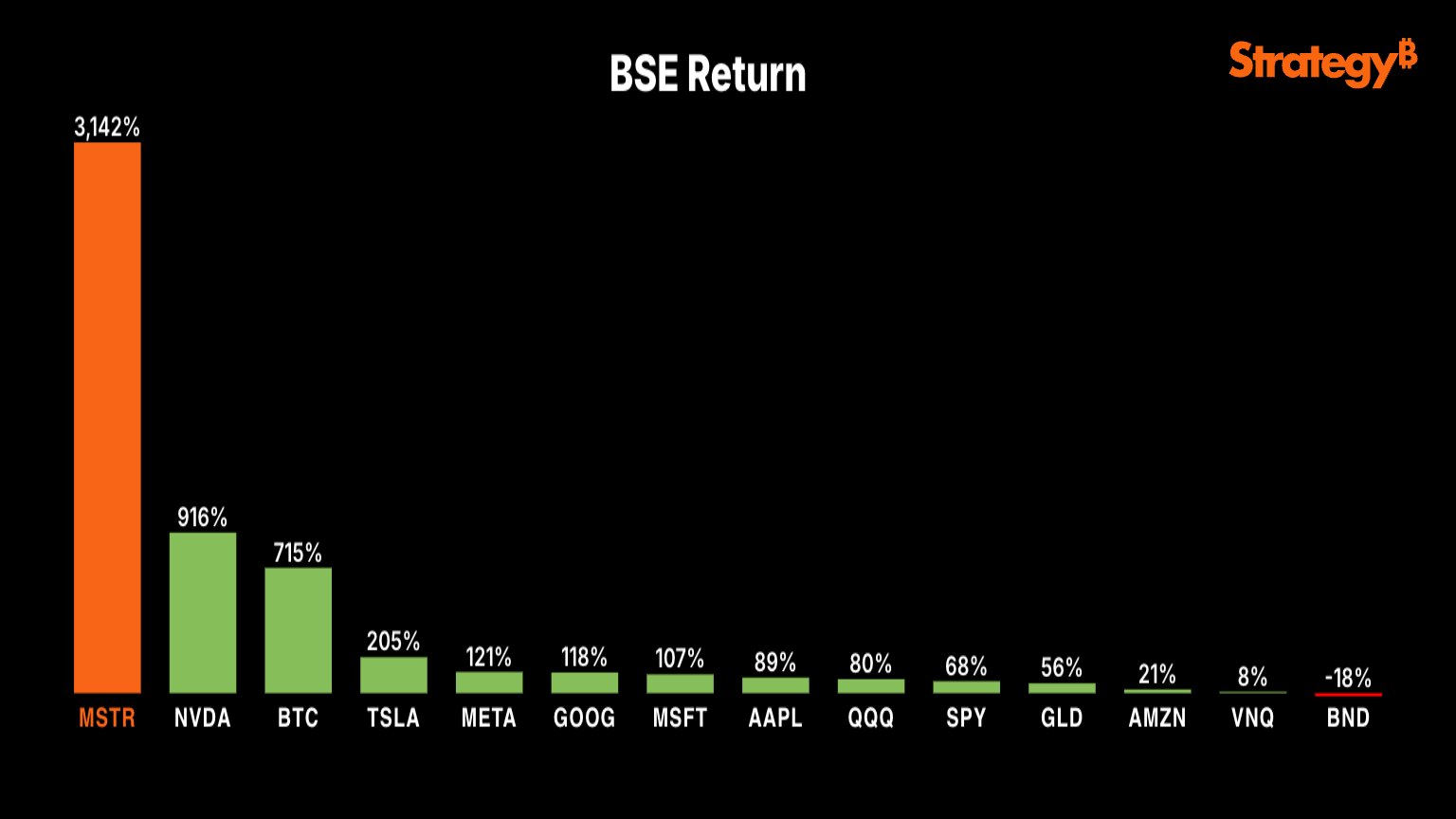

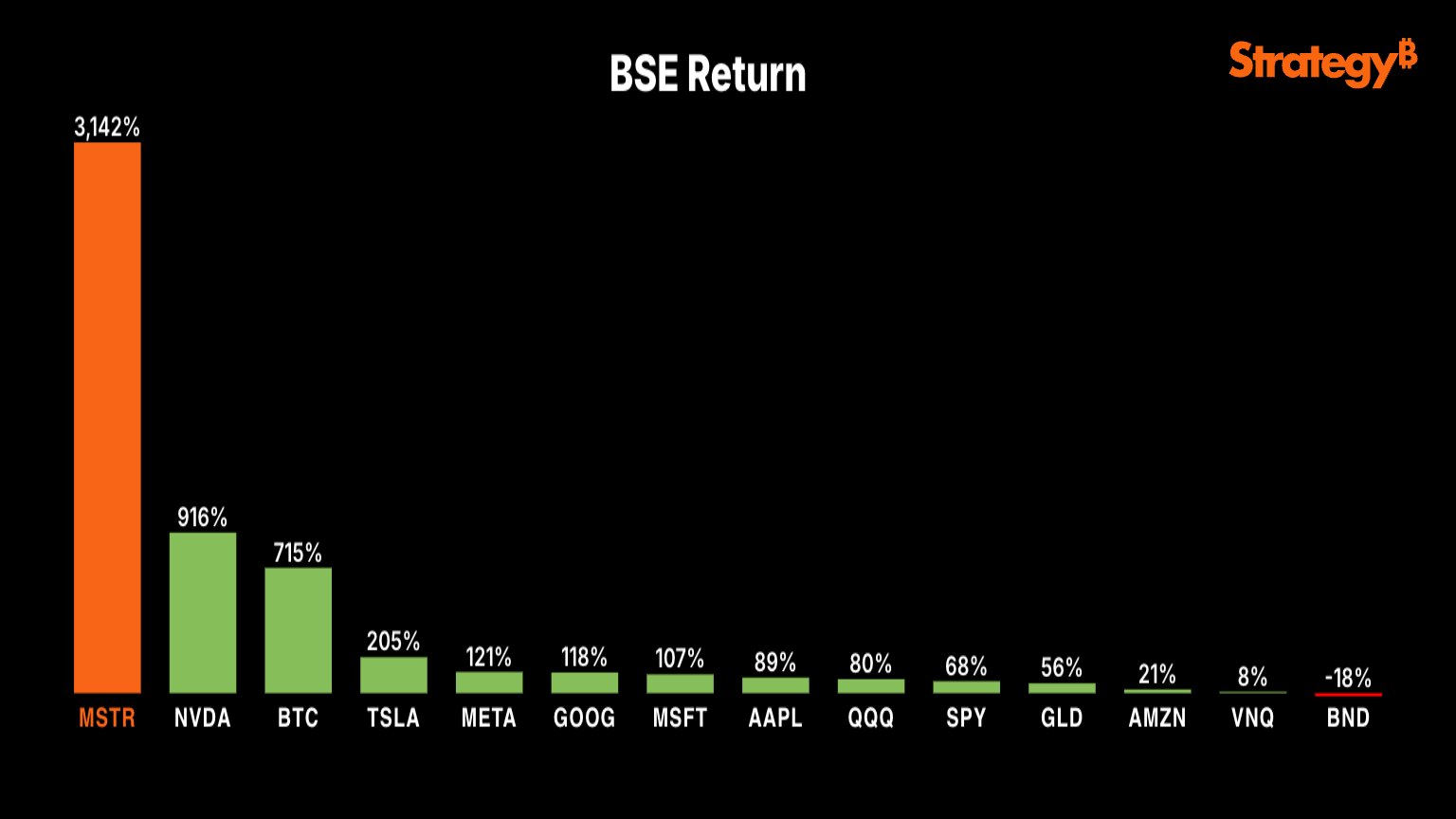

Micro strategy [MSTR] In the past five years, stock has seen a stunning return of 3,000%, largely powered by his Bitcoin exposure. It has considerably surpassed most technical shares. This has translated into an annual growth rate of 600%.

For comparison: the shares of Nvidia have posted the return of “only” 916%. Although the micro strategy follows with a considerable margin.

Source: X

This grim divergence emphasizes the big impact of Bitcoin on the performance of micro strategy.

The rise in Bitcoin from $ 10,000 in 2020 to $ 96.172 on the press, which reflects a price gain of 715%, further substantiates its role as a critical engine for portfolio rides for companies such as MicroStrategy.

With such results, it is no wonder that other major players will soon be able to jump on the bandwagon. And guess? Nvidia looks like it’s the next to make that daring move!