- Bitcoin is chasing long entries, but it may not be too late.

- Demand for crypto in the US is surging as MSTR makes record BTC purchases.

Bitcoin [BTC] Long positions taken during the current uptrend are quickly “rushed,” leading to abrupt exits as prices continue to rise.

This repeating pattern indicated a volatile trading environment where long positions are liquidated quickly, especially after Bitcoin reaches the $90,000 level.

The continued cycle of long market entries followed by rapid declines suggested that traders trying to profit from the uptrend face significant risks.

Source: Hyblock Capital

This trading behavior begs the question: With such aggressive targeting of long positions, is it currently too late, or still feasible, to consider going long Bitcoin without experiencing immediate setbacks?

Bitcoin SOPR for STH

Analyzes of the Short-Term Holders’ SOPR (STH SOPR) indicated balanced market sentiment.

The SOPR is currently midway between the extremes of greed and fear, indicating that there is still potential for further price increases without the immediate risk of a major correction.

The analysis, supported by the 30DMA, found that while STHs made profits, their actions were not indicative of market euphoria.

Historically, once the SOPR enters “extreme greed,” it typically predicts a pullback as the market overheats.

Source: CryptoQuant

Conversely, ‘extreme fear’ zones have traditionally been where major market lows occur, providing excellent buying opportunities.

The current subdued figures indicate a period of steady growth and cautious optimism among traders. A quick step toward the end of greed could point to the need for strategic profit-taking to avoid a recession.

The period presented opportunities for strategic investments, where a balanced approach was crucial to address continued volatility and benefit from the upward trend.

Rising demand and record purchasing of MSTR

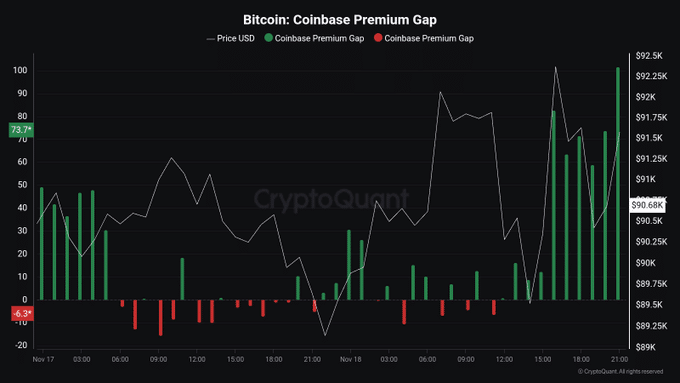

Following the US elections, demand for Bitcoin continued to rise, as evidenced by the rising Coinbase Premium Index. This gauge reflected an increased buying appetite among US traders, sustaining the current bull run.

Data in recent days has shown significant premiums, with the index hitting peaks as Bitcoin’s price soars towards $92,000.

This trend indicated optimism and the potential for further upside, suggesting it may still be appropriate to take long positions now.

Moreover, institutions continued to buy even as Michael Saylor announced they were doing so could raise $42 billion to buy Bitcoin “much ahead” of the three-year plan for MicroStrategy.

Read Bitcoin (BTC) price prediction 2024-25

MSTR has already purchased 66% of next year’s $10 billion target in just 10 days.

The rising demand and continued buying from MSTR who announced a new proposal to buy BTC shows that it is still not too late to buy BTC for the long term.