This article is available in Spanish.

Crypto analyst Ali Martinez has discussed Ethereum’s current price action as the second-largest cryptocurrency by market cap remains below $4,000. The analyst outlined some facts to give a clearer picture of whether or not this is the right time to give up ETH.

Analyst Discusses Whether It’s Time to Give Up on Ethereum

In one X messageAli Martinez outlined certain facts to determine whether it is time to give up on Ethereum. First, the analyst noted that ETH has been one of the weakest performers of late, a development that appears to have led to Vitalik Buterine to shake things up by changing the Ethereum Foundation’s leadership team.

Related reading

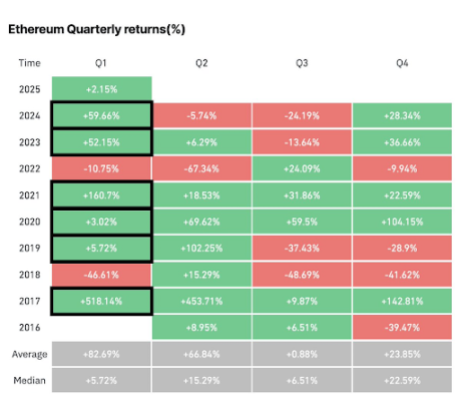

Martinez then alluded to it historical data showing that Ethereum performs well in the first quarter of every year. The analyst previously hinted that this will probably be no different this year. At the time, he noted that ETH has its strongest performance in the first quarter, especially in odd years, and 2025 is one such year.

Given Ethereum’s positive performance in the first quarter, Martinez noted that this could explain why crypto whales have amassed over $1 billion worth of ETH in the past week alone. He previously revealed that these whales had purchased over 330,000 ETH, worth over $1 billion.

Furthermore, the crypto analyst noted that the buying pressure is also clearly visible in the outflow of exchangeswith nearly $2 billion worth of Ethereum withdrawn from crypto platforms last month. Specifically, 540,000 ETH, worth $1.84 billion, were withdrawn from the exchanges last month. This accumulation trend is positive as it indicates that investors are still bullish on ETH.

However, for Ethereum to break out bullish, Martinez said it must overcome several key resistance levels. From an on-chain perspective, the crypto analyst highlighted the $3,360 to $3,450 zone as the large supply wall. This range is the most critical resistance level for ETH, while the key support zone is between $3,066 and $3,160.

From a technical analysis perspective

Martinez also provided insight into Ethereum’s price action from a technical analysis perspective. He stated that ETH appears to form the right shoulder of a head and shoulders patternwith a $4,000 neckline. He added that a decisive breakout above this level could trigger a rally towards $7,000.

Related reading

The crypto analyst also revealed that this upside target aligns with Ethereum 3.2 Market value to realized value (MVRV) Price range, currently hovering around $7,000. Amid this bullish outlook, Martinez said one worrying sign is Ethereum’s network growth, which has slowed. The number of new ETH addresses is said to have decreased by 9.32%, indicating reduced adoption.

Despite this, Martinez believes the outlook for Ethereum is still bullish. He told market participants to keep an eye on the support zone of $2,700 to $3,000. According to him, this demand zone must hold to maintain ETH’s bullish outlook.

At the time of writing, Ethereum is trading around $3,200, down 4% in the past 24 hours, according to facts from CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com