- A popular analysts believe that the Altcoin sector is now in a ‘buy’ zone for investors in the medium term

- BTC and USDT Dominance are not entirely in accordance with such a bullish prospect

At the beginning of 2025, the Altcoin sector registered a continuing sale, with top cryptos such as Solana [SOL] And Ethereum [ETH] shed +65% of their values. However, that can change shortly after a key indicator had flashed a ‘sale’ signal.

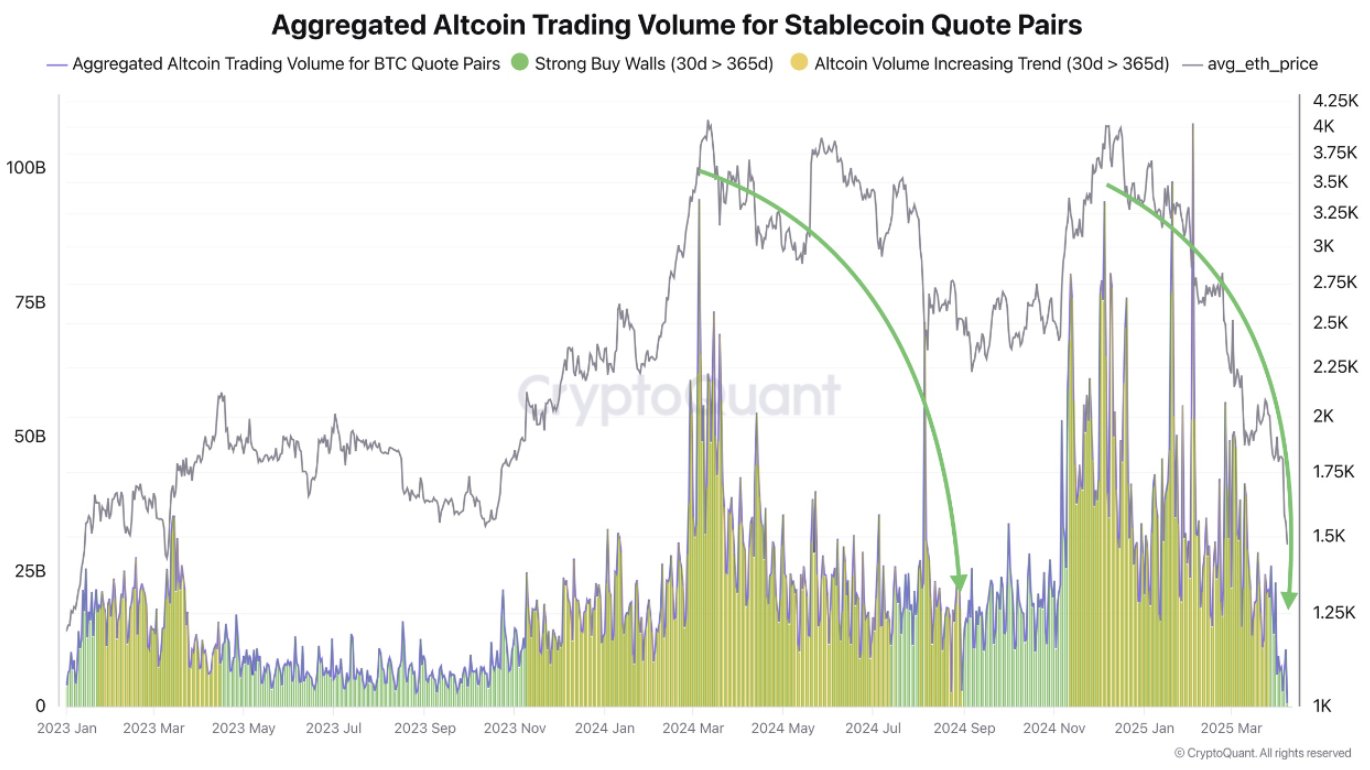

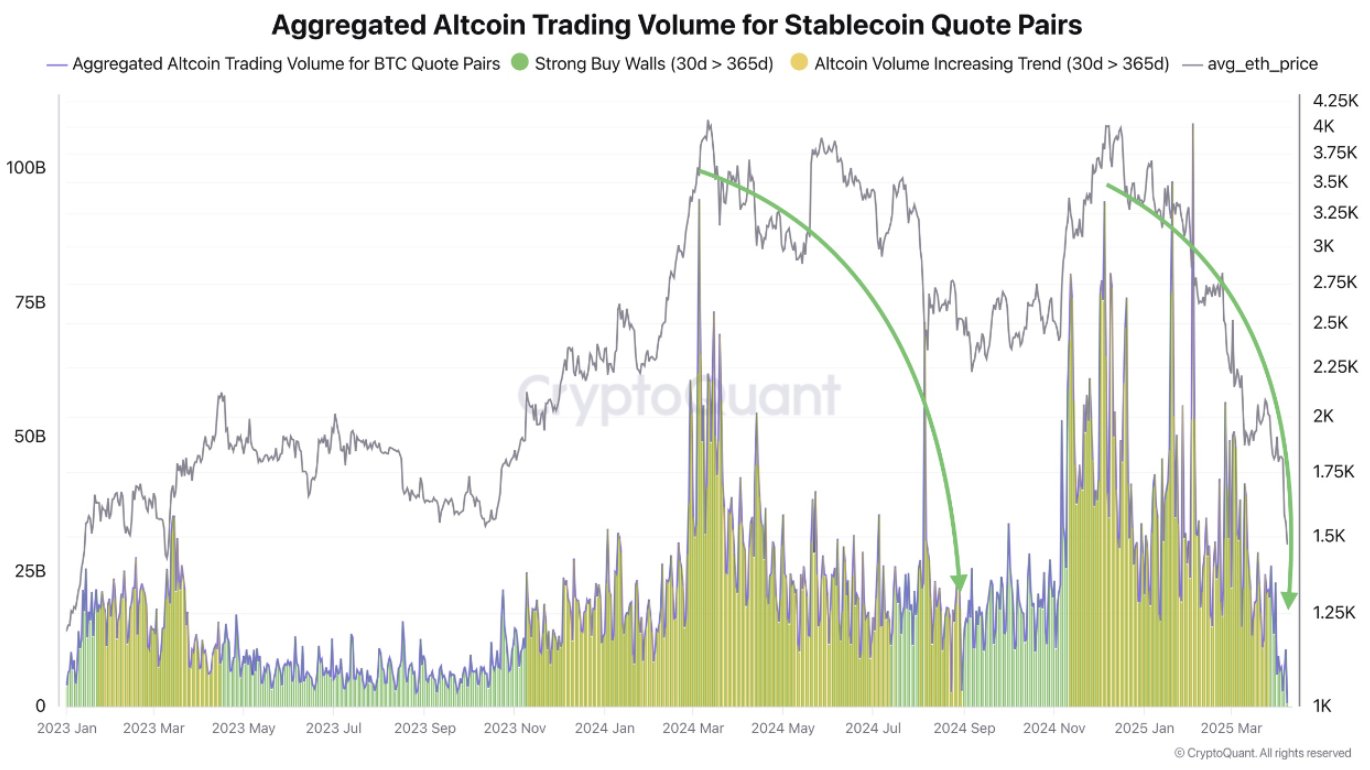

Cryptuquant Analyst Darkfost unveiled That it might be a good time to slowly introduce Altcoin positions with an “interim” prospect. He also mentioned the aggregated Altcoin Trading Volume positioning.

“We discussed a purchase zone, which is defined by the 30-day advancing average that falls below the annual average … The last time we reached these levels was in September 2023, immediately after the Bear Market ended.”

Source: Cryptuquant

Simply put, the low measurements of the indicator reflected the undervalued market conditions just before the Altcoin sector exploded at the end of 2023 at the end of 2023.

Hence the question – do other altcoin – momentum signals agree with these specific prospects?

Assessment of the dominance of Bitcoin and USDT

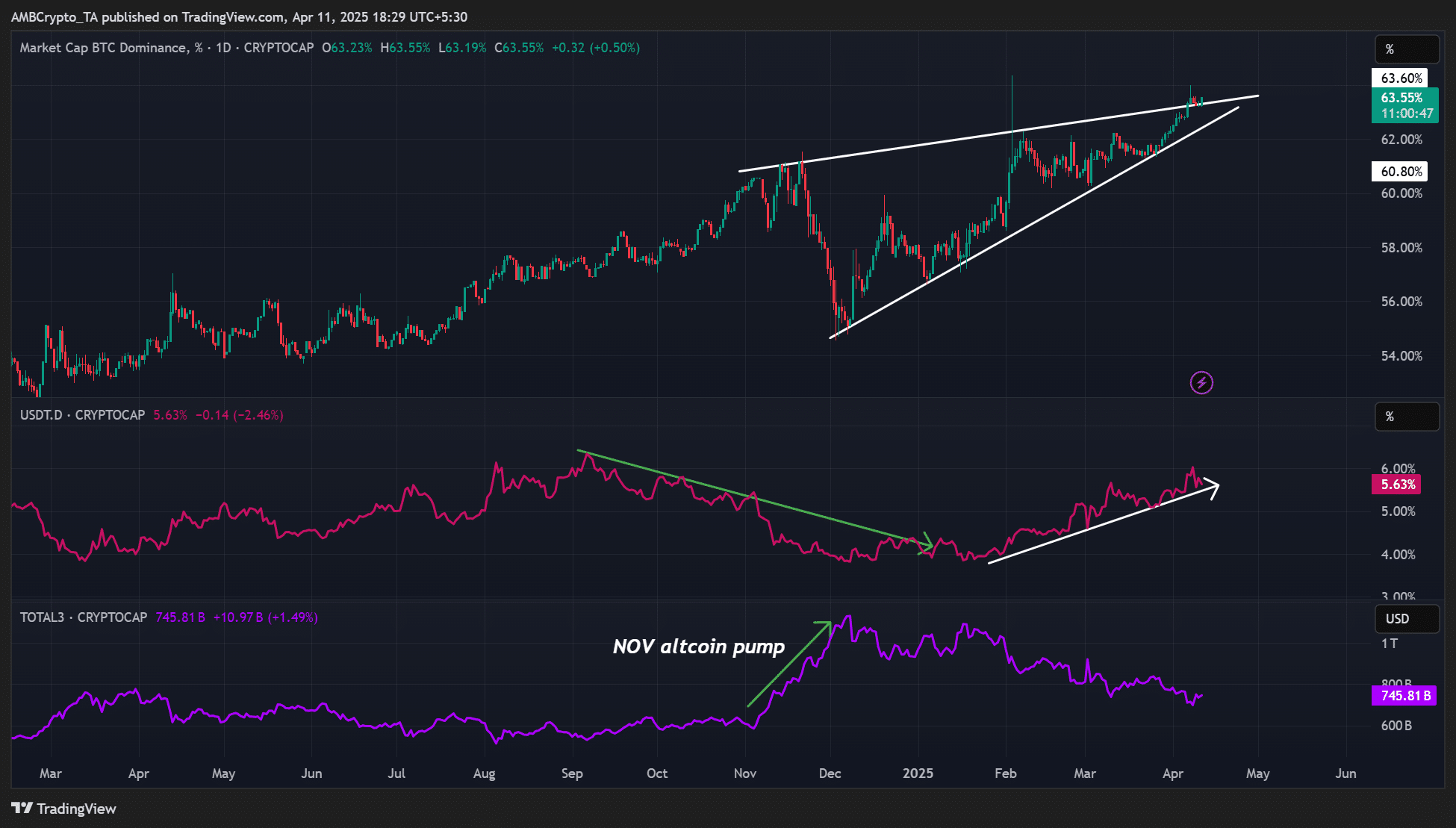

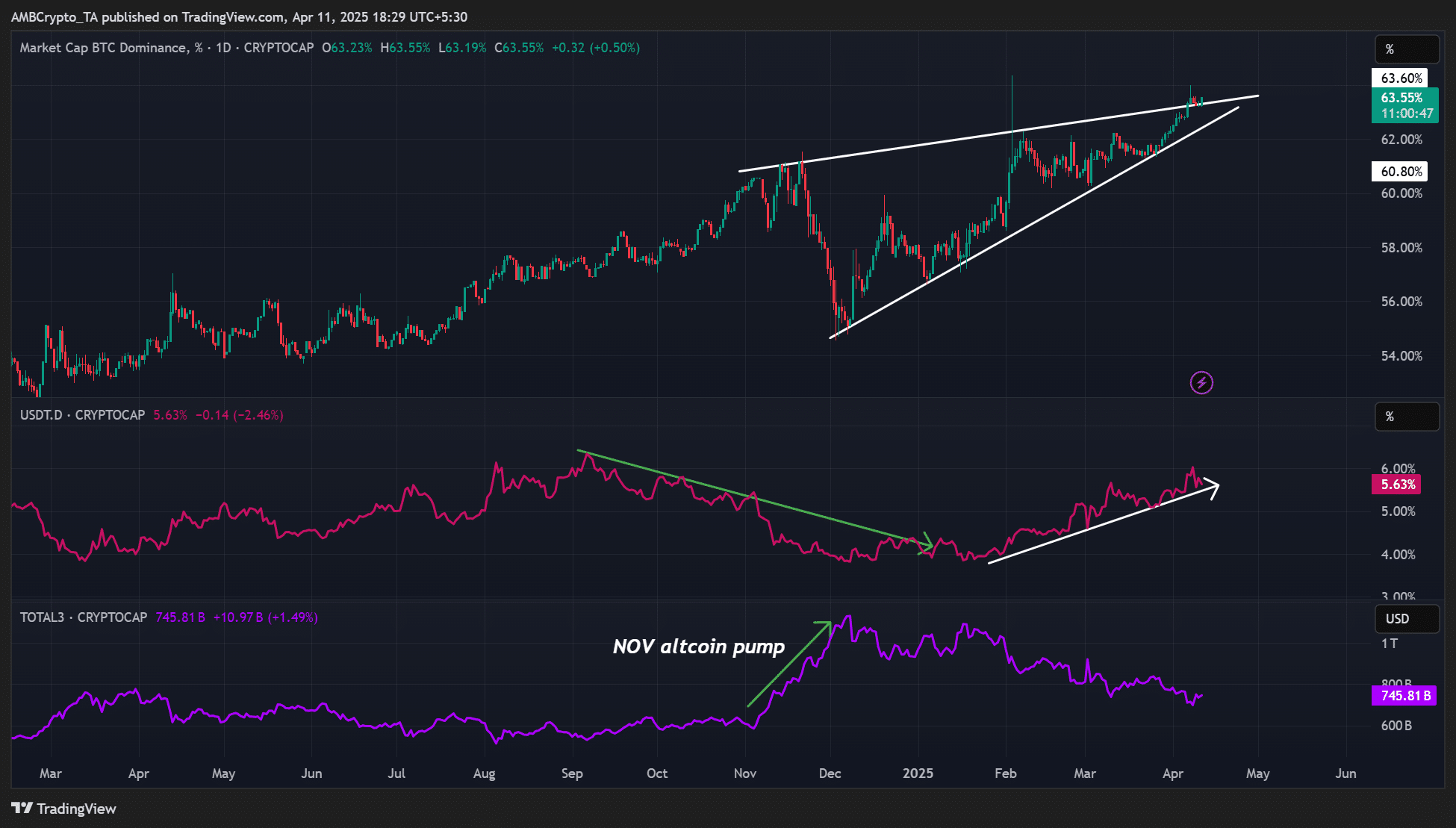

Some important indicators for Altcoin -Momentum are BTC (BTC.D) and Tether USDT Dominance (USDT.D).

In the Altcoin -Exexplosive run last November, USDT.D has fallen, which means that speculators exchanged Stablecoins for their favorite altcoin seal stones. At the same time, this led to capital rotation from BTC to Altcoins. That is why BTC.D.

Source: BTC Dominance versus Altcoin Sector Performance, TradingView

In 2025, however, BTC.D climbed higher to 63.5%, suggesting that capital was parked in BTC from Altcoins. In addition, USDT.D rose from 4% to 5.6%, for which cautious traders were underlined fleeing To Stablecoins to retain capital of Q1 drawings.

Based on the time lectures of the press, it seems that speculators do not like to jump into the Altcoin sector. However, this can turn into a favorable macroom environment.

That said, the RSI Heatmap and the financing percentages revealed that the Altcoin sector was undervalued and had less foam (less leverage). This seemed to be in line with the prospects of Darkfost.

Source: Coinglass

At the end of 2024, the financing percentages reached 50-80% (Orange), which indicates a strong bullish sentiment and over covering. This often leads to sharp pullbacks in case of liquidations. However, the time financing percentages were lower than 10% in different altcoins, so that it could indicate a stable market that could be higher among positive catalysts.

Worth to point out that some selected from bijters performed better than BTC and act for 30 days in the past week. Onyxcoin [XCN] And Fartcoin saw more than 100% profit in the past week. Others, such as curve dao [CRV]have risen by almost 50% in the past month.