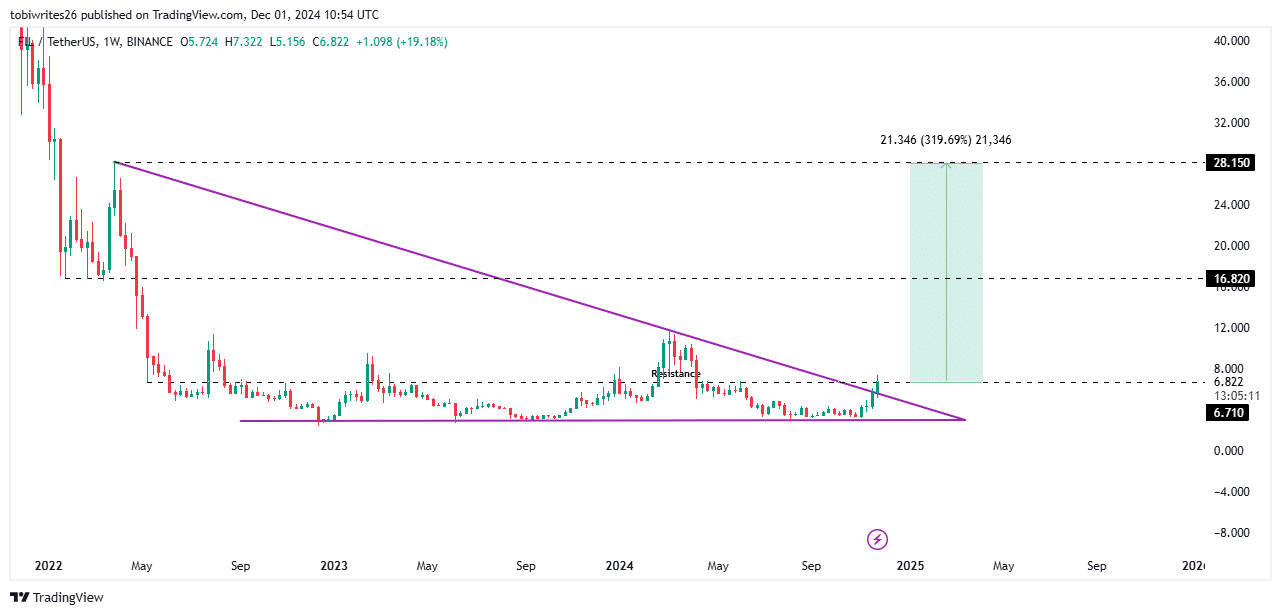

- The asset traded within a bullish triangle pattern, which could lead FIL to $28.

- Market sentiment is increasingly favoring bulls as participants anticipate a continued uptrend.

Over the past month, Filecoin [FIL] has delivered an impressive performance, up 94.18% and nearly doubling in price from recent lows. The bullish momentum continues, with a gain of 6.17% over the past 24 hours, contributing to a weekly gain of 24.04%.

AMBCrypto analysis revealed that market participants will play a major role in shaping FIL’s trajectory in the coming trading sessions.

Bullish participants maintain control of FIL

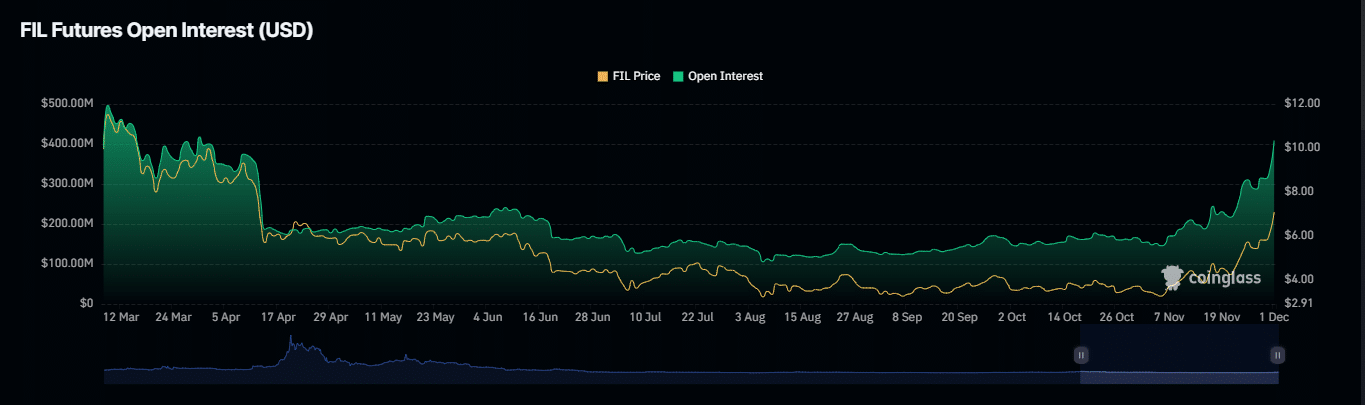

Data from Mint glass confirms that bullish sentiment remains strong for FIL, supported by rising open interest (OI) and positive funding rates.

Open interest, which tracks the total number of unsettled perpetual contracts on an asset, has risen significantly.

Over the past 24 hours, FIL’s OI has risen 19.13% to $396.72 million, indicating increased activity favoring long contracts over short ones. This trend is in line with the broader bullish momentum driving the market.

Source: Coinglass

The Funding Rate stood at 0.0296% at the time of writing, demonstrating that long traders are actively supporting the market by bridging the price gap between spot and futures markets. This dynamic reinforces the continued price increase as it reflects greater confidence among buyers.

Given the current bullish sentiment, AMBCrypto’s analysis suggests that FIL could continue its upward trajectory and possibly reach double-digit price levels.

Double-digit target for FIL: path to $28

The chart shows FIL trading within a bullish triangle pattern, a setup often associated with upward momentum. FIL has already broken out of this formation and paved the way for a major rally.

The first target in this move is $16.8, followed by a potential climb to $28. Reaching this milestone would mean a gain of 319% over a short period of time.

Source: trading view

For this rally to progress, FIL needs to break the resistance at $6.71, which is currently curbing the upward move. Lifting this level would pave the way for sustainable price growth.

Long liquidations are hampering FIL’s momentum

Recent liquidation data from the past twelve hours shows heavy losses for long traders.

Read Filecoin’s [FIL] Price forecast 2024–2025

During this period, $743.36 worth of long positions were liquidated, compounding the current difficulty in breaking the resistance line.

If this bearish pressure continues, FIL could face further challenges in continuing its bullish rally. A shift in market sentiment will be critical to overcome these setbacks and regain upside momentum.