- BONK’s price rose on the charts, fueled by a 34.44% increase in trading volume

- After listing on Gemini, BONK saw a strong increase in trading interest and adoption

Popular memecoin THUMP (BONK) is causing a stir among market participants. With a press time price of $0.00001812, the altcoin has risen 1.59% in the past 24 hours. However, BONK’s trading volume skyrocketed by 34.44% during the same period.

Thanks to strong investor interest and growing trading activity, BONK had a market capitalization of just over $1.35 billion.

BONK gains momentum after Gemini stock exchange listing?

Trading interest increased following BONK’s recent listing on the Gemini exchange. As a result, there has also been more adoption. The exchange now supports BONK deposits and withdrawals, including asset movements, and offers investors instant transfers.

However, BONK is just the latest in a line of popular memecoins that Gemini has embraced among its crypto offerings. In fact, Gemini already has DOGE, PEPE, SHIB and WIF offerings on the exchange.

However, it’s worth noting that this is an important entry to have. Especially since BONK can now reach a much broader user base, a user base that will allow the memecoin to quickly expand its market share.

Symmetrical triangle pattern indicates rally

According to crypto analyst @cryptojackthe BONK/USDT pair flashed a symmetrical triangle pattern on the charts. Such a pattern occurs when a trend continues in a new direction, which could mean a potential bullish breakout when trading volume arrives. However, this pattern has been forming for several months. As it approaches an obvious breakout point, higher volatility could emerge soon.

Source:

A breakout could push BONK to new all-time highs if volume increases alongside the breakout. Symmetrical triangles are typically seen as trend continuation indicators, meaning BONK can extend its upward momentum. This technical setup has attracted a lot of attention, with traders watching closely for signs of higher volume that could confirm the trend.

If BONK can break out, supported by high volumes, it could result in new highs if it inspires a lot of investor confidence.

However, this breakout could open the door for short-term traders and long-term investors to get in on the uptrend. BONK’s price action recently created room for new all-time highs. As a result, BONK will likely join the market optimism.

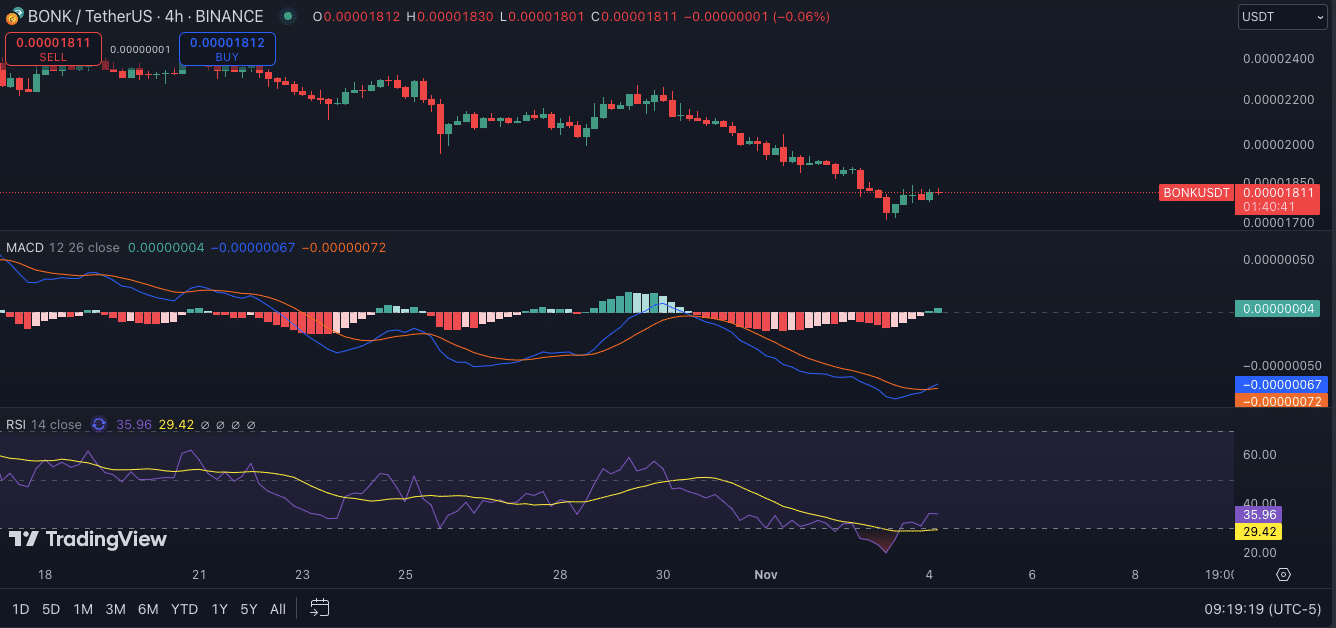

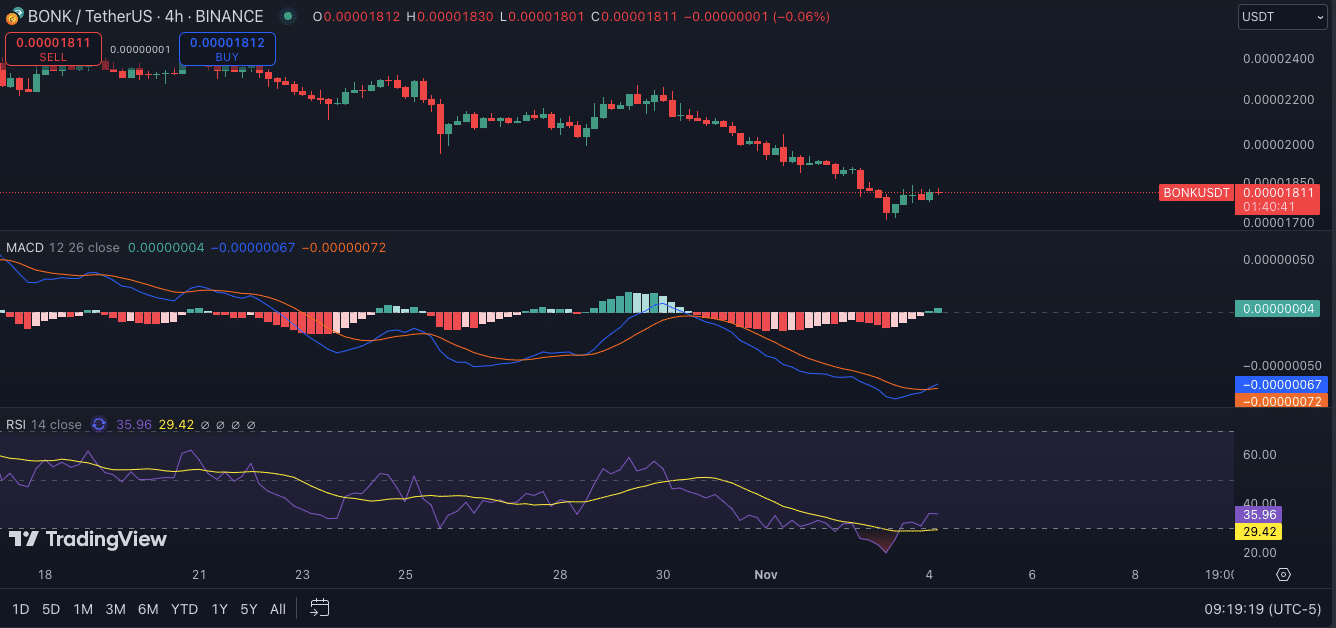

MACD and RSI favor BONK’s rebound

On the 4-hour chart, the Moving Average Convergence Divergence (MACD) indicator suggested a possible shift in momentum, with a potential bullish crossover. This pattern, combined with the histogram bars shifting from red to light red, indicated a decline in bearish momentum.

If this trend continues, the movement of this MACD could signal an early-stage reversal, attracting traders interested in a possible upside move.

Meanwhile, the Relative Strength Index (RSI) for BONK appeared to be approaching the oversold level at 38.51 – a sign of easing selling pressure. As the RSI moves higher, traders can expect a rebound if it breaks above 50, further supporting bullish sentiment if accompanied by volume.

Source: TradingView

A potential RSI rebound, alongside a bullish MACD, would add to the technical indicators supporting a price recovery. Higher volumes and continued buying pressure are likely to confirm this shift, increasing confidence among buyers and traders alike. This combination of indicators could lead to increased interest as BONK approaches critical technical levels.

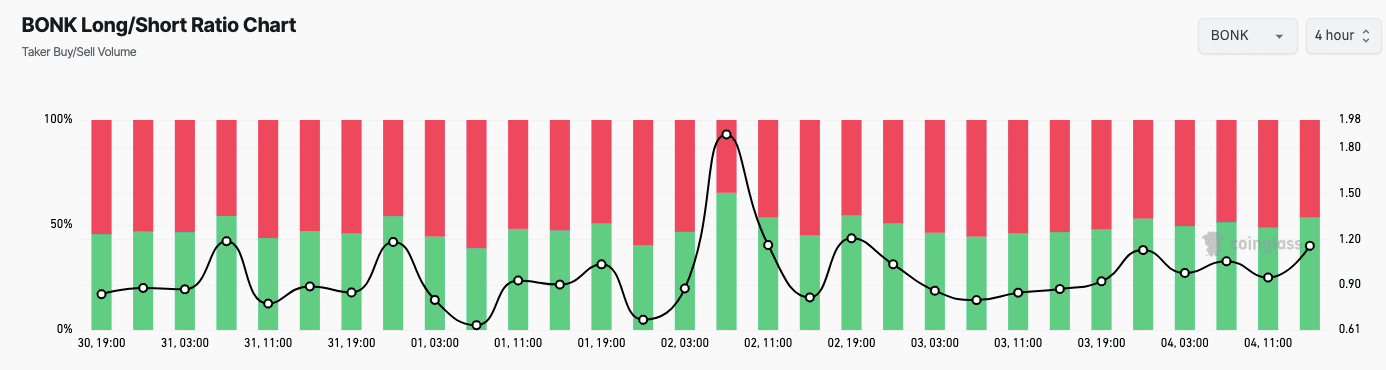

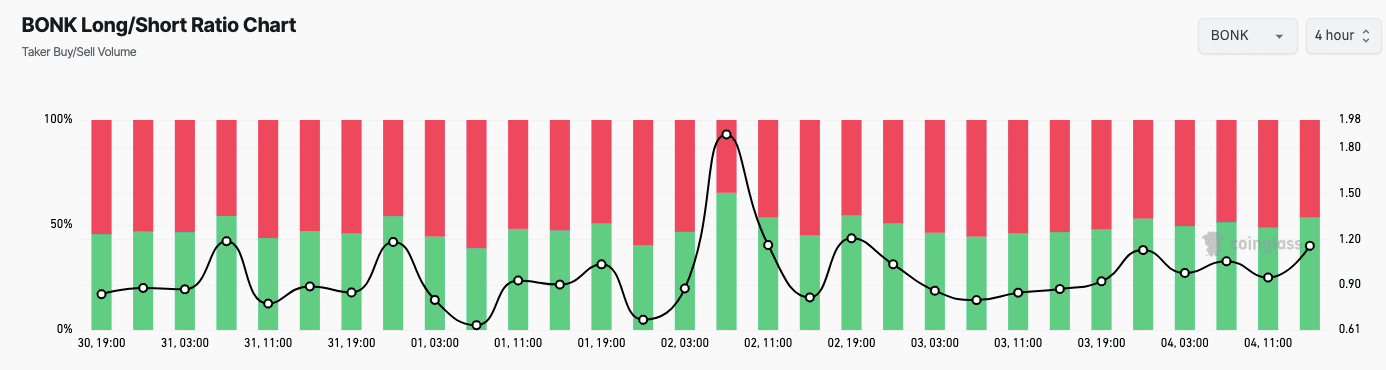

BONK’s Long/Short ratio

According to Coinglass, a look at BONK’s Long/Short Ratio revealed a balance between bullish and bearish sentiment among traders. The chart, which uses green bars to represent buying volume and red bars for selling volume, predicted recent increases in buying volume.

At the time of writing, the Long/Short ratio was hovering above 1.0, indicating growing optimism about a possible near-term price increase.

Source: Coinglass

Fluctuations in the ratio indicate that traders remain divided, but recent spikes in buying volume are a sign of higher bullish sentiment. This pattern is consistent with the broader market’s bullish outlook for BONK, with the Long/Short ratio indicating a possible shift toward buying pressure. Because the ratio favors buying volume, some analysts predict that BONK’s price could see greater volatility soon.

If buying volume remains strong, this trend could consolidate BONK’s upward trajectory, potentially encouraging more traders to take long positions. This boom in trading interest could push BONK’s price higher in the coming days, further cementing its position in the memecoin market.