- The price of Bitcoin corrected under $ 100k, and fell almost 8% compared to the recent of all time.

- Analysts noted that holders did not show any signs of sale in the long term, which had new market cycles on the bow.

Bitcoin [BTC] is currently confronted with a remarkable correction, after the price has fallen as high as more than $ 109,000 last week to now to now is again under the $ 100,000 price marking from today.

In particular at the time of writing, BTC has fallen by almost 5% in the past week to the time trade price of the press of $ 99,986 – which reduces the price to 7.9% of his all – time reached high last week.

Large market players show reluctance

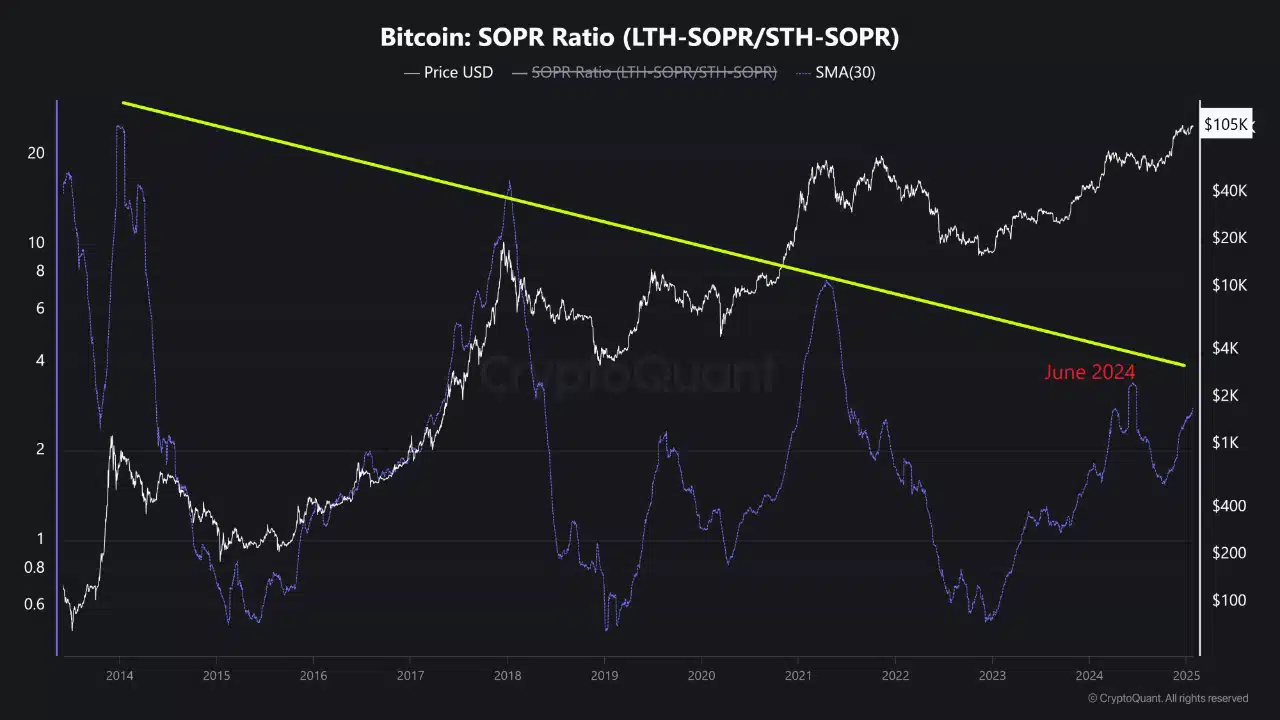

In the midst of the continuous correction, a cryptoquant analyst has marked An intriguing trend in the behavior of the long term (LTH).

In a message on the cryptoquant Quicktake platform entitled ‘Major Market Players are reluctant to sell’, the analyst noted that the sopratio (LTH Sopr/StH Sopr) showed lower growth in the current Bullrun compared to earlier cycles.

Source: Cryptuquant

This ratio, which measures the realized profit of the long -term holders compared to holders in the short term, remains lower than levels that are seen during the price of Bitcoin in mid -2024.

The analyst also suggested that as Bitcoin, ripe, long -term holders have increasingly followed a more measured approach, so that she renounces speculative activities.

Institutional participation also seems to have reformed market dynamics.

With more investors who regard Bitcoin as a long -term storage of value instead of a commercial instrument, the capital that flows in trade shows has decreased.

As a result, many long -term holders choose to keep their bitcoin in portfolios instead of cashing.

The implication is that although the market can experience corrections, there will probably be new cycles in which Bitcoin is held for longer periods, which reduces speculative sales and the market may stabilize.

Data on chains offers extra insights

In addition to investigating the behavior of the long term, it is important to consider other important statistics to get the full picture of what is going on behind the scenes of BTC and where it will probably probably go in the short term.

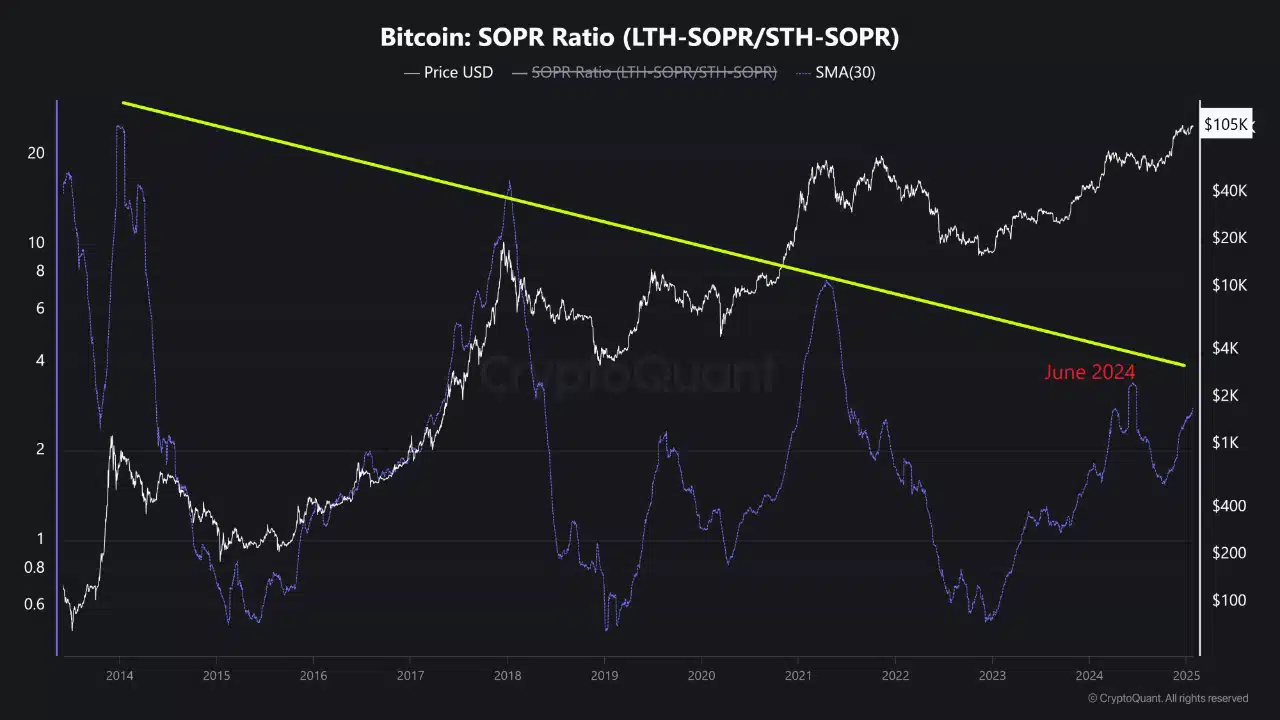

Remarkable, facts Cryptoquant on the MVRV ratio of BTC showed that this metric has had an increase so far, together with the recent BTC price action.

This increase brought the MVRV ratio of BTC from 2.2 on January 9 to 2.52 on January 21.

Although there has been a slight decrease to 2.4 from January 26, the overall trend of this metric is still free in an upward trend.

Source: Cryptuquant

It is worth noting that the constant increase in the MVRV ratio indicates a positive sentiment among holders and investors.

Read Bitcoin’s [BTC] Price forecast 2025–2026

A higher ratio usually indicates that the market is still willing to appreciate Bitcoin at levels above the price realized, which may indicate resilience and potential for recovery.

However, the slight withdrawal in MVRV can also be a warning sign, which suggests that the market can approach a period of consolidation.