- Long -term holders added 297k BTC in nine days, which showed more confidence.

- Continuous Bitcoin accumulation can push BTC past $ 88k, which means that $ 90k will soon test.

Since recovering the recent market crash, Bitcoin [BTC] has witnessed a significant increase in demand, in which investors return to the market. Of course, this revival has fueled the increased accumulation activity across the board.

According to Glass nodeBitcoin’s accumulation trend score has risen to a year to date. At the time of the press, the score was 0.43, which indicates the growing demand for the crypto.

Source: Glassnode

A rising accumulation score suggests that portfolios re -introduce on a wider scale.

Despite the recent hesitation price, large investor groups carefully resumed the pile, with long -term holders (LTHS) who are in charge. In the past nine days, LTH Supply has increased by 297,000 BTC, indicating growing confidence among experienced investors.

Further reinforcement of this trend, the binary spent in the past week has fallen to 0.3, indicating that fewer holders in the long term Bitcoin sales-a strong bullish signal.

Source: Checkonchain

By reducing sales activities, other market participants have followed the example. To the extent that non -published outputs have grown sustainably until 2025 and 3.03 million have been hit.

Although it is a decrease of 5.2 million in 2024, the current levels remain relatively high, which implies that BTC holders remain bullish and anticipate a better return and market conditions in the short term.

Source: Bitbo

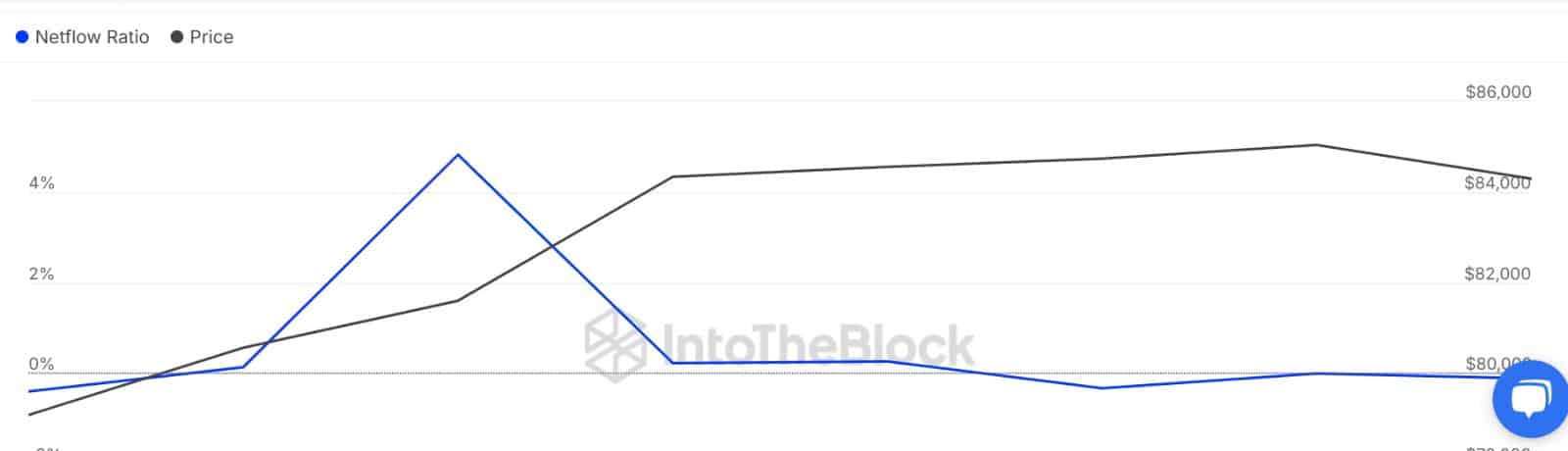

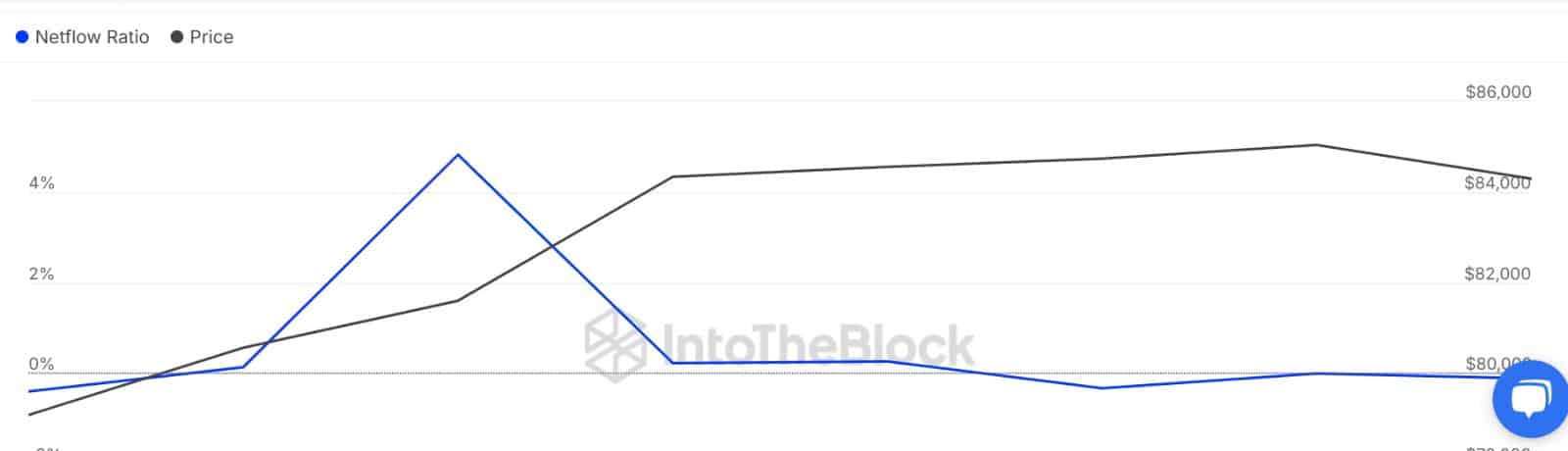

Moreover, whale activity has further strengthened the continuous accumulation story.

In the past three consecutive days, the exchange flow of large holders has remained negative, indicating that more BTC was withdrawn than deposited.

Simply put, whales are in stock – a classic signal from a potential bullish shift.

Source: Intotheblock

What does it mean for BTC?

With long -term holders (LTHS) and large investors who accumulate, Bitcoin’s market stability seems strong because large players bet on improved performance.

This optimistic sentiment among market participants often stimulates higher prices.

If the current accumulation trend continues, Bitcoin could see a reversal in fortunes, mainly fed by organic demand.

An upward movement from here can lead to an outbreak of consolidation, with BTC surpassing $ 86,700. If the momentum applies, Bitcoin can win back $ 88k and push to the psychological level of $ 90k.

Conversely, if short -term holders (STHs) take a profit of recent profits, Bitcoin can correct down, possibly falls to $ 82,696.

Monitoring of accumulation trends and investor activity will be crucial in determining the next direction of BTC.