- Bitcoin’s “Cup & Handle” pattern indicated a bullish run, closely following the S&P500 and Gold.

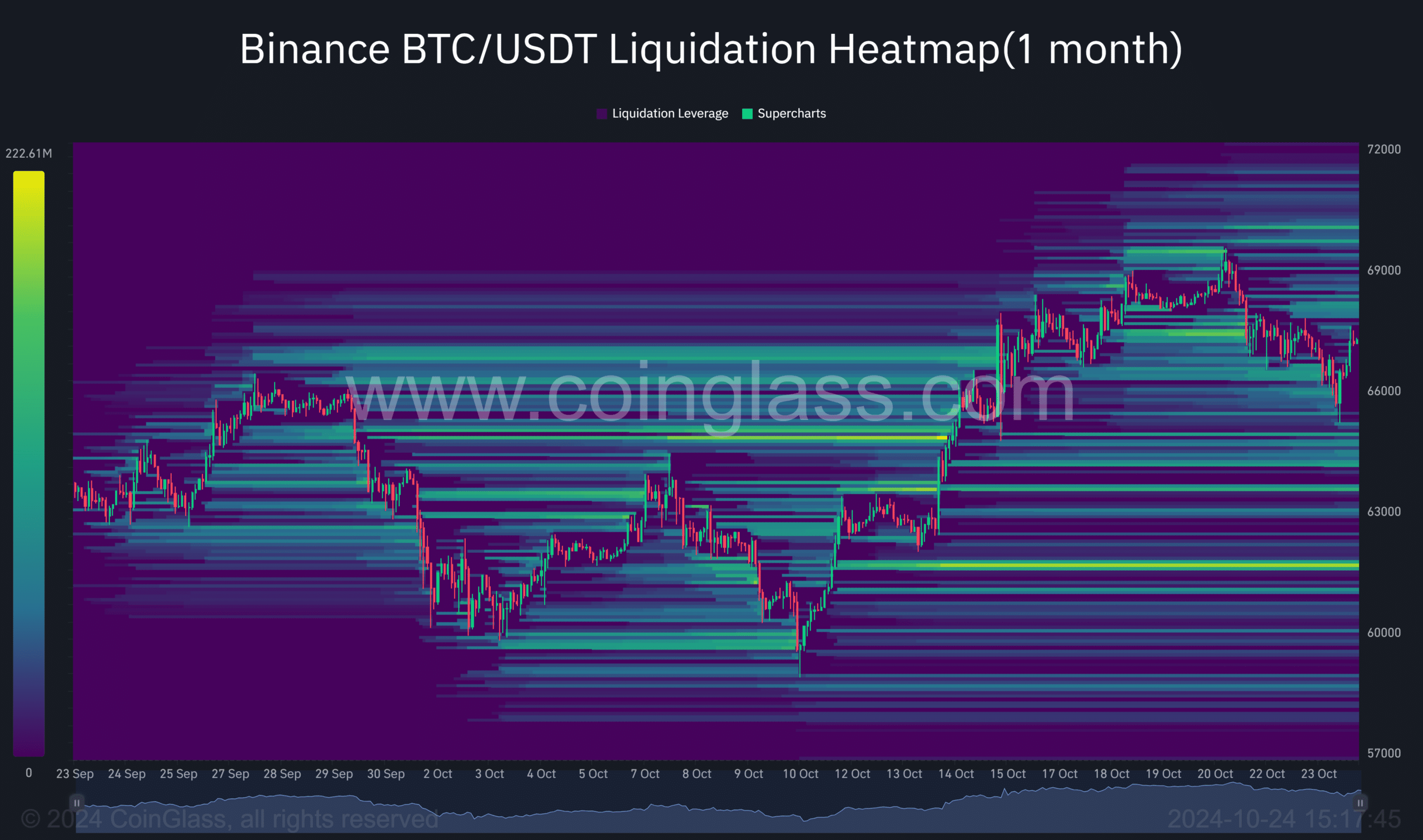

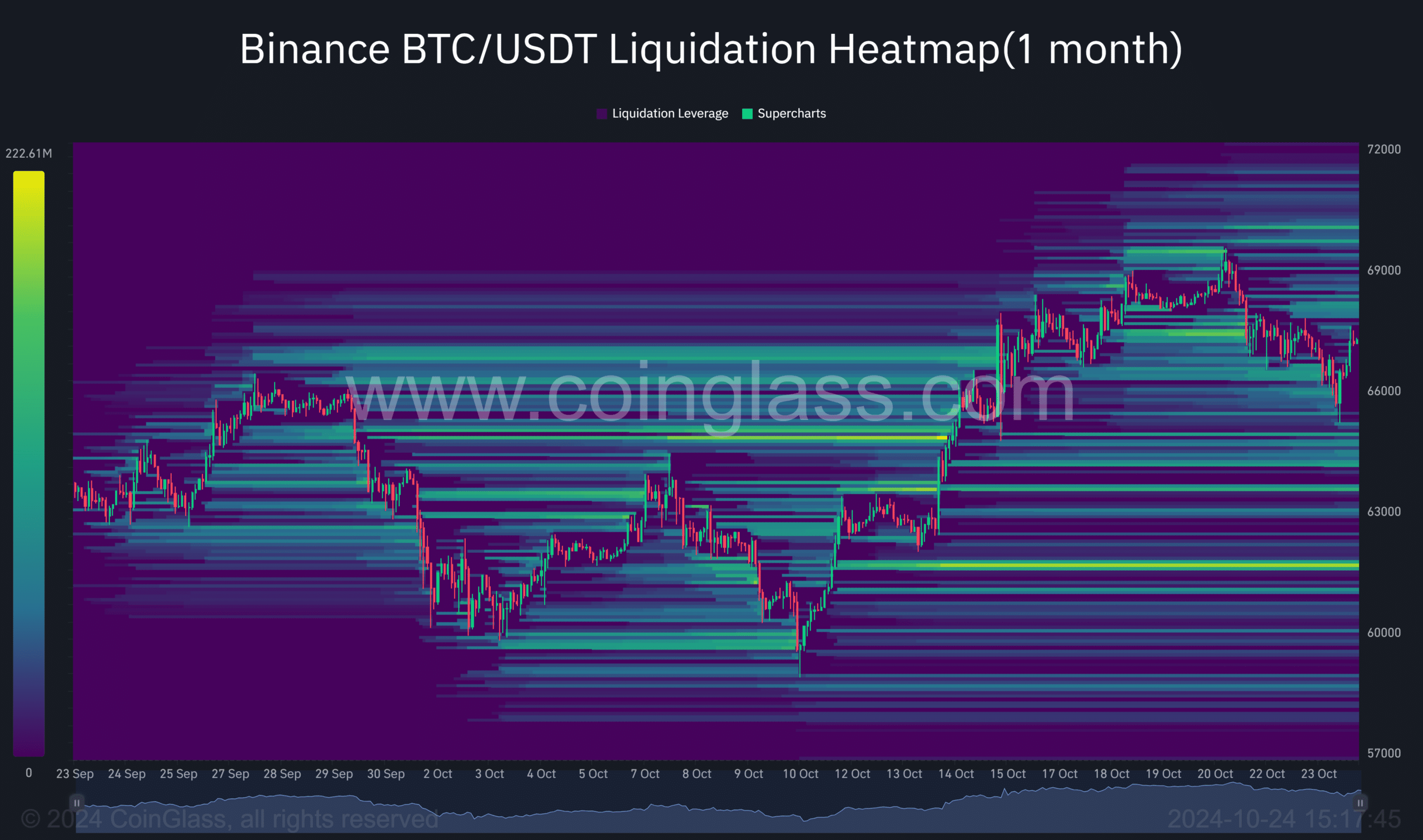

- A Potential BTC Rebound to $69,785 Could Liquidate $91.32 Million in Shorts

Bitcoin (BTC) at the time of writing appeared to be charting a “Cup and Handle” pattern, a pattern quite familiar to both the S&P500 and Gold, according to a recent analyst report. tweet. Based on the setup, a bullish breakout could send Bitcoin’s price up as high as $230,000 in the coming months.

The million-dollar question that investors are eager to see answered, then, is whether this cryptocurrency market will follow other traditional assets in its march toward this goal.

Shorts can fall…

Bitcoin’s potential recovery could trigger an extremely intense liquidation event if the price returns to $69,785.

Currently, there are $91.32 million worth of short positions at risk if the crypto heads north. As the momentum builds the market, significant volatility should be expected.

Source: Coinglass

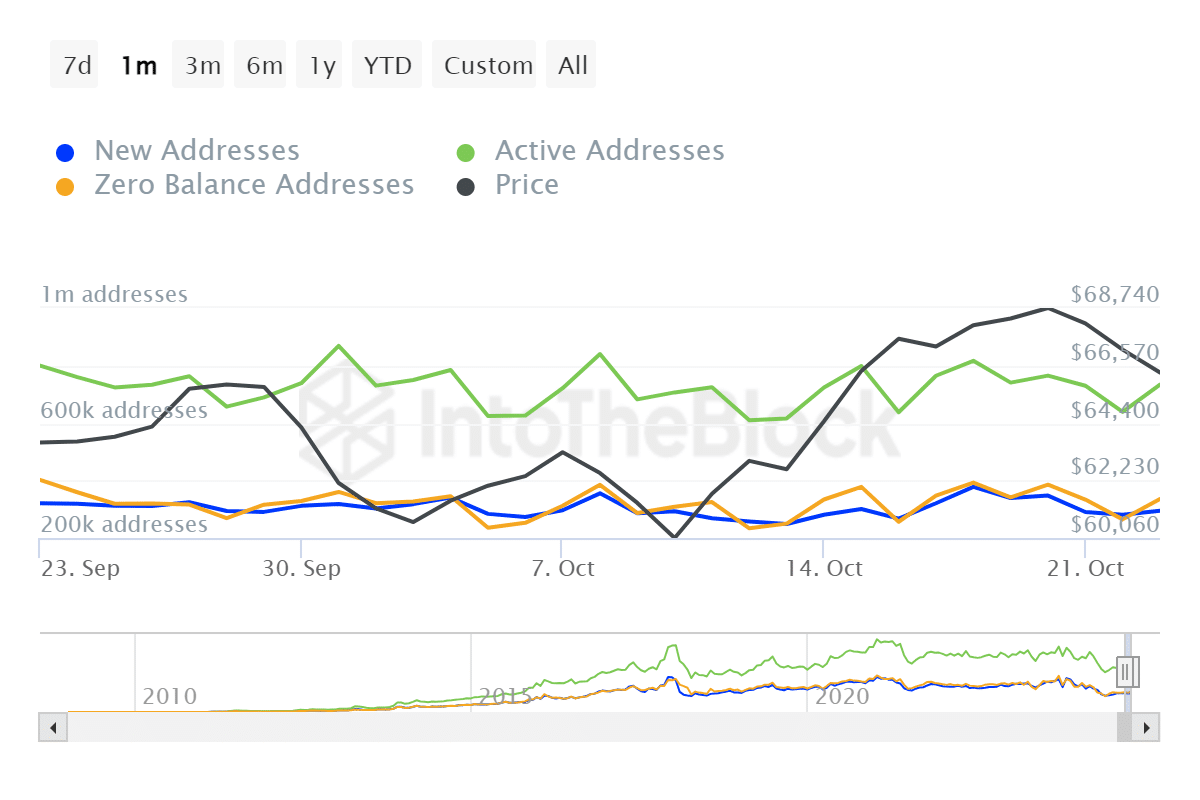

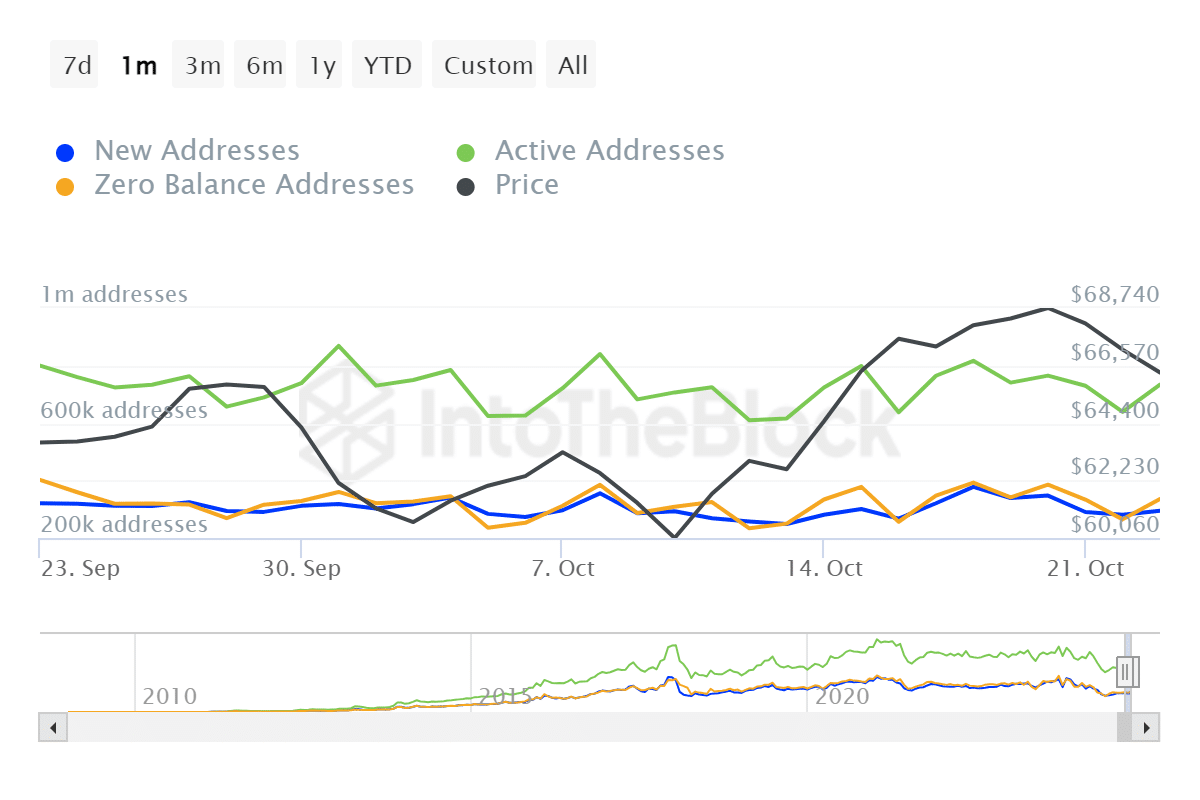

Bitcoin addresses rise on the edge

AMBCrypto further analyzed IntoTheBlock’s data, with the same data indicating an increase in the number of active addresses over the past 24 hours.

Bitcoin’s network has become significantly more active lately. In fact, the number of active addresses increased by 14% to 733,000 addresses. This increase in participation is a sign of greater interest and engagement, adding fuel to the royal coin’s price momentum.

Source: IntoTheBlock

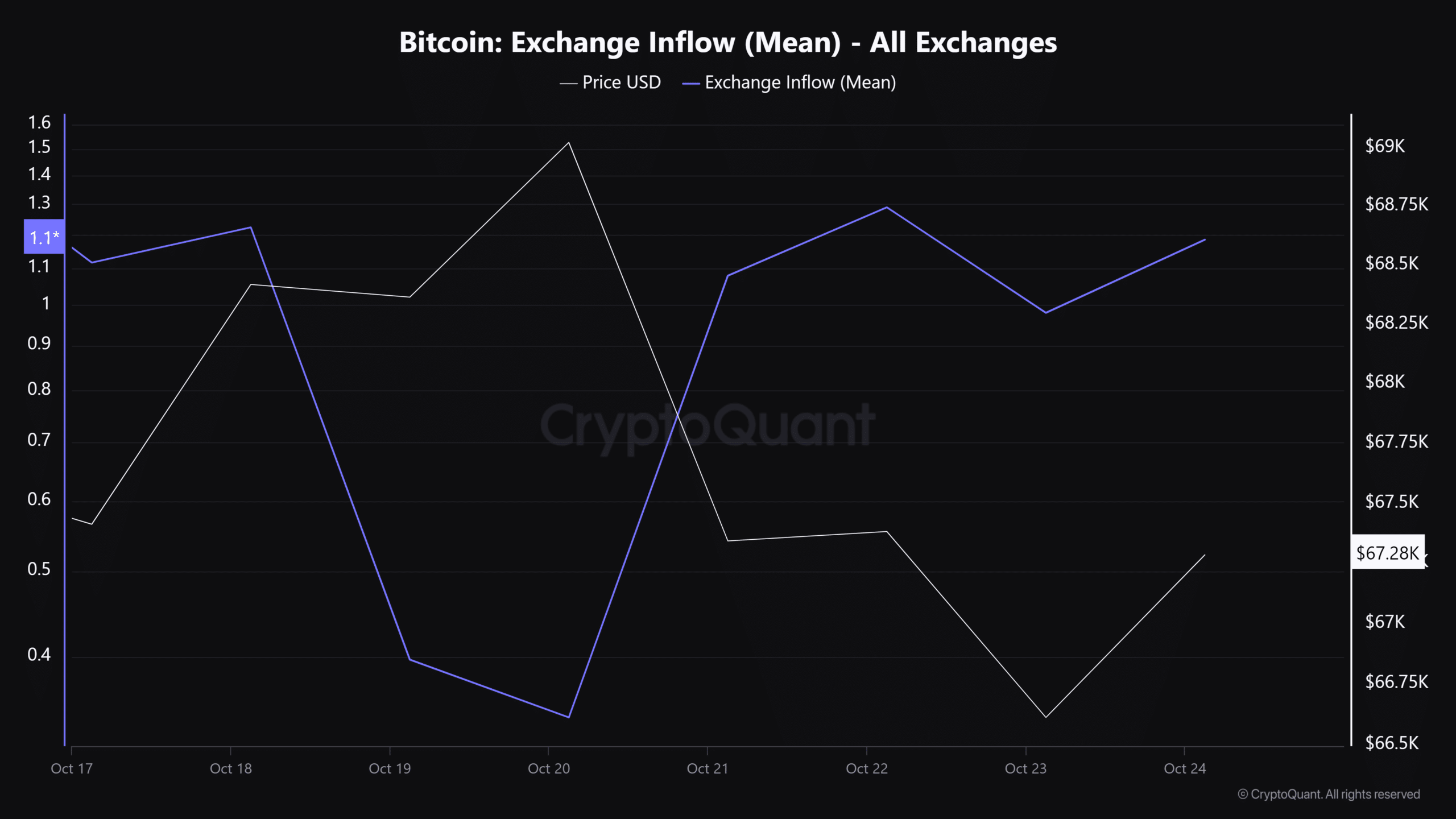

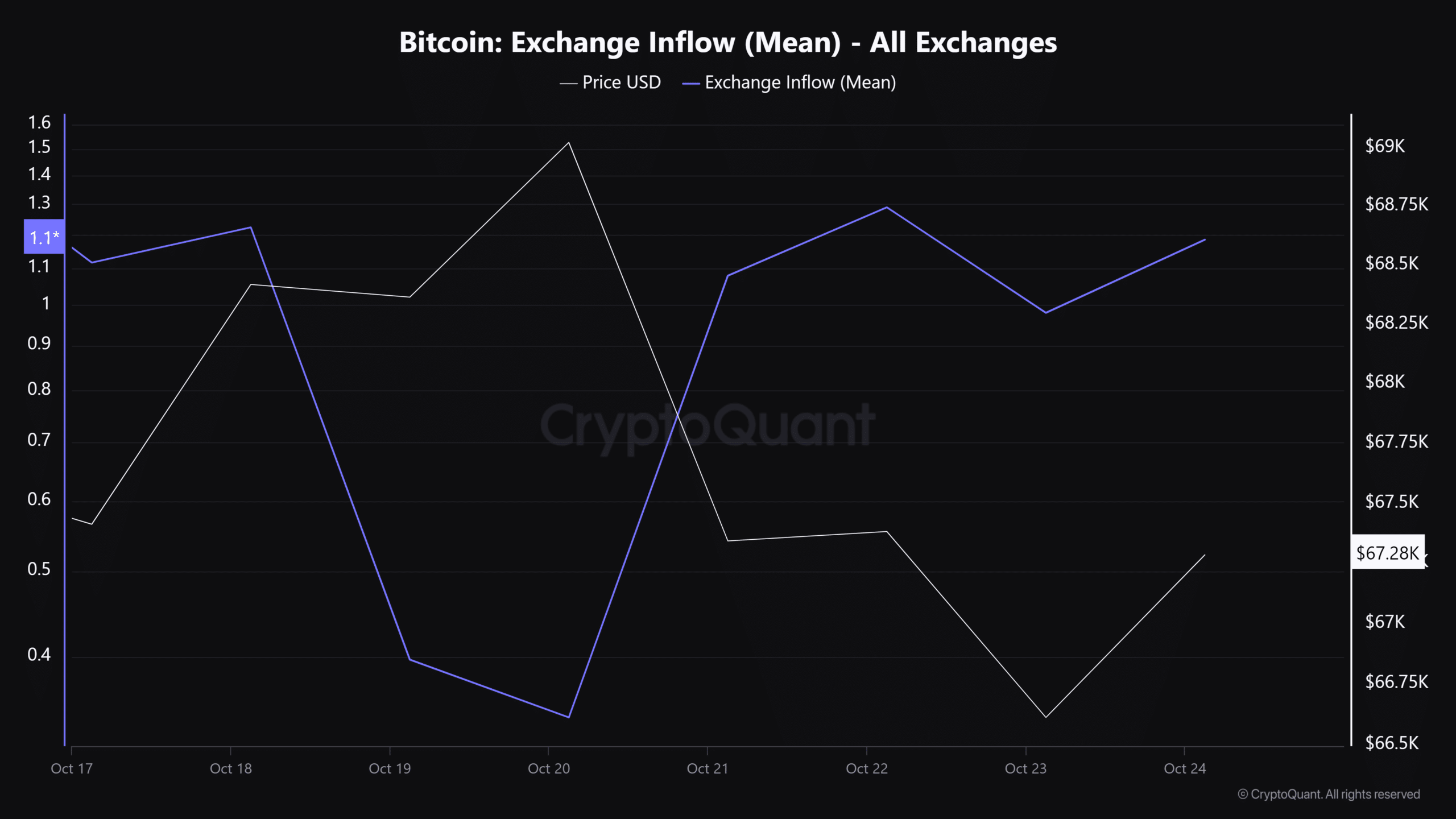

The inflows into the currency markets are adding to a potential bullish rally

With most analysts now expecting BTC to rise bullishly, it is worth noting that this asset has been seeing significant inflows lately. The same was evident from the latest findings about CryptoQuant.

This can be interpreted as a sign of high Open Interest and demand for Bitcoin, with all statistics pointing to the crypto possibly going to the moon as well.

Source: CryptoQuant

With Bitcoin following in the footsteps of major assets like Gold and the S&P500, the coming months could be crucial for its future.

If the assets manage to reach the expected heights, there could be many potential ripple effects on the larger economy.