Bitcoin, the world’s largest cryptocurrency by market capitalization, has been in a consolidation phase for the past few weeks. While this appears to be a period of relative stability, co-founder of the on-chain intelligence platform Glassnode, Yann Allemann, suggests that this could indicate impending price movement.

In the past, similar periods of consolidation have often been followed by price swings, and investors keep a close eye out for signs of where the market could head next.

While some investors may be nervous about the recent consolidation, others see it as an opportunity to buy in for the next big move. As the market awaits Bitcoin’s next price action, analysts and enthusiasts alike are speculating about what might come next for the leading cryptocurrency.

Factors pointing to a positive outlook for Bitcoin price

Amid the current state of the Bitcoin market, several factors have been identified by Everyone on Twitter, contributing to the prediction of a positive future for the cryptocurrency. These factors include the depletion of short seller resources, the strengthening of support levels, and the expectation of an overall bullish trend.

Shorts get worn out the longer #BTC has $26.8k… big move coming up

The price explodes anytime #Bitcoin consolidates under the MA. Tires are already tight. The clock is ticking.https://t.co/t20rwaMxPB pic.twitter.com/5UG6UB9KQn

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) May 17, 2023

Bitcoin price fluctuated within the $26,500 and $27,100 range, a period marked by the predominance of “extreme fear” sentiment among market participants.

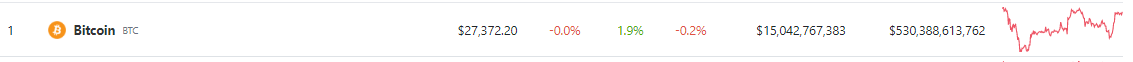

At the moment of writing CoinGecko shows that the price of Bitcoin is at $27,372, reflecting a modest 1.9% increase in the past 24 hours. However, it is worth noting that the cryptocurrency has also experienced a slight 0.2% decline in the past seven days.

Source: Coingecko

Nevertheless, Allemann emphasizes that this pattern often serves as a precursor to upward movements in the market. A compelling observation is the resilience of Bitcoin’s price in maintaining levels above the 50 and 200 Simple Moving Averages (SMAs), which now serve as robust support levels that have proven their strength through five separate tests.

These technical indicators that do not fall further apart signal a positive trend in the market and add to the overall optimism about Bitcoin’s future performance.

Uncertainty about the debt ceiling could affect the price of Bitcoin

Another factor that could potentially affect Bitcoin’s price in the coming days is the ongoing debate over the debt ceiling in the United States.

The debt ceiling is a limit on the amount of money the U.S. government can borrow to fund its operations. If the government fails to raise the debt ceiling, it could lead to default on its debt obligations, which could have serious consequences for the global financial system.

Crypto total market cap barely unchanged at $1.10 trillion. Chart: TradingView.com

The uncertainty surrounding the debt ceiling debate could lead to more volatility in financial markets, including the cryptocurrency market. Historically, Bitcoin has shown a positive correlation with the stock market, especially during times of economic uncertainty.

Therefore, potential negative effects on the stock market from the debt ceiling debate may be possible overflow to the cryptocurrency market and cause significant price fluctuations.

-Featured image of Bitcoinik