- Bitcoin has dragged itself back to the $98,000 price range.

- The financing rate has been positive for weeks.

Like Bitcoin [BTC] flirts with the $100,000 mark, questions arise about the sustainability of the current rally.

Although investor enthusiasm is high, several market indicators suggest that caution may be warranted.

Therefore, AMBCrypto analyzed three critical areas to understand whether Bitcoin is entering an overheated phase.

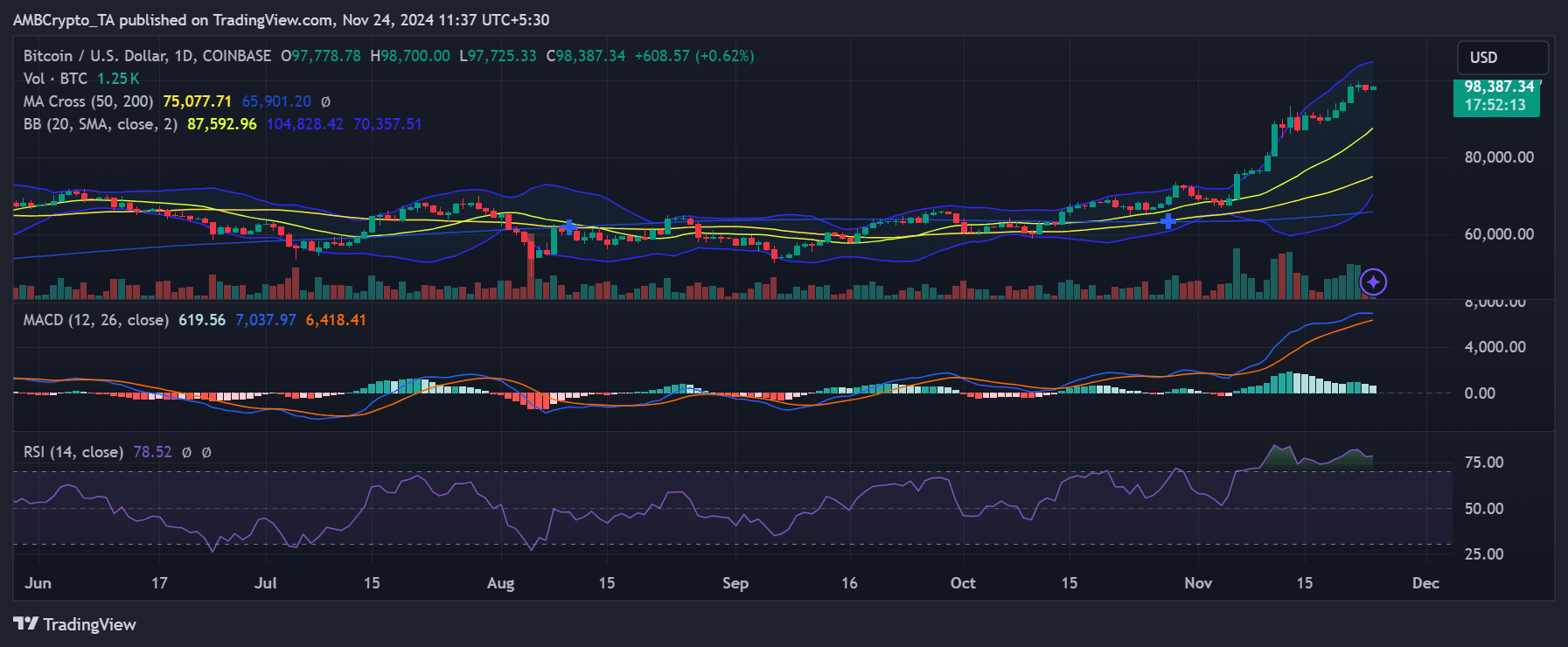

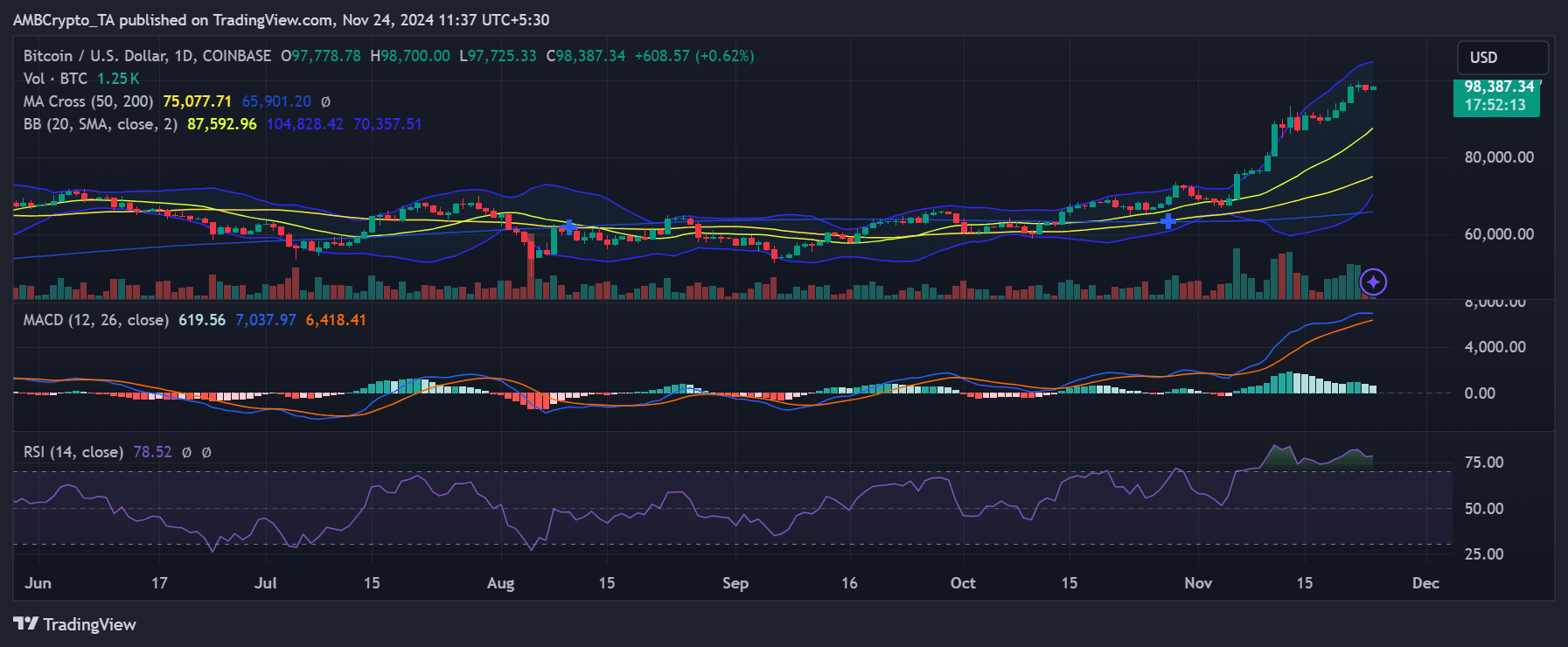

Bitcoin’s price momentum and overbought conditions

The daily BTC/USD chart revealed Bitcoin’s sharp upward trajectory as the king coin broke out of consolidation around $65,000 a few weeks ago.

The Relative Strength Index (RSI) stood at 78.6, indicating that Bitcoin was in overbought territory. Historically, RSI levels above 70 often precede short-term corrections as traders lock in their gains.

Source: TradingView

Additionally, Bollinger Bands showed price trading close to the upper limit, indicating greater volatility.

With the 20-day moving average significantly lagging the spot price, a mean reversal could be in store, especially if profit-taking accelerates.

At the time of writing, BTC was trading around $98,200, up slightly from the 97,000 price zone it fell to during the last trading session.

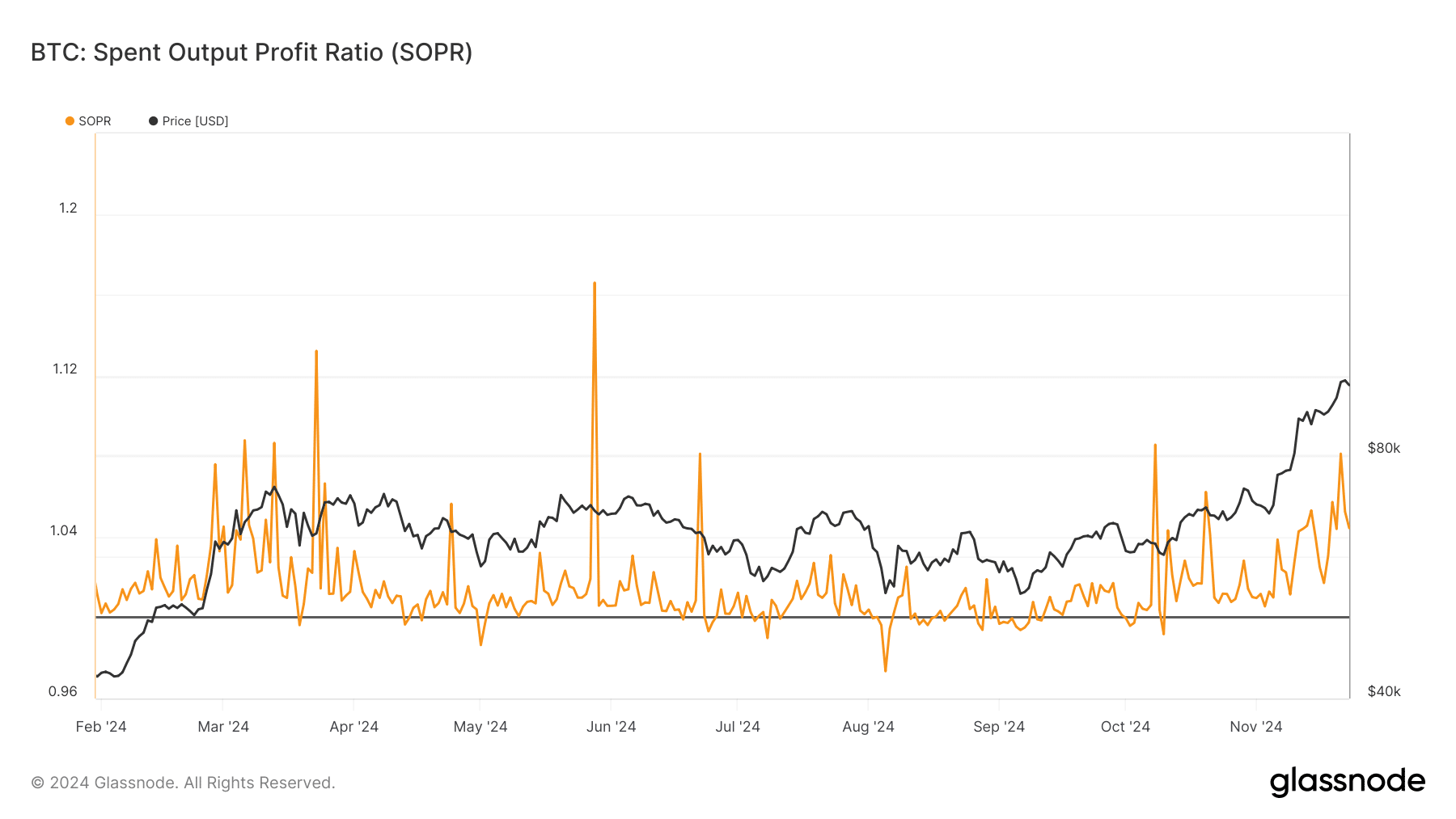

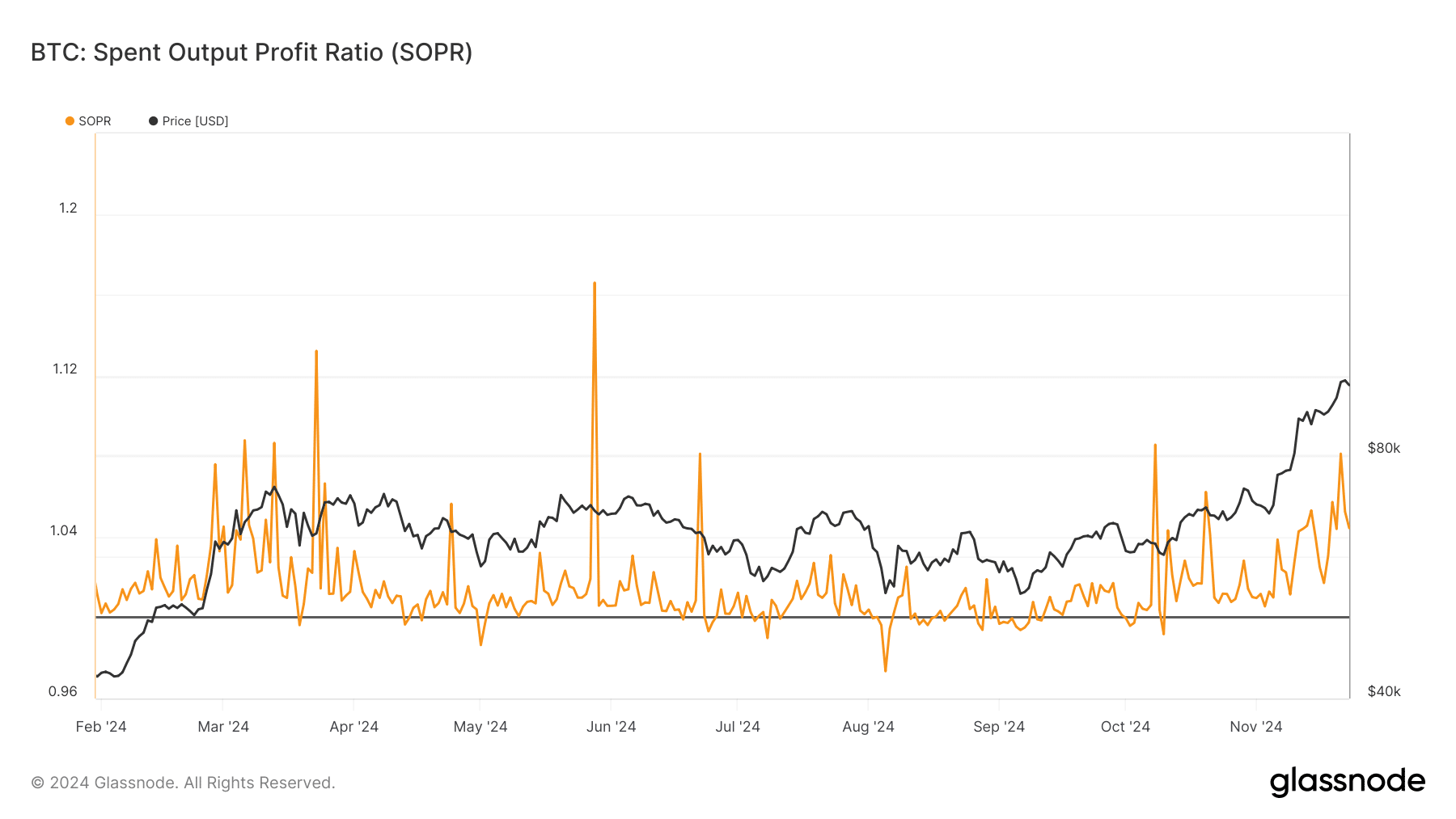

Bitcoin SOPR shows profit taking

The Spent Output Profit Ratio (SOPR) graph painted a clearer picture of market behavior. SOPR, which measures whether coins moved on-chain generate a profit, has risen steadily alongside Bitcoin’s price.

AMBCrypto’s analysis found that SOPR values have risen to around 1.08 over the past week, indicating higher levels of realized profits.

Source: Glassnode

Historically, such high SOPR levels often coincide with local tops, as investors increasingly cash out during bullish euphoria.

A sudden drop in the SOPR would indicate increased selling pressure, potentially triggering a broader correction. At the time of writing, the peak has dropped slightly and the BTC SOPR was around 1.04.

A market with overleverage

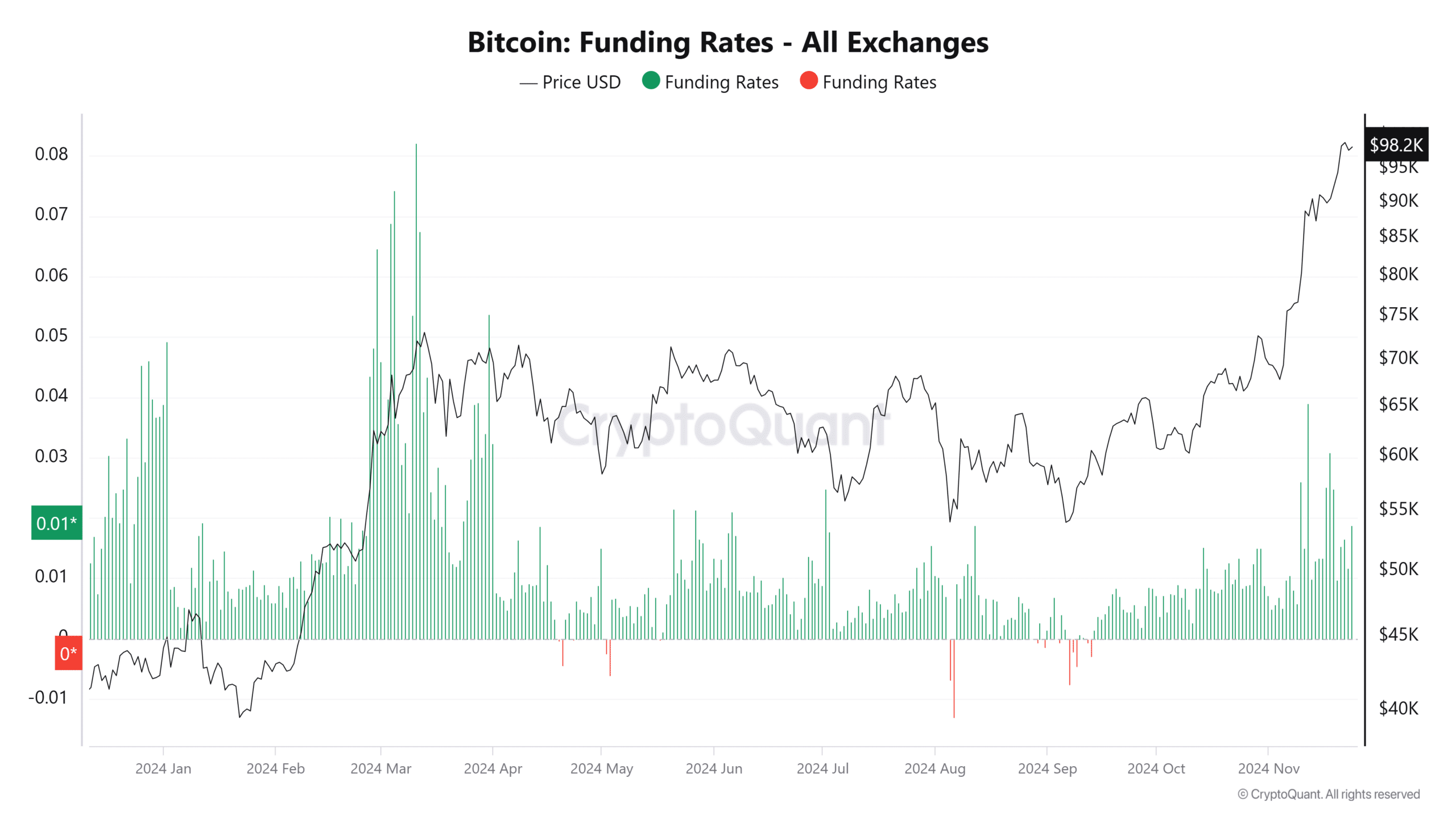

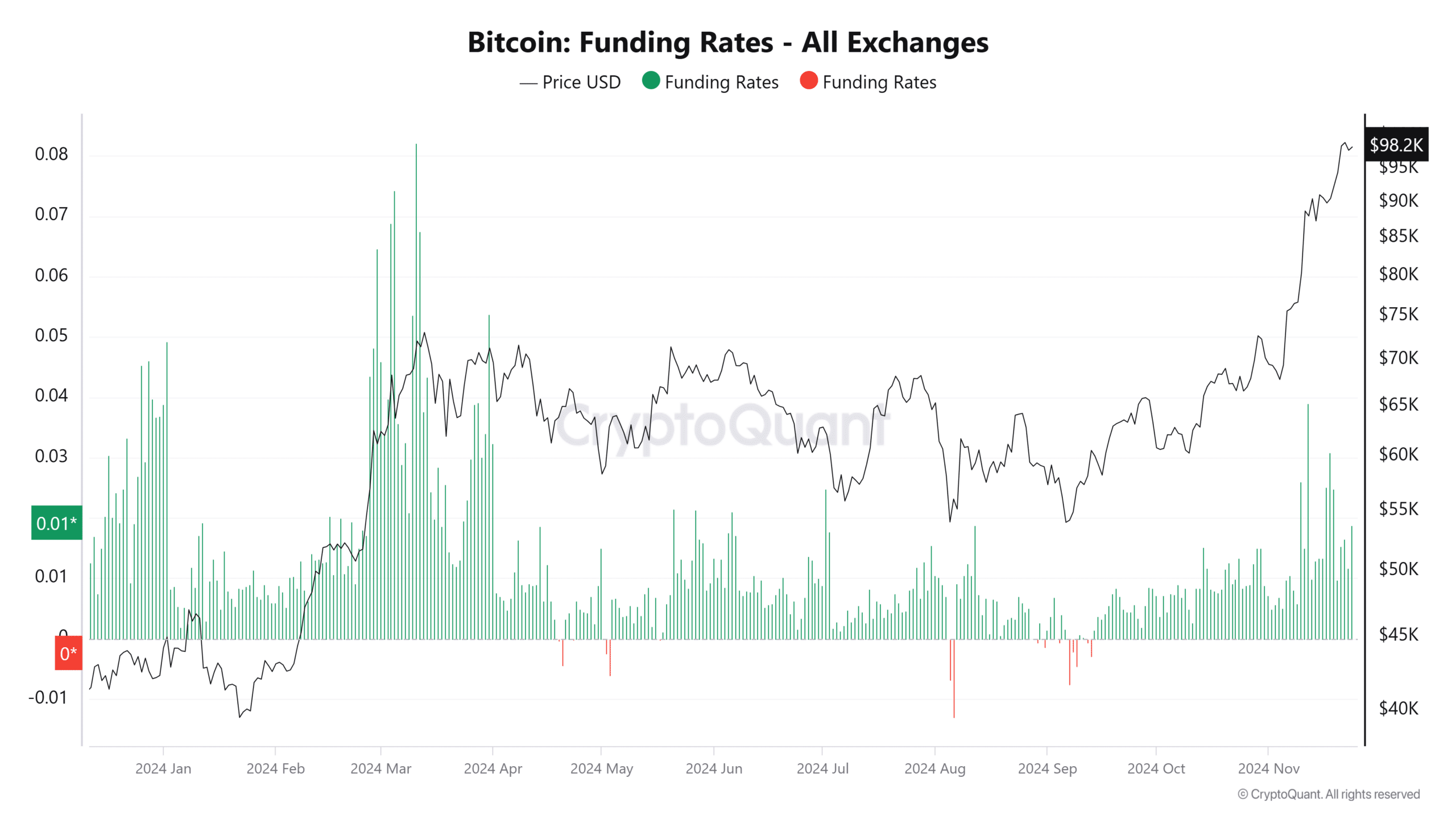

Another red flag came from the Bitcoin Funding Rates chart, which showed a sharp increase on the major exchanges.

Financing rates are positive when long positions dominate the market, and excessively high interest rates indicate over-indebtedness.

Source: CryptoQuant

At the time of writing, funding rates were approaching levels last seen at the peak of the 2021 bull market, implying that speculative enthusiasm could be overheating.

Should a correction occur, overextended positions would likely exacerbate the sell-off through liquidations, adding to downward pressure.

Market reset before stable trends?

While Bitcoin’s rally is undoubtedly historic, the convergence of overbought RSI levels, high SOPR values, and spiking funding rates indicated potential overheating.

Read Bitcoin’s [BTC] Price forecast 2024-25

A healthy correction could reset the market and pave the way for sustainable growth rather than speculative mania.

While Bitcoin could continue its upward trajectory, the risks associated with its rapid rise cannot be ignored.