- Arbitrum’s weekly report revealed another major transaction milestone.

- ARB sees a large outflow of whales, potentially limiting the potential benefit.

Ethereum’s layer 2 network Arbitrum just released its latest weekly report. One of the highlights was a major network milestone that underscores the rapid pace at which the network is growing.

Read Arbitrums [ARB] price forecast 2023-24

According to the weekly Arbitrum report, the network recently passed the 300 million transaction mark. This performance confirms that the network has experienced robust utility and growth. Not bad for a network that started operating during a bear market.

3/6 Arbitrum Milestones:

Arbitrum recently reached 300 million transactions.

https://t.co/kv5djqOTp7

— Arbitrum (

,

) (@arbitrum) July 14, 2023

In addition to the milestone, Arbitrum also confirmed that it will hold Security Council elections on September 15. According to the official announcement, the election will feature multiple sensitive topics, including critical risks to which Arbitrum is exposed.

Some interesting on-chain observations

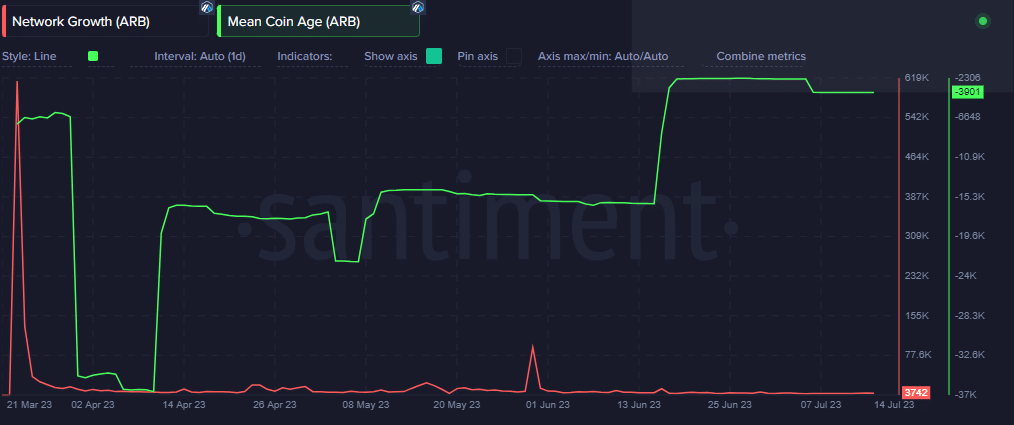

While the transaction milestone was a step in the right direction, some growth metrics did not perform well. For example, Arbitrum’s network growth metric has fluctuated near its lower range for the past six months.

Source: Sentiment

On the other hand, Arbitrum’s native token ARB witnessed an increase in the average coin age. This suggested that most token holders were hodling rather than selling. This despite ARB’s bearish price action.

ARB hit a new all-time low of $4.20 in June this year. The same historic low represented a 70% dip from the token’s highest price point in the past six months. It changed hands at $5.80 at the time of writing after recovering slightly from its all-time lows.

Source: TradingView

Are whales losing interest?

ARB has seen significant outflows according to the Money Flow Index (MFI) despite the slight price increase. Further investigation into the outflow revealed that whales have recently sold a significant portion of their holdings.

This reflected a sharp dip in the supply distribution between 5 and 6 July. The same inventory distribution statistic showed no signs of re-accumulation.

Source: Sentiment

This selling pressure from whales may have held back ARB’s potential this week. Although it is worth noting that the cryptocurrency experienced some bullish momentum, especially on Wednesday (July 12). Nevertheless, at the time of writing, it had already given up most if not all of Wednesday’s gains.

How much are 1,10,100 ARBs worth today

Will we see a resurgence in demand for whales? Well, that remains to be seen, but it’s not entirely impossible. The recent transaction milestone confirmed the state of network demand and this could potentially bolster ARB’s market sentiment.