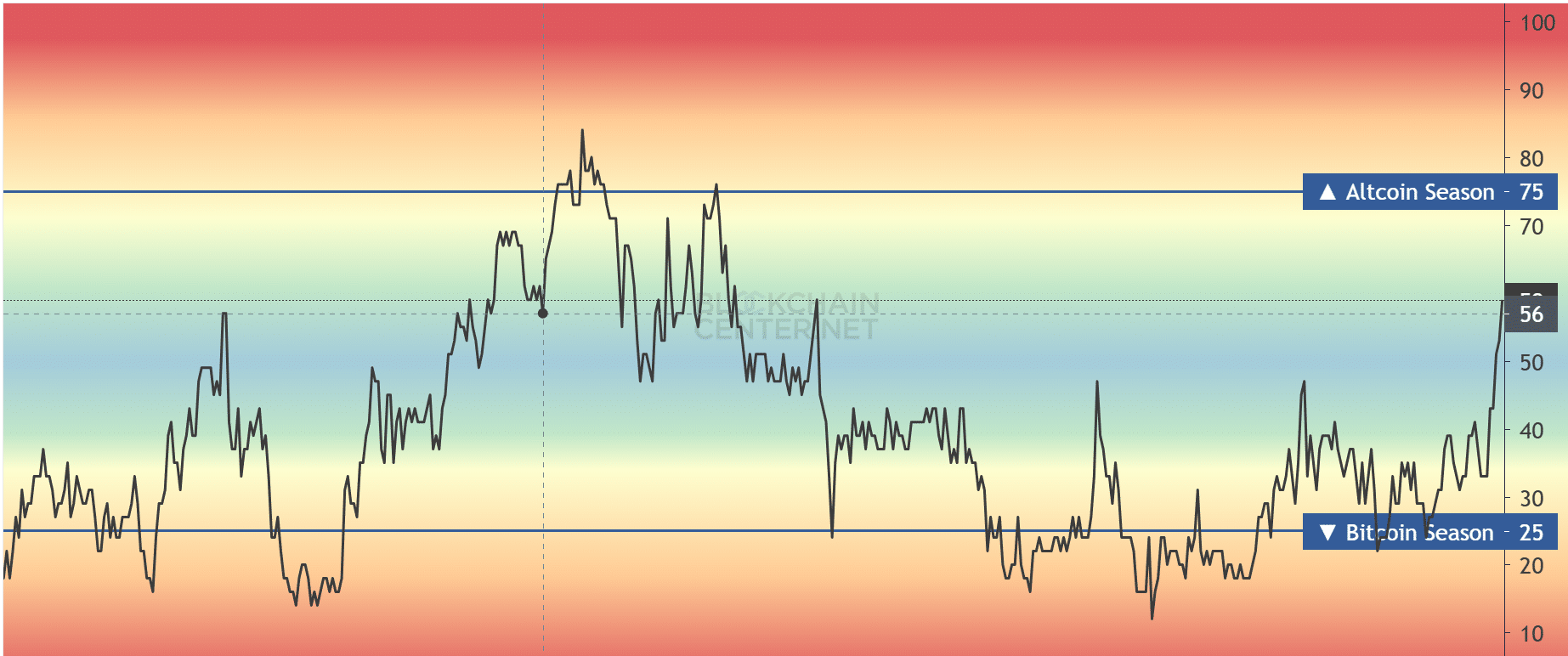

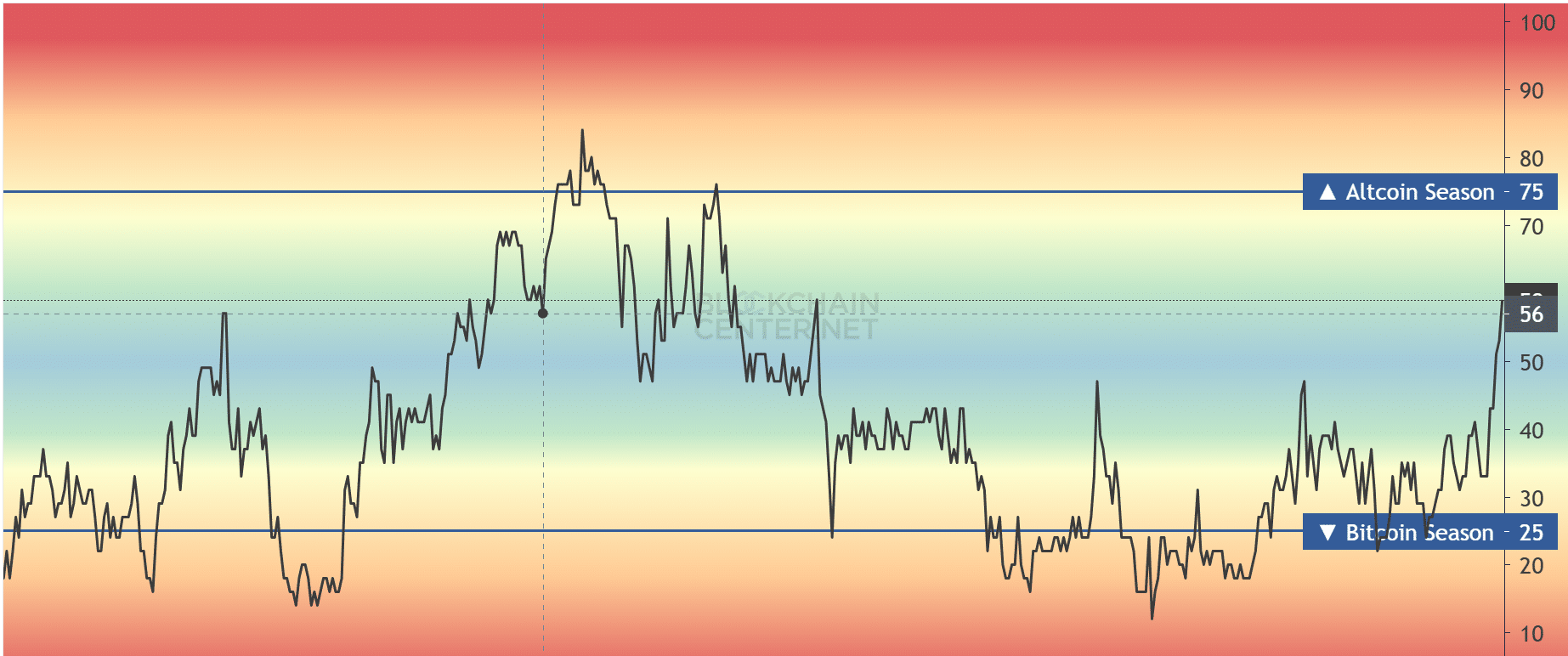

- The Altcoin Season Index saw a major spike for the first time since April.

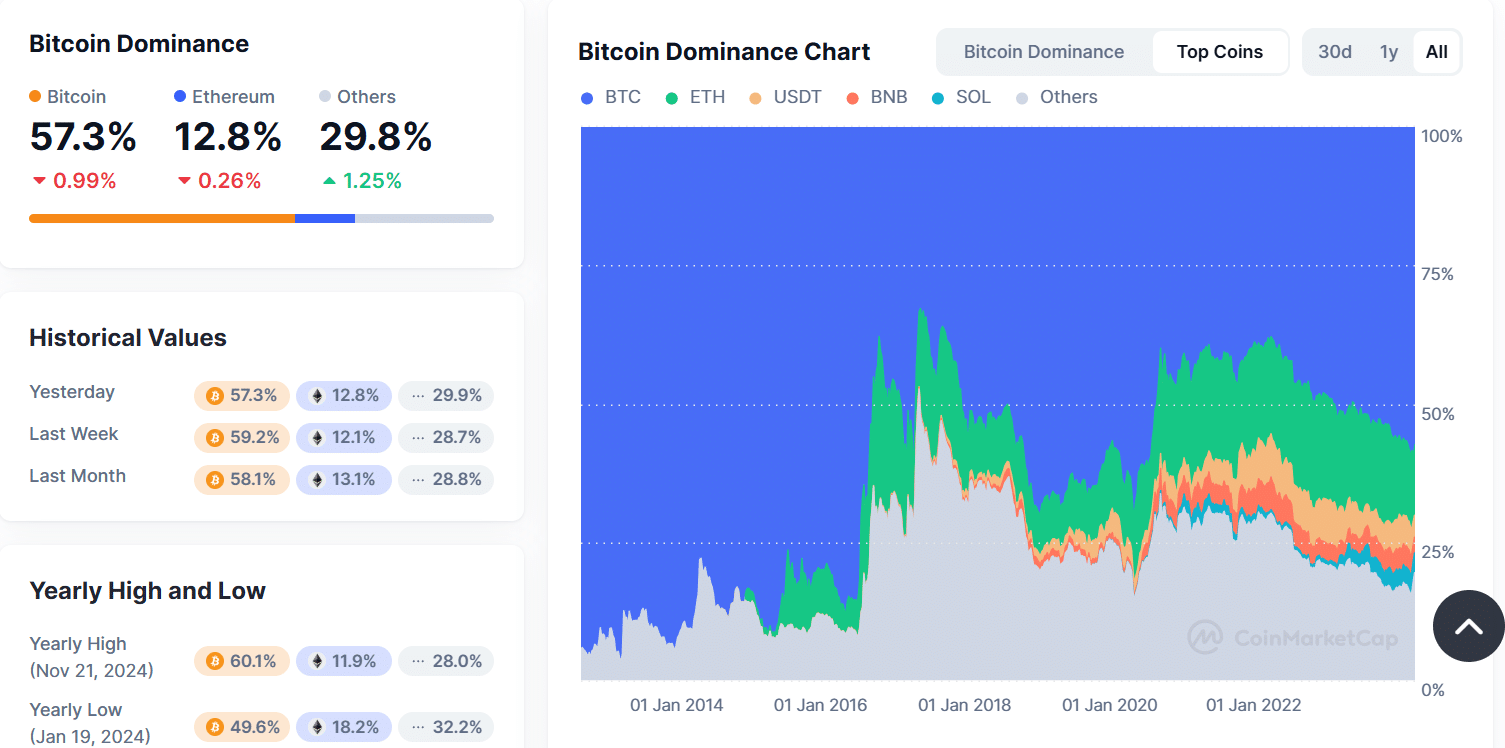

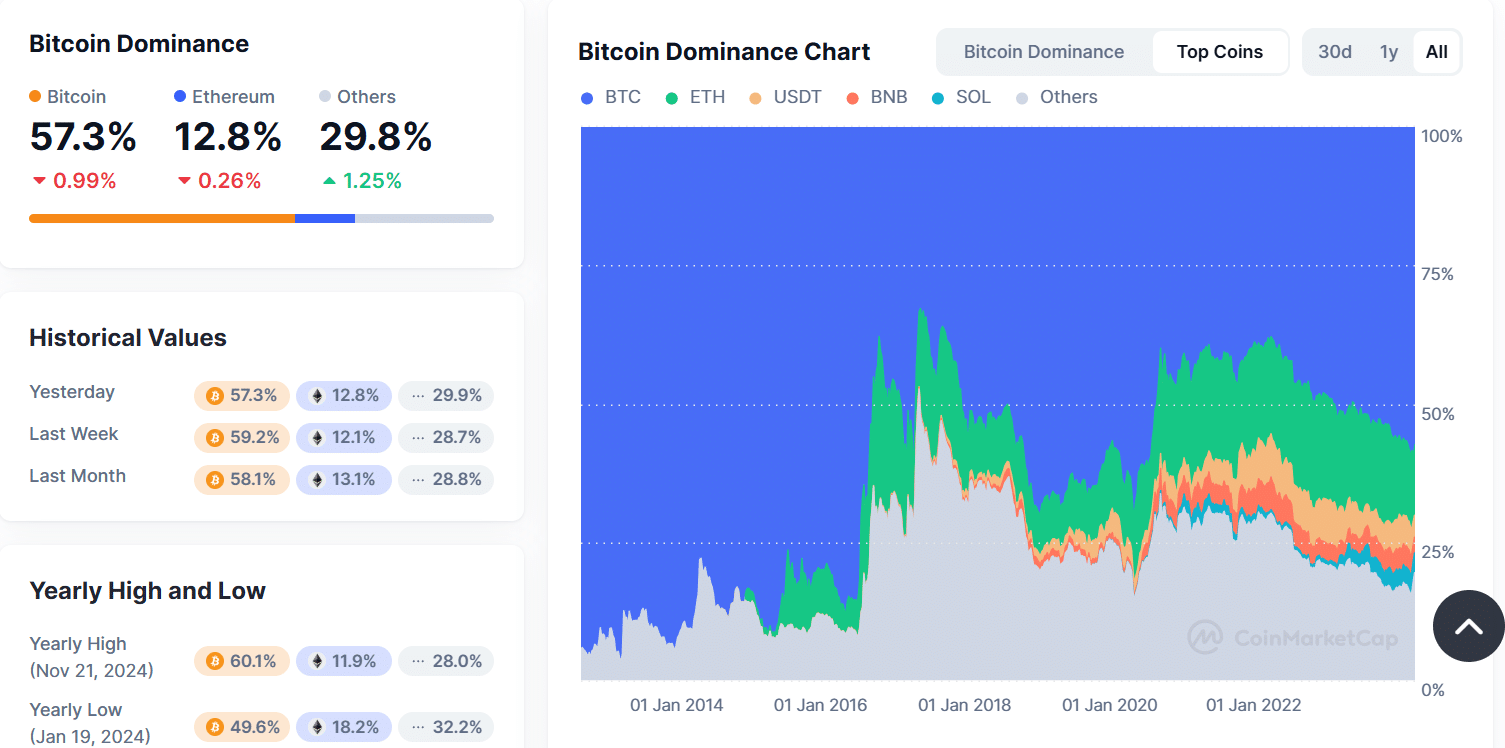

- Bitcoin remained dominant despite the spike.

The cryptocurrency market is witnessing dynamic shifts as the Altcoin Season Index rises to 59, indicating a possible transition to an altcoin-dominated cycle.

Bitcoins[BTC] While dominance is still strong at 57.3%, it has declined slightly, indicating investor interest in alternative assets.

Rising altcoin seasonal index

The Altcoin Season Index, which measures the performance of altcoins against Bitcoin, recently rose to 59.

Analysis of the graph showed that the index recently peaked at 33, almost approaching the 75 threshold that officially marks an altcoin season.

Source: blockchain center

This increase signals growing momentum among altcoins, supported by significant price movements in coins like Ethereum[ETH]Solana[SOL]and Binance Coin[BNB].

Historically, such moves have corresponded with periods of reduced Bitcoin dominance, paving the way for altcoins to shine.

The index’s trajectory shows a shift from Bitcoin-led dominance earlier this year to a more diversified market. However, it is crucial to note that the index has not yet decisively entered altcoin territory, indicating cautious optimism.

Bitcoin Dominance: Holding Out Amid Changing Sentiment

At the time of writing, Bitcoin’s dominance stood at 57.3%, having fallen from the yearly high of 60.1% recorded last week.

This downward trend coincides with altcoins capturing a larger share of the market. Ethereum’s dominance has increased slightly to 12.8%, indicating renewed interest in the second-largest cryptocurrency.

Source: CoinMarketCap

The historical context underlines Bitcoin’s resilience during bearish markets, which often serve as a refuge for investors.

Still, the recent dip in dominance could indicate that the market is gearing up for a broader rally in alternative assets, especially as investor confidence grows.

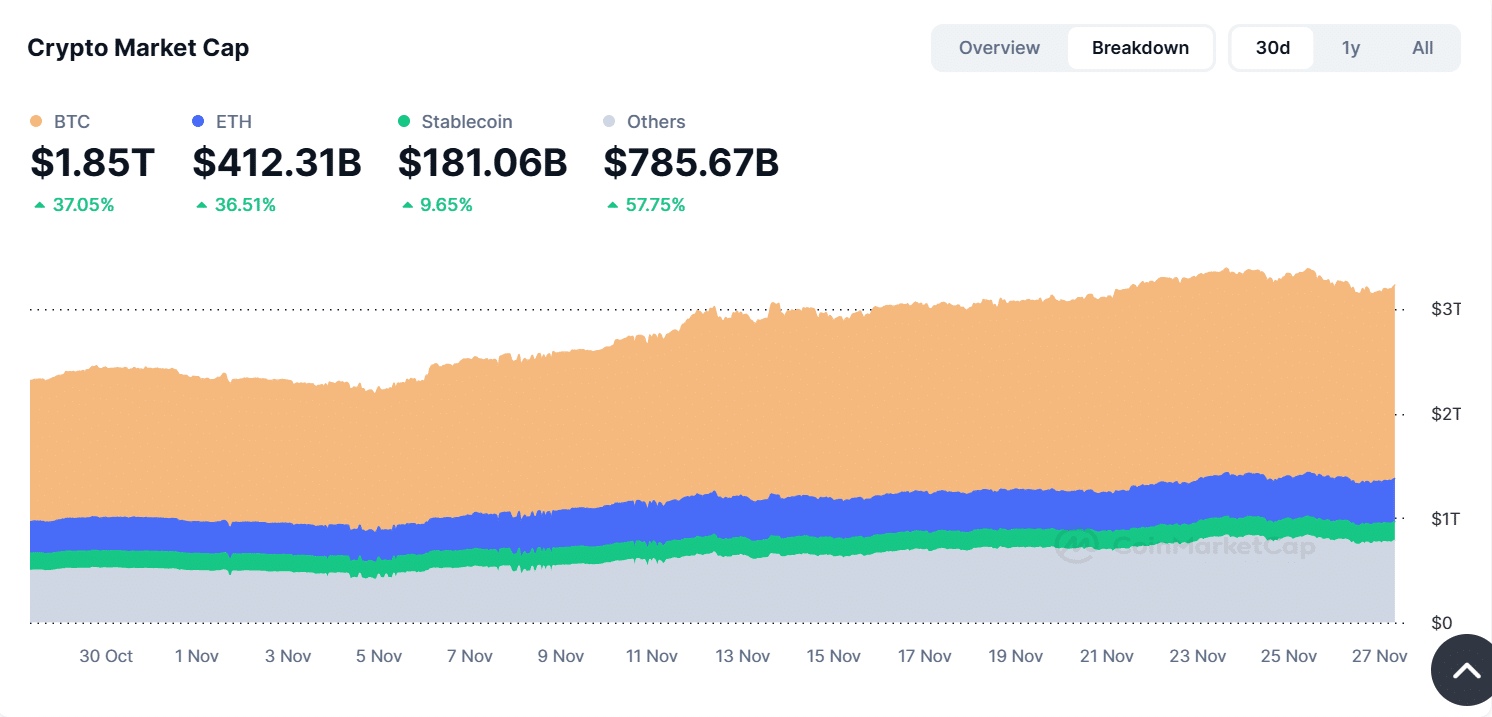

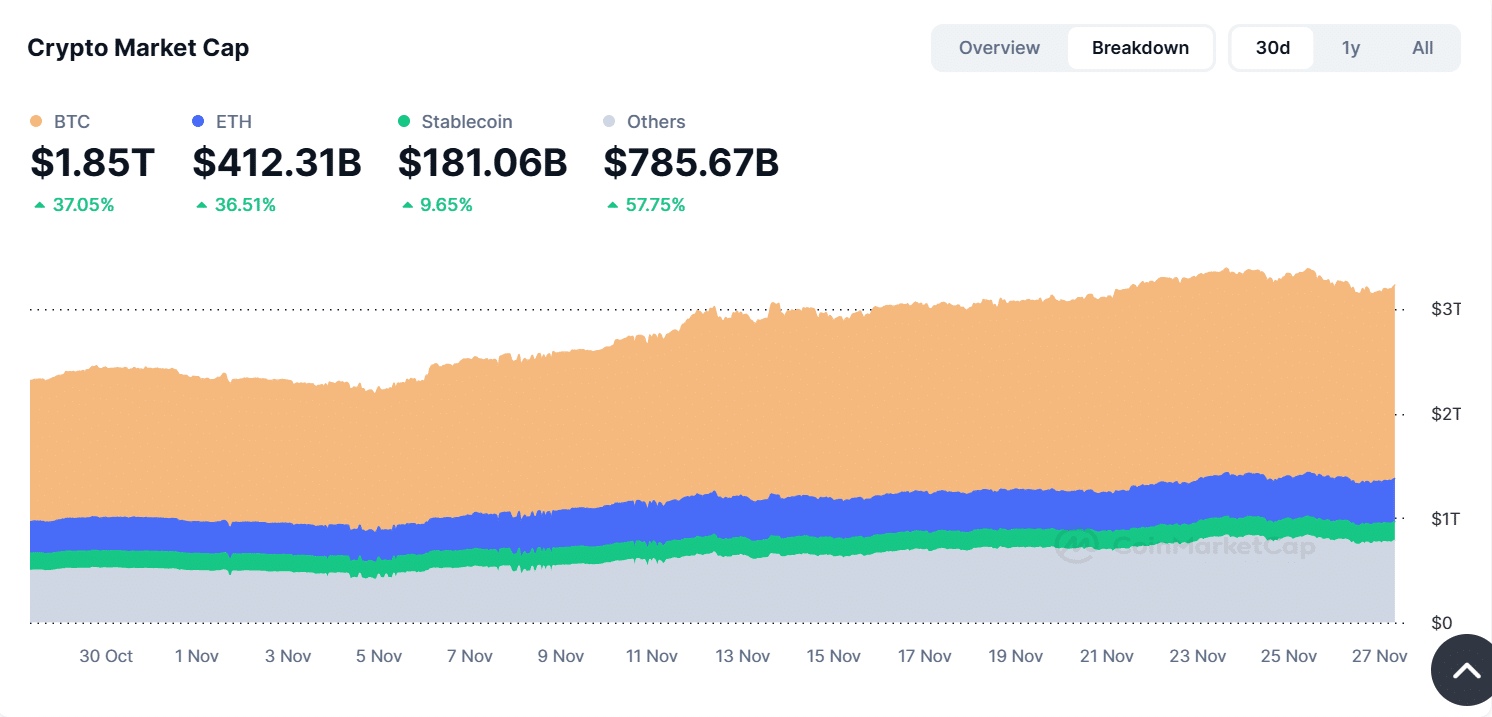

Market Cap: Altcoins Close the Gap

The total crypto market capitalization, as per data from CoinMarketCaphas risen to $3.23 trillion. Bitcoin contributes $1.85 trillion, and altcoins, excluding stablecoins, account for a significant $785.67 billion.

Notably, stablecoin capitalization has also risen steadily to $181.06 billion, reflecting continued demand for liquidity and risk mitigation.

Source: CoinMarketCap

Over the past month, altcoins have shown strong growth, with market leaders like Ethereum and Solana posting double-digit percentage gains.

The increase in altcoin market capitalization is consistent with the Altcoin Season Index and reinforces the narrative of a possible altcoin breakout.

Are we in an altcoin season?

While the Altcoin Season Index and declining Bitcoin dominance point to a shift, the market remained at a crossroads.

or altcoin enthusiasts, the coming weeks will be critical as the market seeks clarity on whether this is an ongoing altcoin season or just a temporary surge.

Investors should keep an eye on key metrics such as the Altcoin Season Index and Bitcoin dominance as current market dynamics highlight an exciting phase. But until altcoins cross the 70 threshold on the index, we have yet to reach altcoin season.