Financial services titan Franklin Templeton says it is building a cash fund for regulated securities on smart contract platform Solana (SOL).

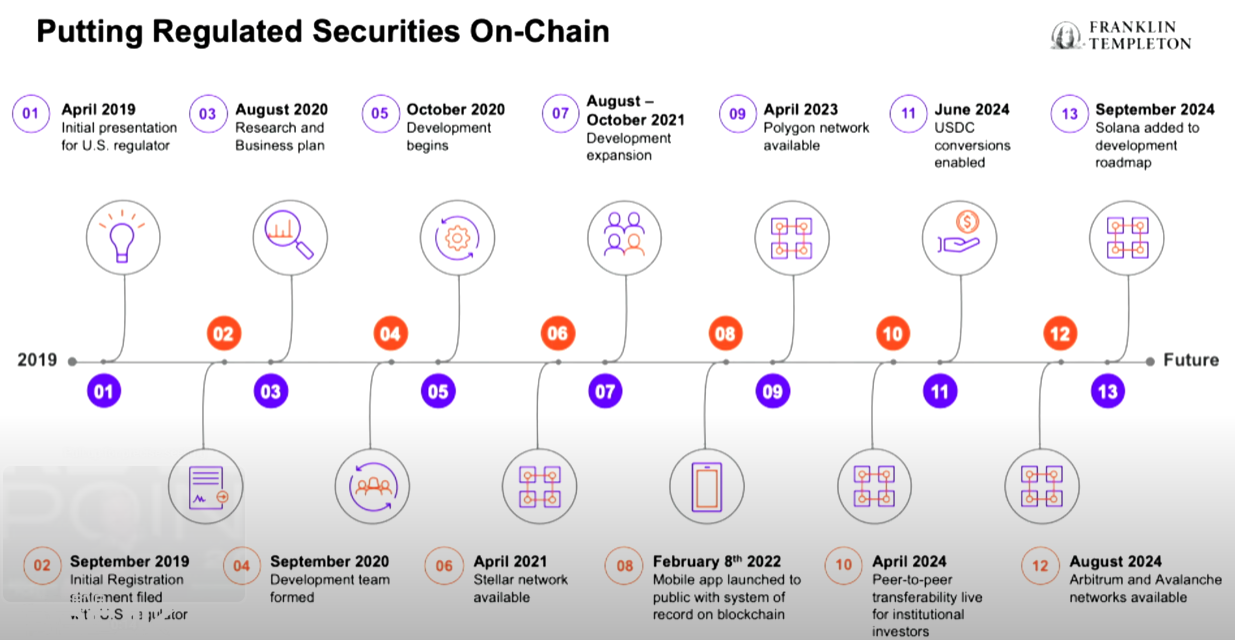

In a session at the Solana Breakpoint 2024 event, Mike Reed, head of digital asset partnership development at Franklin Templeton, says the investment giant’s final step to complete its project is to submit to develop natively on the Solana -blockchain.

According to Reed, the tokens minted by the company on Solana would represent authentic proofs of ownership.

“We do not use third parties, we store authentically on-chain. We do not have an off-chain archive file that we maintain; the proof of ownership is the token itself. You own that token in your wallet and that is your authentic proof of ownership.”

Reed further explains why Ethereum’s competitor (ETH) is Franklin Templeton’s favorite blockchain.

“I will point out the things we like about Solana: speed, we want to be able to move money very, very quickly. The cost-efficiency of running this system in the chain is an advantage for both us as a company and for you as an end user.

Modern architecture, the standards used on Solana, are extremely important to us and we are working to develop standards that we believe should be used across the industry. Finally, the Solana team was absolutely fantastic to work with and their development tools are second to none. no.”

Solana is trading at $148.38 at the time of writing, a gain of 1.66% over the last 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney