- The supply absorption of BTC by spot ETFs has turned negative.

- This indicated a temporary decline in interest in BTC spot ETFs.

Bitcoin’s recent decline [BTC] supply absorption by the spot Bitcoin exchange-traded fund (ETF) has signaled a decline in interest in the asset class.

This was noted by pseudonymous CryptoQuant analyst Oinonen_t in a new one report.

The BTC spot ETF market is witnessing a slight decline

The supply absorption of BTC by BTC ETFs tracks the rate at which newly mined coins are acquired or absorbed by these funds.

This metric is important because greater supply absorption from spot ETFs could potentially lead to upward price pressure on BTC.

Conversely, reduced demand can signal a potential decline in the value of the leading currency.

Oininen_t found that the coin’s supply absorption recently turned negative, falling to a low of -0.38. The analyst confirmed the above view and opined:

“Despite the hype surrounding the upcoming halving in 21 days, the spot price of bitcoin has not changed dramatically over the past 30 days. One explanation for the stagnant price action is the negative supply absorption of the ETFs.”

The analyst added that if spot ETFs cannot absorb the newly mined coins,

“The demand for the approximately 900 bitcoins issued daily must come from other sources.”

However, in today’s market, the retail investors who typically collect these coins have shifted their attention to meme coins.

In recent weeks, the values of some Solana have risen [SOL]-based meme coins have grown by triple digits, leading to a significant increase in the market capitalization of meme coins.

Read Bitcoin’s [BTC] Price forecast 2024-25

According to Oininen_t,

“While retail investors have shown growing interest in Bitcoin, their focus may be on the new Solana-based tokens and “meme coins.”

The analyst concluded that the negative supply absorption is a temporary disadvantage in the spot ETF market:

“The bigger picture still looks promising. In a multi-year scenario, I see Bitcoin trying to reach market cap parity with gold, which would represent a 1,000 percent increase from the current spot price.”

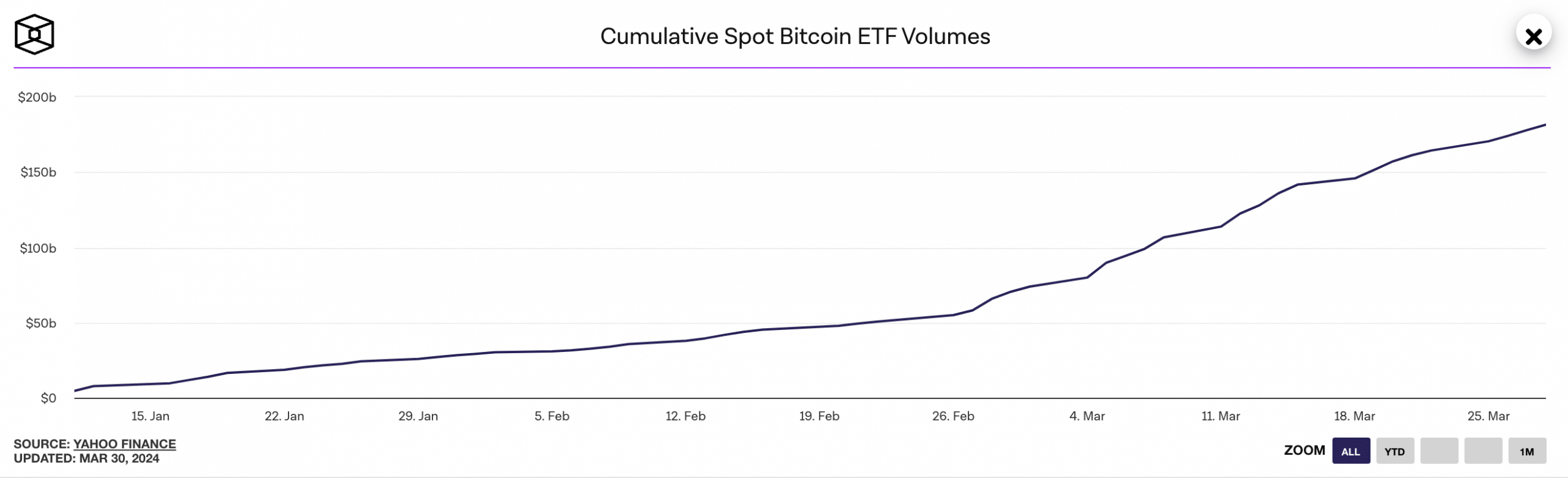

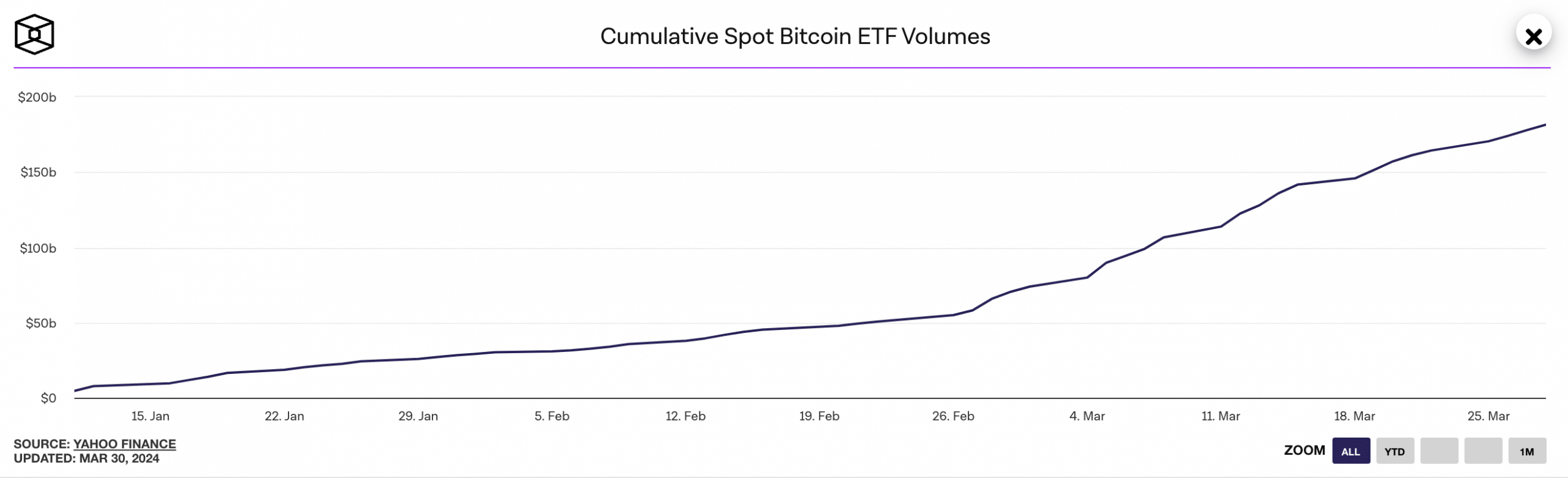

Since their launch, the volume of Bitcoin spot ETFs has grown significantly. The daily cumulative volume for this asset class at the time of writing is $182 billion and is up over 3500%.

Source: Het Blok

With an asset under management (AUM) value of $24 billion, the Grayscale Bitcoin Trust (GBTC) currently has the largest market share in the BTC spot ETF market.