- Injective experienced a significant increase in Total Value Locked (TVL), due to growing confidence in its blockchain.

- However, this is being overshadowed by ongoing retail sell-offs, which continue to exert downward pressure.

After gaining 9.33% in the past month, Injective [INJ] is losing steam, with a decline of 5.06% during last week’s sessions. Daily losses have exacerbated the decline, with an additional 1.60% drop as shifting market sentiment continues to drag its value down.

Could INJ’s TVL increase trigger a price rebound?

According to Chain brokerInjective witnessed a staggering 61.2% increase in Total Value Locked (TVL) over the past seven days, taking its value to $2.52 billion – a clear sign of growing confidence in its ecosystem.

TVL, a key indicator of DeFi protocol performance, represents the total value of assets staked, lent, or provided as liquidity. While such increases are often in line with upward price momentum, INJ’s case breaks the rules.

Despite impressive TVL growth, INJ’s price has fallen by 5.06% over the same period, indicating declining confidence among market participants.

Further analysis attributes this price drop to continued selling pressure from retailers, overshadowing the blockchain’s growing usefulness.

Retail traders turn bearish on INJ

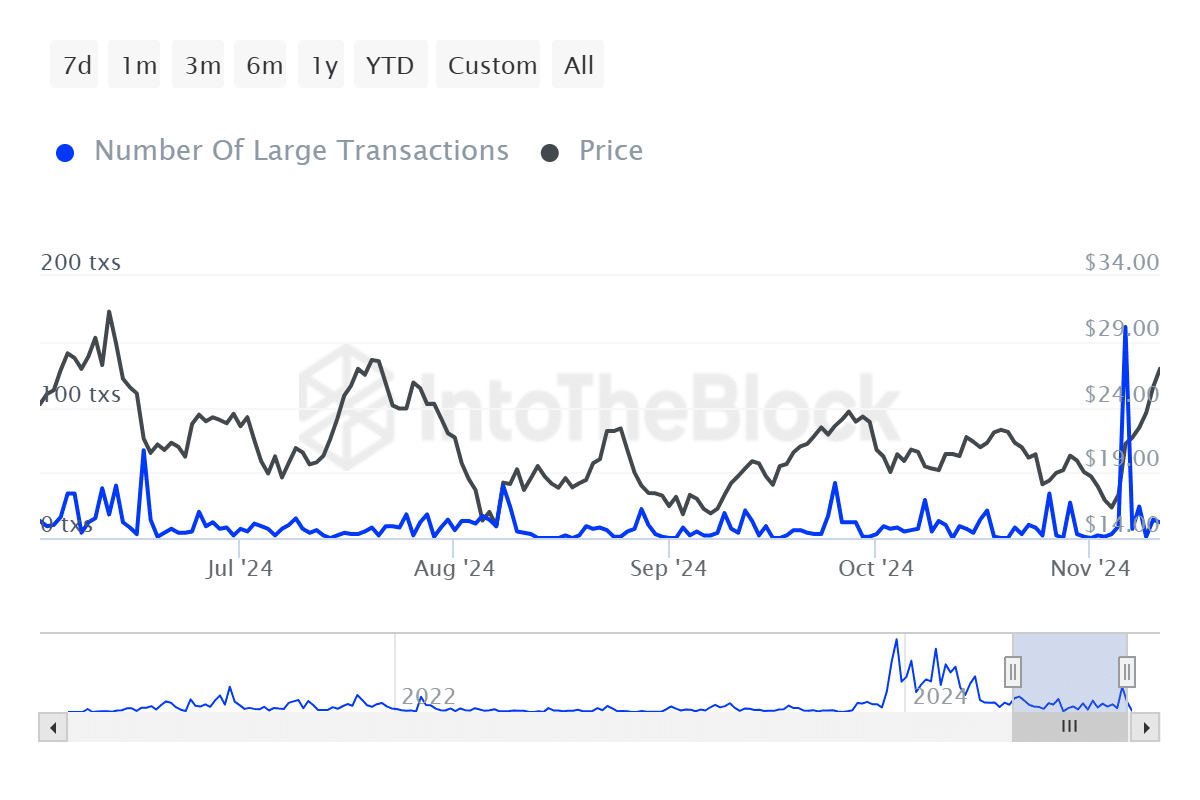

Data from InHetBlok reveals increasing selling activity, with bearish sentiment among retailers becoming increasingly apparent.

The average transaction size, which tracks the average value of daily transactions, decreased over the past week, reaching $6,419.46. Such slow movement often indicates reduced activity from retail traders, indicating cautious or bearish market outlook.

Source: IntoTheBlock

This slowdown is further confirmed by a 15.94% decline in the number of daily active addresses (DAAs) over the same period. A decline in DAA generally reflects declining interest and increased selling pressure, both of which have contributed to INJ’s recent price decline.

Furthermore, bearish market sentiment is reflected by long liquidations totaling $754,270 as traders are forced to close their positions amid continued downward momentum.

The market’s downward movement remains evident, with retail pressure playing a major role in INJ’s recent troubles.

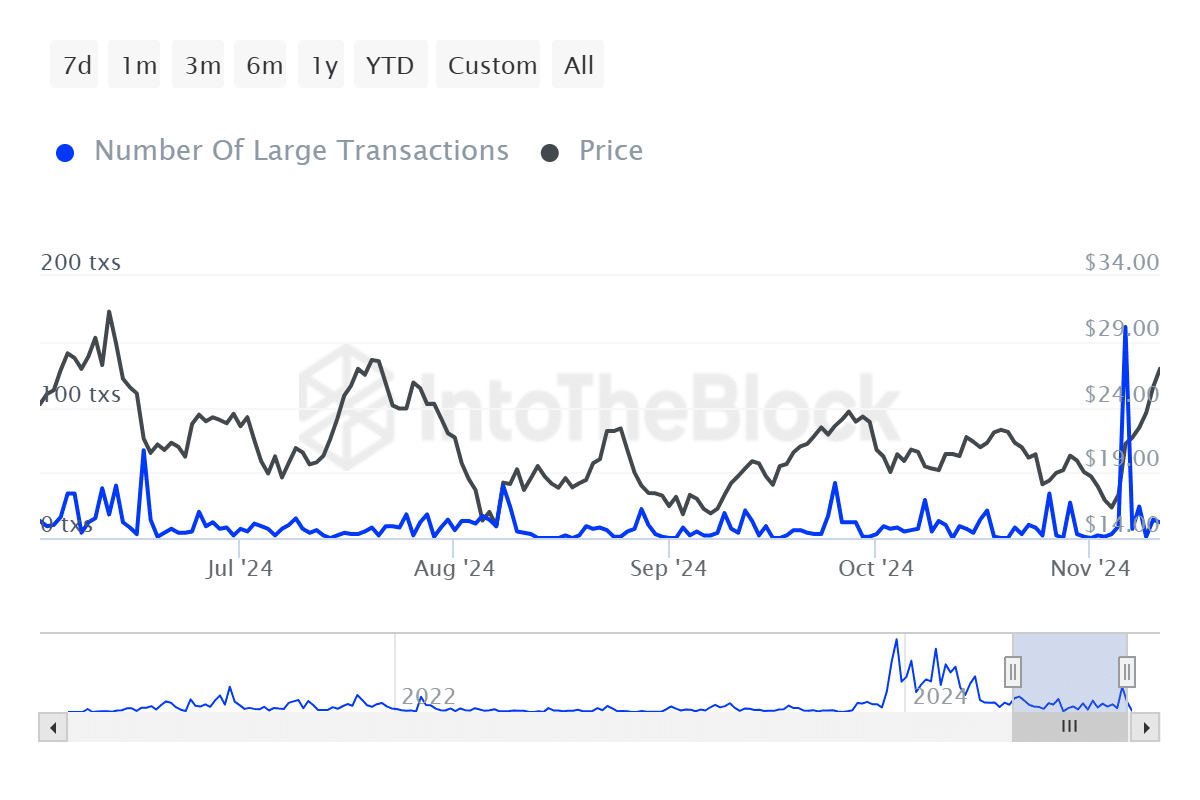

Whales are holding back, leaving INJ’s market direction uncertain

Major investors, or “whales,” have remained inactive recently, with just one major trade in the past 24 hours and a modest total of 22 major trades in the past seven days.

Source: IntoTheBlock

Such low activity indicates that whales are currently indecisive and refraining from making market-moving moves.

Read Injective [INJ] Price forecast 2024–2025

Normally, an increase in the number of large trades would indicate a more decisive trend: a rise accompanied by a price drop indicates bearish sentiment, while a rise accompanied by a price increase indicates bullish momentum.

The occurrence of either scenario could play a decisive role in shaping INJ’s next big market move, making whale activity a crucial factor to watch in the coming days.