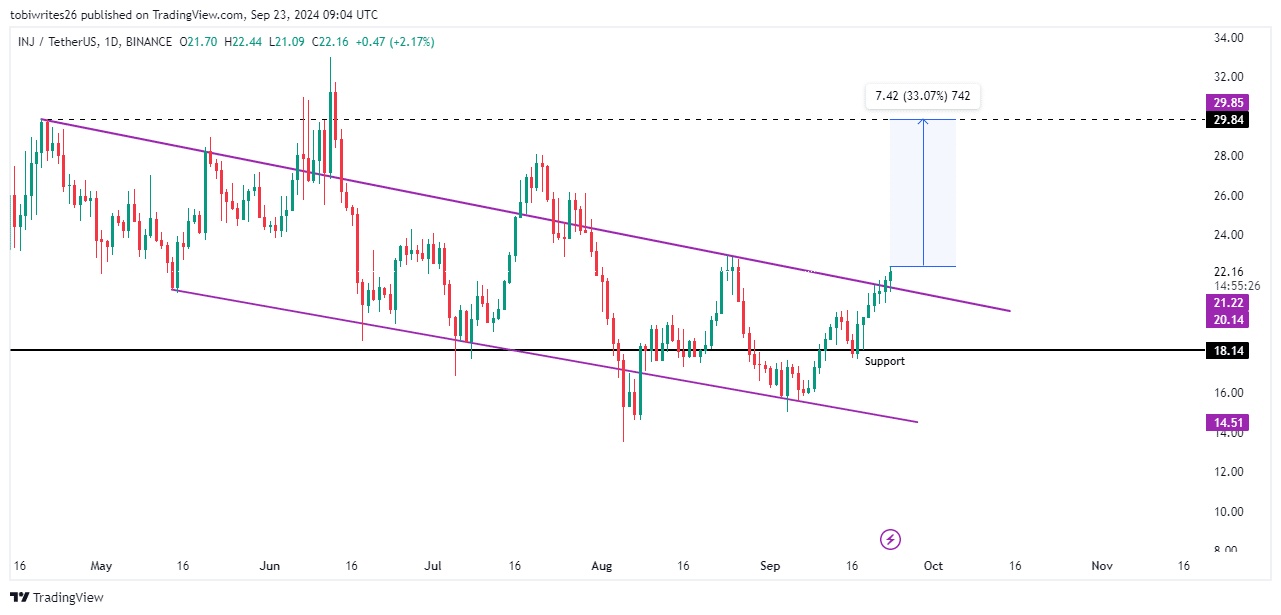

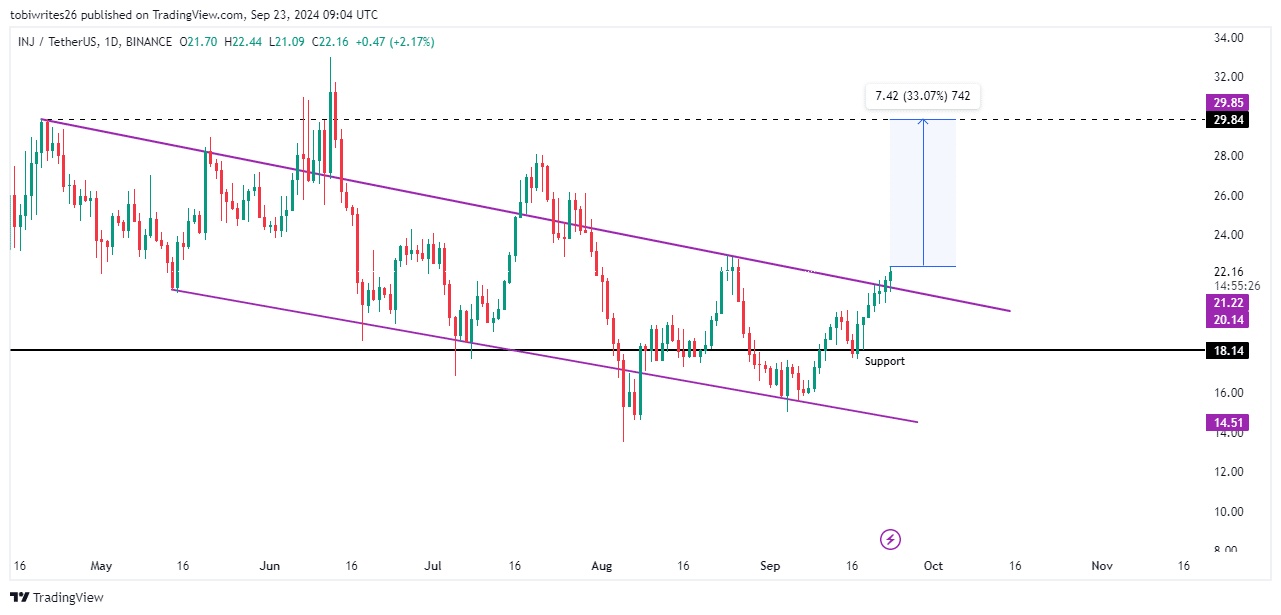

- Injective gained momentum after breaking out of the month-long descending channel, with projections pointing to an upward move towards $29.84.

- At the time of writing, market sentiment surrounding INJ was positive, positioning the token favorably.

This past week, Injective [INJ] has started a big rally, gaining 18% after recovering from the lower limit of its trading channel.

With a notable increase of 3.02% in the past 24 hours, the upward trend appears to be continuing.

Injective aims to peak at $29

At the time of writing, INJ was on a significant rebound after breaking out of a declining channel that started in April. A pattern like this often precedes a major upswing.

The breakout came after INJ bounced off the descending channel support level and added additional momentum after trading at a subsequent support at 18.14.

If the current bullish strength continues, INJ could rise from the current price of $22.14 to the channel’s peak at $29.84, meaning a potential gain of 33.07%.

Source: TradingView

Conversely, if INJ were to experience a downturn, it could potentially move towards the $18.14 level again before potentially resuming its upward trajectory.

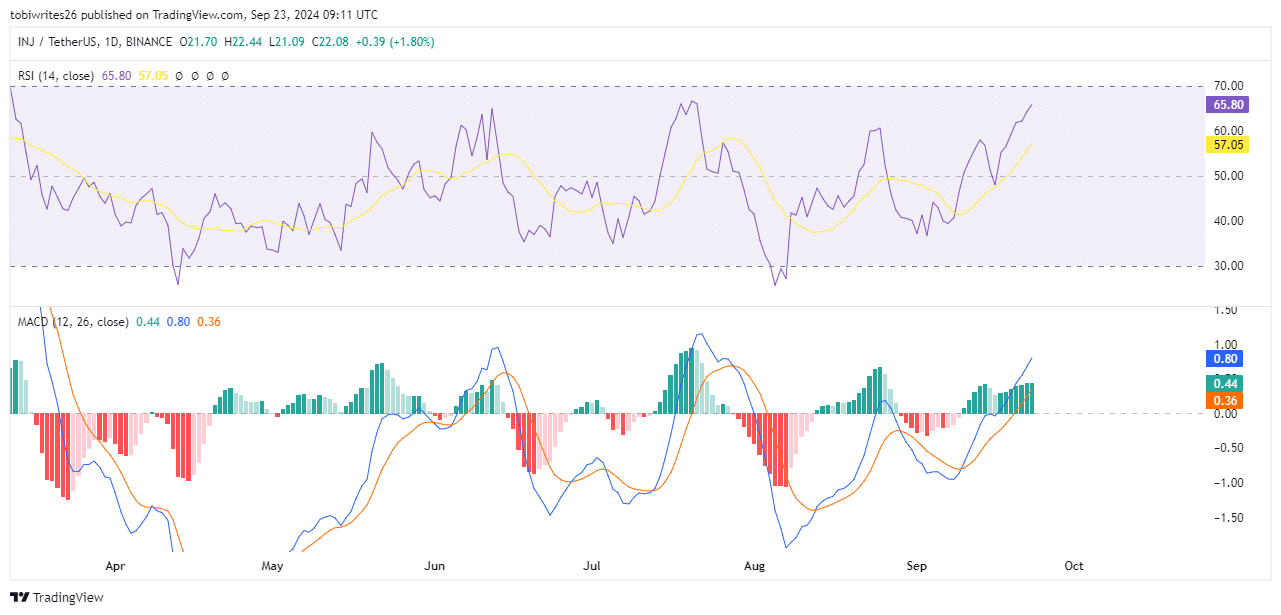

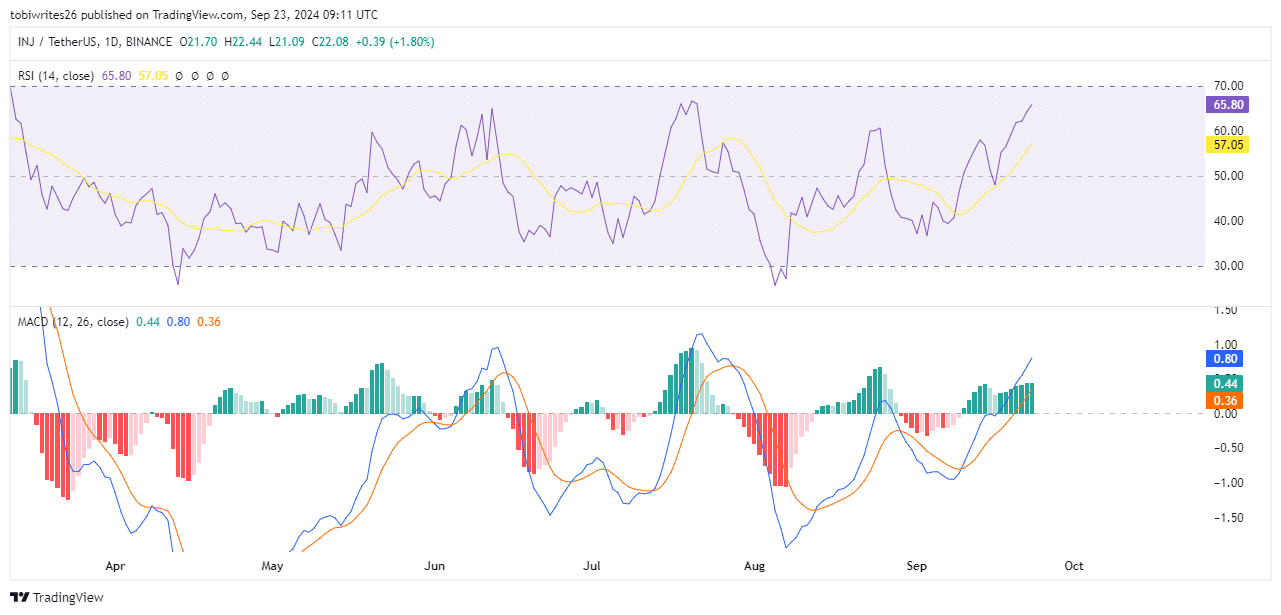

The purchase interest rate rises

The buying price for Injective (INJ) has soared, with both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators signaling a bullish trend.

The RSI was 65.80, indicating strong trader accumulation, which could push the price of INJ further from current levels.

The MACD, a key trading indicator, reinforces this outlook by providing a strong buy signal.

This is clearly visible as the blue MACD line and the orange signal line have entered positive territory, accompanied by a predominance of green rising momentum bars.

Source: TradingView

Sustained trends of these indicators indicated a favorable move for INJ in the coming trading sessions.

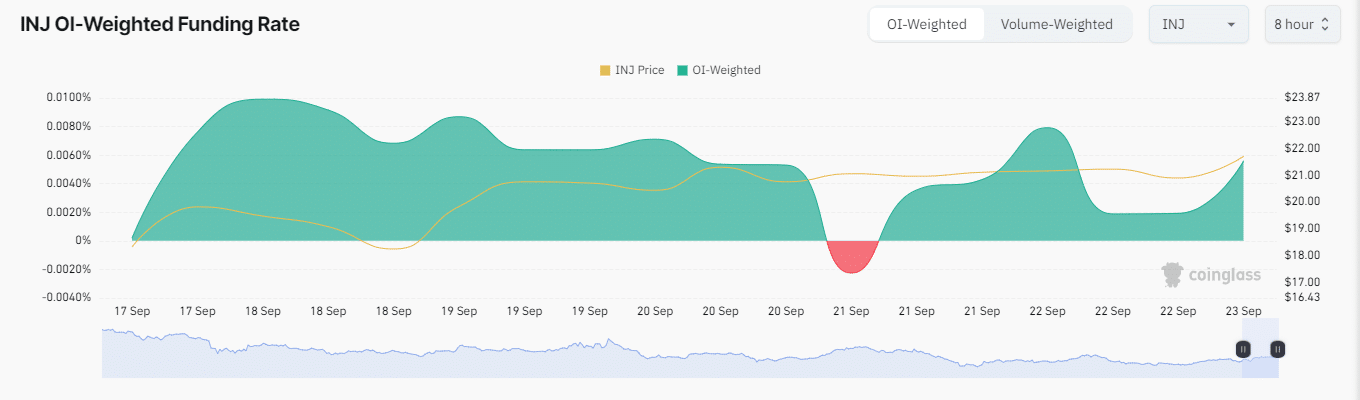

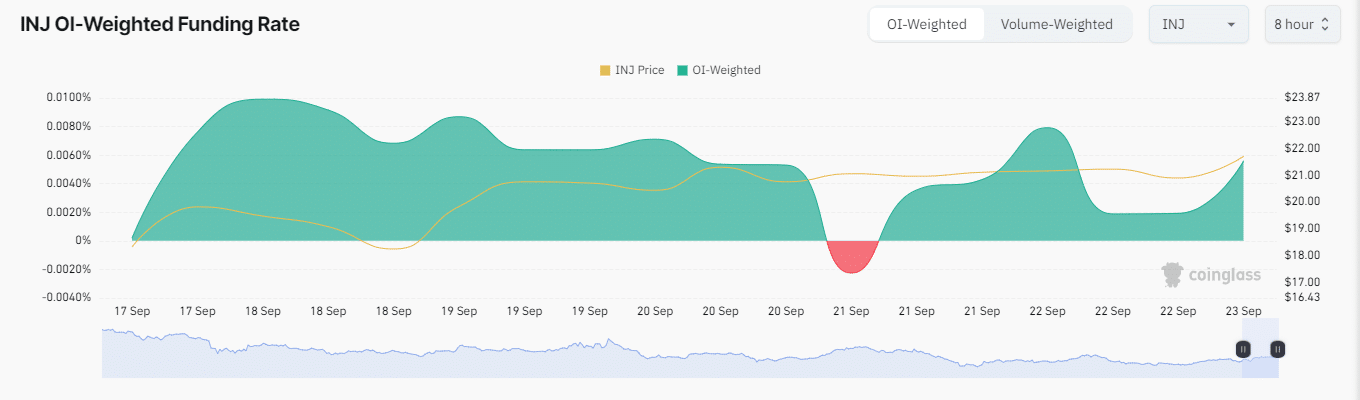

THIS indicates an ongoing bullish trend

Injective was experiencing a bullish rise at the time of writing, per Mint glassas more funding flowed into the asset. This was highlighted by an increase in the OI-weighted financing rate, which stood at 0.0056% at the time of writing.

Source: Coinglass

This increase indicated increased buying activity in the market, especially since it occurred during an uptrend.

Read Injective [INJ] Price forecast 2024–2025

The OI-weighted funding rate, which adjusts the standard funding rate based on the open interest of each leverage level, provides a more precise reflection.

Positive interest rates, as currently observed, generally indicate strong market optimism, supporting expectations that INJ will reach the $29.84 target.