- According to crypto analysts, a falling wedge pattern indicated a 214% rally for INJ.

- Data from the chain showed that 67.32% of holders were waiting for a breakout.

injective [INJ] has recently attracted attention, with a potential bullish breakout on the horizon.

INJ’s price was $17.77 at press timeafter rising 8.08% in the past 24 hours, in addition to a 5.04% increase in the past week.

Its market capitalization reached $1.73 billion, with a circulating supply of 98 million tokens, indicating increased interest in the asset.

Crypto analyst Captain Faibik has also done this identified a falling wedge pattern on the 3-day chart, suggesting a breakout could lead to a 214% rally.

The pattern, generally seen as a bullish indicator, remained intact and the analyst emphasized the importance of patience for investors.

Source:

INJ signals consolidation

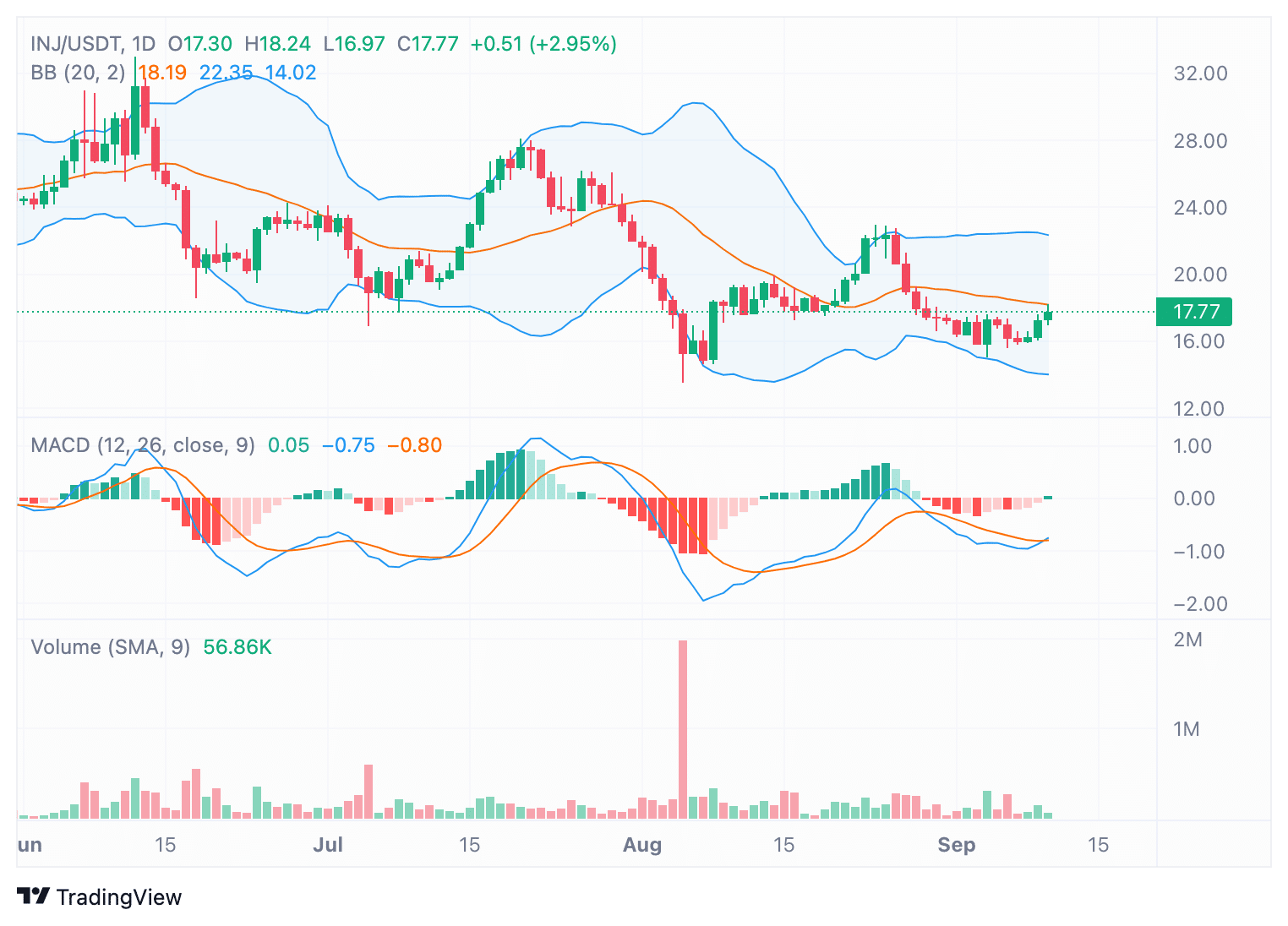

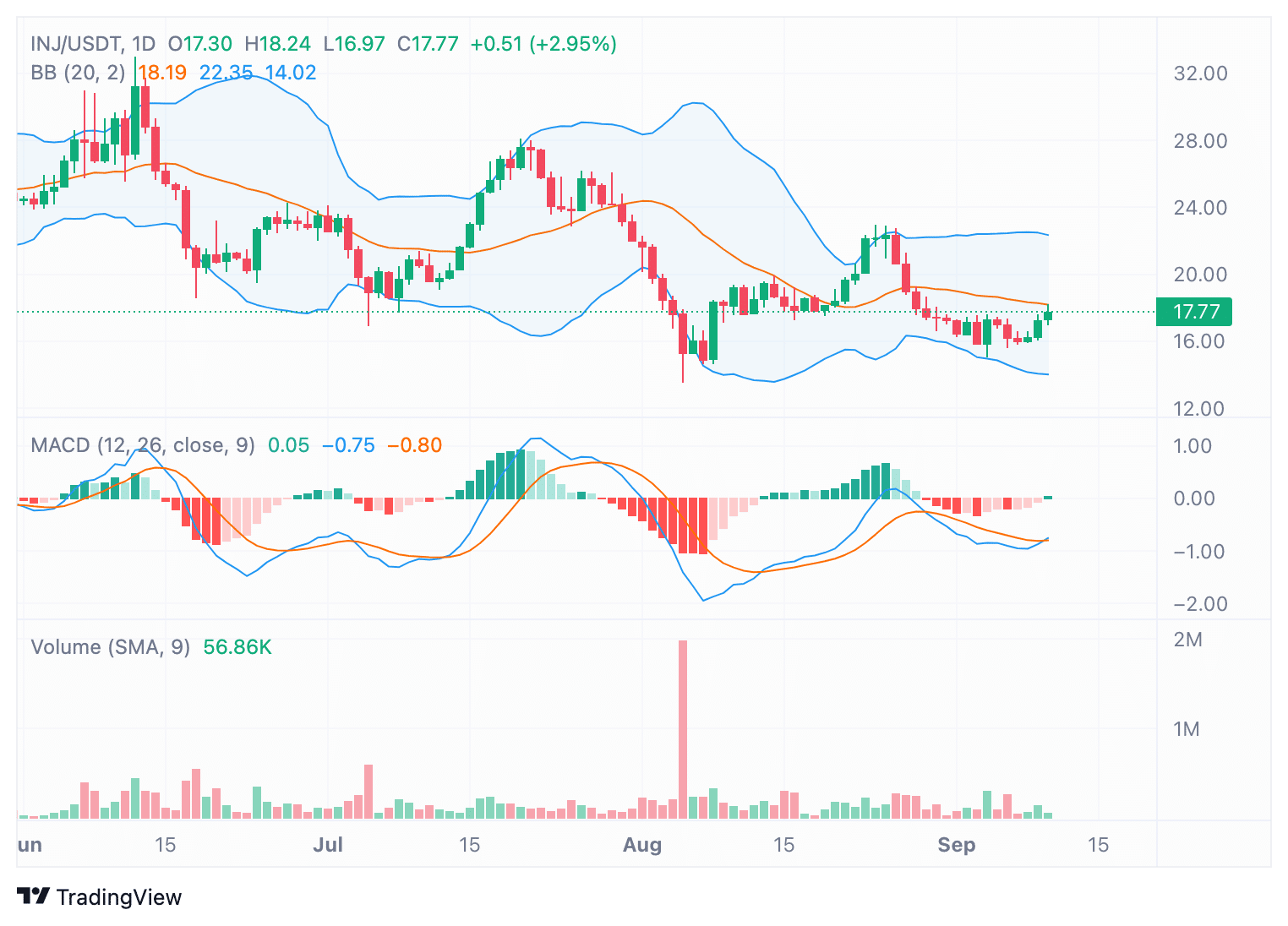

According to AMBCrypto’s examination of the technical indicators on the daily chart, INJ appeared to consolidate above the middle Bollinger Band at $17.77.

The narrowing Bollinger Bands suggested lower volatility in recent sessions, which could indicate the assets were gaining momentum ahead of a potential price move.

The MACD indicator also showed a bullish crossover, with the blue MACD line slightly above the orange signal line.

While this indicated upward momentum, the MACD histogram remained nearly neutral, indicating that the trend is still developing.

Source: TradingView

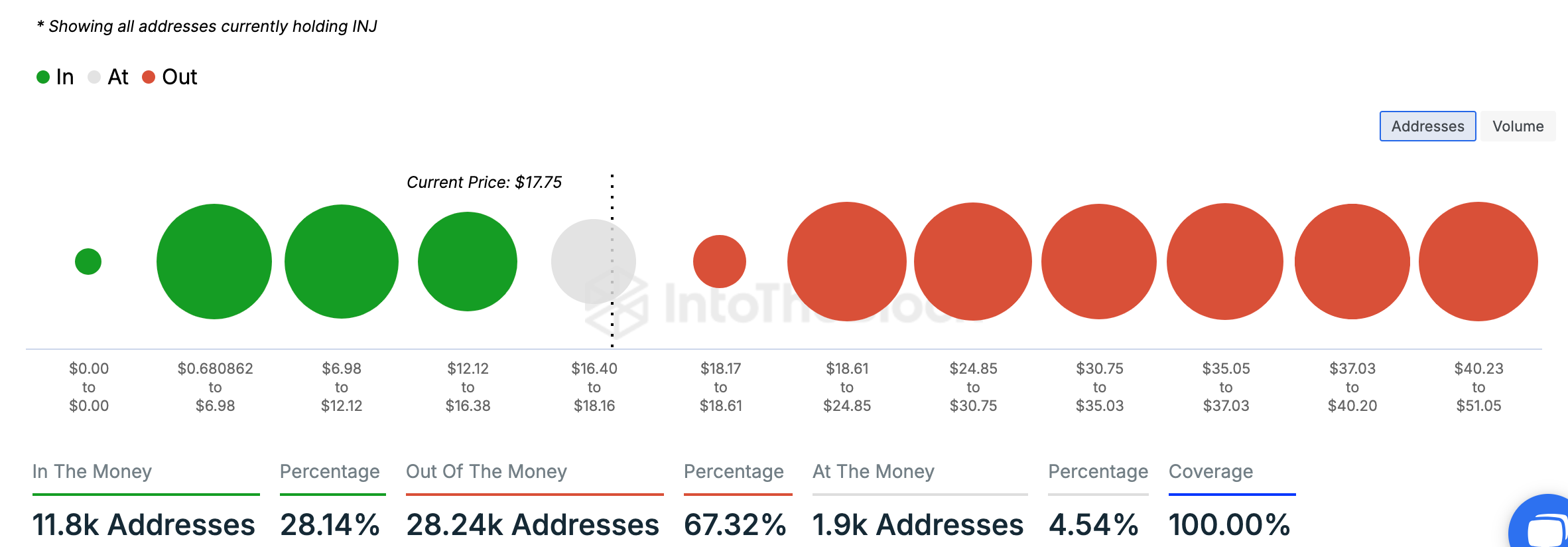

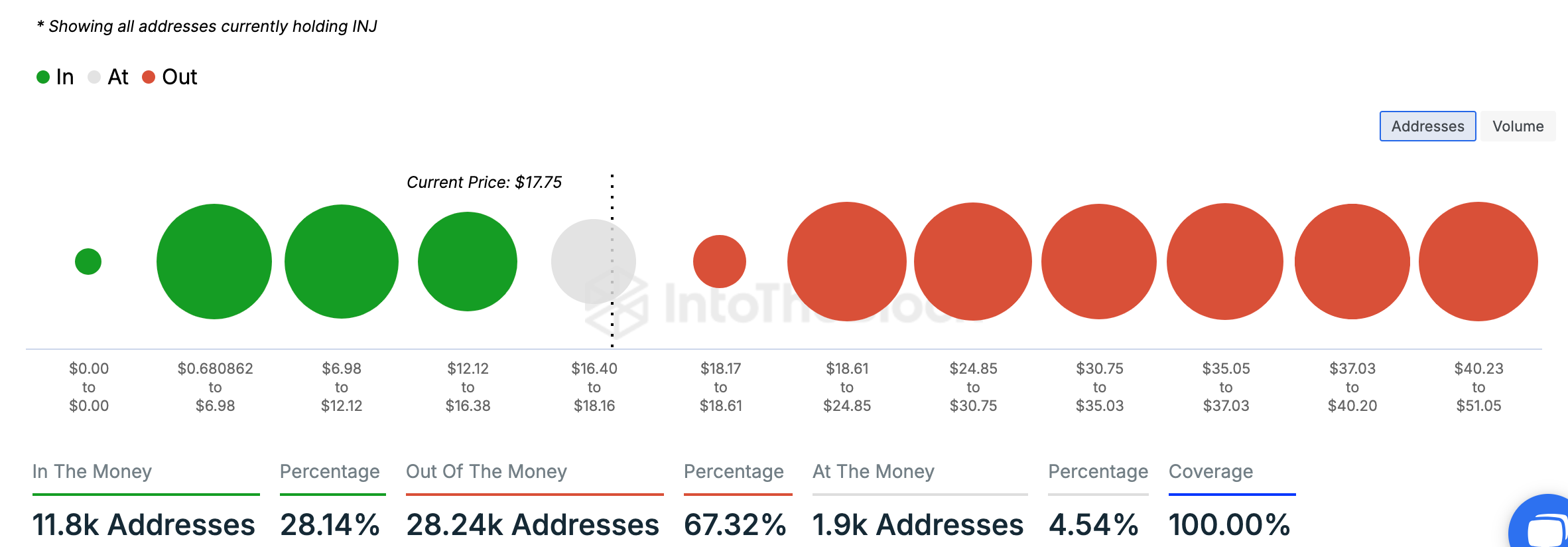

The on-chain data showed that the outlook for INJ holders was mixed. At the time of writing, 28.14% of addresses were ‘In the Money’, meaning they were buying INJ at prices below the current level of $17.75.

However, a significant 67.32% of addresses were still out of the money, having purchased at higher prices, mainly between $18.61 and $24.85.

Source: IntoTheBlock

Despite this, the largest concentration of profitable buyers acquired INJ between $6.98 and $12.12, indicating that a significant number of holders remained bullish.

Only 4.54% of addresses were close to breakeven, further supporting the idea that the asset is preparing for a major move.

DeFi activity and market liquidity

Data from DefiLlama shows that the Total Value Locked (TVL) in Injective’s ecosystem is $37.06 million, while stablecoins account for $22.45 million.

Read Injective [INJ] Price forecast 2024–2025

The platform saw a 24-hour trading volume of $10.75 million, with inflows totaling $133,190 in the same period.

This indicated consistent interest in INJ within the DeFi space, which could help fuel the expected breakout.